What is Bittensor Crypto (TAO) and How Does It Work?

While the broader market struggles to recover from recent losses, TAO cryptocurrency has emerged as a standout performer, capturing attention from both institutional players and individual investors. This renewed interest stems from groundbreaking developments including Grayscale's strategic moves, innovative subnet token implementations, and impressive price momentum that's leaving competitors behind.

This comprehensive analysis explores the driving forces behind TAO's remarkable rally, examines Bittensor's unique value proposition, decodes the mechanics of subnet tokens, assesses current price dynamics, and considers future potential for this high-performing digital asset.

What is Bittensor Crypto (TAO)?

TAO serves as the native cryptocurrency of Bittensor, a decentralized protocol that's transforming artificial intelligence through its permissionless network architecture. Unlike conventional AI projects, Bittensor creates economic incentives for developers, researchers, and computing resource providers to contribute AI models and infrastructure, rewarding them with TAO tokens for their valuable contributions.

Core characteristics defining TAO and the Bittensor ecosystem:

- Decentralized AI Ecosystem: Enables open access to AI services without centralized control barriers

- Inclusive Participation Framework: TAO tokens facilitate staking, governance, and network operations through a sophisticated incentive model

- Merit-Based Reward System: Contributors receive TAO compensation proportional to their model's utility and network impact

This revolutionary approach positions TAO as a compelling investment opportunity within the rapidly expanding AI and decentralized infrastructure sectors.

How Does Bittensor Crypto (TAO) Work?

Bittensor's operational foundation relies on its innovative "Proof of Intelligence" mechanism:

- Specialized Subnets: The network organizes into multiple subnets, each dedicated to specific AI domains such as natural language processing or computer vision

- Validator-Miner Dynamics: Validators assess AI model outputs from miners, with the highest-performing models earning greater TAO rewards

- Transparent Operations: All network activities, including reward distributions and model evaluations, are recorded on-chain to ensure accountability

This structure fosters continuous AI improvement driven by economic incentives, aligning individual participant interests with overall network growth.

Bittensor Crypto (TAO) Tokenomics

TAO's economic model features several distinctive characteristics:

- Fixed Maximum Supply: Mirroring Bitcoin's scarcity model, TAO has a hard cap of 21 million tokens

- Daily Emission Schedule: Approximately 7,200 new TAO enter circulation daily, allocated to miners and validators based on performance metrics across subnets

- Upcoming Halving Event: December 2025 will see emission rates reduced by 50%, potentially increasing token scarcity and value

- Performance-Based Distribution: Top-performing subnets receive the largest share of new TAO emissions, determined through transparent validator scoring

- Staking Ecosystem: Participants can stake TAO to acquire subnet tokens, creating additional utility and investment opportunities

These economic mechanisms generate sustained demand for TAO while ensuring network growth aligns with quality AI development.

The Emerging Opportunity: TAO Subnet Tokens in Q4 2025

Subnet tokens represent a rapidly developing segment within the TAO ecosystem that many investors have yet to fully recognize, despite their significant potential.

Understanding Subnet Token Mechanics:

- TAO-Denominated Valuation: Unlike traditional cryptocurrencies, subnet tokens derive value directly from TAO rather than fiat currencies

- Dynamic Supply Economics: Token supplies adjust based on performance and demand, with higher-valued subnets attracting increased mining activity

- Performance-Based Allocation: Top-ranked subnets receive greater TAO rewards, creating competitive incentives for quality improvement

Strategic Importance for TAO Valuation:

- Diversified Applications: Subnets like Chutes, Ridges, and Gradient are developing specialized AI solutions with venture capital backing

- Decentralized Exchange Integration: Platforms including Taofi's DEX enable seamless subnet token trading and bridging

- Investment Metrics: Monitoring price performance relative to TAO, Alpha Distribution Ratios, and staking participation helps identify promising subnet opportunities

As subnet applications generate increased utility and revenue, they create direct value accretion for the broader TAO ecosystem.

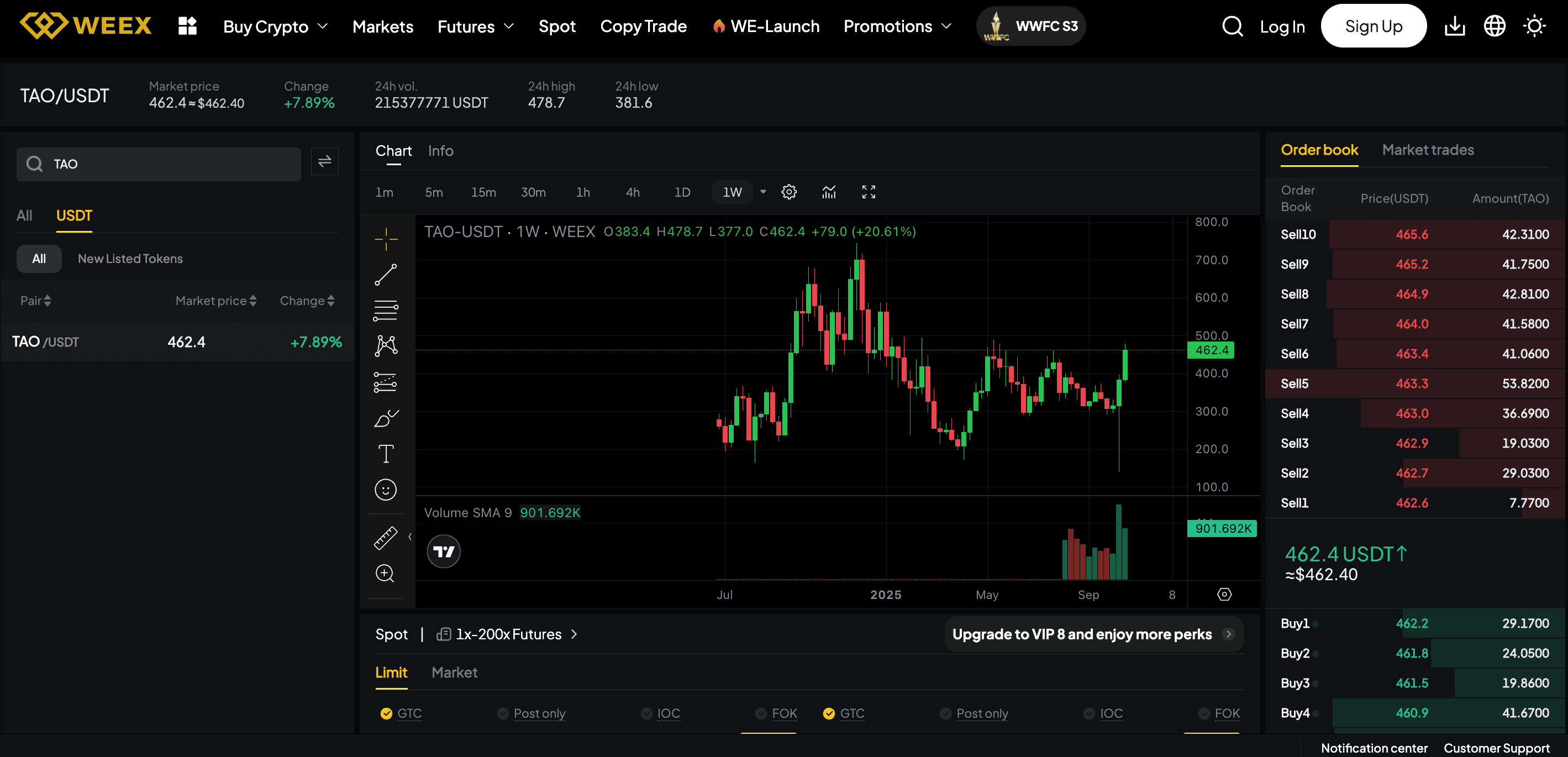

TAO Price Analysis

TAO demonstrated exceptional resilience during recent market turbulence, outperforming most altcoins with a swift 30% rebound driven by multiple factors:

- Institutional Validation: Grayscale's regulatory filing for a TAO investment trust enhanced institutional credibility

- Trading Activity Surge: Daily trading volume increased 197% as investor interest intensified

- DePIN Sector Leadership: Bittensor currently dominates over 33% of the decentralized infrastructure narrative

- Community Engagement: Strong social media presence across multiple platforms fueled retail investor participation

This robust performance underscores TAO's strong fundamental positioning within the decentralized AI infrastructure space.

TAO Price Projection

Technical analysis suggests continued bullish momentum:

- Chart Pattern Development: TAO has been consolidating within a falling wedge formation since October 2024, typically indicating potential upward breakout

- Price Target Scenarios: Successful breakout could propel prices toward $1,353, representing 236% upside from current levels

- Critical Resistance Levels: Breach of $402.30 followed by sustained movement above $499.60 would confirm bullish trend continuation

- Momentum Indicators: RSI reading of 63 suggests additional upward capacity without immediate overbought concerns

- Support Framework: Key support levels establish at $219.60 and $130.30 in case of trend reversal

Current market conditions, institutional interest, and sector leadership position TAO favorably, though volatility remains an inherent characteristic.

How to Buy Bittensor Crypto (TAO)?

You can access TAO on WEEX. The project's rapid growth and significant trading volumes have made it available across multiple established exchanges, providing investors with multiple avenues for participation.

Currently, WEEX has launched both Spot and Futures trading for the TAO token. You can trade tokens on WEEX for ultra-low fees by following these steps:

- Open and log in to the WEEX App or official website.

- Search for "TAO" in the search bar and select either Spot or Futures trading.

- Choose your order type, enter the quantity and price, and complete your trade.

Conclusion

TAO has established itself as one of 2025's most compelling investment narratives, combining decentralized AI innovation, robust technical foundations, pioneering subnet economics, and institutional validation. With substantial potential in subnet development and supportive market structure, TAO appears positioned for continued outperformance, though investors should maintain awareness of sector volatility and evolving market conditions.

Further Reading

- What is Hajimi (HAJIMI) and How Does It Work?

- What Is Dogecoin and How Does It Work?

- What Is Ethereum and How Does It Work?

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

You may also like

Top 3 Best Crypto Earning Apps in 2025: Why WEEX Auto Earn Stands Out?

Imagine daily habits—like having coffee, walking, or gaming—now earning you crypto. A growing range of apps turns routines into effortless rewards, making portfolio growth accessible without trading knowledge.

Today, you can earn crypto by learning, staying active, shopping, or even sharing device resources, often starting for free. These approaches lower entry barriers and weave crypto naturally into everyday life.

Leading platforms such as WEEX, Bybit, and KuCoin now integrate staking, learn-and-earn programs, and liquidity incentives. These features let users grow assets through both market activity and structured rewards, creating a more holistic crypto journey. To help you start, here’s a curated list of the best crypto-earning apps for 2025.

WEEX - Best of AllWEEX Auto Earn excels in 2025 with its flexible and transparent approach, allowing users to earn rewards instantly with no lock-up periods or minimum deposits. It calculates interest hourly across Spot, Funding, and Futures accounts, with daily USDT payouts based on your lowest daily balance for predictable returns.

New users benefit from bonus APR by verifying within seven days, while smart features like auto-pausing when balances fall too low enhance user experience. With zero platform fees, WEEX Auto Earn offers a secure and seamless path to passive crypto earnings.

Core Features of WEEX Auto EarnFlexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

BybitWhile widely recognized as a leading crypto trading platform since 2018, Bybit serves a global community of over 50 million users with far more than just advanced trading tools. The exchange offers a diverse suite of earning features designed to help both passive investors and active traders grow their crypto portfolios effectively and conveniently.

Core Features:Bybit Savings: Provides flexible and fixed-term options with competitive, guaranteed APRs for low-risk yield.Crypto Liquidity Mining: Users can supply liquidity to AMM-based pools and earn yields, with optional leverage to increase potential returns.Dual Asset: A short-term trading tool that allows users to choose “Buy Low” or “Sell High” strategies to earn enhanced interest based on market outlook.Wealth Management: Access professionally managed crypto investment funds, allowing hands-off participation in curated trading strategies.Beyond its reputation as a high-performance exchange, Bybit stands out through these integrated earning solutions—making it a comprehensive platform for users seeking growth through savings, staking, liquidity provision, or managed investments.

KuCoinFounded in the Seychelles and operating globally, KuCoin serves over 37 million users across 200+ countries. Beyond its core exchange services, KuCoin offers a wide range of integrated features that enable users to earn, learn, and engage with crypto through accessible, education-driven, and reward-based experiences.

Core Features:

KuCoin Earn: Provides both flexible and fixed-term staking options, recognized by Investopedia and Forbes as a leading staking platform.Learn and Earn: Users earn Token Tickets by completing educational courses and quizzes, which can be redeemed for cryptocurrency.Mystery Box: Offers limited-edition NFT releases through brand collaborations on KuCoin's NFT marketplace.It’s important to note that many of these features require KYC verification, and access may be restricted in certain regions, including the United States and Canada. Users are encouraged to confirm eligibility before participating in any program.

Why WEEX Auto Earn Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature.

What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Grow Your Crypto Daily: Earn Up to 100% APR with WEEX Auto Earn

In the dynamic crypto market, your idle assets can work for you around the clock. WEEX Auto Earn is a flexible savings product designed to let your USDT earn daily compound interest—with no lock-up periods, no minimum deposit, and complete liquidity control.

New User Bonus: High-Yield Welcome OfferAs a new user, you receive a special tiered interest rate to maximize your initial earnings:

Example Earnings (Deposit: 10,000 USDT)

Tiered Rate Structure:

First 100 USDT → 100% APRRemaining 9,900 USDT → 3.5% APR30-Day Earnings Breakdown (Daily Compounding):

High-Yield Portion (100 USDT)Daily rate: 100% ÷ 365 ≈ 0.27397%30-day earnings: 8.55 USDTStandard Portion (9,900 USDT)Daily rate: 3.5% ÷ 365 ≈ 0.009589%30-day earnings: 28.77 USDTTotal 30-Day Earnings for New Users: ≈ 37.32 USDT

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DateToday's EarningsTotal EarningsAccount BalanceDay 11.2451.24510,001.25Day 21.2472.49210,002.49Day 31.2493.74110,003.74Day 41.2514.99210,004.99Day 51.2536.24510,006.25Day 61.2557.510,007.50Day 71.2578.75710,008.76Day 81.25910.01610,010.02Day 91.26111.27710,011.28Day 101.26312.5410,012.54Day 151.27118.8910,018.89Day 201.27925.2810,025.28Day 251.28731.7110,031.71Day 301.29537.3210,037.32Existing User Benefits: Sustained Growth PlanFor our loyal users, WEEX offers a stable enhanced earnings program:

Example Earnings (Deposit: 10,000 USDT)

Tiered Rate Structure:

First 200 USDT → 13% APRRemaining 9,800 USDT → 3.5% APR30-Day Earnings Breakdown (Daily Compounding):

Enhanced Portion (200 USDT)Daily rate: 13% ÷ 365 ≈ 0.03562%30-day earnings: 2.15 USDTStandard Portion (9,800 USDT)Daily rate: 3.5% ÷ 365 ≈ 0.009589%30-day earnings: 28.48 USDTTotal 30-Day Earnings for Existing Users: ≈ 30.63 USDT

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DateToday's EarningsTotal EarningsAccount BalanceDay 11.0211.02110,001.02Day 21.0222.04310,002.04Day 31.0233.06610,003.07Day 41.0244.0910,004.09Day 51.0255.11510,005.12Day 61.0266.14110,006.14Day 71.0277.16810,007.17Day 81.0288.19610,008.20Day 91.0299.22510,009.23Day 101.0310.25510,010.26Day 151.03315.4210,015.42Day 201.03620.610,020.60Day 251.03925.810,025.80Day 301.04230.6310,030.63Core Benefits of WEEX Auto EarnFlexibility & ControlNo lock-up periods: Withdraw or trade anytimeZero management fees: Keep 100% of your earningsLow entry point: Start with as little as 0.01 USDTSmart & EfficientDaily compounding: Automatic reinvestment for exponential growthReal-time calculation: Hourly interest based on eligible balancesTimely payouts: Earnings distributed daily at 12:00 UTCSecure & TransparentMulti-account coverage: Includes spot, funding, and futures balancesFair calculation: Based on daily lowest balance snapshotAuto-management: Pauses and settles when balance drops below 0.01 USDTWEEX Auto Earn Earnings TimelineDay 1 → Activate Auto Earn, start earning immediatelyEvery day → Automatic compounding and reinvestmentDay 30 → New users earn ≈ 37.32 USDTDay 365 → Continuous growth through compoundingTake Action: Put Your USDT to Work TodayWhether you're new to crypto or an experienced trader, WEEX Auto Earn offers the simplest way to grow your idle assets.

Three Simple Steps to Start Earning:

Log into WEEX App, go to "Assets" pageTap "Auto Earn" and enable the featureWatch your daily earnings grow automaticallyFor more information, check this video below to learn more:

Quick Tip:

New users: Activate within 7 days of verification for bonus APRComplete verification before activation for the best ratesDon't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?

A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?

A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?

A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?

A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Grow Your Assets with WEEX Auto Earn! One Click to Gain Profit

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Why Choose WEEX Auto Earn in 2025?WEEX Auto Earn stands out in 2025 with its exceptional flexibility, transparency, and user-friendly design. It offers instant access to funds—no lock-up periods or minimum deposits—while automatically calculating hourly rewards across your Spot, Funding, and Futures accounts. Earnings are paid out daily in USDT based on your lowest daily balance, ensuring fairness and predictability. New users enjoy a bonus APR when verifying within seven days, and the feature includes smart automation like auto-disabling if balances drop too low—all with zero fees, making passive earnings both seamless and secure.

Core Features of WEEX "Auto Earn"Flexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).How to Grow Your Assets with WEEX Auto Earn?Participating in WEEX Auto Earn is simple and fast. Whether you are a beginner or a frequent trader, you can participate and grow your wealth. By following the steps below, you can participate in just a few minutes while making more assets.

Follow the steps to participate now:

Open the APP, go to the Assets page, and click on Auto Earn.Toggle the switch in the middle of the page to enable Auto Earn.Once confirmed, interest will start accruing immediately, and earnings will be distributed to your funds account the next day. Distributed earnings can be viewed in your funds account history.For more information, check this video below to learn more:

WEEX Auto Earn RoadmapWEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Ready to put your idle crypto to work—on your terms? Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interests t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

What is WEEX Auto Earn and Why It Stands Out?

WEEX Auto Earn is a digital asset growth tool launched by Weex, supporting USDT. Users do not need to lock their assets; funds can be deposited or withdrawn flexibly. The system calculates interest daily and automatically distributes earnings, allowing idle funds to continuously generate returns.

WEEX vs Market Products: Why WEEX Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature. In this article, we'll show the core dimensions where WEEX differentiates itself from typical market offerings and directly compares it against major competitors.

Core Advantages of WEEXWEEX's design philosophy prioritizes capital efficiency, ease of use, and clear value for both novice and experienced traders. Check below its key advantages!

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DimensionWEEX AdvantageFor UsersCompared to Typical Market ProductsYieldNew users enjoy 100% APR, existing users up to 13% APRBeginners get amplified returns; loyal users benefit from stable, competitive wealth management.Offers a highly competitive annualized yield, especially for onboarding and rewarding existing customers.Capital FlexibilityNo lock-up, instant accrual, withdraw anytimeMaximizes capital efficiency. Funds remain available for trading or withdrawal without interruption.Most competing platforms require fund transfers to a separate “earn” wallet or enforce lock-up periods.Ease of UseOne-click participation, automatic settlement and payoutOperational barriers are minimized. Users enable the feature once and earnings are handled automatically.Many platforms require manual, repeated subscriptions and redemptions for each earning cycle.Yield TransparencyDaily distribution with a clear interest calculation formulaReturns are credited predictably every day, fostering trust and allowing for easy tracking.Ensures greater transparency compared to opaque or complex yield aggregation methods.Low Entry ThresholdNo mandatory KYC for basic use, extremely low minimum investment (0.01 USDT)Removes access barriers, making sophisticated yield generation accessible to all retail investors.Some products require VIP status, large minimum deposits, or extensive identity verification.What's Special with WEEX Auto Earn?To contextualize WEEX's position, here is a direct comparison of its “Auto Earn” feature against similar flexible savings products from other leading exchanges:

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

ProductWEEX Auto EarnBinance Simple EarnOKX EarningBitget Wealth ManagementProduct TypePassive Income / Auto-CompoundFlexible SavingsSimple EarnFlexible InvestmentAPR / Yield RulesBase Rate: ~3.5%New Users (0-100U): 100% APR

Existing Users (0-200U): 13% APRDaily APR: ~2.21%

Tiered Annualized Yield<1000U: ~10% APR (for 180 days)

>1000U: ~1% APR0-300U: 13% APR

>300U: ~3% APRMinimum Investment0.01 USDT0.1 USDT0.1 USDT0.1 USDTInterest PayoutPaid next day. Automatic after enabling; no separate action needed.Starts accruing next day (T+1) after manual subscription.Starts accruing next day after manual subscription.Hourly accrual, withdraw anytime.Yield SourceOn-chain activitiesLending & DeFi incomeLending & Market MakingNot specifiedAccounts UsedUnified Account: Funding, Contract, & Spot Available BalanceSpot WalletFunding & Spot Trading AccountsFunding & OTC Accounts

Key Takeaways from the Comparison:

Aggressive User Acquisition: WEEX offers the most attractive promotional APRs (100% for new users, 13% for existing) to directly acquire and reward its user base.Unmatched Convenience: The one-click, auto-compounding model with no manual redemption required is a significant usability advantage over competitors who often require recurring manual operations.True Capital Integration: By using a unified account balance for earning, WEEX eliminates the need to manually move funds between “trading” and “savings” wallets, a friction point on other platforms.What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.ConclusionWEEX Auto Earn offers a differentiated approach to crypto yields by prioritizing user convenience and capital efficiency. Its key advantages include seamless integration with trading accounts for automatic earnings on idle balances, highly competitive promotional APRs for new and existing users, and complete liquidity preservation through zero lock-up periods. The platform eliminates traditional friction points through one-click activation and daily automated distribution.

Discover how WEEX transforms passive crypto holdings into productive assets while maintaining full trading flexibility. Experience WEEX Auto Earn to grow your wealth now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Introduction to WEEX Auto Earn and How It WorksDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are the interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interes t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

What Is Edel (EDEL)?

Edel (EDEL) is capturing significant interest for its innovative approach to channeling traditional financial market revenue streams into the Web3 ecosystem. As more users seek to understand this emerging project, there's growing curiosity about its operational framework, token mechanics, and rising prominence within the Base Chain network.

This comprehensive overview provides clear, accessible information about Edel's functionality, token economic model, current market performance, and secure acquisition methods. Consider this your straightforward reference for navigating the project's fundamentals and making well-informed participation decisions.

What Is Edel (EDEL)?Edel represents a groundbreaking protocol designed to democratize access to securities lending revenue—traditionally dominated by institutional brokers—within the blockchain environment. The platform essentially redirects value from conventional equity markets directly to decentralized network participants.

Through an automated smart contract infrastructure, Edel facilitates loan origination, pricing mechanisms, and transaction settlements without intermediary involvement. This decentralized approach globalizes securities lending accessibility while ensuring continuous 24/7 market operation.

Edel's Significance in the Web3 EcosystemEstablishes a permissionless prime brokerage frameworkFacilitates secured lending against collateralized assetsGenerates authentic revenue streams from tokenized equity instrumentsProvides transparent yield opportunities for liquidity providersEnsures global accessibility without institutional barriersPositioned as a foundational coordination layer for the emerging "Wall Street 2.0" paradigm, Edel has gained traction among professional trading operations and cryptocurrency funds while maintaining accessibility for all users. Participants benefit from protocol-native yield generation, transparent settlement processes, and globally available vaults for tokenized assets.

Edel (EDEL) Token Economic ModelThe EDEL token forms the economic backbone of the Edel ecosystem, coordinating liquidity provision, ensuring operational stability, and incentivizing platform participation. The tokenomics are structured to promote long-term protocol sustainability while rewarding user contributions.

Core Token UtilitiesFacilitates liquidity operations for tokenized equity productsDistributes yield generated from protocol revenue streamsEnhances security across lending and borrowing activitiesIncreases in utility as more assets enter Edel's vault ecosystemAligns participant incentives with market growth objectivesThe official token contract address (0xfb31f85a8367210b2e4ed2360d2da9dc2d2ccc95) should always be verified during acquisition to ensure authenticity.

Edel (EDEL) Market Performance and Token MetricsEDEL maintains active trading on Base Chain, with market performance reflecting protocol adoption rates, liquidity expansion, and demand dynamics for tokenized equity products.

Key Price InfluencersSecurities lending market activity levelsLiquidity vault growth metricsInstitutional-grade participant engagementExpansion of tokenized equity marketsIntegration within DeFi yield generation strategiesEDEL's unique positioning at the intersection of traditional finance and blockchain automation continues to attract interest. As tokenized financial assets gain broader adoption, EDEL's utility and demand are expected to correlate with protocol transaction volumes.

ConcludingEdel (EDEL) represents a sophisticated bridge between conventional equity markets and decentralized finance. Its transparent smart contract architecture and expanding liquidity infrastructure position it as a significant contributor to the evolving tokenized securities landscape.

Further ReadingWhat Is Sapien (SAPIEN) and How Does It Work?What Is Decred (DCR)?What Is Momentum (MMT)?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is BabyBoomToken (BBT) and What's The Mission of BabyBoomToken (BBT)?

BabyBoomToken (BBT) is one of the newest meme coins gaining major traction in the Web3 community, not only because of its branding but also its unique mission addressing the global declining birth rate. With a rapidly growing ecosystem, strong advisory board, and rising price momentum, many investors are now asking: What is BBT, and why is it suddenly trending?

This article provides a comprehensive overview of BabyBoomToken — examining its core mission, tokenomics, market performance, and practical utilities — to help you determine if BBT aligns with your investment approach in the cryptocurrency space.

What is BabyBoomToken (BBT)?BabyBoomToken (BBT) is an innovative Web3 initiative that sits at the intersection of health awareness, user rewards, and social impact. Moving beyond the typical hype-driven model of most meme coins, BBT has set its sights on a substantive global challenge: promoting healthier lifestyles and supporting family growth, particularly in regions experiencing concerning demographic declines.

The project successfully merges the engaging, community-oriented nature of meme coins with a tangible, purpose-driven agenda. This dual identity is supported by a developing ecosystem of decentralized applications (dApps), strategic alliances, and guidance from a team of seasoned advisors.

Its primary objectives include:

Addressing the worldwide trend of falling birth ratesAdvocating for wellness and healthy livingDelivering tangible value through a token-based rewards systemLeveraging blockchain technology to create positive social changeThis focus positions BabyBoomToken as a distinctive project within the meme coin sector, one that aims to generate real-world impact alongside market activity.

BabyBoomToken (BBT) Price, Market Data, and Performance AnalysisRecent market data indicates that BabyBoomToken is undergoing a period of significant growth and heightened investor interest:

Price: $0.262124-Hour Change: +222.4%24-Hour Range: $0.06717 – $0.3186Market Capitalization: $35,411,688Fully Diluted Valuation (FDV): $262,380,76424-Hour Trading Volume: $263,075Circulating Supply: 134,962,974 BBTTotal Supply: 1,000,000,000 BBTMarket Rank: #8657-Day Performance: +9.4%30-Day Performance: +117.5%Core Consideration to Keep in MindSecurity audits from GoPlus have identified that the contract deployer retains privileges to alter key token functions. These could include parameters such as transaction fees, selling permissions, and even the ability to mint new tokens or restrict transfers. Potential investors are strongly advised to be aware of these centralization risks and perform their own thorough research.

What's The Mission of BabyBoomToken (BBT)?BBT differentiates itself by focusing on a pressing socio-demographic issue: the steady decline in birth rates across many nations. This trend poses long-term challenges, including aging populations and potential economic strain due to a shrinking workforce.

The project seeks to contribute to a solution through a multi-faceted approach that incorporates:

Decentralized applications focused on health and wellnessAn incentive model that rewards user participationInitiatives designed to encourage and support family growthPrograms aimed at creating measurable social valueBy anchoring its identity in this real-world mission while embracing the viral nature of meme coins, BBT attempts to carve out a unique niche that extends beyond transient speculation.

Leadership and Strategic Advisors of BabyBoomToken (BBT)The BabyBoomToken project is supported by an advisory board composed of professionals from diverse fields including blockchain, technology, medicine, and demography.

Web3 Strategy Advisor – Wael Rajab: A Director at DEXT Ventures with over eight years of experience in the blockchain industry. He provides guidance on strategic partnerships, market entry strategies, and overall ecosystem development.Technology Advisor – Justin Baird: A former CTO at Microsoft for Startups APAC and an early innovator at Google. He advises on the technical architecture and development of the project's applications.Medical Advisor – Dr. Jennifer Uriah: A practicing Obstetrician & Gynecologist at Atma Jaya Hospital and Cinta Kasih Tzu Chi Hospital. She offers expertise on integrating medical data and shaping the project's health-focused initiatives.Academic Advisor – Dr. Diahhadi Setyonaluri: A Professor at the University of Indonesia with a PhD in Demographic & Social Research from the Australian National University. She informs the project's understanding of demographic trends and social impact metrics.The involvement of advisors with established reputations aims to lend credibility and guide the project's long-term strategic direction.

ConclusionBabyBoomToken (BBT) presents a unique proposition in the crowded meme coin landscape by combining community-driven appeal with a focused social mission. Its goal to address global demographic challenges is ambitious and sets it apart from purely speculative assets. The backing of a credentialed advisory team adds a layer of substantive oversight to the project.

However, the significant control retained by the contract deployer, as highlighted in security reports, introduces a notable element of risk that requires careful consideration. BBT represents an attempt to blend speculative momentum with purposeful innovation, making it a noteworthy project for investors who are interested in tokens that aspire to generate both market excitement and tangible societal value.

If you are looking to engage with this unique token, BabyBoomToken (BBT) is available for trading on the WEEX. You can register for a WEEX account today and begin trading BBT immediately.

Further ReadingWhat is Hajimi (哈基米)?Why POPCAT Crashes? A Complete ExplanationWhat Is Crypto Guy (CZ) Coin?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Phoenix (PHB) Price prediction 2025-2035

Phoenix (PHB) represents a specialized blockchain infrastructure designed specifically for artificial intelligence applications while prioritizing data privacy. The platform integrates Layer 1 and Layer 2 architectural elements to create a secure, decentralized environment for enterprise AI solutions, positioning itself at the intersection of blockchain technology and advanced artificial intelligence.

Why Phoenix (PHB) So Unique?Phoenix differentiates itself through its unique integration of AI capabilities with blockchain security protocols. The platform enables businesses to process sensitive information—including healthcare data and financial models—while maintaining data confidentiality through advanced cryptographic techniques.

Core Architectural FrameworkBuilt upon the BNB Smart Chain utilizing BEP20 standards, Phoenix leverages the network's established efficiency and cost-effectiveness while incorporating specialized AI modules. This foundation provides the scalability and cross-chain interoperability necessary for enterprise-grade AI applications.

PhoenixONE: Decentralized AI Research PlatformThe PhoenixONE component serves as a community-driven research ecosystem, employing sophisticated models including KIMI K2 for real-time analytical processing. A distinctive feature involves the on-chain verification capability for all AI-generated outputs, ensuring transparency and auditability.

Token Economic StructureTotal Supply: 59.5 million PHB (anticipated full circulation during 2025)Inflation Mechanism: 10% annual emission rate supporting validator incentives and development fundingUtility Functions: Network fee payments, governance participation, premium AI feature accessThe inflationary model aims to sustain network operations, though strategic staking approaches may help mitigate dilution effects.

Current Market Analysis (November 2025)Market sentiment currently reflects bearish tendencies with approximately 85% negative signals. Key metrics indicate:

Fear & Greed Index: 51 (neutral positioning)Monthly positive performance: 17 of 30 days (57%)Price volatility: 11.33%RSI reading: 54.42 (neutral territory)The current market conditions suggest PHB requires significant catalysts to initiate sustained upward momentum.

Short-Term Price Projections (5-Day Outlook)October 30: $0.5033 (+0.37%)October 31: $0.4519 (-9.87%)November 1: $0.4157 (-17.10%)November 2: $0.3977 (-20.69%)November 3: $0.3875 (-22.71%)The near-term outlook suggests potential resistance around $0.5033 followed by corrective movements.

Phoenix (PHB) Price Prediction 2025Lower bound: $0.3529Average projection: $0.4007Upper target: $0.5033Potential ROI: +0.12%Market expectations indicate range-bound trading patterns throughout 2025, reflecting the extended timelines typically associated with enterprise AI adoption.

Phoenix (PHB) Price Prediction (2026-2030)January 2026: $0.3868 (-23% from current levels)2027 Range: $0.42 - $0.75 (average $0.58)2028 Range: $0.55 - $1.10 (average $0.82)2029 Range: $0.78 - $1.60 (average $1.15)2030 Range: $1.05 - $2.40 (average $1.65)These projections incorporate an estimated 15% annual growth rate in blockchain-based AI adoption.

Phoenix (PHB) Price Prediction 2030Assuming Phoenix captures approximately 5% of the enterprise AI blockchain market segment:

Projected range: $8 - $12 per PHB tokenPrimary growth drivers: Evolving privacy regulations, healthcare AI expansion, DeFi integrationCritical Technical Levels

Support thresholds: $0.3861 → $0.2276Resistance barriers: $0.8534 → $1.16 → $1.3250-day moving average: $0.4401200-day moving average: $0.5431The $0.3861 support level represents a crucial technical threshold, with breaches potentially indicating deeper corrective patterns.

Top Considerations Before Investing in Phoenix (PHB)Inflation impact: 10% annual emission may pressure price appreciation during slow adoption periodsEnterprise sales cycles: Typical 12-18 month implementation timelinesCompetitive landscape: Including Bittensor, and Render NetworkConclusionNear-term market conditions suggest continued volatility and potential downward pressure. However, the long-term investment thesis remains compelling, given the accelerating convergence of AI and blockchain technologies. Phoenix stands positioned to potentially capitalize on the growing enterprise demand for privacy-preserving AI solutions, with significant appreciation potential materializing through 2030 assuming successful execution of the project roadmap.

Looking to trade Phoenix (PHB) tokens? WEEX offers secure and seamless trading with deep liquidity and competitive fees. Perfect for both short-term traders and long-term investors, our platform provides the ideal environment to capitalize on PHB's potential in the booming AI-blockchain sector.

Start your PHB trading journey on WEEX today and position your portfolio at the forefront of crypto innovation.

Further ReadingWhat Is Zcash (ZEC) and How Does It Work?What Is Dogecoin and How Does It Work?What Is Ethereum and How Does It Work?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQWhat blockchain does Phoenix (PHB) run on?Phoenix operates on the BNB Smart Chain utilizing the BEP-20 token standard, delivering high-speed transaction processing with minimal gas fees while maintaining cross-chain compatibility essential for deploying sophisticated AI applications across multiple blockchain environments.

What powers Phoenix's AI system?The platform's AI capabilities are driven by PhoenixONE, an advanced decentralized intelligence framework that employs cutting-edge machine learning models including KIMI K2 architecture. This system processes real-time data streams while ensuring complete auditability through blockchain-verified output validation.

How is PHB used in the ecosystem?PHB tokens function as the fundamental economic layer within the Phoenix network, facilitating transaction fee payments, enabling governance participation through voting mechanisms, and granting access to specialized AI features. Token holders can engage in staking protocols to potentially mitigate the effects of the network's 10% annual inflationary model.

What's the PHB price prediction for 2030?Market analysts project PHB could reach an average valuation of approximately $1.65 by 2030, based on anticipated expansion in enterprise blockchain-AI integration and growing adoption within privacy-sensitive industries including healthcare and finance.

What's the biggest risk for PHB holders?Primary concerns include the token's inflationary emission schedule and potential delays in corporate adoption cycles. While Phoenix's specialized focus on privacy-enhanced AI presents compelling long-term prospects, short-to-medium term performance remains contingent on accelerating enterprise implementation and user acquisition.

What Is Hana Network (HANA)?

Hana Network represents a paradigm shift in how social interactions and financial transactions converge on blockchain technology. This innovative platform creates a unified ecosystem where entertainment, peer-to-peer finance, and micro-transactions coexist seamlessly, lowering the barrier to crypto adoption through intuitive, socially-driven features that enable instant value exchange without traditional intermediaries.

HANA Market Overview: Price, Supply, and LiquidityCurrent Trading Value: $0.045 per HANA tokenCirculating Supply: 315 million tokensMaximum Supply: 1 billion tokensMarket Capitalization: Approximately $14.2 millionDaily Trading Volume: Around $10.8 millionMarket Classification: Emerging mid-cap cryptocurrencyThe token has demonstrated characteristic growth patterns of promising early-stage projects, with periodic momentum surges following platform updates and exchange integrations. While market liquidity continues to improve, long-term value sustainability will ultimately depend on organic adoption across Hana's social finance applications.

What Hana Network Does?Hana Network establishes itself as a comprehensive social finance infrastructure through four interconnected pillars:

Interactive Gaming Experience: HanaFuda merges casual gaming mechanics with NFT-based reward systemsDigital Collectibles Engine: Capsule Shot provides accessible NFT creation and trading capabilitiesLive Engagement Platform: Dipsy facilitates real-time content monetization through integrated tipping featuresFiat Integration Gateway: Streamlined onboarding process bridging traditional finance and digital assetsThis multi-layered approach positions Hana Network to revolutionize everyday digital interactions, from content creator compensation to social entertainment experiences.

Development Background of Hana Network (HANA)Originating from a skilled Japan-based development team in late 2022, Hana Network has methodically expanded its global footprint while maintaining technological excellence. The project's successful $9 million funding round and participation in premier industry incubation programs have provided crucial resources and market validation.

The implementation strategy has followed a deliberate progression:

Foundation Phase (2023): Core platform development and initial market validationExpansion Phase (2024): Full feature deployment and user acquisition initiativesGrowth Phase (2025): Global market penetration and ecosystem enhancementMarket Integration and Trading EvolutionRecent strategic exchange listings have dramatically improved HANA's market accessibility and trading liquidity. These developments have catalyzed increased trading activity while introducing the token to diverse investor communities. Market participants should monitor key indicators including exchange integration announcements, network growth metrics, and sustainable volume patterns.

Hana Network (HANA) Price Prediction (2025-2027)Market analysts identify several potential growth trajectories based on current technical indicators and platform development progress:

HANA Price Prediction (Q4 2025)Stability Range: $0.04 - $0.05Growth Potential: $0.06 - $0.07Breakout Scenario: $0.08 - $0.10HANA Price Prediction (2026)Baseline Projection: $0.07 - $0.10Development Success: $0.12 - $0.15Accelerated Growth: $0.18 - $0.22HANA Price Prediction (2027)Sustainable Growth: $0.10 - $0.14Market Leadership: $0.18 - $0.25Ecosystem Maturity: $0.30 - $0.40Economic Model Considerations and Risk AssessmentHana Network's token economics incorporates carefully balanced mechanisms to support sustainable growth while acknowledging inherent market risks:

Supply Management: Future token releases require strategic timing to support ecosystem developmentAdoption Metrics: Platform utility must demonstrate consistent growth to justify valuationMarket Dynamics: Sensitivity to both platform-specific developments and broader market conditionsThe project's innovative fusion of social engagement with practical financial applications provides distinctive market positioning, though continued execution excellence remains paramount.

ConclusionHana Network represents a significant advancement in blockchain's practical application to social platforms and creator economies. With solid technological foundations, strategic funding background, and clear development roadmap, the project demonstrates substantial potential to influence the evolution of social finance.

For forward-looking participants, HANA offers exposure to blockchain's convergence with social ecosystems while supporting the growing digital creator economy. Success will depend on sustained platform development, user experience optimization, and effective navigation of the dynamic blockchain landscape, while maintaining focus on creating genuine utility for its expanding community.

For investors interested in gaining exposure to HANA's potential, WEEX provides a secure and professional trading environment to access this promising social finance token. The platform offers competitive trading conditions with robust liquidity, enabling seamless participation in Hana Network's ecosystem growth while maintaining the highest standards of fund security and trading efficiency.

Further ReadingWhat is Ping (PING) and Why is Suddenly Trending?What Is Dogecoin and How Does It Work?What Is Ethereum and How Does It Work?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Top 7 AI Crypto to Buy in October 2025

The convergence of artificial intelligence and blockchain is accelerating throughout 2025, fundamentally reshaping the tech landscape. This fusion is giving rise to powerful crypto projects that provide the critical infrastructure—from decentralized computation to data storage—necessary for a more open and accessible AI economy.

For investors in October, this creates a pivotal opportunity to look beyond short-term volatility and target tokens with strong utility and ecosystem growth. Our selection of the top 7 AI cryptos for this month is grounded in a clear-eyed assessment of their recent market performance, active development, and underlying on-chain strength, highlighting the most compelling assets in this dynamic space.

Bittensor (TAO)Bittensor operates a pioneering decentralized network that functions as a global marketplace for machine intelligence. By enabling developers to contribute, train, and monetize AI models in an open ecosystem, it is creating a novel economy for neural network computation.

Current Price: $425.Market Position: Holds a substantial market capitalization of around $4.13 billion.Catalyst: A significant boost in institutional confidence followed a recent SEC filing by Grayscale that featured the token.Technical Outlook: The network is showing a decisive breakout from a prolonged downtrend, indicating a robust technical reversal. Its unique model for incentivizing AI development solidifies its position as a cornerstone project for long-term growth in the AI blockchain space.Render (RENDER)Render Network is decentralizing access to GPU power, creating a distributed infrastructure critical for both AI model training and immersive metaverse applications. It efficiently harnesses idle computing resources from a global network.

Current Price: $2.548Market Cap: Stands at $1.46 billion, ranking it within the top 60 cryptocurrencies.Momentum: Exhibiting a strong recovery from recent market pressures.Value Proposition: Its core vision of aggregating GPU resources for complex computation tasks makes it an indispensable component of the expanding AI and creative economies, with a growing list of partnerships in AI and visual computing.NEAR Protocol (NEAR)Originally designed as a scalable Layer 1 blockchain, NEAR Protocol has strategically positioned itself as a hub for AI and decentralized applications, emphasizing user and developer-friendly tools.

Performance: Priced at $2.52, marking a 12.19% gain in the last 24 hours.Valuation: Commands a market cap of $3.16 billion.Ecosystem Strength: Supported by a robust community of over 1,100 active developers, one of the highest counts in the sector.Potential: Its collaborative environment and active integration with machine learning initiatives provide a foundation for sustained innovation and ecosystem maturity, despite normal market fluctuations.Story (IP)Story (IP) explores a specialized niche, utilizing blockchain to create decentralized ecosystems for AI-driven story generation and collaborative creative ownership.

Current Price: $5.453Volatility Note: Its weekly chart shows a decline of over 30%, highlighting its speculative and high-risk nature.Outlook: As an early-stage project, it appeals to investors targeting high-reward opportunities in emergent AI content creation platforms. Its success is closely tied to the future mainstream adoption of AI-generated media.Internet Computer (ICP)Internet Computer aims to redefine decentralized cloud computing, with a specific focus on enabling AI models and services to run natively on its blockchain.

Current Price: $3.167Development Activity: Maintains strong momentum with approximately 758 active developers.Technical Edge: Its ability to host AI workloads directly on-chain represents a significant architectural advancement beyond standard smart contracts, positioning it as a strong candidate for long-term AI infrastructure adoption.Filecoin (FIL)Filecoin provides a critical service for the AI industry: secure, decentralized data storage. It serves as the foundational layer for storing and distributing the vast datasets required for AI training and operation.

Current Price: $1.577Context: Despite a challenging weekly performance, its core utility remains undiminished.Strategic Importance: In an era where data is paramount, Filecoin’s permissionless and robust storage solution is increasingly vital for the backend of decentralized AI data pipelines.The Graph (GRT)The Graph serves as the decentralized data layer for the blockchain world, indexing and organizing information so that AI applications can efficiently query and utilize on-chain data.

Current Price: $0.0653Sector Role: Its protocol is fundamental for any AI application that requires real-time, structured data from blockchains.Prognosis: As the demand for intelligent blockchain analytics grows, The Graph’s role as a core infrastructure provider is expected to become even more critical.Developer and On-Chain ActivityA key metric for evaluating the long-term potential of these projects is their developer activity and on-chain growth.

NEAR Protocol and Internet Computer lead the pack with high levels of developer engagement, indicating strong, ongoing ecosystem development and sustainability.Bittensor shows rapidly growing community interest, largely driven by its novel economic model and increasing institutional attention.Render, The Graph, and Filecoin maintain moderate but consistent development activity, focused on enhancing their core infrastructural offerings.Story (IP), while promising, is still in its early stages with a smaller, nascent ecosystem.Outlook for Q4 2025October 2025 is shaping up to be a defining period for AI cryptocurrencies. The convergence of on-chain AI logic, decentralized computing, and distributed data storage is creating a multi-layered infrastructure poised to support the next generation of decentralized applications.

While the market remains inherently volatile, the growing institutional focus on leading projects like TAO, NEAR, and RENDER points to a maturing sector with long-term potential. These tokens are at the forefront of a blockchain-powered AI renaissance, moving beyond theory toward practical, scalable use cases.

ConclusionThe merger of AI and blockchain is more than a trend; it is a fundamental shift in how digital intelligence and value can be created and distributed. The projects leading this charge are evolving from speculative assets into critical architects of a decentralized digital future. For strategic investors, the current market presents a significant opportunity to engage with foundational technologies that are likely to play a central role in the ongoing evolution of the crypto landscape. As always, success in this dynamic sector requires diligent research, strategic diversification, and a focus on long-term fundamentals.

The foundation for the next digital era is being built now. Don't just watch from the sidelines—begin your AI crypto trading journey on WEEX now!

Further ReadingTop Elon Musk Crypto to Watch in 2025Top 5 Four.meme Coins in the BNB EcosystemTop Solana Memecoins to Watch in 2025Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is Open Campus (EDU) and Why Is EDU Hot in October 2025?

Open Campus is a blockchain-based initiative designed to transform the worldwide education landscape by establishing a decentralized network. This ecosystem integrates students, instructors, content developers, and educational bodies, facilitating direct interaction and value exchange. It shifts authority away from centralized entities, enabling educators to earn directly from their materials, learners to maintain control over their academic records, and organizations to engage in clear, cooperative ventures.

Core Goals of Open CampusThe existing educational framework is plagued by issues like restricted accessibility, non-transparent certification, and inadequate compensation for educators. Open Campus strives to create a learning environment that is equitable, transparent, and universally accessible. Its primary goals are to:

Grant educators and creators full ownership and monetization rights for their instructional materials.Provide learners with tamper-proof academic credentials and self-sovereign digital identities.Allow educational institutions to leverage and monetize their resources on a clear, trustworthy platform.Foster a worldwide community that removes barriers to quality education.Through the application of Web3 tools, Open Campus is establishing a new, incentive-driven framework that promotes open participation and fair compensation.

What is EDU Token?The EDU token functions as the primary digital currency within the Open Campus Protocol, a decentralized network built for the education sector. This system allows all members of the educational community—including tutors, curriculum designers, and learners—to receive fair value for their contributions. The $EDU token serves several key purposes:

Educators and creators are compensated by EDU for publishing and sharing quality content.Students utilize EDU tokens to pay for courses, certifications, and other educational services.Token holders participate in platform governance, voting on key decisions about protocol upgrades, fund allocation, and content standards.As the Open Campus network grows, the utility and demand for the EDU token are expected to increase correspondingly.

Why Investors Are Watching EDU Again?The recent upward movement in EDU's market value is linked to increasing investor focus on tokens with tangible utility and real-world applications. The education sector, along with decentralized science (DeSci), is gaining traction as a promising niche, and Open Campus is a recognized project in this domain. Several elements contribute to its renewed appeal:

Strategic collaborations with other Web3 educational platforms and decentralized organizations.An engaged governance system that lets the community decide on fund distribution and project development.Its established position as a top blockchain network dedicated to education.Speculation around new exchange listings and integration with additional layer-two scaling solutions.The token's economic model is also a factor, with a significant portion of the total supply already in circulation, reducing the risk of inflation from large, unlocked reserves.

What Could Influence EDU’s Price Next?Traders and investors are monitoring several potential developments that could impact EDU's price trajectory:

New governance proposals that increase funding for educational initiatives and creator incentives.Technical integrations that connect the EDU Chain with more decentralized applications and e-learning tools.Announcements regarding listings on major global or regional cryptocurrency exchanges.Collaborative agreements with traditional universities, online learning platforms, or digital credentialing services.A sector-wide uptrend in tokens related to decentralized science and education.Should these catalysts materialize, EDU could potentially experience a steady upward trend through the last quarter of 2025.

ConclusionThe price recovery of EDU in October 2025 signals a restoration of confidence in its core mission and a broader market interest in practical Web3 applications. With a strengthening ecosystem, increased trading activity, and a well-defined role in decentralized learning, Open Campus has successfully recaptured market attention.

For traders looking to capitalize on this momentum, the EDU token is readily accessible for trading on WEEX exchange. The project's continued progress—specifically in scaling its blockchain, growing its library of tokenized educational content, and enhancing tools for educators—will be critical to its long-term position. Maintaining a price level above $0.13 will be a key test to determine if this resurgence is a temporary spike or the start of a more durable growth phase.

Further ReadingWhat is Bittensor Crypto (TAO) and How Does It Work?What is YieldBasis (YB) and How Does It Work?What is Enso (ENSO) and How Does It Work?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is Enso (ENSO) and How Does It Work?

Enso represents a groundbreaking approach to blockchain interoperability, functioning as a decentralized Layer 1 network that streamlines cross-chain smart contract interactions. The protocol serves as a universal coordination layer that seamlessly connects smart contracts across diverse blockchain ecosystems, including multiple Layer 1 networks, rollups, and application-specific chains. This architecture enables developers to create sophisticated multi-chain applications without grappling with the underlying technical complexities of cross-chain communication.

The protocol introduces two fundamental concepts that redefine how users interact with decentralized systems. Intents allow developers and users to express desired outcomes—such, such as cross-chain asset transfers or complex DeFi operations—through declarative statements rather than procedural instructions. Actions represent standardized, reusable smart contract modules that execute specific operations like token transfers or staking functions. Enso's network intelligently combines these Actions to fulfill user Intents, creating a more intuitive and efficient framework for blockchain interaction that significantly enhances both developer experience and end-user accessibility.

How Enso Works?The shared network stateEnso's shared network state functions as a universal registry that maintains comprehensive metadata about smart contracts across connected blockchain ecosystems. This global state repository provides developers with a unified interface for accessing and interacting with smart contracts regardless of their underlying blockchain infrastructure. Each registered smart contract is represented as an entity containing all necessary technical specifications to generate executable bytecode, along with chain identification data that ensures proper deployment targeting.

The shared state transforms how developers approach multi-chain application development. For instance, when a developer needs to interact with Aave's lending protocol across Ethereum, Arbitrum, and Polygon, Enso can automatically assemble the required components from its shared state to generate precise bytecode for each specific chain. This abstraction layer effectively converts complex, chain-specific smart contract interactions into standardized, reusable components that can be seamlessly composed into sophisticated cross-chain applications.

Network ParticipantsEnso's ecosystem operates through four specialized participant roles that collectively ensure efficient intent fulfillment and network security:

ConsumersIndividuals or developers who submit outcome-oriented requests to the network, specifying what they want to accomplish without detailing the technical execution path.

Action ProvidersDevelopers who create and maintain reusable smart contract modules called Actions, which encapsulate specific blockchain operations and their implementation details.

GraphersSpecialized network participants who analyze the shared state to identify optimal Action combinations, constructing efficient execution paths that satisfy user intents while minimizing costs and maximizing performance.

ValidatorsNetwork operators who verify proposed solutions through comprehensive simulation and testing, ensuring execution correctness and security across all involved blockchain environments.

The Enso operational workflow follows a structured process:

Intent Submission: Users declare desired outcomes through high-level descriptionsAction Registration: Providers publish standardized smart contract modulesPath Optimization: Graphers construct optimal execution paths using available ActionsSolution Verification: Validators simulate and validate proposed solutionsSelection & Execution: The network selects the optimal solution for user executionReward Distribution: Execution fees are distributed to participants through an auction mechanismUse Cases of ENSOEnso's technology enables numerous advanced applications across the blockchain ecosystem:

Decentralized Exchanges: Simplifies complex liquidity provisioning through intuitive zaps and automated position managementWallet Integration: Enables seamless cross-chain transactions and direct DeFi protocol accessStablecoin Infrastructure: Facilitates multi-chain deployment of yield-generating stablecoinsVault Management: Streamlines asset deposition and migration processesMarket Making: Automates sophisticated trading strategies and liquidity optimizationIntroduction of Enso (ENSO)ENSO serves as the fundamental economic and governance token within the Enso ecosystem, featuring a fixed maximum supply of approximately 127 million tokens. The token implements a carefully designed emission schedule that gradually decreases over a ten-year period before concluding entirely. ENSO enables several critical functions:

Governance: Token holders participate in protocol evolution through staking-based voting mechanismsNetwork Security: Validators stake ENSO to secure the network and verify transaction correctnessDelegation System: Token holders can delegate to validators and earn proportional rewardsConclusionEnso represents a significant advancement in blockchain interoperability by introducing an intent-centric approach to cross-chain application development. The protocol's unique architecture, combining a shared network state with specialized participant roles, creates a powerful framework for building sophisticated multi-chain applications. By abstracting away the technical complexities of cross-chain interactions and introducing economic incentives for optimal execution, Enso positions itself as a foundational layer for the next generation of decentralized applications that can seamlessly operate across the entire blockchain ecosystem.

If you are looking to participate in Enso's innovative ecosystem, the ENSO token is now available for trading on WEEX Exchange. We offer secure and seamless access to ENSO trading pairs, complemented by competitive fees and reliable liquidity. Just start your ENSO trading journey today through our user-friendly interface and robust security measures.

Further ReadingWhat is Bittensor Crypto (TAO) and How Does It Work?What Is Dogecoin and How Does It Work?What Is Ethereum and How Does It Work?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

India Crypto Tax 2025: A Complete Guide

The rapid growth of cryptocurrency and digital asset trading in India has been matched by comprehensive regulations and an evolving tax regime. As of 2025, every Indian resident or business engaging with crypto must understand their tax obligations to avoid penalties and ensure compliance with the Income Tax Department (ITD). This all-in-one guide walks you through every aspect of crypto taxation in India, including the latest rules, reporting strategies, and tools like the WEEX Tax Calculator to simplify your process.

Do You Pay Cryptocurrency Taxes in India?Absolutely. Anyone earning, trading, investing, or even gifting cryptocurrency in India is subject to a specialized tax framework. The Finance Act 2022 officially classified cryptocurrencies, non-fungible tokens (NFTs), and similar assets as Virtual Digital Assets (VDAs), placing them firmly within the purview of Indian taxation.

What Activities Are Taxable?The scope is broad. Indian tax law covers almost every significant crypto transaction:

Crypto Activity

Is It Taxable?

Tax Type

Buying crypto with INRYes (1% TDS)Tax Deducted at SourceSelling crypto for INRYes30% tax on gains + 1% TDSSwapping crypto (crypto-to-crypto)Yes30% tax on gains + 1% TDSSpending crypto on goods/servicesYes30% tax on gainsReceiving airdrops, mining, stakingYesSlab-rate income tax on receiptGifting cryptoSometimesTaxable for the recipient (see below)HODLing or moving between own walletsNoNot taxableLost/stolen cryptoNoNot taxable; cannot offset lossesAs this table shows, only a limited number of activities—such as holding crypto or transferring funds between your own wallets—are not taxed.

Who Needs to File?Any individual, company, partnership, or Hindu Undivided Family (HUF) that realizes crypto gains or income during the financial year must declare it. Even occasional investors and part-time traders are not exempt. The ITD has specifically targeted non-reporting, imposing strict penalties and leveraging information reported by exchanges.

How Much Tax Do You Pay on Crypto in India?India enforces one of the strictest crypto tax regimes in the world, characterized by a flat 30% rate on profits from VDAs. However, that isn’t the only obligation. Here’s a breakdown of how much tax you may owe:

The 30% Flat RateSince April 1, 2022, any profits from selling, trading, or spending VDAs—regardless of how long you held them—are taxed at a flat 30% rate. Unlike shares or equity, there is no distinction between long- and short-term capital gains. This means your profits from a day-trade or a multi-year investment are taxed identically.

The 1% TDS (Tax Deducted at Source)In addition to the capital gains tax, India mandates a 1% TDS on the value of most crypto asset transfers when certain annual thresholds are met:

RS50,000 per financial year for most individualsRS10,000 per financial year for certain users (e.g., those with lower overall income or trading via select platforms)Indian exchanges usually deduct TDS automatically. For peer-to-peer or international transactions, the buyer is responsible for withholding TDS and remitting it to the government.

Tax on Crypto as IncomeSome crypto activities are taxed at your personal income tax slab rate instead. Examples:

Mining new coinsEarning crypto via salaryReceiving airdrops, staking, or DeFi rewards (upon receipt)After receipt, any later disposal triggers the 30% tax on capital gains.

Crypto Tax Rate Table (FY 2024-25 / AY 2025-26)Type of Crypto Income

Tax Rate

TDS Applies?

Offset Losses?