Bearish Candlestick Patterns

In our previous article "How to Read the Most Popular Candlestick Patterns," we introduced common candlestick formations that signal potential upward price movements. Conversely, bearish candlestick patterns emerge after an uptrend and indicate a possible reversal from bullish to bearish momentum. When these patterns appear, traders should carefully assess them in the context of the broader market structure.

Common Bearish Candlestick Patterns

- Hanging Man Pattern

- Shooting Star Pattern

- Bearish Engulfing Pattern

- Evening Star Pattern

- Three Black Crows Pattern

Important Note: Unlike traditional financial markets, cryptocurrency candlestick charts display green for price increases and red for price decreases.

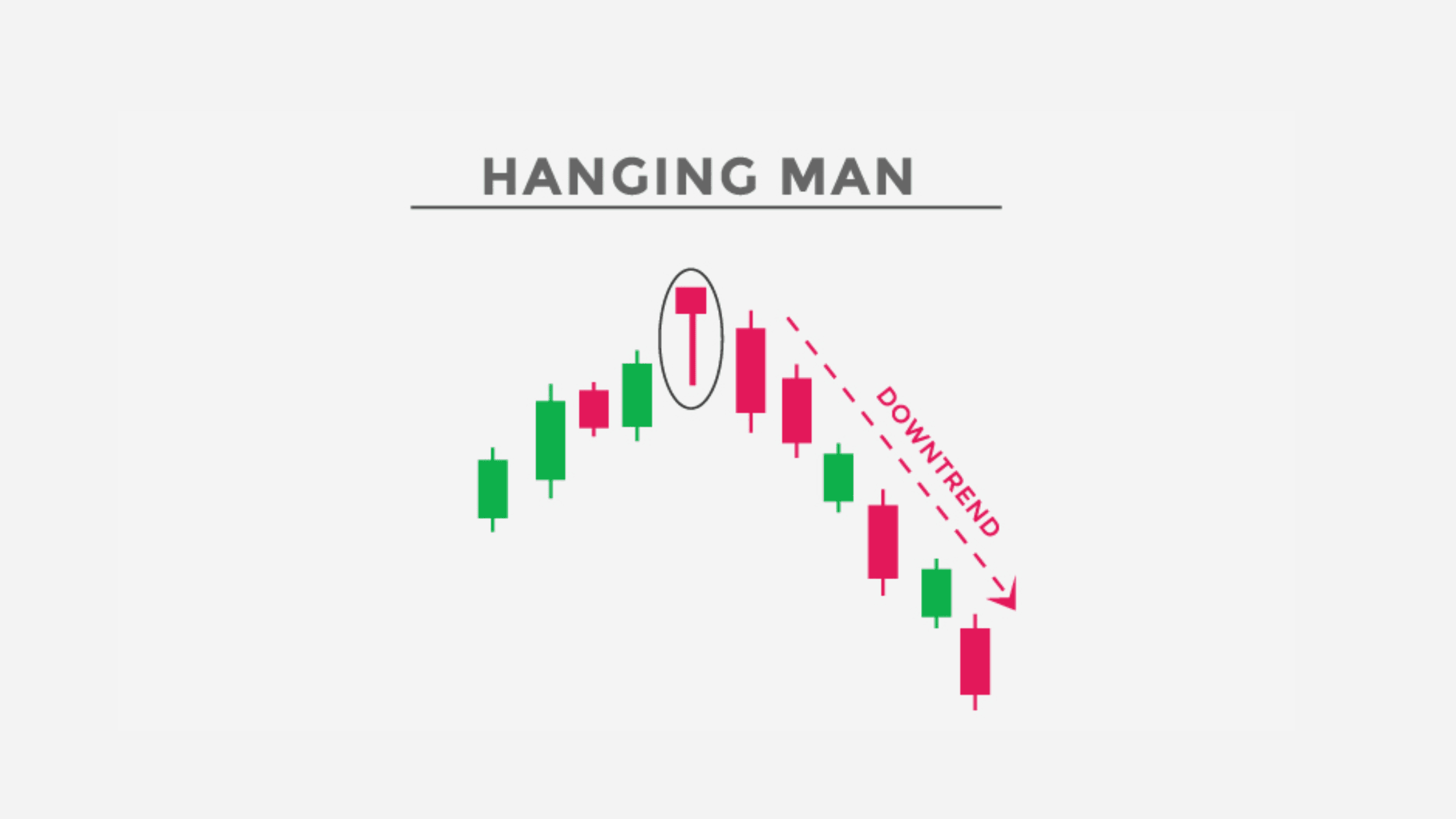

Hanging Man Pattern

Hanging Man Pattern is a bearish reversal signal that appears after an uptrend. It features a small body (either green or red) with a long lower wick that's at least twice the body length, and little to no upper wick. This pattern indicates that despite initial buying pressure, sellers stepped in aggressively to push prices down before a slight recovery.

Source: Forexopher

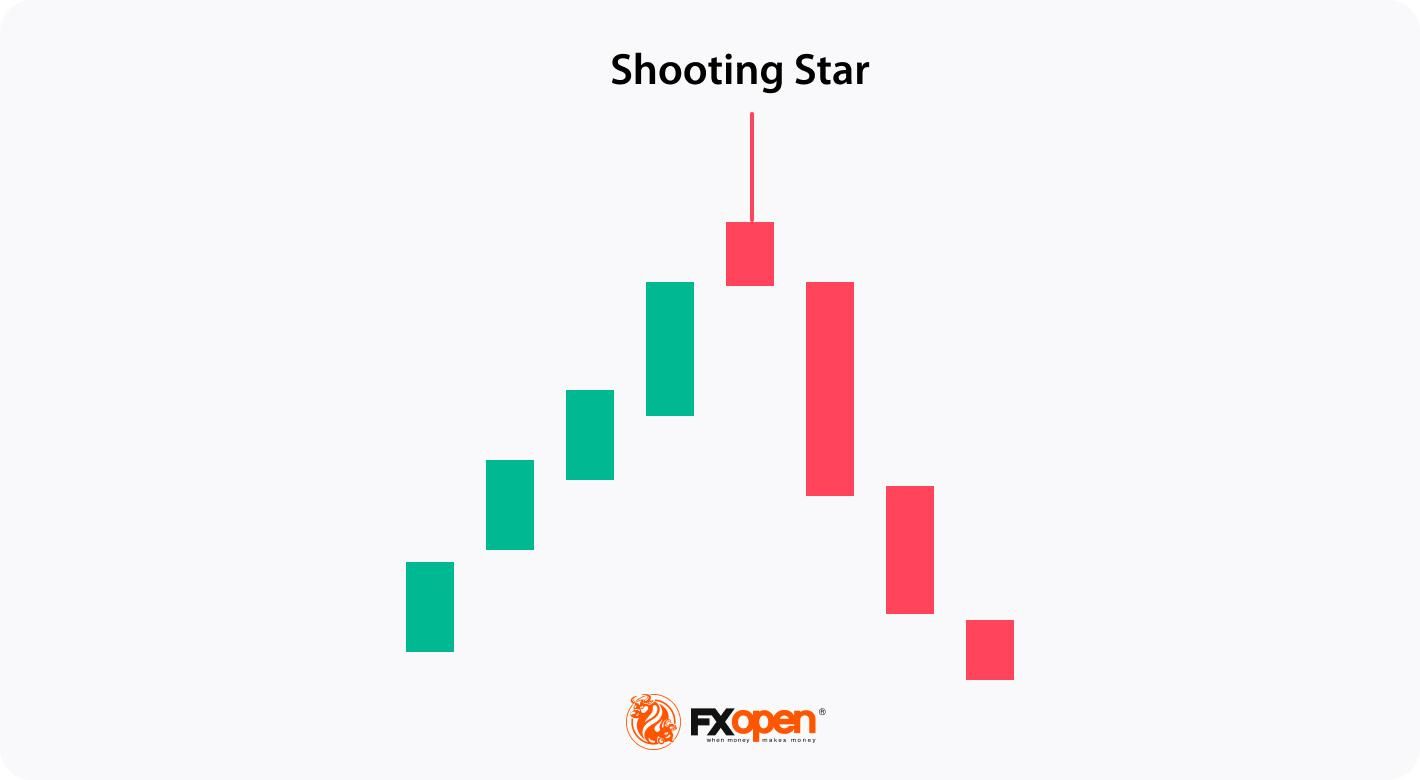

Shooting Star Pattern

Shooting Star Pattern is a bearish reversal candlestick that forms after an uptrend, signaling potential trend exhaustion. It features a small real body (either bullish or bearish) positioned near the candle's low, with a long upper wick that's typically 2-3 times the body length and minimal lower wick. This distinctive shape reflects strong selling pressure that rejected higher prices after an attempted rally.

Source: FXOpen

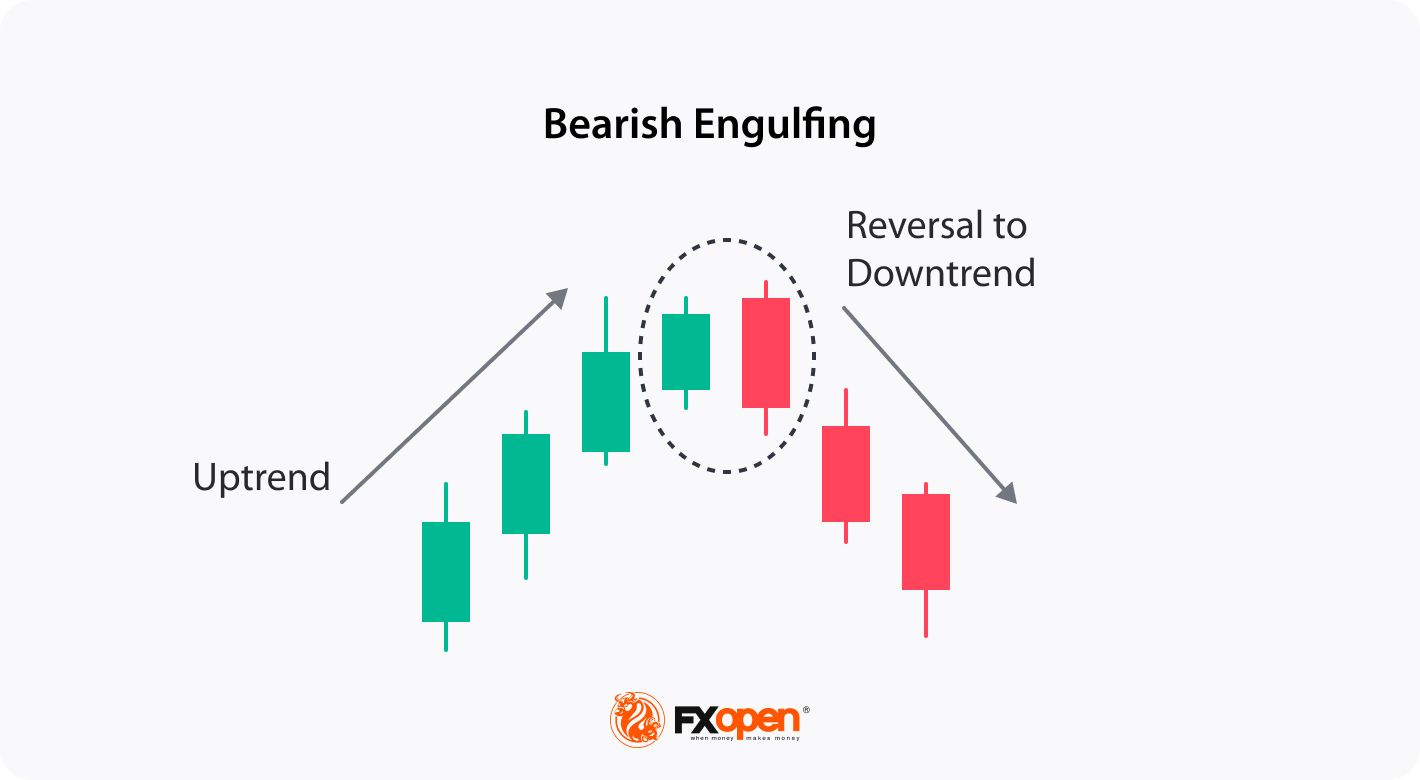

Bearish Engulfing Pattern

Bearish Engulfing Pattern is a powerful two-candle reversal formation that emerges at potential market tops. This pattern begins with a small bullish candle, immediately followed by a larger bearish candle that completely engulfs the previous candle's body. The dramatic shift from buying to selling pressure suggests strong bearish momentum taking control, with the size of the engulfing candle directly correlating to the potential strength of the coming downtrend

Source: FXOpen

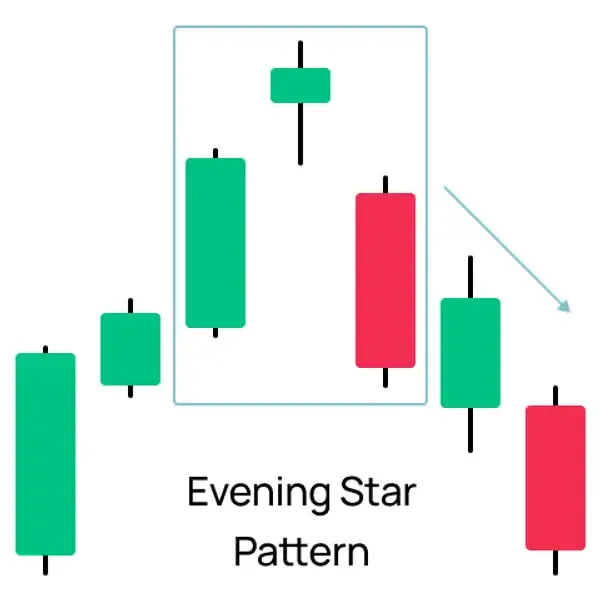

Evening Star Pattern

Evening Star Pattern is a highly reliable three-candle bearish reversal formation that emerges during uptrends, signaling potential trend exhaustion. This classic pattern begins with a strong bullish candle, followed by a small-bodied candle (which may be bullish, bearish or a doji) that gaps above the first candle, and concludes with a decisive bearish candle that closes below the midpoint of the initial bullish candle. The pattern's effectiveness increases when the third candle's close penetrates the first candle's low, demonstrating strong selling momentum.

Particularly noteworthy in cryptocurrency trading, this pattern maintains its predictive power despite the market's inverted color scheme (green for price increases, red for decreases), serving as a critical warning for traders to consider taking profits or implementing protective measures.

Source: Morpher

Three Black Crows Pattern

Three Black Crows Pattern is a potent bearish reversal signal characterized by three consecutive long-bodied red candles with minimal wicks, forming after an uptrend or at key resistance levels. Each candle opens near the previous close but faces increasing selling pressure that drives prices progressively lower, creating a staircase-like decline. This pattern demonstrates strong and consistent bearish momentum, with its reliability increasing when the candles show successively lower closes and minimal retracements.

Source: FXOpen

Disclaimer: This information does not provide advice on investment, taxation, legal, financial, accounting, or any other related services, nor does it constitute advice to purchase, sell, or hold any assets. WEEX Learn provides information for reference purposes only and does not constitute investment advice. Please ensure you fully understand the risks involved and exercise caution when investing. The platform is not responsible for users' investment decisions.

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com

WE-Launch

WE-Launch