WEEX: Position Take Profit and Stop Loss Feature

In futures trading, the real challenge is usually how to exit, not when to enter. Delayed stop-losses, giving back unrealized gains, and uncontrolled risk after scaling in—these are the main drivers of drawdowns.

The Position Take-Profit / Stop-Loss feature now lives and running stably on WEEX lets you predefine both profit capture and maximum loss for an entire position in one go. Once triggered, it executes a full position market close automatically—reducing emotional interference, improving execution certainty during sharp volatility, and turning risk–reward into measurable, reviewable data.

This article will clearly and quickly cover: what it is, when to use it, its core benefits, how to set it properly, plus common FAQs.

What Is Position Take-Profit / Stop-Loss?

Position Take-Profit / Stop-Loss sets exit conditions for the entire current futures position. After you define a take-profit price and/or a stop-loss price for a position, once market price hits a trigger, the system attempts to close all remaining size at market.

When It’s Useful

Typical scenarios include:

- Unified exit after scaling into multiple fills

- Unable to monitor the market continuously

- Defining worst-case loss before key events or data

- Strategies requiring fixed risk–reward ratios

- Emotional swings driven by floating PnL

- Accounts enforcing per-trade risk caps

If you need laddered partial take-profit, ultra-short-term scalping, or order book microstructure tactics, you will need to combine this with other tools.

Benefits of the Position Take Profit and Stop Loss feature:

- Automated trading and simplified management: Users do not need to manually close positions; the system automatically handles trades based on preset conditions, helping users quickly lock in profits or limit losses while reducing the need to constantly monitor market dynamics.

- Reduced emotional interference and faster response: With automated settings, users can minimize the impact of emotions on decision-making, respond quickly to market changes, and effectively control risks to protect their capital.

How to Set Up the Position Take Profit and Stop Loss?

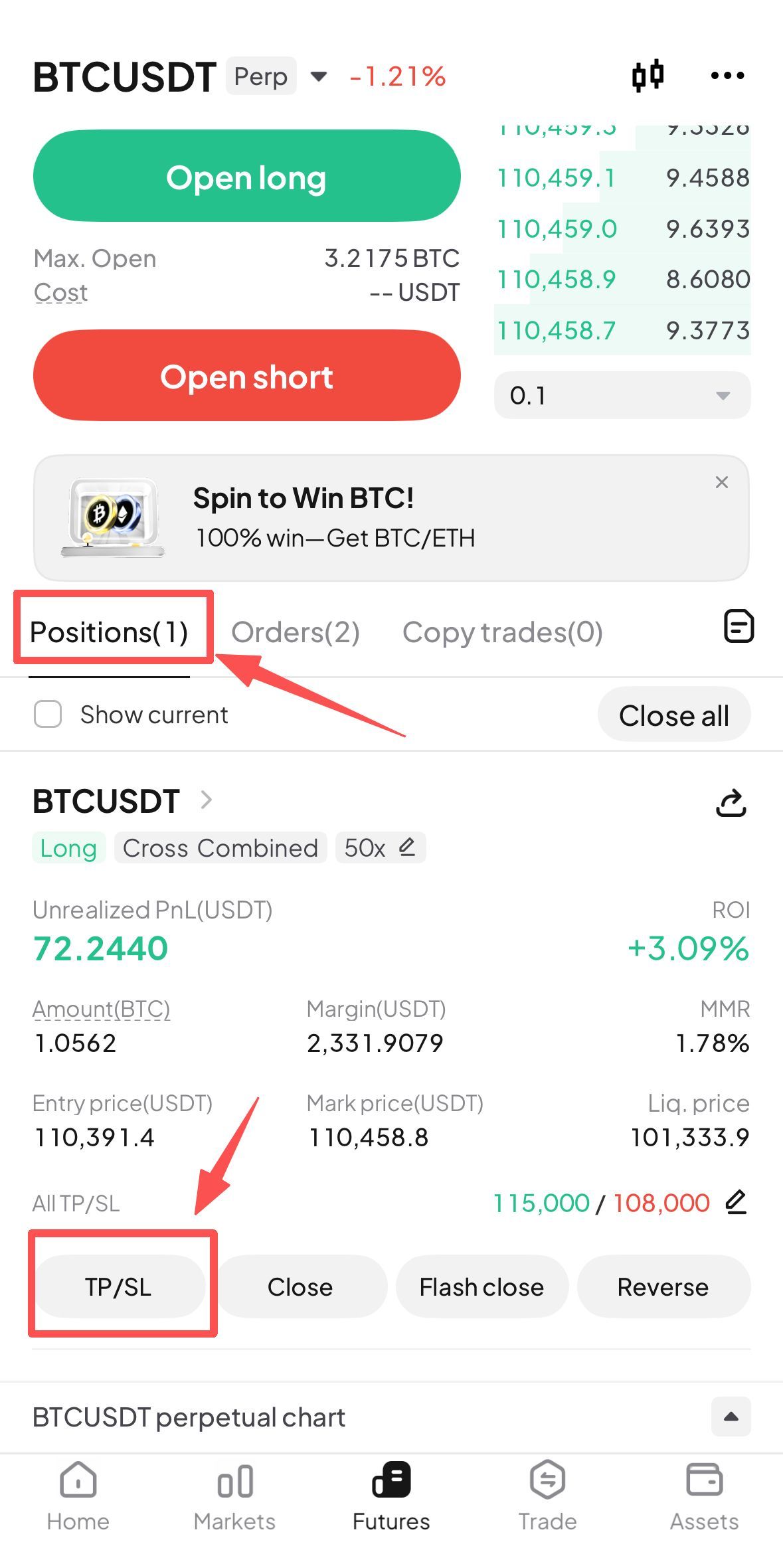

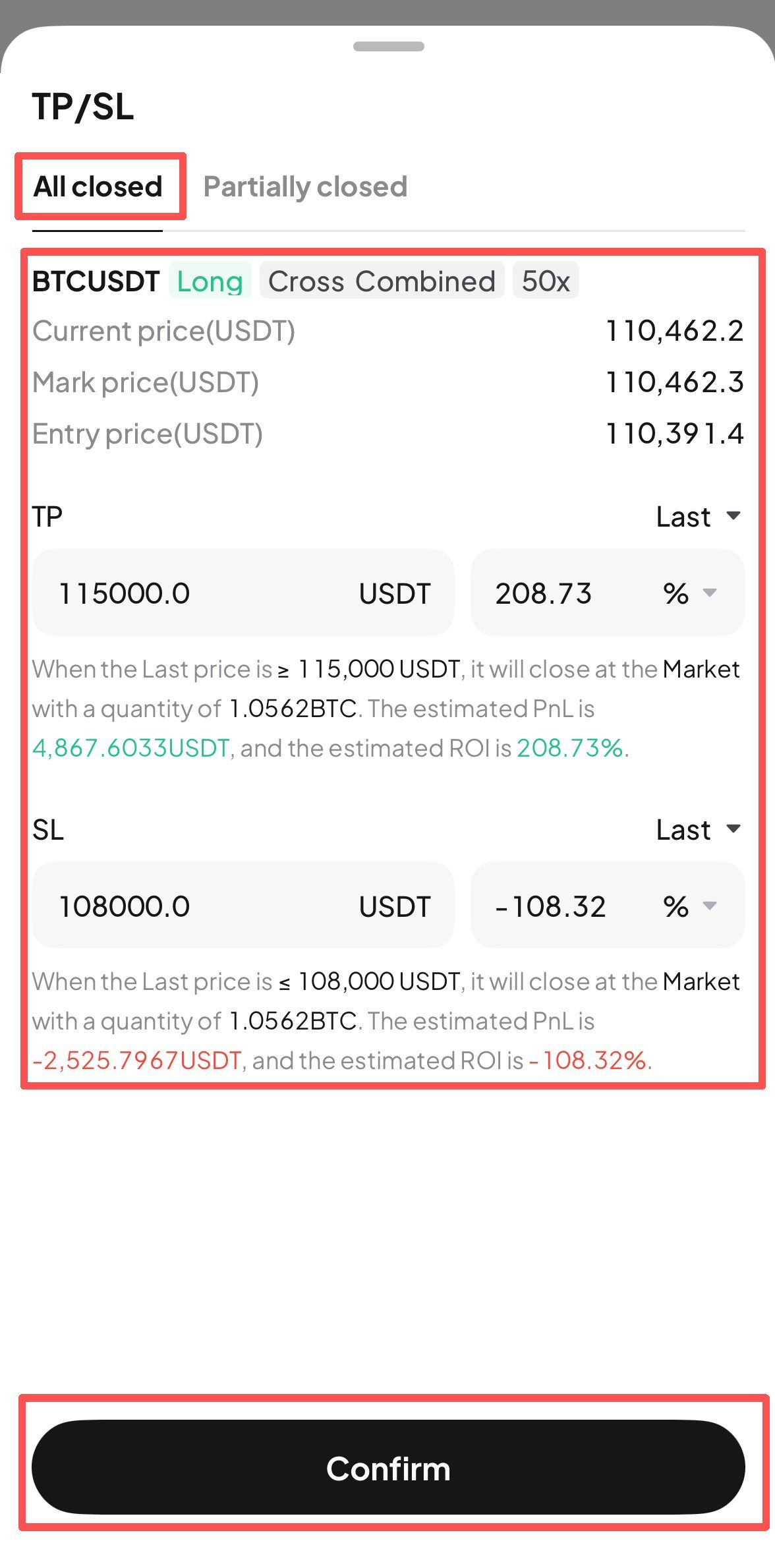

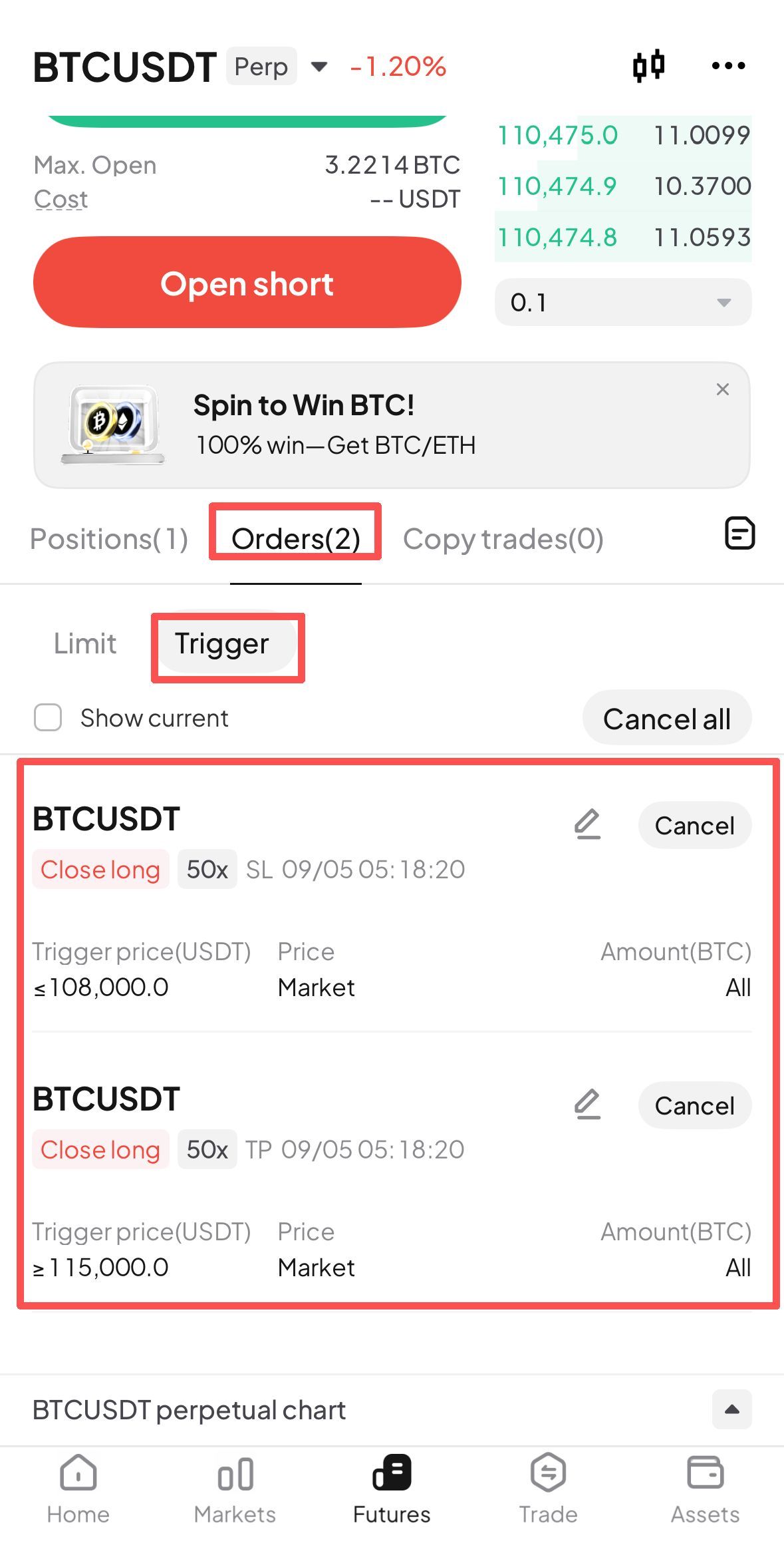

APP:

- After opening a futures trading order, users can find the "TP/SL" button in the Positions interface.

- Click the "TP/SL" button to enter the setup interface for the entire position take profit and stop loss. Users can fill in the take profit target price or stop loss target price based on their trading strategy, and click "Confirm" once completed.

- After setting up the take profit/stop loss for the entire position, users can find the corresponding take profit/stop loss orders in the Trigger section of the Orders interface. When the asset price reaches the specified order price, the system will automatically execute a market order to close the entire position.

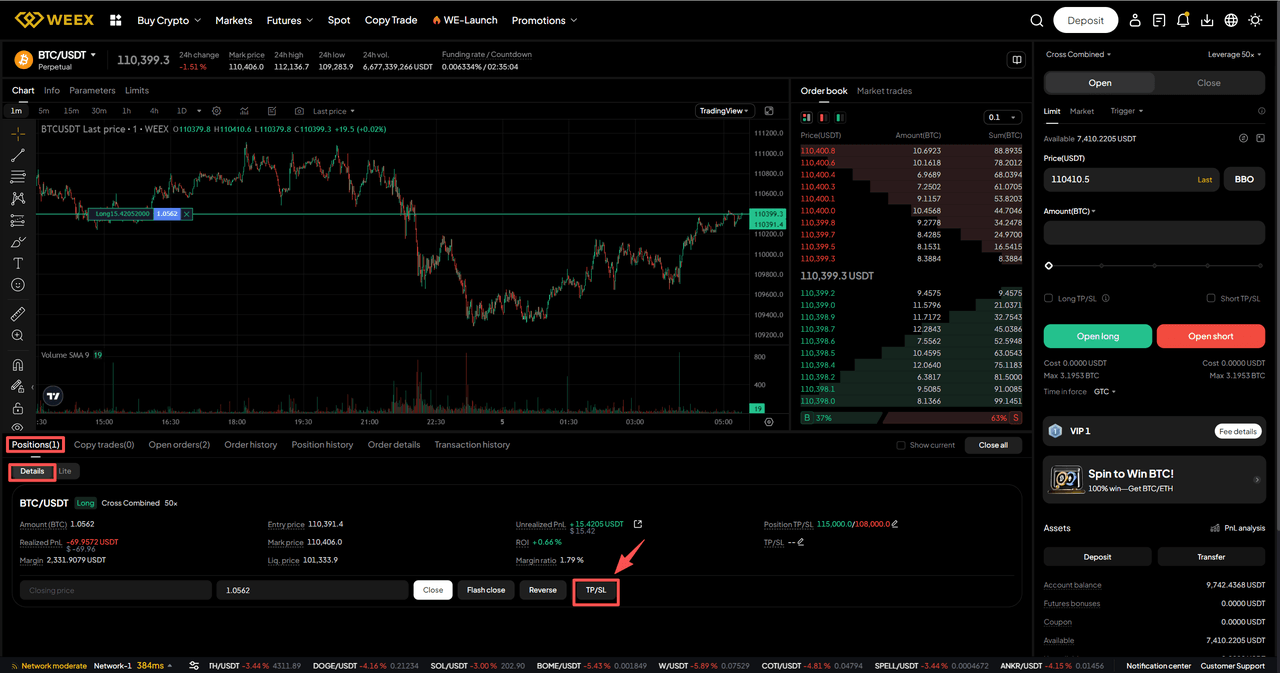

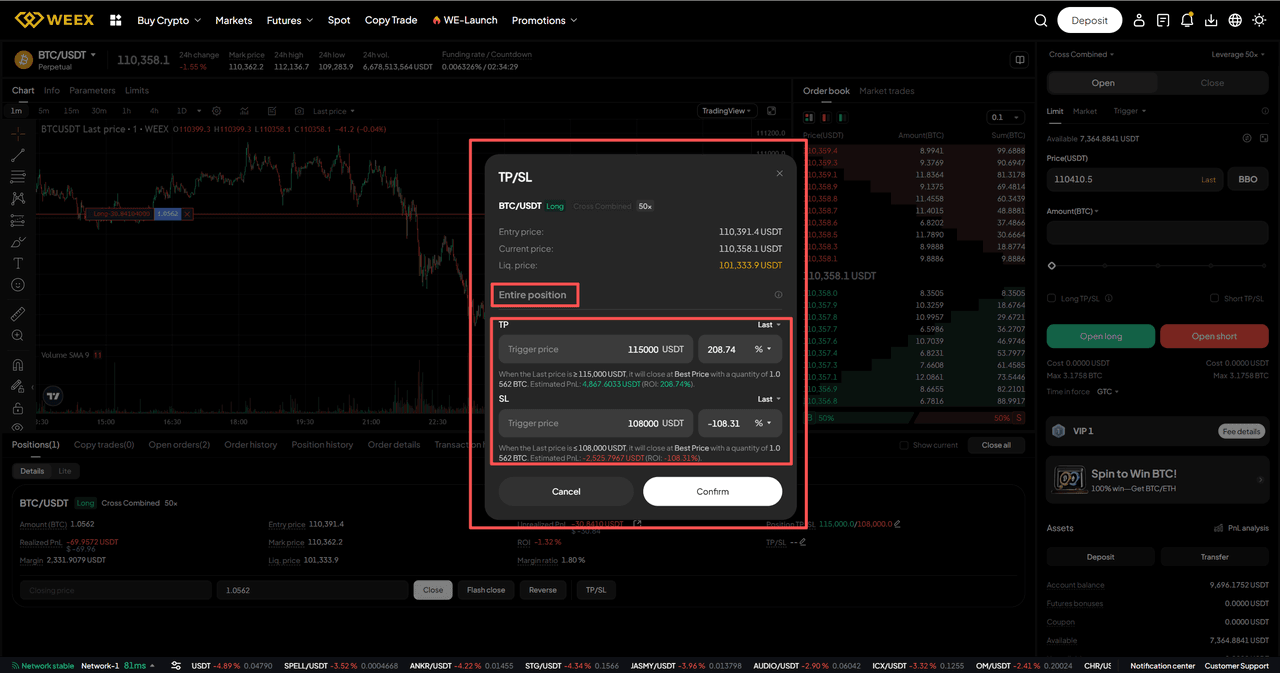

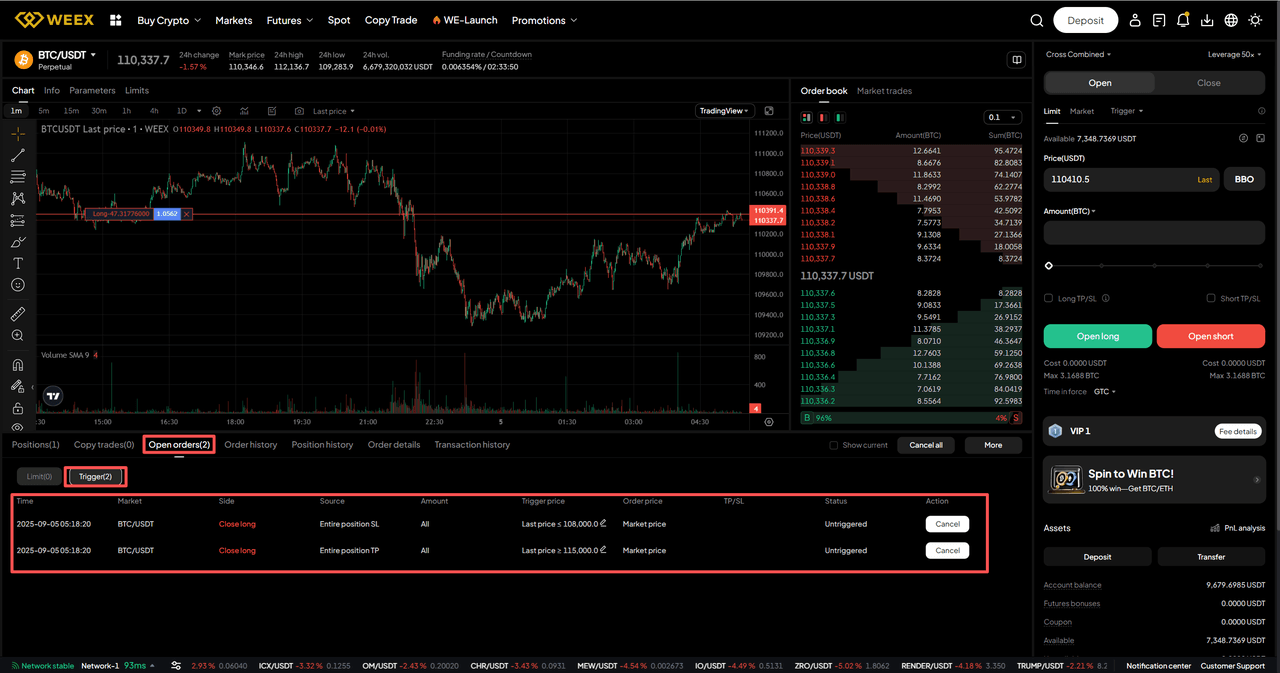

WEB:

- After opening a futures trading order, users can find the "TP/SL" button in the Details section of the Positions interface.

- Click the "TP/SL" button to enter the setup interface for the entire position take profit and stop loss. Users can fill in the take profit target price or stop loss target price based on their trading strategy, and click "Confirm" once completed.

- After setting up the take profit/stop loss for the entire position, users can find the corresponding take profit/stop loss orders in the Trigger section of the Open orders interface. When the asset price reaches the specified order price, the system will automatically execute a market order to close the entire position.

Q&A

1. Do I have to set both take‑profit and stop‑loss?

No. You can set only a stop‑loss (cap worst loss), only a take‑profit (lock in expected gain), or both to define a fixed risk‑reward ratio.

2. Will it always fill exactly at my set price once triggered?

No guarantee. A trigger just means the condition is met; the system then sends a market close. The actual average fill can differ due to slippage, depth, and volatility.

3. Can I modify or cancel after setting it?

Yes. Open the position’s Take-Profit/Stop-Loss panel to adjust or remove. The latest submission overrides prior ones. If you’ve manually reduced part of the position, the remaining size keeps using the updated settings.

You may also like

How to Keep Your Crypto Safe? Everything You Need to Know

One of the defining attributes of cryptocurrency, compared to traditional fiat currencies such as the U.S. dollar, is the direct ownership and control it grants individuals over their digital assets.

Rather than depending on banks or financial institutions to hold and transfer value, cryptocurrency is inherently designed to be accessed solely by the holder of the associated digital wallet. This architecture makes it resistant to censorship, seizure, or freezing by centralized authorities—provided it is stored with appropriate security measures.

However, this self-custody model also imposes the full responsibility of security on the individual. In an industry where theft, fraud, and accidental loss are not uncommon, safeguarding crypto assets demands knowledge and vigilance. While acquiring cryptocurrency has become increasingly accessible, knowing how to store it securely remains a challenging task, especially for those less familiar with technology.

How to Store Crypto Safely?Since cryptocurrencies exist purely in digital form, there are no physical tokens to place in safes or vaults. Instead, access to your crypto is managed through digital wallets—software applications or dedicated hardware devices that securely store the cryptographic keys needed to control your funds.

A deeper understanding of wallet types and their security trade-offs is essential for anyone entering the crypto space.

How Crypto Wallets WorkTo grasp how cryptocurrency security functions, it helps to understand the role of cryptographic keys generated with each wallet.

When a wallet is created, two mathematically linked keys are produced:

A public key, which is hashed to create a public wallet address—similar to a public email address used to receive funds.A private key, which acts like a master password to authorize transactions and should never be shared.If the public key is comparable to a home address, the private key is the key to the front door. Losing the private key means permanent loss of access to the associated funds.

Most wallets also generate a seed phrase—a series of words that serves as a backup to restore a wallet on a new device. Like a private key, this seed phrase must be stored securely offline; if exposed, anyone can gain control of the wallet and its contents.

How to Keep Your Crypto Safe?1. Keep Private Keys and Seed Phrases OfflineNever store digital copies of private keys or seed phrases on devices connected to the internet. Write them down on paper or use specialized metal backup plates, and store them in a secure, fire-resistant location.

2. Limit Exposure on Exchanges and DeFi ProtocolsWhile trading platforms and decentralized finance protocols enable active participation, they also concentrate risk. Avoid keeping all your assets on any single platform or protocol. Use them primarily for active trading or yield farming, and transfer unused funds back to a secure personal wallet.

3. Enable Two-Factor Authentication (2FA)Strengthen account security by enabling 2FA using an authenticator app. Avoid SMS-based 2FA when possible, as it is more susceptible to SIM-swapping attacks.

4. Maintain Privacy About HoldingsPublicly disclosing crypto holdings can make you a target for phishing, social engineering, or physical threats. Practice discretion in both online and offline discussions about your assets.

Types of Crypto WalletsHot WalletsThese wallets remain connected to the internet, offering convenience for frequent transactions. Examples include browser-based wallets like MetaMask and mobile apps like Trust Wallet. While user-friendly, hot wallets are inherently more exposed to online threats such as malware, phishing, and hacking.

Cold WalletsPhysical devices that remain offline except when initiating transactions. Examples include Ledger and Trezor hardware wallets. Because they are disconnected from the internet, cold wallets offer significantly stronger protection against remote attacks. They are recommended for storing significant amounts of crypto long-term.

As a rule, purchase hardware wallets only from official sources to avoid tampered or compromised devices.

Read More: What is a Crypto Hardware Wallet?

Common Cryptocurrency Security ThreatsCrypto’s unregulated and high-value nature attracts a range of fraudulent schemes. Awareness of common scams is a critical defense mechanism.

1. Fake Giveaway ScamsOften impersonating celebrities or influencers on social media, these scams promise to multiply any crypto sent to a specified address. In reality, funds sent are stolen, and any “success stories” posted are typically fabricated.

2. Phishing AttacksAfter data breaches, affected users may receive emails or messages that appear to come from legitimate platforms, urging them to re-enter login details or private keys. These often contain malicious links designed to steal credentials or install wallet-draining malware.

3. Ponzi and High-Yield SchemesFraudulent platforms promise unsustainable returns with little risk or transparency. They may appear professional but often lack verifiable teams, clear revenue models, or consistent withdrawal functionality. Historical examples like BitConnect highlight the importance of thorough due diligence before investing.

A basic security checklist can help:

Verify the team and company background.Look for clear explanations of how returns are generated.Test withdrawal functionality with small amounts.Be skeptical of guarantees of high returns with no risk.Getting Started Securely with WEEXEntering the cryptocurrency space requires a balanced approach: embracing the freedom of self-custody while adopting disciplined security habits. Start by selecting a reputable wallet, practicing secure key management, and educating yourself on common threats. Over time, these practices become second nature, enabling you to navigate the digital asset ecosystem with greater confidence and safety.

If you're ready to explore cryptocurrency with security and ease, choose WEEX—a platform built with institutional-grade safeguards, 24/7 multilingual support, and seamless trading execution. Sign up today and experience a secure, reliable gateway to crypto trading.

Further ReadingWhat Are Airdrop Scams and How to Avoid Them?What Are Crypto Signals and How to Use them?What are Pyramid and Ponzi Schemes?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is RSI Divergence and How It Works?

RSI divergence occurs when an asset's price moves in one direction while its Relative Strength Index (RSI) moves in the opposite direction. This discrepancy between price action and underlying momentum often indicates potential trend weakening or a forthcoming reversal.

Traders use RSI divergence as an early signal that a prevailing trend may be losing strength, which can help identify potential market tops or bottoms. The concept is applicable across various timeframes and can assist in decisions to enter, exit, or adjust positions.

What is the RSI and How Is It Calculated?The Relative Strength Index (RSI) is a momentum oscillator that quantifies the magnitude and speed of price changes over a defined period—typically 14 periods. The index oscillates between 0 and 100.

In essence, RSI compares the average gains and losses over the selected period. A higher RSI (closer to 100) indicates stronger buying momentum, while a lower RSI (closer to 0) reflects stronger selling pressure. Levels above 70 are generally considered overbought, and levels below 30 are viewed as oversold—conditions that may precede price reversals.

Most modern trading platforms calculate RSI automatically, allowing traders to focus on interpretation rather than computation. Due to its clarity and adaptability, RSI is widely used across equities, forex, and cryptocurrency markets.

How to Define RSI Divergence?Divergence is identified when the price forms a new high or low that is not confirmed by a corresponding new extreme in the RSI.

Bullish Divergence: Price records a lower low, while RSI forms a higher low.Bearish Divergence: Price makes a higher high, while RSI makes a lower high.These patterns suggest underlying momentum is weakening, even if price action appears strong. Divergences do not guarantee reversals but increase the probability of a shift when observed within a broader technical context. Traders often use historical backtesting to assess the reliability of divergence signals in different market environments.

Types of RSI DivergenceRegular Bullish Divergence Occurs during a downtrend: price makes lower lows, but RSI forms higher lows. This signals decreasing selling pressure and may precede a bounce or trend reversal upward.Regular Bearish Divergence Appears in an uptrend: price reaches higher highs, while RSI makes lower highs. This indicates fading bullish momentum and can be used to prepare for short entries or exit long positions.Hidden Bullish Divergence Observed in an uptrend: price forms a higher low, but RSI prints a lower low. This suggests the underlying uptrend remains intact and a pullback may be ending.Hidden Bearish Divergence Seen in a downtrend: price makes a lower high, while RSI creates a higher high. This reinforces the ongoing downtrend and can be used to add or maintain short positions during retracements.Recognizing these variations helps traders align decisions with the prevailing market structure.

How to Spot RSI Divergence?Apply a 14-period RSI to your price chart.Identify significant highs and lows in both price and RSI.Draw trendlines connecting these extremes in each window.Look for opposing slopes between the price and RSI trendlines—this confirms divergence.Use breaks of key support/resistance or trendline violations as additional confirmation before acting on the signal.When Does RSI Divergence Work Best?RSI divergence tends to be more reliable on higher timeframes—such as daily or weekly charts—and after a sustained directional move. It is less effective during parabolic or extremely strong trends, where momentum and price may remain disconnected for extended periods.

Context is critical. Combining divergence with other confirming factors—such as key support/resistance levels, volume patterns, or candlestick formations—increases the robustness of the signal.

Common RSI Divergence PitfallsDivergence signals possible weakening, not certain reversal. Strong trends may consolidate before resuming.Signals can be invalidated if price continues to make new extremes despite RSI divergence.Lower timeframe divergences carry less weight and often indicate only short-term corrections within a larger trend.Overreliance on divergence without confluence from other indicators increases risk.General RSI Trading GuidelinesUse RSI alongside other technical tools to build a multi-factor view of market conditions.Analyze multiple timeframes to gauge the strength and scope of a potential reversal.Always define invalidation levels and employ stop-loss orders to manage risk.Trade in probabilities, not certainties—no signal guarantees success.Exercise patience: wait for confluence rather than entering solely on divergence.Consider intermarket dynamics, especially in crypto—Bitcoin’s trend often influences altcoin behavior.Base divergence analysis on closing prices rather than intra-candle wicks for clearer signals.Trading Strategies Using RSI Divergence

Reversal Strategy (Regular Divergence)Entry: After confirmation, such as RSI crossing a key level or price breaking a trendline.Stop-loss: Placed beyond the recent swing high/low.Take-profit: Set near previous support or resistance.Trend Continuation Strategy (Hidden Divergence)Entry: On a pullback within a prevailing trend, supported by hidden divergence.Confirmation: RSI crossing back above/below 50, or price resuming its trend direction.Real-World Example: Bitcoin in Late 2022

In November 2022, Bitcoin established a significant market bottom near $15,500. Analysis of the weekly chart revealed a clear bullish divergence: price made a lower low while RSI formed a higher low. This was accompanied by a volume spike at the lows—a common capitulation signal—before the market reversed into a new uptrend.

ConclusionRSI divergence is a valuable technical tool for identifying potential trend reversals and continuations. Regular divergences often flag trend changes, while hidden divergences support staying with the existing trend. By integrating these patterns into a structured trading plan—supported by risk management and additional technical confirmation—traders can enhance decision timing and trade with greater discipline. Remember, divergence alone does not assure success, but it provides probabilistic signals that can improve overall trading effectiveness when used thoughtfully.

Further ReadingWhen the Market is Down, What Should We Do?What Are Crypto Signals and How to Use them?Crypto Trading vs.Traditional Investment, What's the Difference?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Top 3 Best Crypto Earning Apps in 2025: Why WEEX Auto Earn Stands Out?

Imagine daily habits—like having coffee, walking, or gaming—now earning you crypto. A growing range of apps turns routines into effortless rewards, making portfolio growth accessible without trading knowledge.

Today, you can earn crypto by learning, staying active, shopping, or even sharing device resources, often starting for free. These approaches lower entry barriers and weave crypto naturally into everyday life.

Leading platforms such as WEEX, Bybit, and KuCoin now integrate staking, learn-and-earn programs, and liquidity incentives. These features let users grow assets through both market activity and structured rewards, creating a more holistic crypto journey. To help you start, here’s a curated list of the best crypto-earning apps for 2025.

WEEX - Best of AllWEEX Auto Earn excels in 2025 with its flexible and transparent approach, allowing users to earn rewards instantly with no lock-up periods or minimum deposits. It calculates interest hourly across Spot, Funding, and Futures accounts, with daily USDT payouts based on your lowest daily balance for predictable returns.

New users benefit from bonus APR by verifying within seven days, while smart features like auto-pausing when balances fall too low enhance user experience. With zero platform fees, WEEX Auto Earn offers a secure and seamless path to passive crypto earnings.

Core Features of WEEX Auto EarnFlexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

BybitWhile widely recognized as a leading crypto trading platform since 2018, Bybit serves a global community of over 50 million users with far more than just advanced trading tools. The exchange offers a diverse suite of earning features designed to help both passive investors and active traders grow their crypto portfolios effectively and conveniently.

Core Features:Bybit Savings: Provides flexible and fixed-term options with competitive, guaranteed APRs for low-risk yield.Crypto Liquidity Mining: Users can supply liquidity to AMM-based pools and earn yields, with optional leverage to increase potential returns.Dual Asset: A short-term trading tool that allows users to choose “Buy Low” or “Sell High” strategies to earn enhanced interest based on market outlook.Wealth Management: Access professionally managed crypto investment funds, allowing hands-off participation in curated trading strategies.Beyond its reputation as a high-performance exchange, Bybit stands out through these integrated earning solutions—making it a comprehensive platform for users seeking growth through savings, staking, liquidity provision, or managed investments.

KuCoinFounded in the Seychelles and operating globally, KuCoin serves over 37 million users across 200+ countries. Beyond its core exchange services, KuCoin offers a wide range of integrated features that enable users to earn, learn, and engage with crypto through accessible, education-driven, and reward-based experiences.

Core Features:

KuCoin Earn: Provides both flexible and fixed-term staking options, recognized by Investopedia and Forbes as a leading staking platform.Learn and Earn: Users earn Token Tickets by completing educational courses and quizzes, which can be redeemed for cryptocurrency.Mystery Box: Offers limited-edition NFT releases through brand collaborations on KuCoin's NFT marketplace.It’s important to note that many of these features require KYC verification, and access may be restricted in certain regions, including the United States and Canada. Users are encouraged to confirm eligibility before participating in any program.

Why WEEX Auto Earn Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature.

What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

What is Sad Coin and Why This Meme Coin Is Going Up?

Sad Coin (SAD) is a meme token centered on the widely recognizable "sad face" motif, reflecting the collective emotional fluctuations of the crypto market. The project’s branding blends irony with ambition, positioning itself as culturally resonant during both downturns and speculative upswings.

Its community actively engages in discussions around market cycles, Solana’s potential, and the volatile nature of meme-driven assets. While concrete holder and volume data remains dynamic, the token emphasizes narrative and sentiment over traditional metrics—reminding participants to balance humor, speculation, and risk awareness in a highly unpredictable environment.

Why Is Sad Coin Going Up?Sad Coin's recent upward movement is primarily fueled by short-term market momentum and heightened trader sentiment rather than fundamental utility or long-term project development. Over the past 24 hours, SAD has experienced an increase of approximately 22%, reaching a price level around $0.13. This surge is accompanied by noticeable rises in transaction volume, active wallet participation, and net buying activity—indicators commonly associated with speculative interest and rotational trading into lower-cap meme tokens.

The token benefits from its easily recognizable branding, centered around the widely known “crying Wojak” meme, which facilitates social sharing and community identification. This cultural shorthand helps attract attention during periods when traders are actively scanning the market for high-volatility, sentiment-driven opportunities. On-chain metrics further reflect this activity, showing elevated transaction counts and stable liquidity provision, characteristics often seen in emerging meme assets that attract momentum-focused participants.

Additionally, Sad Coin’s market capitalization range allows for sharp percentage movements without requiring massive capital inflows, making it an appealing target for short-term traders seeking rapid gains. While this environment supports quick price appreciation, it also underscores the token's dependence on ongoing attention and speculative engagement—factors that can shift rapidly in the highly reactive meme coin landscape.

Sad Coin Price AnalysisCurrently trading near $0.133 with a market capitalization of approximately $131 million, Sad Coin is demonstrating active but mixed short-term price behavior. The 24-hour trading volume stands around $1.3 million—a meaningful level relative to the token’s liquidity depth and age—suggesting sustained speculative interest.

Chart analysis shows that recent price action has formed a series of higher lows following earlier corrections, indicating that buyers continue to enter during dips rather than exiting en masse. However, momentum remains inconsistent across shorter timeframes, reflecting the attention-driven and often discontinuous trading patterns typical of meme assets.

Liquidity conditions remain adequate for moderate-sized trades, reducing slippage risk for retail participants. Positive net buy flow over the past day aligns with the observed price appreciation, yet the token’s trajectory remains closely tied to social engagement and market sentiment rather than structured accumulation or institutional backing.

In essence, Sad Coin is moving because traders are actively trading it—its price reflects real-time participation rather than long-term valuation. This environment is marked by high volatility, where price advances can be as rapid as their reversals once attention or volume subsides.

ConclusionSad Coin’s recent appreciation is largely a reflection of renewed speculative interest in meme-based cryptocurrencies rather than a shift in its underlying fundamentals. Characterized by strong short-term trading activity, rising volume, and active community participation, SAD operates as a momentum-driven asset within a high-risk, high-volatility segment of the market.

Participants should remain mindful of the sentiment-sensitive nature of such tokens and employ disciplined risk management—including position sizing, exit strategies, and ongoing market monitoring—when engaging in short-term trading. For those comfortable navigating decentralized trading environments, Sad Coin represents a current focal point in the evolving narrative of community-driven digital assets.

Further ReadingWhat is the D ($D) and It's Safe to Invest in D ($D)?What Is Quant (QNT)?What Is Momentum (MMT)?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: What is Sad Coin?

A: Sad Coin is a sentiment-driven meme cryptocurrency that leverages viral internet imagery and emotional themes to engage communities. Its value is largely influenced by social momentum and speculative trading activity rather than traditional utility.

Q2: Why is Sad Coin trending today?

A: Sad Coin is gaining attention due to a notable 24-hour price surge of approximately 22%, accompanied by rising trading volume and increased on-chain activity, reflecting renewed speculative interest in meme-based assets.

Q3: Is Sad Coin a long term investment?

A: Sad Coin is primarily viewed as a high-volatility, short-term speculative asset and is not typically positioned as a long-term investment due to its reliance on market sentiment and cultural trends.

Grow Your Assets with WEEX Auto Earn! One Click to Gain Profit

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Why Choose WEEX Auto Earn in 2025?WEEX Auto Earn stands out in 2025 with its exceptional flexibility, transparency, and user-friendly design. It offers instant access to funds—no lock-up periods or minimum deposits—while automatically calculating hourly rewards across your Spot, Funding, and Futures accounts. Earnings are paid out daily in USDT based on your lowest daily balance, ensuring fairness and predictability. New users enjoy a bonus APR when verifying within seven days, and the feature includes smart automation like auto-disabling if balances drop too low—all with zero fees, making passive earnings both seamless and secure.

Core Features of WEEX "Auto Earn"Flexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).How to Grow Your Assets with WEEX Auto Earn?Participating in WEEX Auto Earn is simple and fast. Whether you are a beginner or a frequent trader, you can participate and grow your wealth. By following the steps below, you can participate in just a few minutes while making more assets.

Follow the steps to participate now:

Open the APP, go to the Assets page, and click on Auto Earn.Toggle the switch in the middle of the page to enable Auto Earn.Once confirmed, interest will start accruing immediately, and earnings will be distributed to your funds account the next day. Distributed earnings can be viewed in your funds account history.For more information, check this video below to learn more:

WEEX Auto Earn RoadmapWEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Ready to put your idle crypto to work—on your terms? Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interests t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

What is DarkDrop (DARKDROP) and Why DarkDrop Matters?

DarkDrop (DARKDROP) is a unique Solana-based meme token that distinguishes itself by integrating directly with a functional privacy platform. Unlike most meme tokens, which rely solely on cultural virality and social sentiment, DarkDrop is engineered to support untraceable, on-chain value transfers through a mechanism known as a "dead drop." This approach allows users to send assets without exposing their wallet addresses, creating a layer of privacy that operates natively within the blockchain environment.

By leveraging Solana's high throughput and low transaction costs, DarkDrop enables fast and discreet asset movements while maintaining the playful, meme-oriented branding that attracts community-driven engagement. This duality positions it as more than just a speculative token—it serves as the gateway to a decentralized privacy tool designed for users seeking enhanced transactional confidentiality.

How the DarkDrop Platform Works?The DarkDrop platform functions as a streamlined privacy protocol that facilitates anonymous asset transfers through three primary stages:

Transit When a transfer is initiated, the funds are instantly moved to a disposable, one-time-use wallet known as a burner keypair. This temporary wallet acts as a secure intermediary, breaking any direct on-chain connection between the sender and the transaction.Share The system generates an encrypted claim string, which contains the necessary information to redeem the transferred funds. This string can be shared through any off-chain communication method—such as messaging apps, email, or even physical notes—without revealing wallet addresses or transaction details.Purge Once the recipient redeems the funds using the claim string, the burner wallet is automatically destroyed. The assets are transferred directly to the recipient’s designated wallet, leaving no persistent on-chain trace linking the two parties.This mechanism provides a practical and user-friendly method for conducting confidential transfers, aligning with the core blockchain principles of autonomy and censorship resistance.

DarkDrop (DARKDROP) Market OverviewCurrently, DARKDROP is trading around $0.000065, reflecting its status as an early-stage, low-market-cap asset within Solana’s expansive meme token ecosystem. The token is listed across several major tracking platforms and is paired with multiple currencies, including USD, BTC, EUR, and regional fiats such as NGN and IDR.

Live market data, including historical volatility, trading volume, and market capitalization, is publicly accessible, allowing traders to monitor its performance in real time. What sets DARKDROP apart is its connection to a functioning privacy protocol, which provides a tangible utility narrative beyond pure speculation.

DarkDrop (DARKDROP) TokenomicsDarkDrop operates under a fixed-supply tokenomic model designed to promote scarcity and long-term value stability. Key metrics include:

Total Supply: Capped to prevent inflation.Max Supply: Equal to total supply, ensuring no additional token issuance.Circulating Supply: Actively tradable tokens available in the market.Fully Diluted Valuation (FDV): A forward-looking metric calculated as price multiplied by max supply.This deflationary structure aims to reduce dilution risk over time while supporting the token's role within the DarkDrop ecosystem. As the privacy platform gains adoption, DARKDROP may see increased demand driven by both utility and speculative interest.

Why DarkDrop Matters?DarkDrop occupies a distinctive niche by merging meme culture with cryptographic utility at a time when on-chain privacy is increasingly valued. In an environment where blockchain transactions are inherently transparent, tools that enable discreet transfers offer clear practical appeal.

Built on Solana, the platform benefits from fast confirmation times and minimal fees, making it suitable for real-world use. While the token remains speculative in nature, its underlying privacy mechanism provides a functional foundation that distinguishes it from many meme-only counterparts.

ConclusionDarkDrop (DARKDROP) represents a novel fusion of meme-driven engagement and privacy-centric utility within the Solana ecosystem. Its burner-wallet transfer system, encrypted claim mechanism, and fixed token supply create a compelling case for both traders and users interested in transactional discretion.

Whether it evolves into a widely adopted privacy solution or remains a niche experiment, DarkDrop illustrates how meme tokens can extend beyond cultural trends to deliver meaningful functional value. As the conversation around blockchain privacy continues to grow, projects like DarkDrop offer a glimpse into the potential of utility-first token design.

Further ReadingWhat is DO Your Meme (DOYR)? DO Your Meme (DOYR) Prediction 2026–2030What Is Quant (QNT)?What Is Momentum (MMT)?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

How to Make Your Wealth Grow with WEEX Auto Earn? Everything You Need to Know

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Why Choose WEEX Auto Earn in 2025?WEEX Auto Earn stands out in 2025 with its exceptional flexibility, transparency, and user-friendly design. It offers instant access to funds—no lock-up periods or minimum deposits—while automatically calculating hourly rewards across your Spot, Funding, and Futures accounts. Earnings are paid out daily in USDT based on your lowest daily balance, ensuring fairness and predictability. New users enjoy a bonus APR when verifying within seven days, and the feature includes smart automation like auto-disabling if balances drop too low—all with zero fees, making passive earnings both seamless and secure.

How to Make Your Wealth Grow with WEEX Auto Earn?Participating in WEEX Auto Earn is simple and fast. Whether you are a beginner or a frequent trader, you can participate and grow your wealth. By following the steps below, you can participate in just a few minutes while making more assets.

Follow the steps to participate now:

Open the APP, go to the Assets page, and click on Auto Earn.Toggle the switch in the middle of the page to enable Auto Earn.Once confirmed, interest will start accruing immediately, and earnings will be distributed to your funds account the next day. Distributed earnings can be viewed in your funds account history.For more information, check this video below to learn more:

WEEX Auto Earn RoadmapWEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Introduction to WEEX Auto Earn and How It WorksDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interes t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

Trade to Earn: How Your Everyday Trades Can Start Earning for You

Ready to change how you profit from the crypto market? For too long, the narrative has been confined to HODL or intense Day Trading. Now, a new paradigm is emerging: Trade to Earn. This innovative model fundamentally shifts the user-exchange relationship, allowing active traders to auto earn a dual income stream simply by executing their normal strategy. Trade to Earn is poised to be the digital asset space’s next major incentive model. This article explores what Trade to Earn means, how it evolved, why it might matter for you — and how WEEX implements it.

What is Trade to Earn“Trade To Earn” is a reward mechanism layered on top of normal trading, transforming trading activity into a form of auto earn income. Users receive rewards (typically in the form of the platform’s native token) as a direct rebate or incentive based on their trading activity, such as volume, frequency, or liquidity provided.

Unlike traditional trading, where profit relies solely on market movements, Trade to Earn adds a second potential income stream: trade-generated rewards. For example, when you trade spot or futures, a portion of the trading fees or volume-based rewards are returned to you as tokens or rebates. It turns a normally costly or neutral activity into one that automatically generates additional benefits.

In essence, Trade to Earn leverages the blockchain incentive model to turn trading itself into an "earning activity," similar to how mining or staking rewards incentivize network participation.

The Evolution of Trade to EarnTrade to Earn didn’t emerge overnight. It is the result of years of experimentation in blockchain incentive design — a shift away from rewarding passive holding, toward rewarding real user activity.

The foundations were laid in 2021 during the DeFi boom, when protocols began distributing tokens to users who actively participated rather than those who simply held assets. A defining moment came with dYdX’s $DYDX airdrop, which rewarded traders based on their historical trading volume. For many traders, this was a first-of-its-kind experience: meaningful rewards, earned simply by trading as usual.

That moment sent a clear signal across the industry — activity itself had measurable value.

Between 2022 and 2023, decentralized exchanges pushed the concept further. Platforms like GMX introduced fee-sharing mechanisms through GLP, while Injective rolled out recurring incentive programs that attracted sustained global trading participation. These experiments proved that incentives could drive long-term engagement, not just short-lived volume spikes around token launches.

By 2024, centralized exchanges began adopting similar mechanics at scale. Trading tournaments, large prize pools, leaderboards, and milestone-based rewards evolved from one-off marketing campaigns into structured, gamified loyalty systems.

Today, Trade to Earn has matured into a mainstream incentive model. Rather than treating trades as isolated actions, it recognizes trading activity as an ongoing contribution — one that accumulates over time and rewards consistency, engagement, and participation.

Why Trade to Earn Matters to TradersThe traditional user-exchange relationship was transactional: You pay fees, the platform profits. Trade to Earn replaces this with a new paradigm where your activity is an asset, and your loyalty is rewarded.

Get Rewarded for Real ActionsTrade to Earn flips the script by rewarding active participation, not just passive holding. You earn because you trade, not because you simply hold tokens or wait for luck. Every executed trade contributes to tangible rewards, making your time, decisions, and market participation count. It's an auto earn mechanism tied directly to your trading skill.

Reduce Trading CostsFees are one of the biggest long-term drags on trading performance. Trade to Earn effectively offsets those costs by returning value through rewards or rebates. You don’t need to trade more, trade differently, or take extra risk — you simply pay less over time while doing what you already do.

Turn Short-Term Activity into Long-Term ValueMost trades end when the position closes. Trade to Earn extends the value lifecycle of each trade. Your past activity can unlock ongoing benefits, additional rewards, or ecosystem privileges, such as higher staking yields, governance rights, or premium feature access — transforming one-time actions into compounding participation value.

Share in the Value You Help CreateOn traditional exchanges, trading activity mainly benefits the platform. With Trade to Earn, traders share in the value they help create, turning everyday trading into a direct stake in platform growth. As participation increases, rewards scale alongside activity, creating a system where contribution and returns are closely aligned.

Join WEEX Trade to EarnWEEX offers a concrete example of Trade to Earn in action, turning your everyday futures trading into a source of ongoing rewards and without changing your strategy.

Up to 30% Rebate: Users receive up to a 30% trading fee rebate, paid in WXT (WEEX’s platform token). This effectively converts trading fees into an auto earn return, significantly lowering your net trading cost.Unlimited & Scalable: The program features an unlimited reward pool. Your rewards scale purely with your share of the total trading volume — Trade More, Earn More.WXT Value Support: All rewards are credited directly to your spot account. Crucially, WEEX will conduct a 2,000,000 USDT public WXT buyback after Phase 1 ends to support the token's long-term value.Simple Steps to Join:

Register on the event page https://www.weex.com/events/futures-trading/trade-to-earnTrade USDT-M perpetual futures as usual.Receive WXT rewards upon event conclusion.The clock is ticking until December 15, 2025. Maximize your rewards by starting now. Don't let another trade cost you when it could be earning for you.

About WEEXFounded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 130 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200 trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Follow WEEX on social media:X: @WEEX_Official

Instagram: @WEEX Exchange

TikTok: @weex_global

YouTube: @WEEX_Global

Discord: WEEX Community

Telegram: WeexGlobal Group

Risk Reminder

Futures trading involves risk. Please manage leverage and position sizes carefully.

All rewards are subject to the official event rules and will be distributed after the event ends.

Crypto Futures Trading for Beginners: How to Start with Just 1 USDT on WEEX

A More Accessible Futures Trading Experience

Traditional futures platforms often require a higher minimum margin, complex settings and a significant learning curve. For many new traders, this creates hesitation before placing a first order.

WEEX has redesigned this experience by allowing users to open a real futures position with only 1 USDT. This feature lowers the entry threshold and gives users a practical way to understand how futures trading works in real market conditions.

With 1 USDT as margin, users can observe price movements, test strategies and get familiar with leverage and risk controls while keeping overall exposure very small. The goal is to provide a straightforward and efficient way for beginners to explore futures trading without committing large capital from the start.

What “1U Trading” Really MeansOn WEEX, a user can open a genuine futures position using 1USDT as margin. This is possible because the system is designed to allocate leverage intelligently. If a user’s balance is relatively small, the platform will recommend leverage that makes opening a position feasible. For example, when a balance is below 10USDT, the recommended leverage may be 20 times. Under this structure, a 1USDT margin allows the user to gain exposure equivalent to a 20USDT position.

This approach ensures that even a minimal commitment gives the trader enough exposure to observe price fluctuations, understand risk, and gain meaningful experience in real trading environments.

Why Safety Remains the PriorityEven though leverage enables a larger position, WEEX ensures that risk stays strictly controlled.

The maximum amount a user can lose from a 1USDT-margin trade is limited to that same 1USDT. Once the loss reaches the margin amount, the system will close the position automatically.

There are no negative balances, no hidden liquidations and no unexpected losses beyond the margin the user chooses.

For beginners, this creates an almost ideal environment: a real futures market with real market dynamics, combined with a risk limit that is clear and predictable.

Designed with New Traders in MindThe 1U experience is supported by several product improvements that make the process smoother and more intuitive:

Clear minimum margin presentation The trading interface clearly displays the minimum margin needed to open a position. The system helps users understand how their balance converts into tradable value.

Smart leverage suggestions When the balance is low, WEEX automatically recommends suitable leverage so that users can open a position smoothly. This prevents common beginner errors and reduces the number of rejected orders.

Beginner mode with simplified settings In beginner mode, the interface hides advanced functions such as detailed parameter adjustments and complex order types. This helps new users focus on essential actions without feeling overwhelmed.

Profit and loss preview A visual simulation gives users an intuitive understanding of how a 1USDT position behaves when the market moves. This makes it easier to learn core concepts such as liquidation, margin usage and return on equity.

Together, these features transform the 1U experience from a marketing slogan into a practical, usable trading feature that genuinely lowers the learning curve for new traders.

A short tutorial video is also available for users who want to see how to open a 1USDT futures position step by step.https://www.youtube.com/shorts/qOEPdL3He4c

Additional Opportunities for New UsersUsers who register through an invitation link can participate in the Welcome Bonus program.

https://www.weex.com/events/welcome-event

Users who complete basic onboarding actions, such as opening their first position or making their first deposit, are eligible to receive platform rewards.The specific reward type depends on the user’s region and may include WXT, USDT, or bonus coupons of equivalent value.

In addition to the standard Welcome Bonus program, new users who start with a 1 USDT trade may also qualify for extra promotional rewards when specific campaigns are active on the platform.These incentives provide beginners with a low-cost way to explore futures trading while receiving meaningful rewards for their participation.

Why This Matters for the Future of TradingThe introduction of 1U trading represents more than a functional update. It reflects a shift in how WEEX defines accessibility in crypto futures.

Lowering entry barriers allows more people to understand market dynamics, develop trading habits, and gradually build confidence before committing larger capital.

This makes trading more educational, more transparent and more inclusive.

For individual users, the benefit is clear. A 1USDT trade is affordable, low-risk and meaningful enough to provide real insights into the futures market.

For the industry, it represents a step toward a future where financial knowledge and trading tools are available to a broader audience.

Start Your Futures Journey TodayAnyone can begin exploring futures on WEEX with only 1USDT.

Deposit 1USDT, open your first position and see how real market movements shape your profit and loss.

It is one of the simplest and safest ways to understand futures trading from the inside.Start small, trade smart, and experience the market for yourself.

Begin Your 1U Trading Experience on WEEX

Risk Disclaimer

Futures trading involves significant risk and may not be suitable for all users. The “1 USDT starting margin” feature on WEEX is designed to provide an accessible way for beginners to experience futures trading with limited capital, but it does not eliminate market risk. Although the maximum loss for a 1 USDT-margin position is limited to the margin amount, users should be aware that leveraged trading can result in rapid gains or losses depending on market volatility.

This article is for educational and informational purposes only and should not be considered financial or investment advice.Users should evaluate their own risk tolerance and trading experience before participating in futures trading on WEEX. Past performance, examples, or simulations do not guarantee future results.

By using the platform, you acknowledge that you understand the risks associated with leveraged futures trading.

What Crypto Traders Do in a Bearish Market 2025?

A crypto bear market can feel overwhelming, especially for traders who entered the market at higher prices. Volatility increases, confidence weakens, and prices fall for extended periods. A cryptocurrency bear market presents a formidable psychological and financial test. It is characterized by sustained price declines, heightened volatility, and a pervasive erosion of investor confidence that can challenge even disciplined traders.

But experienced traders know that bear markets are not only survivable but can also present some of the best opportunities for long-term growth. With the right strategy, a bearish market becomes a chance to accumulate assets, optimize taxes, and strengthen your portfolio. For the strategic investor, a bear market is not an endpoint but a crucial phase within the market cycle. It offers a unique window to acquire assets at a discount, implement tax-efficient strategies, and fundamentally reinforce a portfolio's long-term resilience and growth potential.

In 2025, crypto traders are navigating a market still shaped by previous cycles, global regulation changes, and rising institutional involvement. Understanding how traders behave and what strategies they rely on can help you manage your portfolio more effectively during uncertain conditions. The current market environment is a complex interplay of historical cyclical patterns, evolving global regulatory frameworks, and deepening institutional participation. Navigating this landscape successfully requires an understanding of proven behaviors and strategic frameworks that have weathered past downturns.

What Is a Crypto Bear Market?A crypto bear market is defined by a prolonged, fundamental shift in market sentiment and structure. It transcends a simple price correction, manifesting as a sustained period where selling pressure consistently overwhelms buying interest, leading to lower highs and lower lows. While traditional finance may cite a 20% drop, crypto's inherent volatility makes duration (a multi-month trend) and sentiment more reliable indicators than any arbitrary percentage.

The 2018-2019 “crypto winter” serves as a prime example of extended crypto bear market conditions, where Bitcoin declined from approximately $20,000 to $3,200 over eighteen months. Historical patterns suggest these cycles occur approximately every four years, making strategic preparation essential for informed investors. Understanding whether we’re experiencing a crypto bear market today requires monitoring multiple indicators beyond just price action.

Read More: What Is a Bear Market?

Are We in a Crypto Bear Market in 2025?Following a significant rally in 2024, the market’s direction in 2025 hinges on critical demand drivers: institutional adoption flows, clarity in global regulation, and macroeconomic policy. The market exists in a state of tension between recovery momentum and potential headwinds. This highlights a key question for all asset classes, akin to pondering when does a bearish market become bullish in forex—the transition is rarely a single event but a gradual shift in underlying fundamentals. Continuous monitoring of these fundamental factors is more valuable than attempting to label the market in real-time.

Learn More: When the Market is Down, What Should We Do?

Why Crypto Bear Markets Happen?Bear markets are systemic events, typically arising from a confluence of factors:

Leverage Unwind: Cascading liquidations from over-leveraged positions can create violent, self-reinforcing downdrafts.Macroeconomic Contagion: Crypto increasingly correlates with traditional risk assets during periods of inflation or recession fears.Regulatory Shock: Unexpected or severe regulatory actions can trigger sector-wide de-risking.Sentiment Breakdown: Major hacks, frauds, or ecosystem failures can shatter confidence, leading to a withdrawal of capital.Liquidity Evaporation: As prices fall and volatility rises, liquidity providers often retreat, exacerbating price swings.How Long Does a Crypto Bear Market Last?Cryptocurrency’s short history shows varied cycles. Major bear markets have lasted anywhere from several months to over a year, with full recovery to previous all-time highs taking significantly longer. The duration is contingent on the severity of the overvaluation being corrected and the time required for new, fundamental drivers of demand to emerge. Just as the White Bear Lake farmers market operates on a seasonal cycle, bringing fresh produce at predictable times, crypto markets also move through phases, though their timing is less regular and driven by different forces like technology adoption and capital flows.

What Crypto Traders Do in a Bearish Market?Sophisticated traders adopt a multi-faceted approach focused on capital preservation, strategic positioning, and portfolio optimization.

1. Strategic Accumulation & Cost-AveragingInstead of trying to “catch the falling knife” with lump-sum bets, traders employ Dollar-Cost Averaging (DCA). This disciplined approach involves investing fixed amounts at regular intervals, systematically lowering the average entry price and removing emotion from timing decisions.

2. Portfolio Fortification Through DiversificationA bear market exposes concentrated risk. Traders diversify across:

Asset Type: Spreading exposure between large-cap “blue-chip” crypto, select altcoins, and stablecoins.Use Case: Balancing investments across different blockchain sectors (DeFi, infrastructure, gaming).Correlation: Including assets with low correlation to general crypto market movements.3. Employing Technical & On-Chain AnalysisTraders use data to guide decisions, not emotions. Key tools include:

On-Chain Metrics: Tracking exchange flows, holder behavior, and network activity to gauge underlying strength or weakness.Technical Indicators: Using moving averages, RSI, and volume analysis to identify potential support levels and trend changes.4. Generating Yield in a DownturnTo offset price stagnation, traders seek real yield through:

Staking: Earning protocol rewards by participating in network security.Lending: Providing liquidity to decentralized money markets for interest.5. Executing Tax-Loss HarvestingA bear market’s silver lining. Traders can sell assets at a loss to realize a capital loss for tax purposes, then immediately repurchase a similar asset (where regulations allow, like in the U.S. for crypto). This strategy improves the portfolio’s tax efficiency without altering its market exposure.

6. Maintaining Psychological DisciplineThe most critical strategy. This involves:

Adhering to a pre-defined investment plan.Avoiding monitoring portfolios obsessively.Understanding that bear markets are a natural, recurring part of building long-term wealth in volatile asset classes.ConclusionA crypto bear market is an inevitable test of strategy, psychology, and conviction. By shifting focus from short-term price action to long-term fundamentals—strategic accumulation, portfolio resilience, and continuous learning—traders can not only survive but lay the groundwork for exceptional growth in the subsequent cycle. The bear market separates reactive speculators from strategic investors; it is in these challenging periods that the foundation for future success is built.

Further ReadingBearish Candlestick PatternsBearish Candlestick PatternsWhat Are Crypto Signals and How to Use them?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What Is Liquidation? A Complete Guide

Liquidation, commonly referred to as a margin call, represents a critical risk management procedure where positions are automatically closed when an account's equity falls below required maintenance levels. This mechanism activates when adverse price movements erode the collateral supporting leveraged positions, creating a scenario where remaining funds become insufficient to cover potential further losses.

This protective measure predominantly occurs in leveraged trading environments, particularly within cryptocurrency futures markets characterized by high volatility. Significant price swings—whether sudden crashes impacting long positions or rapid rallies affecting short positions—can rapidly diminish account equity below maintenance thresholds. The automated liquidation process serves to protect both traders and trading platforms from catastrophic losses that could otherwise exceed initial investments.

Example: Utilizing 10x leverage for a Bitcoin futures position means that a 10% adverse price movement could potentially trigger liquidation if maintenance margins are breached, highlighting how leverage amplifies both potential returns and risks.

Advanced trading platforms implement sophisticated price calculation methods to prevent unnecessary liquidations during temporary price dislocations or low liquidity periods, ensuring fairness in determining when liquidation thresholds are genuinely breached.

How Is Liquidation Triggered?The specific conditions governing liquidation depend significantly on the margin mode selected—either Isolated or Cross Margin—each presenting distinct risk profiles and calculation methodologies.

What Is Isolated Margin?Isolated Margin mode establishes independent collateral pools for each position, effectively quarantining risk to individual trades. This approach ensures that losses from one position cannot impact other open positions or overall account equity beyond the specifically allocated margin.

Pros and Cons:

Risk Containment: Perfect for testing specific strategies or trading highly volatile assetsClear Risk Parameters: Maximum potential loss is precisely defined upfrontLimited Capital Efficiency: Margin cannot be dynamically reallocated between positionsNo Automatic Support: Other profitable positions cannot prevent liquidation of struggling onesLiquidation Price Calculation in Isolated MarginThe liquidation trigger activates when: Position Margin + Unrealized PNL ≤ Maintenance Margin

Practical Scenario: Opening a long Ethereum position at $3,500 with 10x leverage and $350 margin, with a 0.5% maintenance margin rate ($17.50), would trigger liquidation approximately at $3,150—representing a 10% adverse price movement.

What Is Cross Margin?Cross Margin mode creates a unified collateral pool supporting all positions simultaneously. This approach enhances capital efficiency but interconnects the fate of all positions, where gains from one trade can support others facing temporary drawdowns.

Pros and Cons:

Enhanced Margin Utilization: Collective collateral supports all positionsLiquidation Resistance: Withstands larger adverse movements before triggeringRisk Contagion: Significant losses in one position can jeopardize all open tradesComplex Risk Management: Requires monitoring cumulative exposure across all positionsLiquidation Price Calculation in Cross MarginLiquidation occurs when total account equity—considering all positions and available balance—falls below the aggregate maintenance margin requirement. The precise liquidation price becomes dynamic and interdependent across all positions.

Comparative Analysis:

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

AspectIsolated MarginCross MarginRisk ExposureLimited to individual positionsSpread across entire portfolioCapital EfficiencyLowerHigherPosition ManagementSimplifiedComplexLiquidation ProbabilityHigher per positionLower initiallySuitabilityStrategy testing, volatile assetsDiversified portfolios, experienced tradersWhy Liquidation Is Important?Liquidation mechanisms serve as fundamental safeguards in leveraged trading ecosystems, providing critical protections for both market integrity and participant interests.

Pros:

Prevents debt accumulation beyond traders' financial capacityMaintains market stability during extreme volatility episodesEnsures platform solvency by containing risk propagationEncourages responsible leverage utilization among participantsCons:

Eliminates potential for losses exceeding account balancesProvides clear risk boundaries for position planningMay prematurely exit positions before potential recoveriesRequires sophisticated risk management strategiesWhat Happens After Liquidation Engine Takes OverFollowing position transfer to the liquidation system:

Positions executed above bankruptcy prices generate surplus funds returned to insurance reservesExecution below bankruptcy levels triggers insurance fund utilization to cover deficitsSystemic protection mechanisms activate if insurance resources prove insufficientMarket integrity maintains through this layered protection approachHow to Avoid Liquidation?Strategic Margin Management: Increasing position collateral or reducing leverage ratios directly lowers liquidation probability by creating larger safety buffers against adverse price movements.Proactive Stop-Loss Implementation: Predefined exit points allow controlled position closure before reaching critical margin thresholds, transforming potential liquidations into managed exits.Monitoring and Alert Systems: Real-time margin monitoring with customizable alert thresholds enables preemptive action before liquidation triggers activate.Additional Protective Measures:

Portfolio diversification across uncorrelated assetsPosition sizing aligned with volatility expectationsRegular leverage reassessment based on market conditionsUtilizing risk management tools like guaranteed stop-losses where availableConclusionLiquidation protocols represent indispensable components of responsible leveraged trading frameworks, balancing necessary risk containment with trader protection. Mastering the intricacies of margin modes, liquidation triggers, and preventive strategies empowers traders to navigate volatile markets while safeguarding capital.

The fundamental trading principle remains unchanged: comprehensive risk management precedes profit pursuit. Through disciplined leverage application, strategic position sizing, and proactive monitoring, traders can utilize liquidation mechanisms as safety features rather than experiencing them as unexpected setbacks. This approach transforms liquidation from a threat into a calculated aspect of sophisticated trading strategy, supporting sustainable participation in dynamic financial markets.

What is WOJAK and Why WOJAK Is Trending Again?

WOJAK has resurged as a top-trending meme coin this week, fueled by growing interest in community tokens and nostalgic internet culture. The token has demonstrated sustained upward momentum, establishing higher support levels while testing the $0.0001266 resistance zone - a pattern that has caught traders' attention for potential breakout opportunities.

Leveraging the widely recognized Wojak character's cultural significance, the token maintains distinct branding advantages over newer meme coins. This analysis examines WOJAK's market mechanics, price behavior, and sustainability prospects in the evolving meme token landscape.

Read Also: What Are Meme Coins?

What Is WOJAK?WOJAK represents a cryptocurrency initiative built around the widely recognized Wojak internet meme. The character's emotional resonance and cultural significance across digital platforms provide the project with inherent community appeal. Rather than focusing on complex financial applications, WOJAK emphasizes community engagement and cultural expression through meme-based interactions.

The ecosystem enables participants to create, exchange, and engage with meme content within a decentralized framework. This straightforward approach to community building has allowed WOJAK to maintain visibility despite intense competition within the meme token sector.

WOJAK TokenomicsThe token operates with a fixed maximum supply of approximately 69.42 billion units, nearly entirely distributed across circulating markets. This complete distribution eliminates concerns about future token unlocks potentially depressing prices. Current market metrics show a capitalization around $8.78 million supported by daily trading volume exceeding $736,000.

These figures indicate active market participation relative to the project's scale. Like many meme tokens, WOJAK experiences concentrated liquidity surges during periods of heightened community engagement. The absence of inflationary token mechanics means price movements primarily reflect changing market demand and social sentiment.

WOJAK Price PredictionRecent trading patterns show WOJAK establishing a definite upward trend beginning in late November. The token consistently formed higher support levels while progressively breaking through previous resistance barriers. As prices approached the $0.000126-0.000127 range, WOJAK encountered significant technical resistance that has historically limited advances.

The sequence of ascending price movements and brief consolidation phases suggests renewed buyer interest responding to increased social attention. However, broader perspective reveals WOJAK remains substantially below its November 2024 peak of $0.002061, representing a decline exceeding 93%. This dramatic difference underscores the challenge meme tokens face in sustaining recovery momentum without significant narrative catalysts.

Why WOJAK Is Trending Again?WOJAK's renewed prominence stems from converging factors including cultural recognition and favorable market conditions. Meme tokens typically benefit when traders reallocate profits from established assets toward higher-risk opportunities. WOJAK's advantage lies in its instantly recognizable meme identity within internet culture.

Community-generated content, viral social media campaigns, and coordinated online discussions have amplified WOJAK's visibility. The recent price appreciation has further stimulated conversation, encouraging traders to reevaluate the project's potential within emerging meme token cycles.

WOJAK Utility and EcosystemThe project prioritizes community interaction over complex technological infrastructure. Planned ecosystem features center around social engagement mechanisms including decentralized meme creation platforms, community-organized events, and meme-centric social environments. While these elements contribute to project identity, current market activity primarily reflects speculative interest rather than platform utility.

Can WOJAK Sustain This Growth?WOJAK's capacity for sustained growth depends on multiple variables including community engagement levels, social media momentum, and broader market conditions. Three critical factors will determine its trajectory: the community's ability to maintain active participation, the project's success in generating viral content, and overall market sentiment toward speculative assets. While WOJAK may experience additional price surges if these elements align, the token remains subject to the inherent volatility characterizing meme-based cryptocurrencies.

ConlusionWOJAK maintains its position as a culturally grounded meme token with strong community foundations. Its recent price recovery, increasing trading volume, and active online presence have revitalized its position within the competitive meme coin market. While the project doesn't emphasize technical sophistication, its strength derives from social engagement, creative expression, and cultural relevance.

Prospective participants should recognize the sentiment-driven nature of meme assets and their susceptibility to rapid valuation changes. WOJAK offers distinctive cultural appeal and community atmosphere for those interested in meme-based ecosystems, though its long-term viability depends on sustained narrative momentum and evolving market cycles.

Ready to dive into the meme coin market? Start trading WOJAK and other trending meme tokens on WEEX today—register in seconds and begin your trading journey immediately!

Further ReadingWhat is Hajimi (哈基米)?Why POPCAT Crashes? A Complete ExplanationWhat Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Fast & Easy Tether (USDT) Purchase with PKR on WEEX P2P