Please be informed that the original content is in English. Some of our translated content may be generated using automated tools which may not be fully accurate. In case of any discrepancies, the English version shall prevail.

Please be informed that the original content is in English. Some of our translated content may be generated using automated tools which may not be fully accurate. In case of any discrepancies, the English version shall prevail.What is YieldBasis (YB) and How Does It Work?

The world of decentralized finance (DeFi) has opened new doors for crypto investors—but not without trade-offs. Volatility, complex mechanics, and the ever-present threat of impermanent loss have made yield farming feel more like risk management than passive income. For example, even when markets move in your favor, providing liquidity to automated market makers (AMMs) can still underperform simply holding your tokens.

In this environment, the demand for more stable, predictable returns has never been higher. That's where YieldBasis (YB) steps in—a next-generation DeFi protocol designed to bring sustainable yields to volatile crypto assets like BTC. Backed by Curve Finance's infrastructure and launched in 2025, YieldBasis offers a novel way to earn on-chain yield without suffering from the usual "impermanent loss drag." So, what exactly is YieldBasis, and how does it work? Let's break it down.

What Is YieldBasis (YB)?

YieldBasis represents a fundamental rethinking of decentralized yield generation, creating a protocol that enables cryptocurrency holders to earn consistent returns while avoiding the pitfalls of traditional liquidity provision. Developed by Michael Egorov, the visionary behind Curve Finance, and launched in early 2025, the platform integrates deeply with Curve's established infrastructure to deliver innovative yield solutions.

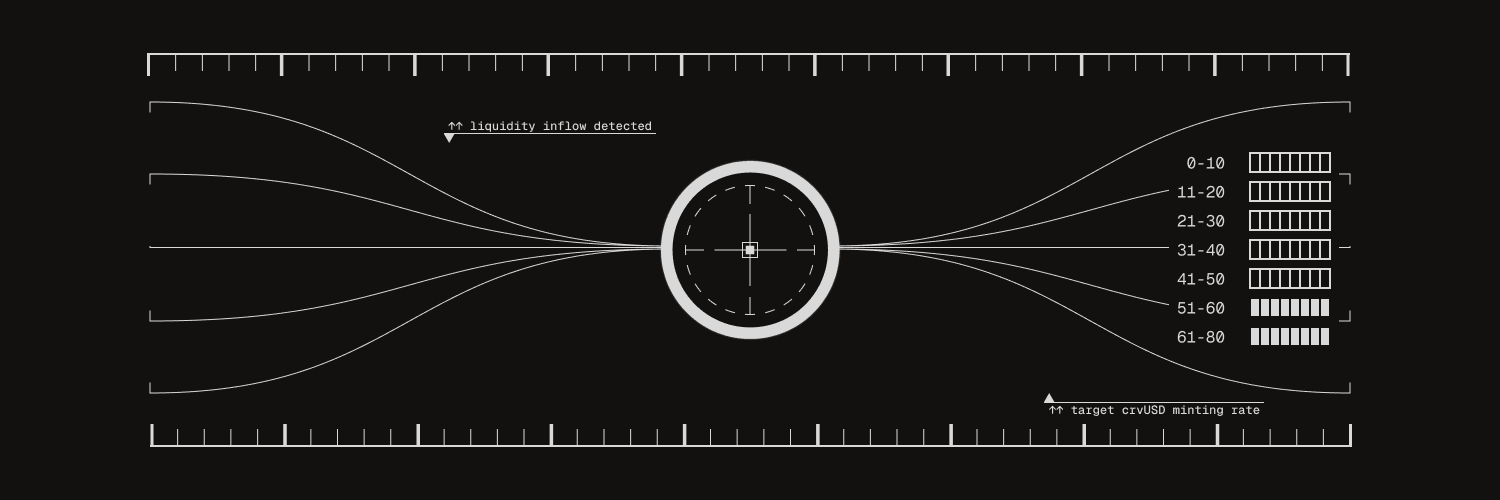

The protocol's breakthrough lies in its leveraged liquidity provisioning approach. Rather than following conventional automated market maker models that expose participants to asset ratio fluctuations, YieldBasis constructs positions that maintain 1:1 price tracking with underlying assets like Bitcoin. This is accomplished by combining deposited BTC with equivalent value in crvUSD, Curve's native stablecoin, while maintaining automated 2× leverage management.

Participants receive specialized wrapped tokens such as ybBTC representing shares in dynamically rebalanced, leveraged liquidity pools. These positions automatically adjust to market movements, preserving the target leverage ratio while eliminating the performance erosion typically associated with impermanent loss.

The protocol launched with substantial Curve DAO support, including significant crvUSD credit facilities to enhance pool liquidity. While initially focused on Bitcoin applications, the architecture supports future expansion to Ethereum and other major digital assets.

How YieldBasis (YB) Works?

YieldBasis employs sophisticated financial engineering to provide cryptocurrency price exposure while circumventing traditional impermanent loss challenges. The system creates 2× leveraged liquidity positions within Curve's automated market maker ecosystem, implementing dynamic rebalancing mechanisms to maintain optimal positioning.

The operational workflow encompasses several key stages:

- Asset Deposit: Users initiate by depositing base cryptocurrencies like Bitcoin

- Leverage Implementation: The protocol automatically borrows matching crvUSD value to establish 50/50 liquidity positions

- Continuous Rebalancing: Advanced algorithms maintain target leverage ratios through virtual pool systems and arbitrage incentives

- Tokenized Positions: Users receive wrapped tokens (e.g., ybBTC) representing their leveraged liquidity stake

- Revenue Generation: Deployed capital earns proportional shares of trading fee revenue

- Enhanced Rewards: Optional staking of yb-tokens generates additional YB token incentives

This integrated approach merges leverage management, automated rebalancing, and fee accumulation into a unified system, creating an ideal yield strategy for long-term holders seeking returns without compromising price appreciation potential.

YieldBasis (YB) Tokenomics

The YB token forms the economic foundation of the YieldBasis ecosystem, serving dual purposes as both functional utility asset and governance instrument. With a predetermined maximum supply of 1 billion tokens, YB incentivizes liquidity provision, rewards ongoing participation, and facilitates decentralized decision-making.

Initial distribution placed approximately 87.9 million YB tokens (representing nearly 9% of total supply) into circulation, with remaining allocations subject to graduated vesting schedules and strategic reserves for protocol development. Following contemporary DeFi conventions, YieldBasis implements a vote-escrow mechanism, enabling token locking to acquire veYB (vote-escrowed YB) that confers governance privileges and fee distribution rights.

Beyond governance applications, YB tokens power the staking and emissions framework. Participants depositing assets receive corresponding yb-tokens, which can be staked to accumulate additional YB rewards. veYB holders qualify for enhanced incentive structures, fostering long-term alignment between liquidity providers and protocol sustainability. The emission schedule incorporates gradual reduction mechanisms to ensure long-term economic viability while appropriately compensating early adopters and active ecosystem contributors.

What Problems Yield Basis (YB) Solves?

YieldBasis addresses several persistent challenges within the decentralized finance landscape, particularly affecting Bitcoin holders:

Limited Yield Opportunities for Bitcoin

Historically, Bitcoin investors have encountered restricted options for generating meaningful on-chain returns. Conventional lending markets typically offer minimal yields, while traditional liquidity provision exposes participants to impermanent loss risks that frequently result in net negative outcomes even during favorable market conditions.

Automated Market Maker Limitations

Standard automated market maker protocols mandate paired asset liquidity provision, creating inherent impermanent loss vulnerability when constituent assets experience price divergence. This structural risk discourages participation and compromises yield generation strategies, especially for volatile assets like Bitcoin.

Governance and Incentive Alignment Deficiencies

Many decentralized finance protocols suffer from underdeveloped governance mechanisms, leading to misaligned incentives and opaque decision processes that can precipitate unsustainable token emissions and suboptimal protocol enhancements.

YieldBasis confronts these challenges through:

- Advanced AMM architecture that neutralizes impermanent loss through leveraged positions and automated rebalancing

- Single-asset deposit capability, enabling Bitcoin holders to generate yields without paired asset exposure

- Vote-escrow governance systems (veYB) that create proper incentive alignment and community-led protocol evolution

These innovations establish YieldBasis as a secure, efficient, and transparent yield generation solution specifically optimized for Bitcoin and other volatile digital assets.

YieldBasis (YB) Price Prediction for 2025, 2026–2030

Current market activity places YieldBasis (YB) trading near $0.72 following its exchange debut. Forward-looking price projections remain inherently speculative, heavily influenced by protocol adoption rates, market sentiment shifts, and broader cryptocurrency trends.

- 2025 Price Prediction: YB may trade between $0.68 and $0.85 as the protocol navigates initial volatility, token distribution events, and early market discovery

- 2026 Price Prediction: Expanding adoption and veYB demand could push token valuations toward $0.90 to $1.40 as protocol liquidity deepens

- 2027 Price Prediction: Continued maturation and ecosystem growth may support price movement toward $1.30 to $2.00, bolstered by increased pool utilization and yield stability

- 2028 Price Prediction: Potential bull market conditions and DeFi expansion could propel YB toward $1.80 to $2.80, particularly with Layer-2 or cross-chain integration

- 2029 Price Prediction: Declining token emissions and strengthening governance utility may support appreciation toward $2.50 to $3.50

- 2030 Price Prediction: Established position as core yield generation platform with sustainable revenue could justify valuations between $3.20 and $4.50

Conclusion

YieldBasis distinguishes itself not through exaggerated yield promises or superficial features, but through delivering substantive value for strategic cryptocurrency investors—a methodical approach to yield generation that preserves asset exposure. By eliminating impermanent loss and leveraging Curve's established infrastructure, the protocol creates an evolved DeFi experience that represents a logical progression for liquidity provision.

Significant developments remain ahead. Market acceptance of leveraged liquidity tokens like ybBTC, along with the protocol's ability to maintain liquidity depth and competitive yields amid decreasing emissions, will critically influence YB's trajectory. Currently, YieldBasis presents a compelling synthesis of innovation and practicality, potentially emerging as one of the more fundamentally transformative projects in the contemporary DeFi landscape.

If you are interested in accessing YB tokens, WEEX Exchange offers secure trading with competitive fees and deep liquidity, providing a reliable platform to participate in YieldBasis's innovative yield ecosystem.

Further Reading

- What is Bittensor Crypto (TAO) and How Does It Work?

- What Is Dogecoin and How Does It Work?

- What Is Ethereum and How Does It Work?

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

You may also like

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com

WE-Launch

WE-Launch