$50 to $1 Million: How to Survive in the Meme Battlefield with 'Wallet Tracking'

Original Article Title: How Wallet Tracking Took me From $50 to $1M+ at 18

Original Article Author: @ugotrd, Trader

Original Article Translation: Luffy, Foresight News

In February 2024, I entered the Meme coin trading world with $80, only to lose it all, an experience of such failure that I had twice.

It was then that I realized I had not grasped the intricacies of this market at all and had been using the wrong approach all along.

Later, I re-entered with $50, this time employing a wallet tracking strategy. In less than a year, by February 2025, this $50 had grown to over $1 million.

Early Pitfalls

My previous logic for buying Meme coins was simple: "This coin has an interesting meme, good marketing, and a clean official website, so it's a good buy."

Undeniably, this method occasionally made some money, but most of the time, it was no different from pure gambling. You had no solid basis, nor could you find any objective reason to judge at what specific price the coin could rise to.

If you want to make consistent profits, you have to find a way to get key information before the market takes off, instead of following the trend after it rises.

I used to be obsessed with various insider messages on X platform and Telegram groups: "This coin is definitely going to rise to a $1 billion market cap this week, just wait and see." Later, I learned that most of the people making these claims were either paid shills or had already accumulated 15% of the token's circulation at a low price. You eagerly entered the market, only to end up as a bag holder.

If your profit-taking target is not based on real information, then your actions are merely responding passively to others' vested interests, rather than truly following market dynamics.

Turning the Tide with Wallet Tracking

I quickly realized that my previous actions lacked a critical piece. I always watched the operations of those top traders and pondered to myself, "How can he predict the market, but I can't?" So I had to find a solution.

Wallet tracking completely transformed my understanding of trading. I no longer try to guess the market tops and bottoms, follow various narrative hot topics, or be led by the nose by the hype on X platform. Instead, I focus solely on one thing: where smart money is flowing.

The start of any major bull run is not on social media, but in a small number of wallets. These wallets are either the project team's initial wallet, a whale wallet, or an early institutional investor wallet. Insiders, KOLs, industry gurus, market makers, newly opened anonymous wallets... are all hiding in these addresses.

My reliance is not on the luck of a single transaction, but on repeatedly capturing replicable market patterns.

At that moment, I completely understood: I don't need to be smarter than the entire market, nor do I need to involve any subjective judgment, much less pay attention to market hype. I just need to focus on data, analyze fund flows, and then decisively execute trading strategies.

Since then, my goal has become extremely clear: to establish a trading system that responds only to the movement of smart money, rather than following every market rumor.

My Wallet Tracking Practical Method

Keep an Eye on KOL Wallets

Back in February 2024 when I just got started, wallet tracking was actually very simple. At that time, hardly anyone would frequently change wallet addresses.

What you had to do was find the hidden wallet addresses of those KOLs who truly had influential traffic, and then just follow their actions, that's all.

They accumulate at the low, make high-profile calls, and the coin price instantly skyrockets 10x.

Using this method, I turned $50 into $5000 in the first month. Then, in the following month, $5000 turned into $30,000.

For example, on February 24th, a project team specifically created a token for a KOL. When the industry guru's token's market cap was only $20,000, he quietly built a position using multiple hidden wallets. When the market cap rose to $30,000, I followed his lead and bought in. He then aggressively promoted the token in Telegram groups and on platform X, causing the token's market cap to instantly exceed $400,000. I took partial profits at this price.

Later that day, the token's market cap surged to $1 million, and I took the opportunity to cash out again. By my calculations, in just a few hours, my initial investment had grown by about 30x.

At that time, my capital was still very small, so I didn't have to worry about liquidity issues and could exit cleanly and completely.

Track Wallets of Conspiracy Groups

A few months later, I no longer focused on individual KOLs, but instead tracked the wallet movements of a whale group (market manipulation small group). At that time, the frequency of everyone changing wallet addresses was increasing, and compared to just looking at a single wallet, tracking the consensus of a group's actions was much more reliable. For example, 10 wallets belonging to different people but part of the same circle, engaging in the same operations simultaneously.

This kind of signal gave me confidence far beyond what a single wallet could provide.

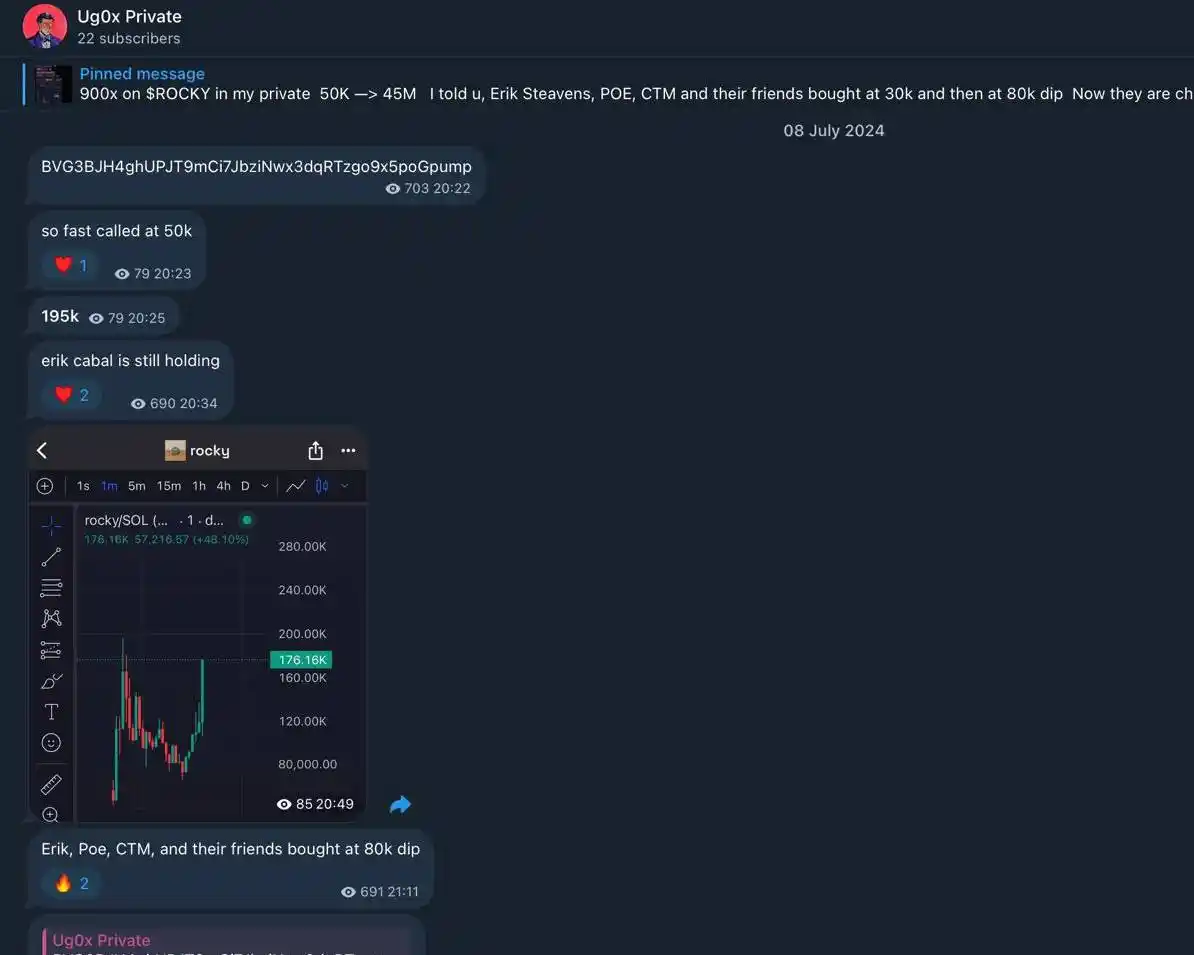

On July 8, 2024, there was a prime example of an operation around the $ROCKY token. At that time, people like Erik Steavens, POE, DOGEN, and CTM quietly bought into the token in the $10,000 to $80,000 market cap range.

Seeing this signal, I was certain it was far from accidental; they were definitely brewing up a pump.

When the market cap reached $40,000, I bought 2.8% of the circulating supply of the token.

In the following days, this group of whales joined forces to drive up the price, and the token's market cap soared to $45 million.

I took profits in batches between $2 million and $10 million in market cap, with an average exit price around $6 million.

With this trade, my initial funds multiplied by 150 times. Although I could have made 1100 times at the peak, I strictly followed my exit plan. With this trade, I earned my first six-figure profit, and I was already satisfied.

Tracking New Wallets, Project Team Wallets, and Whale Wallets

By January 2025, the cryptocurrency market's trading environment was extremely hot, but the difficulty of wallet tracking was also increasing. In order to continue getting firsthand insider information, I had to constantly optimize my methods and adapt on the fly.

When tracking wallets of insiders like these, the key was to find those wallets that had just withdrawn from centralized exchanges like Binance. This meant accurately tracing the fund transfer records and timestamps across multiple Binance addresses. Although this process was time-consuming, it was definitely worth it.

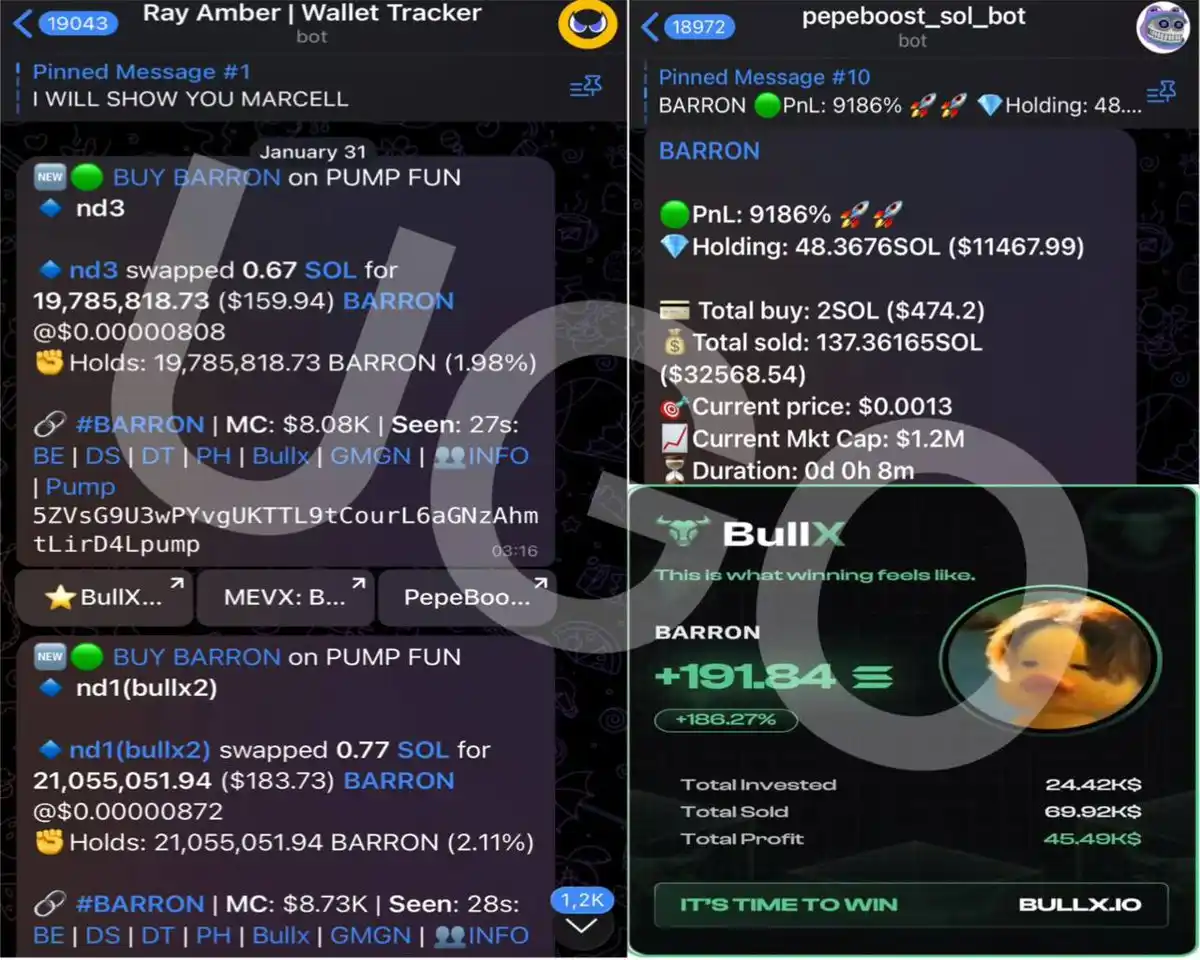

For example, I was actively tracking Marcell's wallet movements at that time, so I could see his newly recharged wallet every day. On January 31, he personally entered the game and accumulated a large position in the $BARRON token.

At a token market cap of $15,000 to $25,000, I built my position across 3 wallets. About three minutes later, Marcell started posting to call for a pump. I promptly took profits between a $1 million to $2.5 million market cap and exited.

This is one of the fastest transactions I have ever conducted: I initially invested $1300 and ended up earning over $110,000. (The BullX trading platform displayed my initial investment as $24,000 because I later bought the dip in this wallet to maximize profits).

Tracking Market Maker Wallets

A market maker wallet is a wallet address directly controlled by the token project team, mainly used to manipulate the coin's price to benefit the project team or the token itself.

Common manipulation tactics include: triggering stop-loss orders through large buy or sell orders to harvest retail investors, or causing a 30% price drop within minutes to trigger panic selling, allowing new investors to enter at a lower price.

However, market makers often transfer tokens between wallets shortly after the token is launched. If these wallets are not newly created or are easily identified, we can directly track the project team's movements, accurately capturing every new token issuance opportunity.

The $HOOD token trade on January 31, 2025, was how I operated.

This project team releases a new token approximately every month. When the token's market cap reached around $2 million, they completed a large holdings allocation, and I promptly bought in at this price before the top KOL (Key Opinion Leader) shill. Hours later, I took profit with a market cap between $80-120 million, resulting in about a 50x return on this trade.

Meanwhile, while managing the initial position profit-taking gap, I also took advantage of the market maker's large sell-off rally, re-entering with a heavy position and making a 40% to 70% price difference in just a few minutes.

The total profit for that day was as high as $152,000. Before the ASTER token trade in September of the same year, January 31 was always my most profitable trading day.

My Trading Golden Rule

I always adhere strictly to risk management rules. For example, I never invest more than 5% of the total position in each trade, and I flexibly adjust the risk exposure based on the quality of the trading opportunity and my confidence level.

When trading with a wallet tracking strategy, never overexpose yourself. Once your tracked target detects your presence, they can easily turn the tables on you.

You also need to learn to empathize, think from the perspective of the entity you are tracking, understand their interests, operating habits, and rhythm control. Only by doing so can you minimize the risk of being harvested to the fullest and achieve consistent and stable profits.

Of course, I strictly adhere to my own trading plan, never letting emotions influence my decisions. In fact, I rarely struggle in this regard, as I started learning forex trading at the age of 14, and discipline has been ingrained in me.

That being said, I have also experienced several painful lessons of profit giveback. But these setbacks did not defeat me; instead, they fueled my progress. With this sense of unwillingness to settle, I delved even deeper, constantly honing my trading edge.

Finally

I am writing this article not to show off. On the one hand, I want to use it as a diary to look back on my growth five years later; on the other hand, I hope to inspire and help more people, letting everyone understand that as long as you are willing to actively seek change and put in effort, there is always a way to achieve your goals.

I must clarify one thing: I never use these tracking techniques to target friends or people around me. Everything I do is purely to understand the underlying logic of market operation and then act accordingly.

I am equally grateful to those whom I have tracked, to the project teams who truly dedicate themselves. I always trade with a sense of awe, without any hostility. I am also sincerely thankful to all the friends I have met on this journey, as they have given me so much help. Thank you all, and thanks to the divine guidance.

You may also like

Key Market Intelligence on December 30th, how much did you miss out on?

Matrixdock 2025: The Practical Path to Sovereign-Grade RWA of Gold Tokenization

Paradigm's Tempo Project Launches Testnet, Is It Worth Checking Out?

When Everyone Uses AI Trading, Where Does Cryptocurrency Alpha Go in 2026?

In 2025, AI trading has become the default, but Alpha hasn’t disappeared — it’s been eroded by crowding, as similar data, models, and strategies cause traders to act in sync and lose their edge.

Real Alpha has shifted to harder-to-copy layers like behavioral and on-chain data, execution quality, risk management, and human judgment in extreme markets, where acting differently — or not acting at all—matters more than better predictions.

Without Narrative Power, Web3 Will Not Tap into the Vastness

Insight: 2026 Could Usher in a “Crypto Winter,” but Institutionalization and On-chain Transformation Are Accelerating

Key Takeaways Cantor Fitzgerald predicts Bitcoin could face an extended downtrend, signaling a potential “Crypto Winter” by 2026.…

Caixin: Digital RMB Wallet Balances to Begin Earning Interest in 2026

Key Takeaways: Starting January 1, 2026, digital RMB wallets will earn interest on balances. The operational structure will…

Key Market Information Discrepancy on December 30th – A Must-See!

Key Takeaways Meta’s massive acquisition of Manus is poised to reshape the tech landscape, indicating significant growth in…

From Failures to Success: Building Crypto Products That Truly Matter

Key Takeaways Building infrastructure in crypto doesn’t guarantee success; understanding user needs is critical. Products aimed at younger…

Lighter Founder’s Latest Response on Token Launch Progress, What Was Said

Lighter’s Founder, Vladimir Novakovski, clarifies key concerns in an AMA, focusing on detecting and resolving bot account manipulations…

Cryptocurrency Trends and Insights: Navigating the 2025 Landscape

Key Takeaways Cryptocurrency continues to evolve rapidly, with new trends reshaping the market. Blockchain technology’s applications extend beyond…

Lighter: Airdrop Successful and Token Trading Imminent

Key Takeaways: The Lighter Discord community recently announced the successful distribution of LIT tokens, marking the beginning of…

The Eve of a Federal Pivot: Evaluating the Looming Change in the U.S. Central Bank

Key Takeaways Investors are gearing up for potential changes in Federal Reserve policy, with concerns about independence and…

UNI Burn Arbitrage Opportunity, Ondo Tokenized Stock Liquidity Debate, What’s the Overseas Crypto Community Talking About Today?

Key Takeaways The crypto market is buzzing with multi-threaded discussions, from macro trends to specific protocols and scams.…

6-Week, 3-Auditor Swap Sees Trump Crypto Firm Alt5 Sigma Mired in Financial Turbulence

Key Takeaways Alt5 Sigma, linked to the Trump family, faces financial reporting chaos and potential delisting risks due…

Announcement: The Fed to Release Minutes of its Monetary Policy Meeting Soon

Key Takeaways The Federal Reserve is anticipated to disclose the minutes from its latest monetary policy meeting, offering…

Yield Farming at 86% APY? How to Use Bots to “Earn While You Sleep” on Polymarket

Key Takeaways Polymarket presents untapped opportunities for bot utilization, despite existing competition. A proprietary trading bot streamlines the…

6-Week, 3-Auditor Switch Undermines Trump-Led Crypto Firm Alt5 Sigma

Key Takeaways Alt5 Sigma, tied to the Trump family, faces financial and operational turmoil marked by rapid auditor…

Key Market Intelligence on December 30th, how much did you miss out on?

Matrixdock 2025: The Practical Path to Sovereign-Grade RWA of Gold Tokenization

Paradigm's Tempo Project Launches Testnet, Is It Worth Checking Out?

When Everyone Uses AI Trading, Where Does Cryptocurrency Alpha Go in 2026?

In 2025, AI trading has become the default, but Alpha hasn’t disappeared — it’s been eroded by crowding, as similar data, models, and strategies cause traders to act in sync and lose their edge.

Real Alpha has shifted to harder-to-copy layers like behavioral and on-chain data, execution quality, risk management, and human judgment in extreme markets, where acting differently — or not acting at all—matters more than better predictions.

Without Narrative Power, Web3 Will Not Tap into the Vastness

Insight: 2026 Could Usher in a “Crypto Winter,” but Institutionalization and On-chain Transformation Are Accelerating

Key Takeaways Cantor Fitzgerald predicts Bitcoin could face an extended downtrend, signaling a potential “Crypto Winter” by 2026.…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com