Bullish Candlestick Pattern

In our previous articles, we covered the fundamentals of Candlestick charts. In the next two installments, we’ll explore common bullish and bearish candlestick patterns, starting with bullish formations. As the name suggests, these patterns signal a higher likelihood of an upward price movement once they appear.

Common Bullish Candlestick Patterns

- Hammer Candlestick Pattern

- Inverted Hammer Pattern

- Bullish Engulfing Pattern

- Morning Star Pattern

- Three White Soldiers

Hammer Candlestick Pattern

The Hammer candlestick pattern typically forms at the bottom of a downtrend, signaling a potential trend reversal. This pattern suggests that despite initial selling pressure, strong bullish momentum emerges, driving the price back up and forming the distinctive hammer shape. When a hammer appears, it often indicates an increased likelihood of an upward price movement in the near term.

Source: TrendSpider

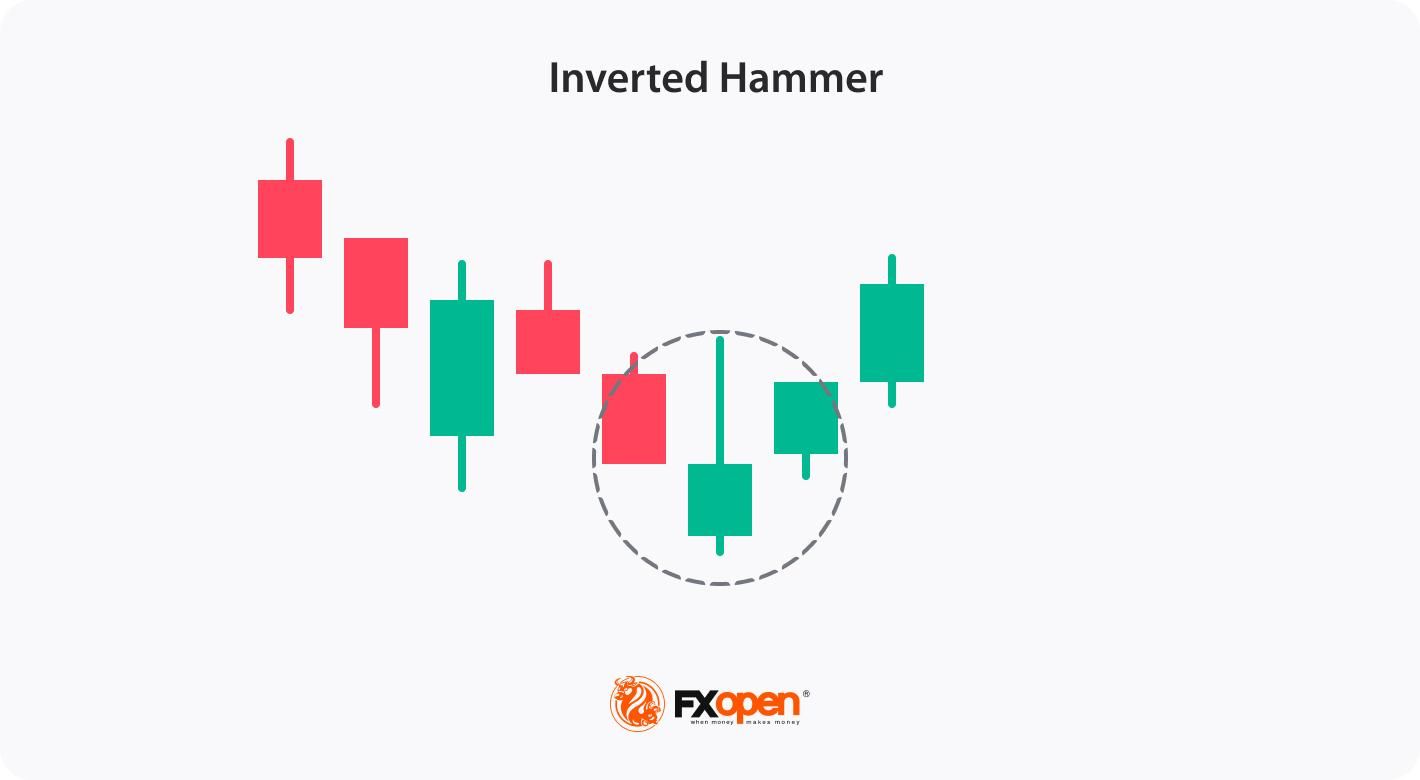

Inverted Hammer Pattern

The Inverted Hammer is a bullish reversal candlestick pattern characterized by a small body and a long upper shadow. It typically appears at the bottom of a downtrend, suggesting that buyers are starting to challenge sellers. While the initial selling pressure pushes the price down, strong buying interest later drives it back up—forming the inverted hammer.

Source: FXOpen

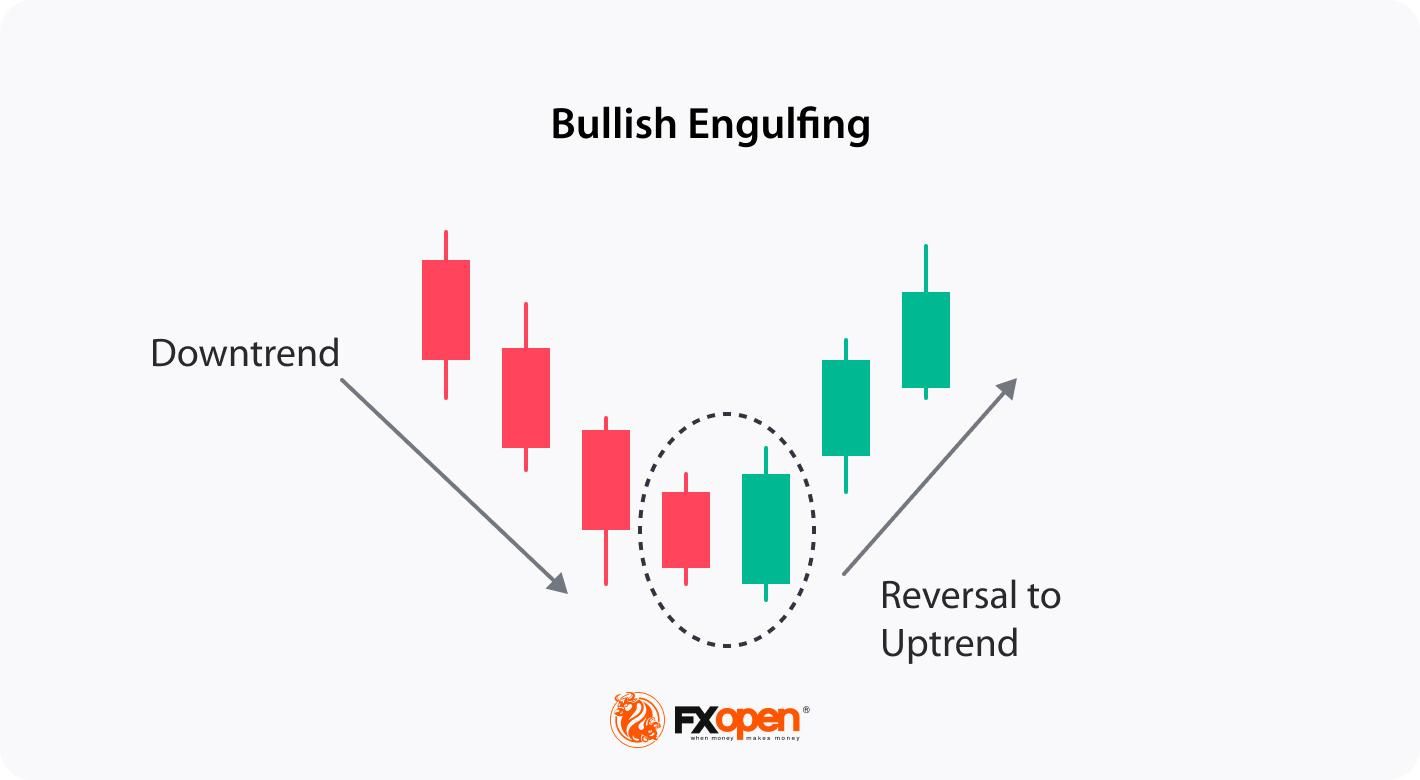

Bullish Engulfing Pattern

The bullish engulfing pattern is a two-candle reversal formation where a small bearish candle is completely overshadowed by a subsequent larger bullish candle, typically appearing at a downtrend's end. This pattern indicates weakening selling pressure and growing buying momentum, often foreshadowing a potential trend reversal.

Source: FXOpen

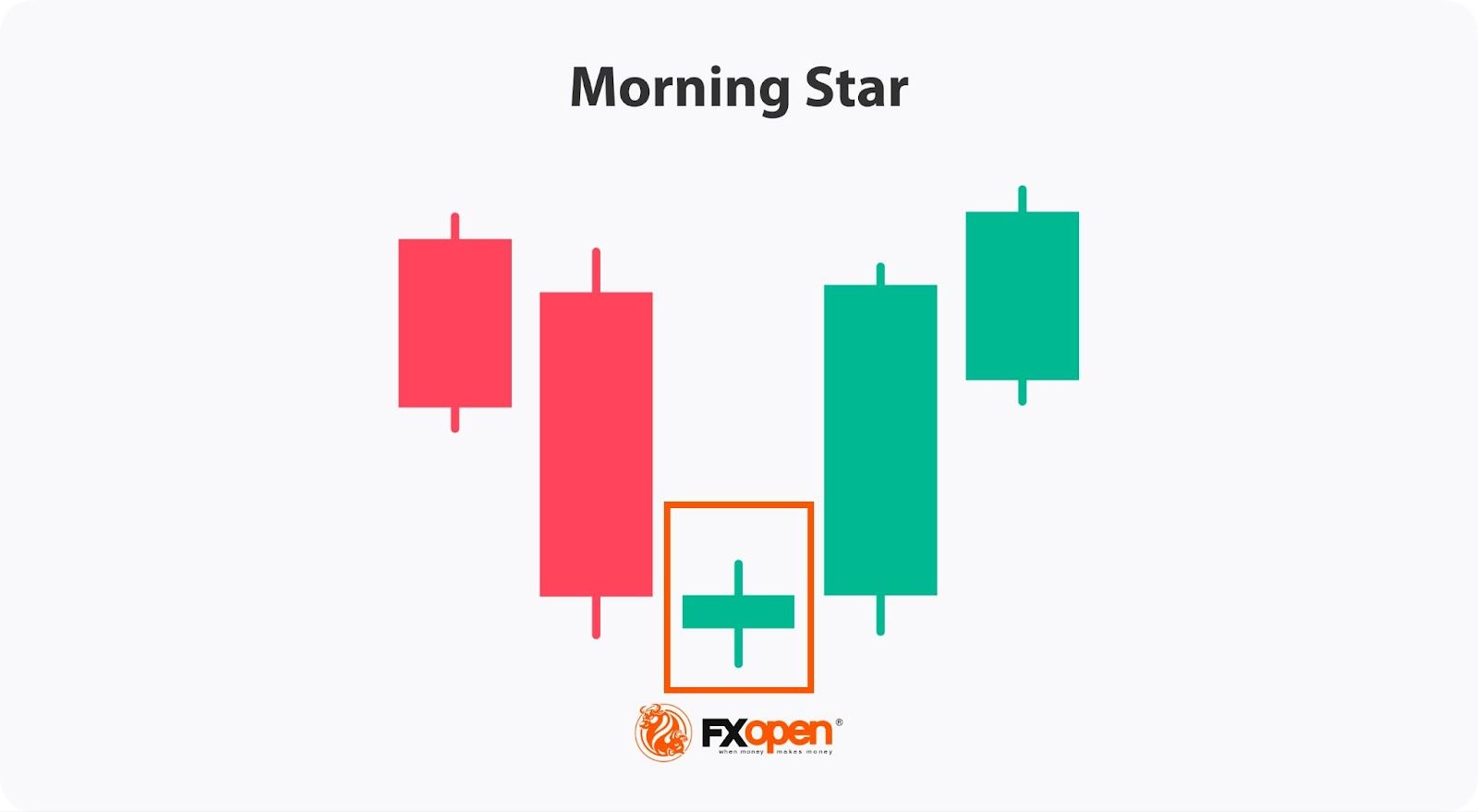

Morning Star Pattern

Evening Star Pattern is a three-candle bullish reversal formation appearing at downtrend bottoms. It begins with a long bearish candle (panic selling), followed by a small-bodied star (market indecision), and completes with a long bullish candle (buyer takeover). This pattern signals weakening bearish momentum and potential trend reversal.

Source: FXOpen

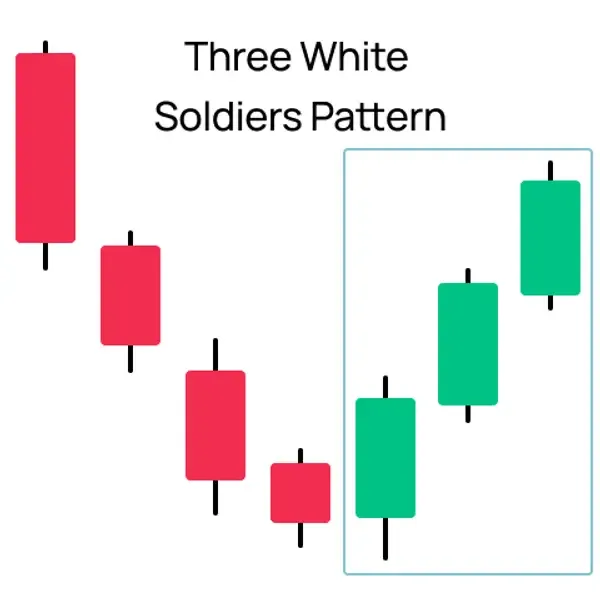

Three White Soldiers

This bullish formation consists of three consecutive long-bodied green candles following a downtrend, signaling strong buying momentum. The pattern's reliability increases with larger candle bodies - the more substantial each bullish candle closes, the stronger the confirmation of a sustained upward trend reversal.

Source: Morpher

Disclaimer: This information does not provide advice on investment, taxation, legal, financial, accounting, or any other related services, nor does it constitute advice to purchase, sell, or hold any assets. WEEX Learn provides information for reference purposes only and does not constitute investment advice. Please ensure you fully understand the risks involved and exercise caution when investing. The platform is not responsible for users' investment decisions.

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com

WE-Launch

WE-Launch