From Manus' Shihong onwards, those Coinsquare interns

Original Article Title: "From Manus' Xiao Hong, Those Interns Who Came to the Table"

Original Article Author: Lin Wanwan, Dongcha Beating

On the last day of 2025, the biggest news in the tech industry came from Meta: Mark Zuckerberg spent billions of dollars to acquire an AI company, Manus, that had been established for less than a year. This was Meta's third-largest acquisition in history, only behind WhatsApp and Scale AI.

A few days after the announcement, everyone discovered that in his bio, he noted himself as a BTC Holder (Bitcoin Holder).

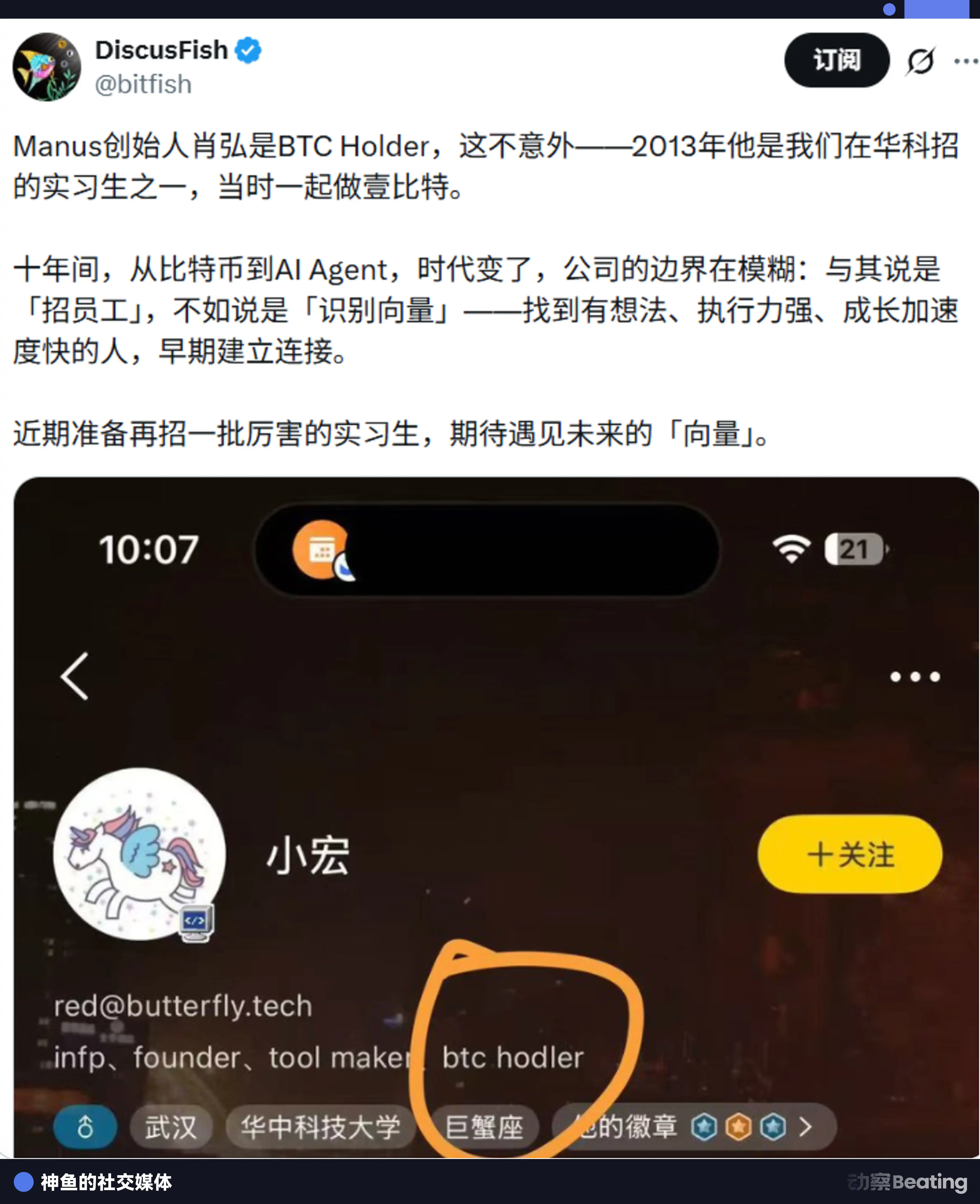

A tweet appeared on Twitter. The person who tweeted goes by the handle "Godfish," real name Mao Shihang, one of China's earliest Bitcoin miners, with a net worth well exceeding tens of billions:

"Manus founder Xiao Hong is a BTC Holder, which is not surprising—back in 2013, he was one of the interns we recruited at Huazhong University of Science and Technology, where we worked on 1Bit together."

2013. 1Bit. Huazhong University internship.

Xiao Hong, born in 1993 in a small town in Ji'an, Jiangxi. Before becoming the Vice President of Meta, his most well-known role was as the founder of the AI products Monica and Manus. But few knew that his first proper internship was at a Bitcoin media company called 1Bit.

That year, he had just finished his sophomore year, tinkering with various student projects at the Huazhong University of Science and Technology's Qiming College, such as WeChat drift bottle, WeChat wall, and campus second-hand trading platform. As the deputy team leader of the founding team, he was already a somewhat famous tech geek among his peers. However, Bitcoin was still a whole new world for him.

1Bit was one of the earliest Bitcoin vertical media outlets in China, with its office located at Beijing Galaxy SOHO. The founding team included Godfish and several equally young idealists, engaged in simple activities: translating foreign Bitcoin information, writing educational articles, and attempting to help more Chinese people understand this new thing that was then referred to as a "Ponzi scheme" by the mainstream media.

What exactly Xiao Hong did at 1Bit is now hard to verify. But looking back twelve years later, the significance of this experience has long transcended a mere internship.

The Bitcoin community in 2013 was a club of early participants in a large-scale social experiment. No regulation, no price anchor, no mature business model—only a group of young people who believed "code is law," huddling together amidst mainstream media ridicule. Those who could enter at that time were either gamblers or truly understood what was going on.

Xiao Hong clearly belongs to the latter. Decentralization, permissionlessness, code is law. These ideas may have seemed like geek self-indulgence at the time, but they formed a framework for understanding the world. Twelve years later, as AI begins to reshape the boundaries of human-computer interaction, this framework may become tangible.

From Bitcoin to AI Agent, the technological forms are vastly different, but the underlying logic is consistent: it's all about how to enable machines to run autonomously, how to establish collaboration in a trustless environment, how to replace intermediaries with code. Those who understood Bitcoin in 2013 will need little additional cognitive assistance to grasp AI Agents in 2025.

In that tweet thread, Shen Yu used a term: "Recognition Vector."

"Over the past decade, from Bitcoin to AI Agent, the era has changed, and a company's boundaries have blurred. Rather than recruiting employees, it's more like identifying vectors..."

What is a vector? Direction multiplied by speed. In 2013, Xiao Hong, a sophomore willing to bet his time on a "shady" field, made a choice. This choice itself was a filter—it sieved out those who only saw immediate certainty, leaving behind those willing to pay for long-term possibilities.

Twelve years later, this vector points to the position of a Meta Vice President.

In the cryptocurrency industry, where the myth of sudden wealth and overnight reset coexist, there is a hidden path to success: in your early twenties, follow the right person. Around 2013, a group of the smartest, most daring young people surged into this rapidly evolving world. Some had just dropped out, some hadn't even graduated, following the era's most insane entrepreneurs, working at the grassroots level in exchanges, mining pools, and media companies.

Their bet was a form of cognition. This cognition allowed them to identify opportunities faster than their peers in every technological wave of the following decade.

Buffett once said, "Life is like a snowball. The important thing is to find wet snow and a long hill."

The cryptocurrency industry of 2013 was precisely that long, wet hill. And those who set foot on this hill in their early twenties have had their snowball rolling for twelve years.

Xiao Hong is one of them. But he is not the only one.

An Intern on a Cap Table

One day in 2013, in an office building in Beijing's Zhongguancun, two young individuals were discussing something insane.

Wu Jihan, 27 years old, holds dual degrees in Psychology and Economics from Peking University. He had just resigned from a venture capital firm and had been involved in Bitcoin investment and advocacy for the past two years. He translated the Chinese version of Satoshi Nakamoto's white paper, which remains the most widely circulated version to date.

Sitting across from him was someone named Zhan Ketuan, 34 years old, a graduate of Shandong University with a Master's degree from the Chinese Academy of Sciences Institute of Microelectronics. With over ten years of experience in integrated circuit development, he was widely recognized in the industry as a chip design expert.

But this story also has a third main character.

Ge Yuesheng, 21 years old, had just graduated from Huzhou College a year ago. Before joining Bitmain, he was colleagues with Wu Jihan at a private equity fund in Shanghai, where he was an intern conducting investment analysis. Under Wu Jihan's influence, Ge Yuesheng began to get involved with Bitcoin.

Among these three individuals, Ge Yuesheng was the most unremarkable. He lacked Wu Jihan's industry insights and Zhan Ketuan's technical background.

But he had one thing: money. More specifically, resources from a family business—funds, mining farms, and electricity.

At that time, neither Wu Jihan nor Zhan Ketuan had much money. According to a former senior executive of Bitmain, Ge Yuesheng's family had invested a substantial amount of money early on, with several family members becoming shareholders. Wu Jihan's founding of Bitmain was significantly supported by Ge Yuesheng's investment and assistance, making this intern one of Bitmain's earliest angel investors.

The division of labor among the three was clear: Wu Jihan was in charge of industry judgment and the market, Zhan Ketuan was responsible for chip development, and Ge Yuesheng provided funding and resources.

To persuade Zhan Ketuan to join them, Wu Jihan offered a stunning condition: Zhan Ketuan would not receive a salary, but if he could develop an ASIC chip that could efficiently run the Bitcoin encryption algorithm in the shortest time possible, he would be given 60% of the shares.

In just half a year, Zhan Ketuan developed the 55nm Bitcoin mining chip BM1380 and the first-generation Antminer based on this chip.

In October 2013, Beijing Bitmain Technologies Ltd. was formally established. According to business records, in the earliest shareholder structure, Zhan Ketuan held 59.2% of the shares, Ge Yuesheng held 28%—and Wu Jihan's name was not even on the founding shareholder list at that time.

This detail was later repeatedly analyzed. Why could 21-year-old Ge Yuesheng receive 28% of the shares?

In 2013, Bitcoin was far from mainstream. In April of that year, the price of Bitcoin broke $100 for the first time; in November, it surged to over $1000; then in December, the price was cut in half, marking the start of a two-year bear market.

Most people flocked in during price spikes and fled during price plunges. While many wealthy individuals existed, Ge Yuesheng chose to enter the industry in its earliest and most chaotic days, binding himself to that ship.

It required not only money but also a certain intuition for trends and the courage to bet in the face of uncertainty.

The later story is well known: these three individuals turned Bitmain into the world's largest mining machine company in less than five years, once occupying over 70% of the global Bitcoin hash rate and reaching a valuation of up to $15 billion. In the 2018 Hurun Blockchain Rich List, Wu Jihan became the "Post-85s Generation New Self-made Billionaire" with a wealth of $16.5 billion, while Ge Yuesheng became the "Post-90s New Self-made Billionaire" with a wealth of $3.4 billion.

In 2019, they left Bitmain together with Wu Jihan to co-found Matrixport. Ge Yuesheng became the CEO of Matrixport and remains so to this day.

A 27-year-old preacher, a 34-year-old tech genius, a 21-year-old intern turned angel investor were bound together by the same vision at the right time.

The First Cohort of "OKCoin Whampoa Military Academy"

If Ge Yuesheng's story is a classic case of an intern turning into a co-founder, the next story showcases a different possibility: from the first employee to being acquired at a high price by the former employer's competitor.

One day in 2013, a young engineer named Wang Hui walked into an office in a Beijing high-rise.

The office was small, with simple furnishings, resembling more of a temporary base for a startup. A whiteboard hung on the wall, covered in system architecture and flowcharts. A few tables were put together, seating fewer than ten people.

This was all that OKCoin had.

Founder Star Xu was worried about hiring. At the time, Bitcoin in China was still in a gray area, with mainstream media either portraying it as a Ponzi scheme or a "tool for money laundering." Engineers willing to forgo offers from large companies to join a "coin speculation company" were scarce.

Wang Hui was the first to take the risk.

As OKCoin's first employee, he needed to build the entire technical architecture from scratch. There were no ready-made solutions to copy, no mature open-source projects to use, and few competitors to reference. Everything was a blank canvas.

This represents a huge challenge, but also a huge opportunity: if this can be accomplished, he will become one of the most technically savvy individuals in this industry.

Over the course of two years, Wang Hui almost single-handedly built OKCoin's core trading system. The performance of that matching engine was, at the time, considered top-notch in the industry. "Many trading platforms couldn't even handle basic concurrency in their systems," he later recalled, "a few more people trading simultaneously would just cause it to freeze."

More importantly, he nurtured the entire tech team from scratch. Many of the key technical personnel at OKCoin (and later rebranded as OKEx, OKX) were groomed by him.

However, by 2016, Wang Hui chose to depart.

There are many rumors within the industry about the reasons for his departure: disagreements with the founder's vision, internal power struggles, dissatisfaction with the company's direction... Wang Hui himself has never publicly responded to these claims.

But one thing is certain, he took with him all the experience and connections accumulated at OKCoin.

His first stop after leaving was a brief collaboration with another former OKCoin executive. That person was Zhao Changpeng, who later founded Binance and became the world's richest in cryptocurrency.

In early 2018, Wang Hui, along with two former colleagues, founded JEX to work on cryptocurrency options trading. The timing was quite delicate. In January 2018, Bitcoin had just started to plummet from its all-time high of $20,000, leaving the entire industry in ruins. Most people were fleeing, but Wang Hui chose to enter against the trend.

JEX received investments from Huobi and Jinse Finance. Just one year later, in 2019, Binance announced the full acquisition of JEX, with the transaction amount rumored to be in the hundreds of millions of Chinese yuan.

It was a rather dramatic outcome: the first employee of OKCoin founded a company that was acquired by Binance.

Round and round, these individuals all came from the same place.

So, there is a saying in the industry to this day: OKCoin is the "West Point Military Academy of the cryptocurrency industry."

Vectors, Windows, and Survivors

Now, let's go back to Xiao Hong.

In 2013, he was just a sophomore intern at YiBit. This internship probably only occupies a small part of his resume—after all, his main focus later on was entrepreneurship within the WeChat ecosystem: YiBan, WeiBan, Nightingale Technology, which was eventually sold to Mingling Technology.

But some things do leave a trace.

Xiao Hong introduced himself as a "BTC Holder." This means that from 2013 to today, he has at least maintained an interest in and involvement with cryptocurrency. In a market where prices fluctuate by orders of magnitude, being able to hold for twelve years is in itself a kind of ability, or rather, a belief.

More importantly, that brief internship in 2013 may have shaped a certain methodology for him: not pursuing technological disruption from zero to one, but being good at finding gaps on existing large platforms and using product capabilities to create value.

From YiBit to the WeChat ecosystem's YiBan and WeiBan, then to the AI browser plugin Monica, and finally to the general AI Manus, the underlying logic of this trajectory may be consistent: find a large platform that is booming and create the best tool on that platform.

The stories of these three interns reveal some common patterns:

First, timing is more important than effort. They all entered the cryptocurrency industry between 2013-2017. That was the industry's "chaotic period." Early enough that most people had not yet realized the opportunity's existence; but not so early that the infrastructure had not been fully established. Those who entered during this window of time gained disproportionate room for growth. By 2020 and beyond, the industry had become relatively mature, making it much more difficult for newcomers to replicate the same path.

Second, who you choose to follow is more important than what you choose to do. Ge Yue Sheng followed Wu Jihan, Wang Hui followed Xu Mingxing, Xiao Hong followed God Fish. These big shots may not necessarily be the most famous, but they were among the most discerning and execution-oriented people at the time.

The benefits of following the right person are not only about learning, but more importantly about entering a high-quality network. After leaving OKCoin, Wang Hui was able to quickly obtain investment and be acquired by Binance, largely due to the reputation and connections he had accumulated in the industry.

Third, the ability to bet in the face of uncertainty is rare. Joining a Bitcoin company in 2013, sticking to a DEX project during the bear market in 2018, giving up a stable job to start a business in 2020—these choices all seemed risky at the time.

But risk and reward are symmetrical. Those willing to bear uncertainty ultimately received returns commensurate with the risks they took.

Of course, these are survivorship bias stories.

Most young people who entered the circle of coins around 2013 did not become billionaires. Many of them exited during the bear market, missed out during the bull market, and went to zero in the surge and plunge. However, this does not prevent us from extracting some valuable lessons from the stories of survivors.

On the last day of 2025, Xia Hong tweeted, "To succeed in creating a great product in a globalized market, there are many troubles that do not come from the business itself and the user value itself. It's all worth it."

From a intern at YiBi in 2013 to a Vice President at Meta in 2025, Xia Hong took 12 years.

During these 12 years, his former boss Shen Yu, went from a 23-year-old graduate school dropout entrepreneur to a industry tycoon worth billions. Shen Yu's former partner Wu Jihan, on the other hand, transformed from an evangelist to the founder of a mining empire, then left amidst internal conflicts, started afresh, and rose again.

The pace of this industry is too fast. Fast enough that in a decade, a person can go from an intern to a billionaire, and also fast enough that within a decade, a giant can fall from the peak, only to rise once more.

So, treat every intern around you well. Because you never know, in ten years, who you might need to take out for a meal.

You may also like

Glassnode New Year Report: $95K Call Option Premium, Bulls Shift to Aggressive Offense

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

Solana Price Prediction: Morgan Stanley Just Filed for a SOL ETF – Is This the Beginning of Wall Street’s Next Crypto Obsession?

Key Takeaways Morgan Stanley’s filing for a SOL-based ETF signifies growing institutional interest in cryptocurrencies beyond Bitcoin, boosting…

Binance Launches Regulated Gold and Silver Perpetual Futures Settled in USDT

Key Takeaways: Binance has introduced its first regulated perpetual futures contracts, which are tied to traditional assets like…

Ondo Finance Price Prediction – ONDO Anticipated to Decrease to $0.331411 by Jan 12, 2026

Key Takeaways The prediction for Ondo Finance (ONDO) indicates a significant price decline to $0.331411, translating to a…

Capital Inflows into Bitcoin: An Examination of Current Trends and Future Implications

Key Takeaways Institutional long-term holding strategies have reshaped Bitcoin’s traditional market cycles. Capital inflows into Bitcoin have dried…

All these uncommon things in the crypto world are listed on Idle Fish

The old altcoin script is outdated, take you to decipher the new market structure

Key Market Information Discrepancy on January 8th - A Must-See! | Alpha Morning Report

Rumble Launches Crypto Wallet in Collaboration with Tether, Boosting Share Value

Key Takeaways: Rumble’s latest innovation integrates cryptocurrency tipping for content creators directly within its platform. Built in partnership…

Babylon Labs Secures $15 Million from a16z Crypto to Enhance Bitcoin Collateral Framework

Key Takeaways Babylon Labs has successfully raised $15 million from a16z crypto to further develop and expand its…

Crypto Markets Today: Bitcoin Slides as Asia-Led Sell-Off Hits Altcoins

Key Takeaways: Bitcoin could not surpass the $94,500 mark and fell to roughly $91,530, contributing to a wider…

Start-of-the-Year Crypto Rally Stalls: What’s Next?

Key Takeaways The initial crypto market boost at the start of 2026 has lost momentum, primarily due to…

Strategy’s STRC Preferred Stock Rebounds to $100: Potential Catalyst for Bitcoin Purchases

Key Takeaways STRC, the perpetual preferred equity of Strategy, returns to $100, the first time since November. This…

Karatage Welcomes Shane O’Callaghan as Senior Partner in Strategic Move

Key Takeaways Karatage, a London-based hedge fund, appoints Shane O’Callaghan as a senior partner to enhance its institutional…

Lloyds Bank Achieves a Milestone: UK’s First Gilt Purchase via Tokenized Deposits

Key Takeaways Lloyds Bank executed the first-ever UK government gilt purchase through tokenized deposits, highlighting a transformative use…

Morgan Stanley Files for Ether Trust after Bitcoin and Solana ETF Proposals

Key Takeaways Morgan Stanley has made a significant move by filing for an Ethereum Trust with the SEC,…

Glassnode New Year Report: $95K Call Option Premium, Bulls Shift to Aggressive Offense

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

Solana Price Prediction: Morgan Stanley Just Filed for a SOL ETF – Is This the Beginning of Wall Street’s Next Crypto Obsession?

Key Takeaways Morgan Stanley’s filing for a SOL-based ETF signifies growing institutional interest in cryptocurrencies beyond Bitcoin, boosting…

Binance Launches Regulated Gold and Silver Perpetual Futures Settled in USDT

Key Takeaways: Binance has introduced its first regulated perpetual futures contracts, which are tied to traditional assets like…

Ondo Finance Price Prediction – ONDO Anticipated to Decrease to $0.331411 by Jan 12, 2026

Key Takeaways The prediction for Ondo Finance (ONDO) indicates a significant price decline to $0.331411, translating to a…