AI Wars: WEEX Alpha Awakens | WEEX Global Hackathon API Test Process Guide

AI Wars: WEEX Alpha Awakens registration is now open. and this guide outlines how to access the API test and successfully complete the process.

Please pass the pre-screening for the DoraHacks registration, then follow the steps below to complete your API test.

Mini Tip : To test your AI Trading capability, you need to complete at least 10 USDT trading using WEEX API.

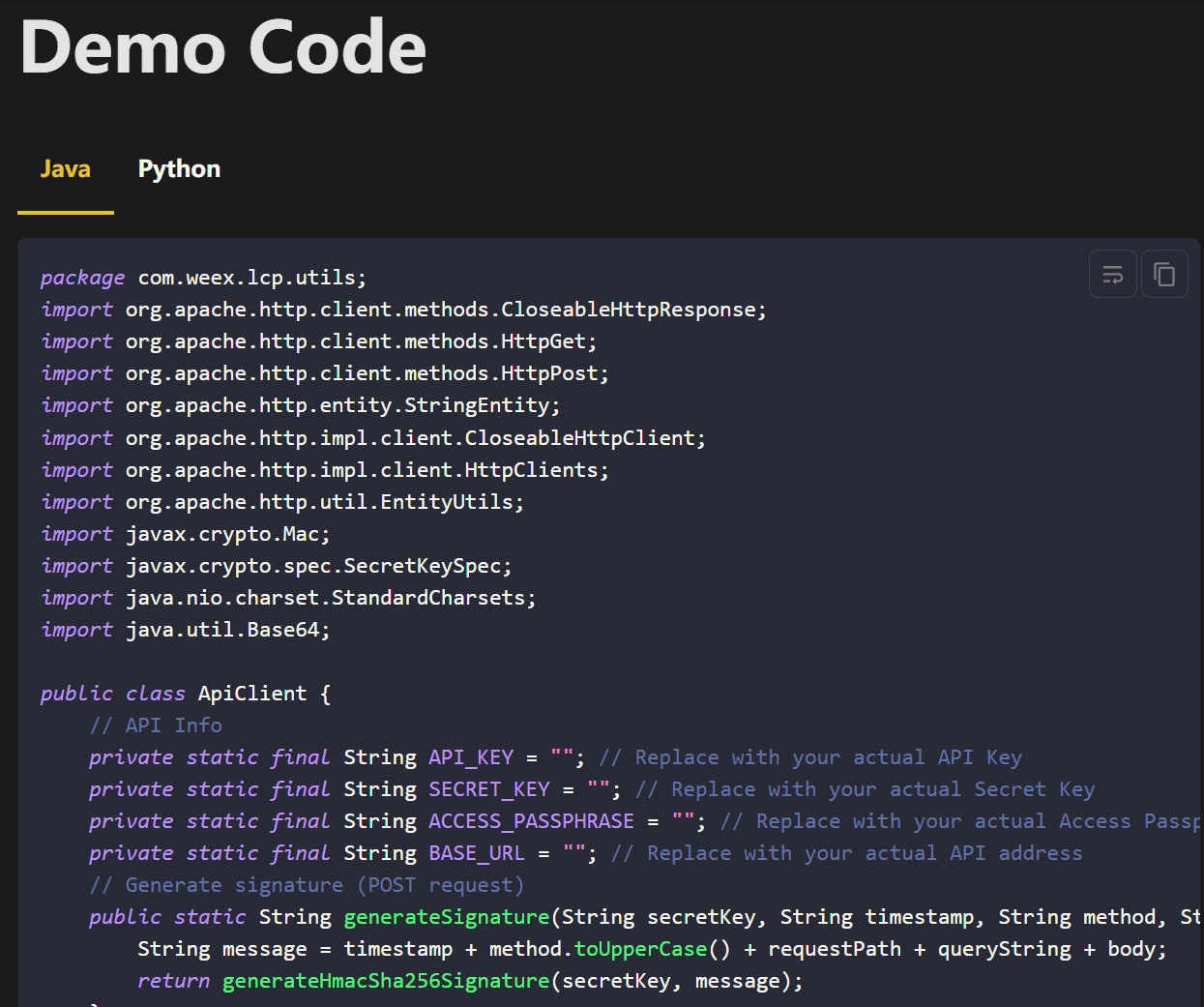

1. Copy Demo Code into Your Compiler and Add API Key

- Visit the WEEX Quick Start Guide.

- Copy the demo code provided and paste it into your compiler.

- Insert the WEEX API Key and Secret Key received after passing the review into the appropriate fields in the demo code.

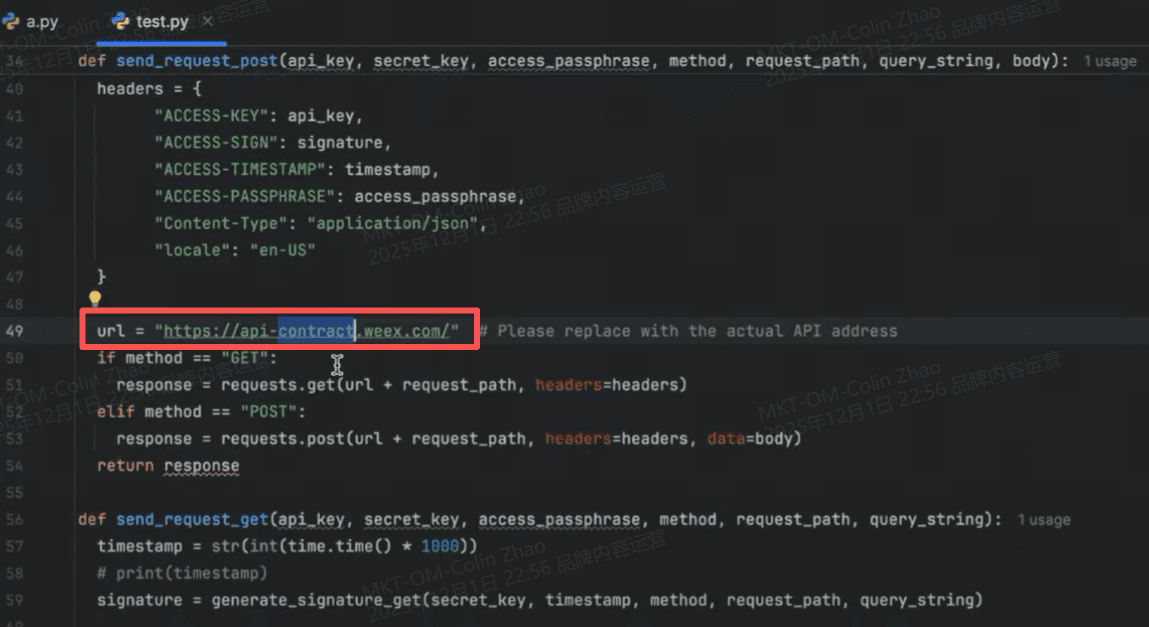

2. Check Domain Name and Path (URL)

Verify the correct domain and path structure for API requests to ensure smooth operation.

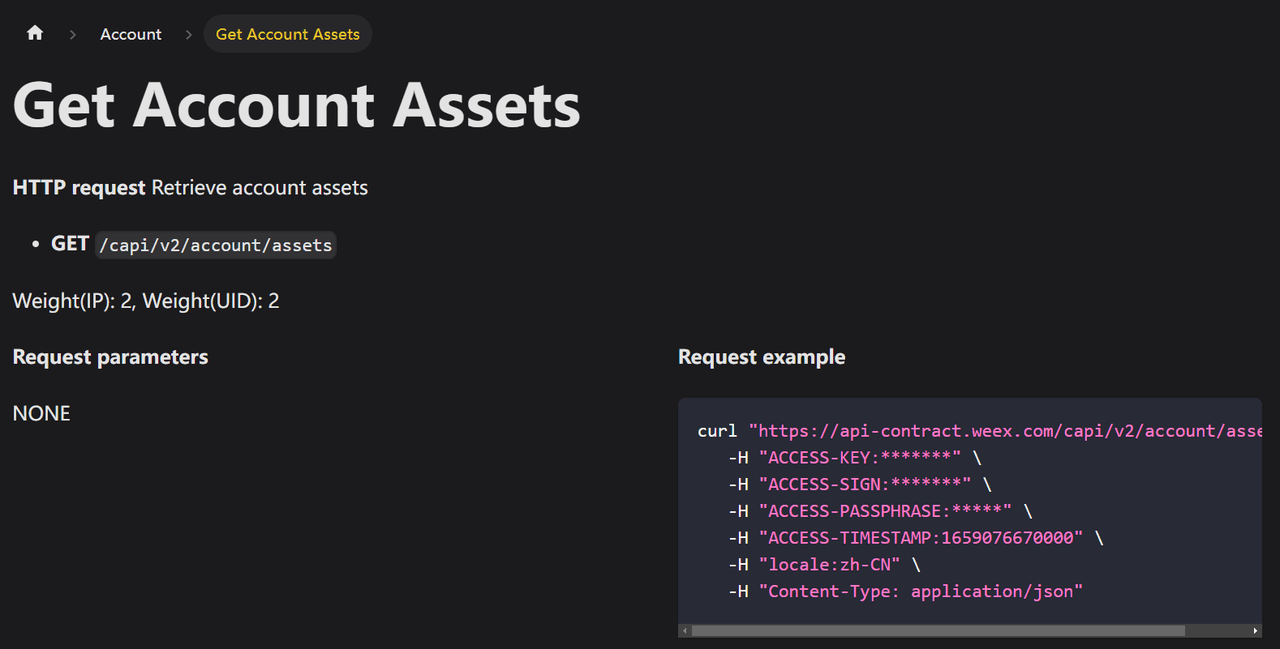

3. Check Account Balance

- Check your account balance using the following endpoint to ensure you have enough funds for testing: Account Balance API

- Each test account has a balance of 1000 USDT testing funds.

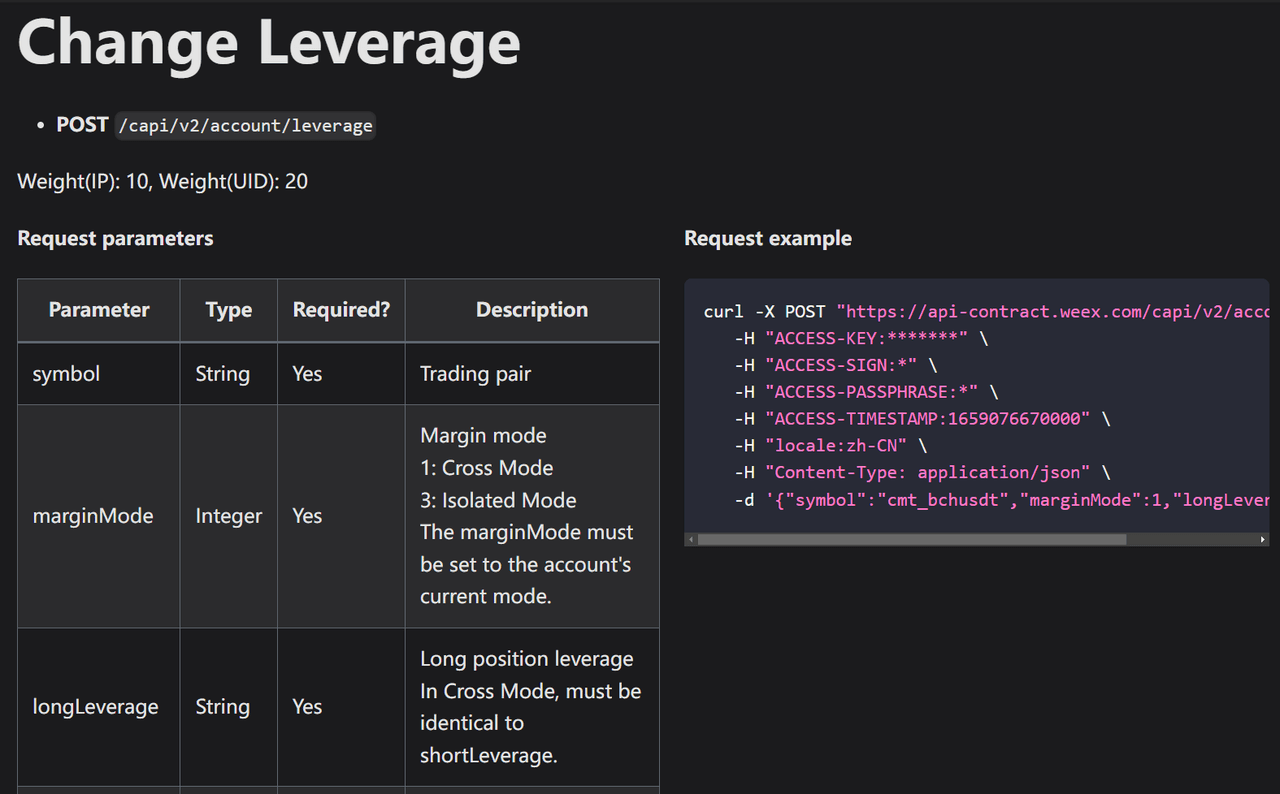

4. Set Leverage

Set your leverage multiplier for the trading actions: Leverage Adjustment API

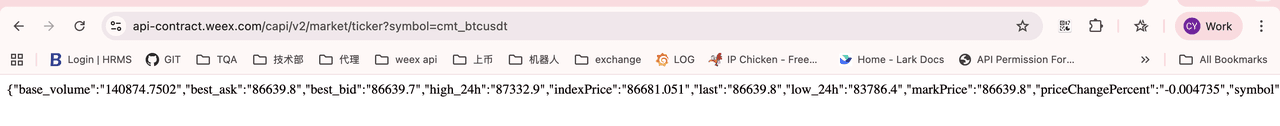

5. Get Asset Price

- Retrieve the current asset price for a specific market, such as BTC/USDT, using this endpoint: Price Ticker API

- Example of the returned data:

{

"base_volume": "140874.7502",

"best_ask": "86639.8",

"best_bid": "86639.7",

"high_24h": "87332.9",

"indexPrice": "86681.051",

"last": "86639.8",

"low_24h": "83786.4",

"markPrice": "86639.8",

"priceChangePercent": "-0.004735",

"symbol": "cmt_btcusdt",

"timestamp": "1764642775721",

"volume_24h": "12067031451.06358"

}6. Review the Place Order Request

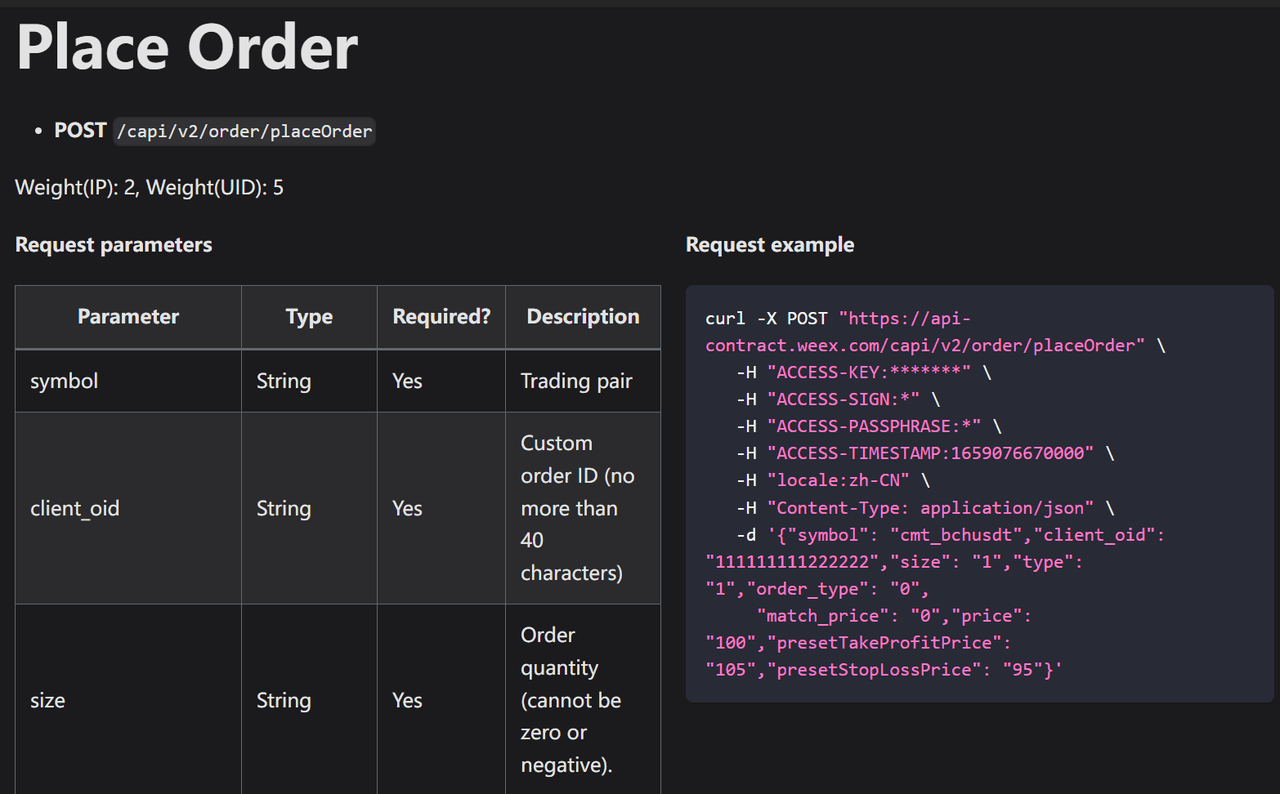

Learn how to structure your order request using the following endpoint: Place Order API

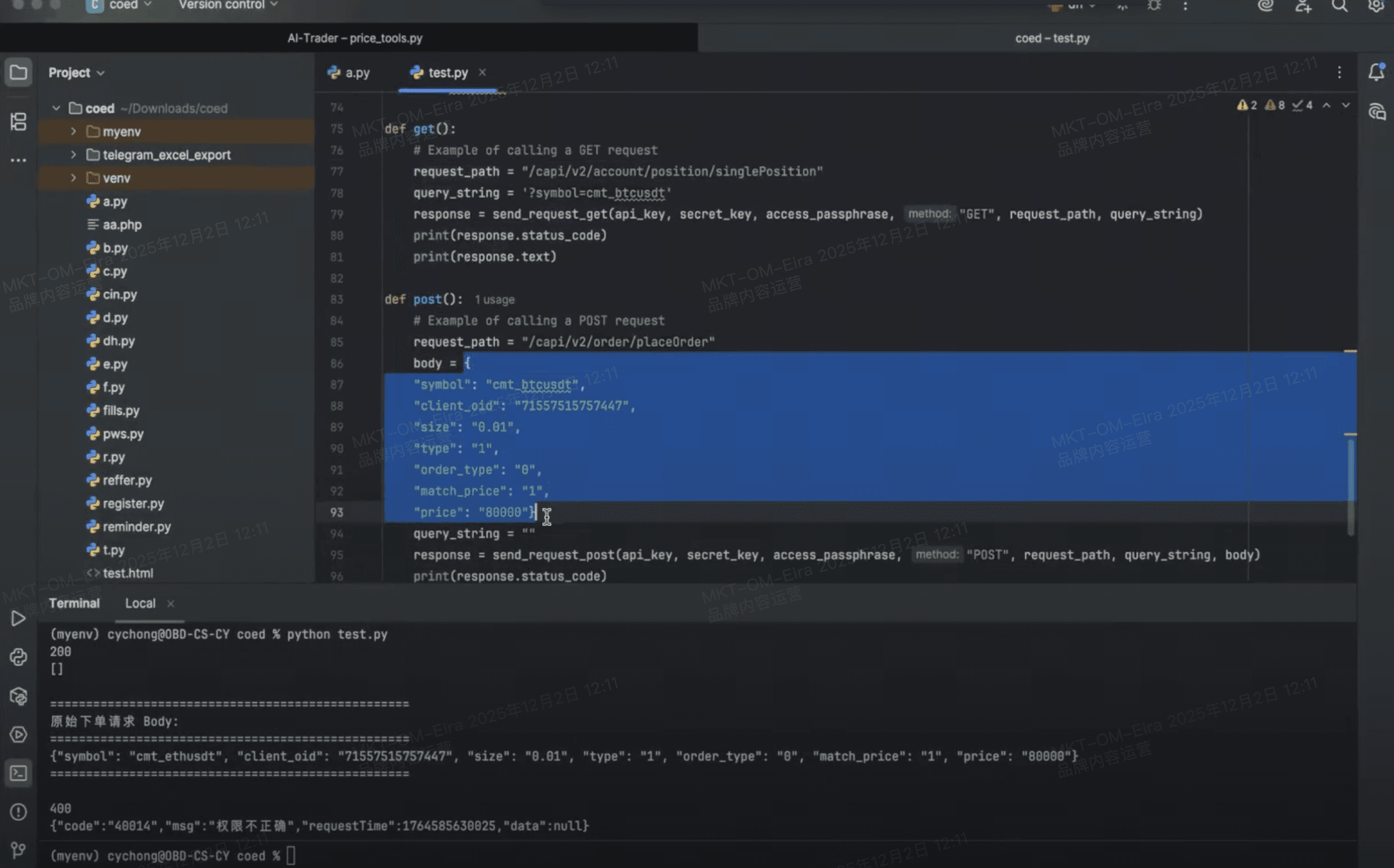

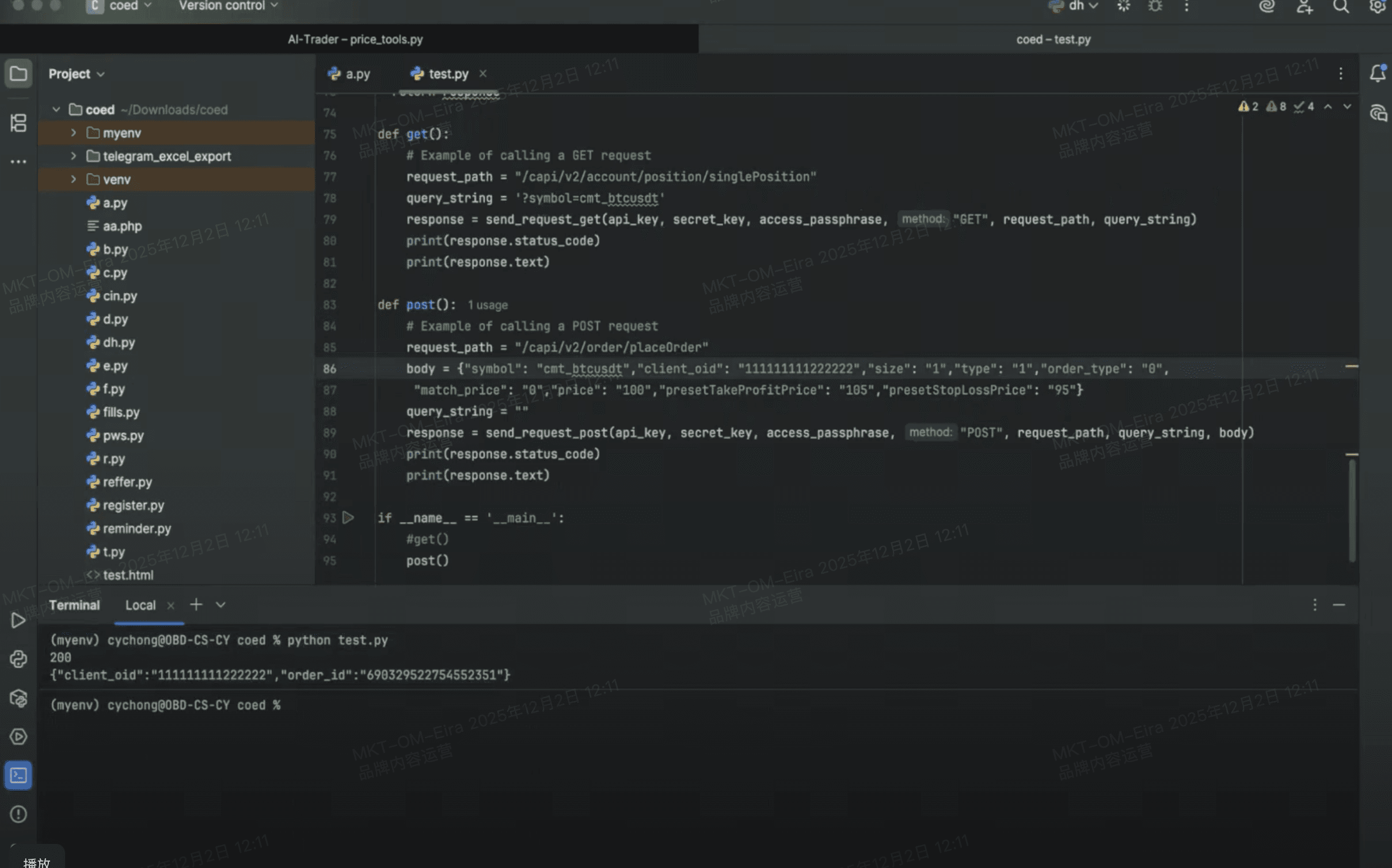

7. Apply to Your Compiler

Apply the code from Step 1 and Step 6 to your compiler to execute the trading logic.

8. Complete Order Placement

Execute the order placement with the necessary parameters, such as asset, quantity, price, and leverage.

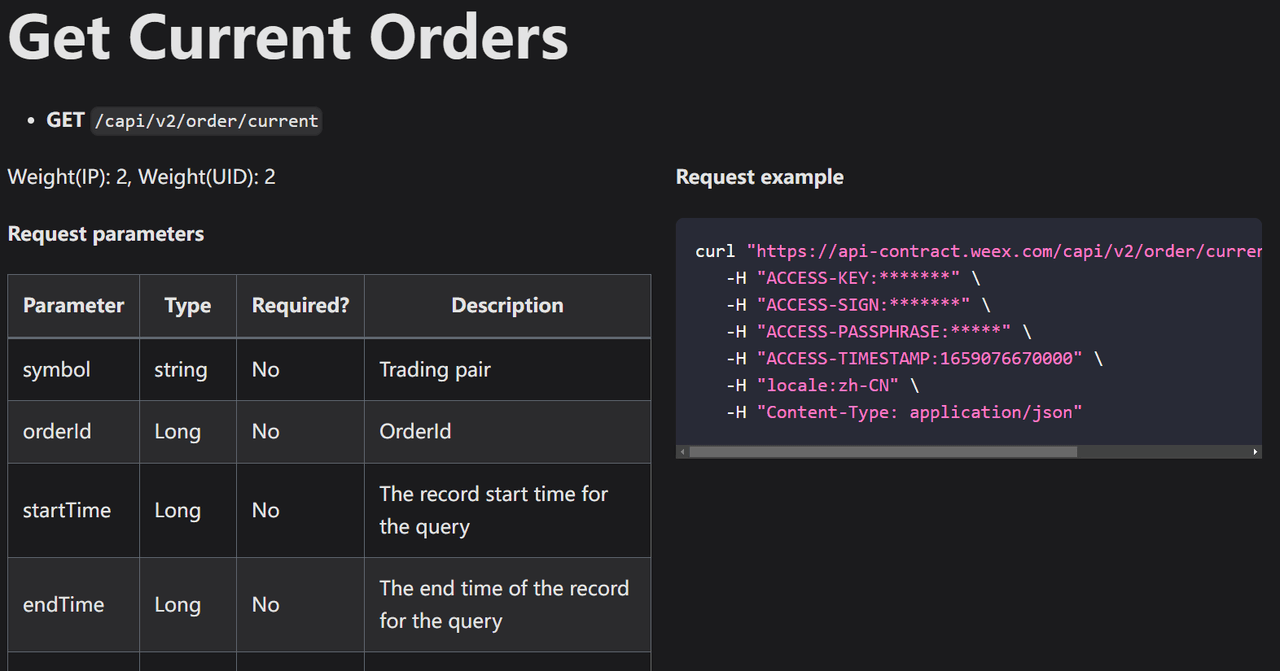

9. Get Open Order Information

Check the status of your open orders: Open Order Status API

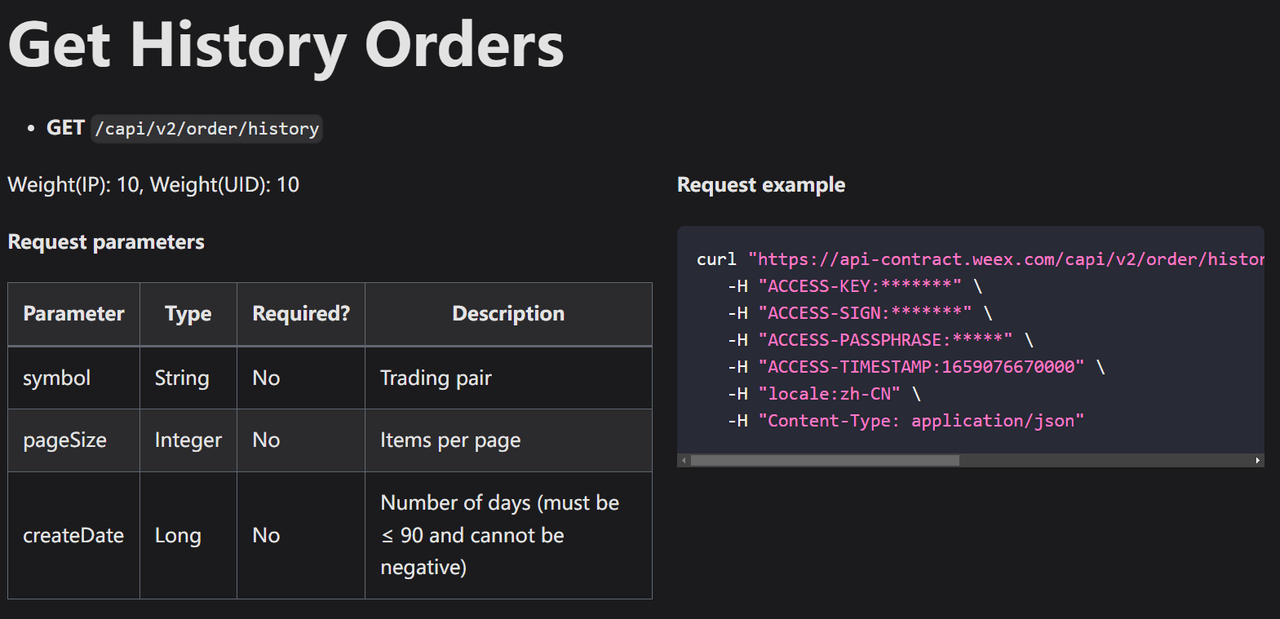

10. Retrieve Historical Order Records

Review order history to assess trading performance: Order History API

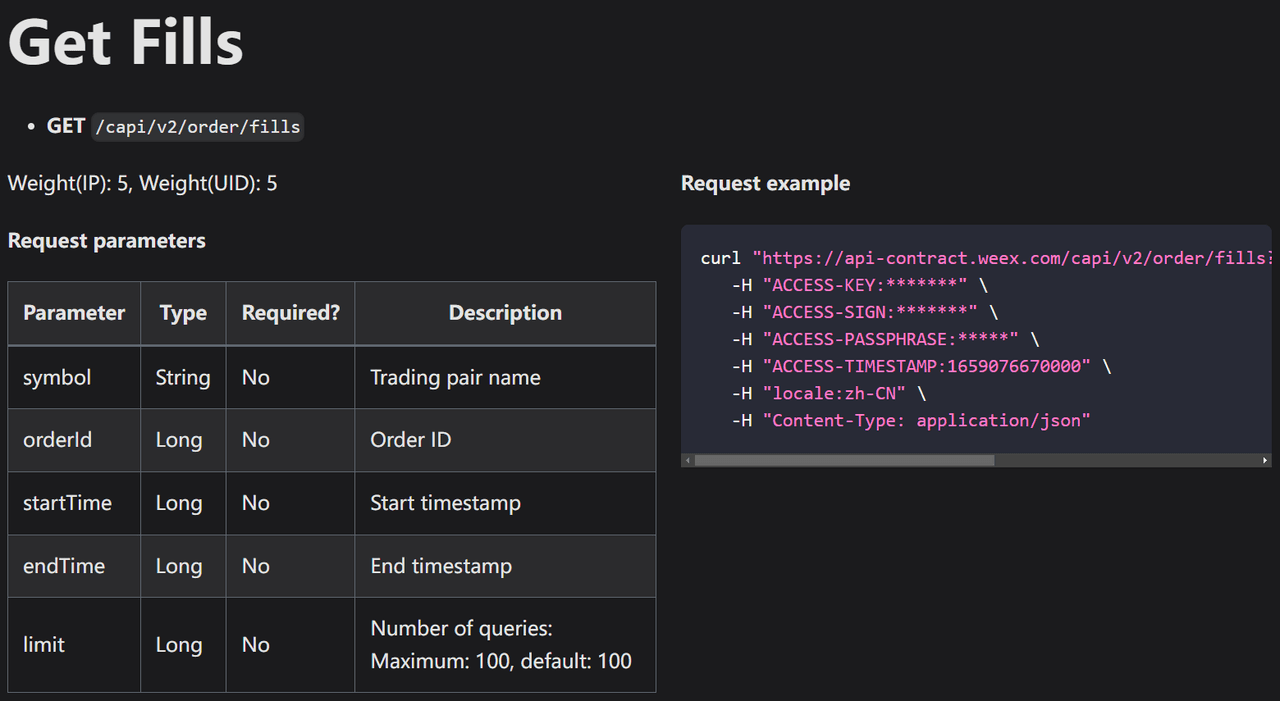

11. Get Trade Details for Completed Orders

View the details of your completed trades: Trade Details API

Once you pass the APl Test, you officially advance in the competition. If you have any questions, you can support from the APl Wars Technical Support Group.

Now all you need to do is to wait for the selection of committee members

Participants who pass will:

- Receive confirmation from the organizers (via DoraHacks or Telegram)

- Be added to the official participant list

- Have their team name displayed in the official DoraHacks BUIDL list

About WEEX

Founded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 130 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200 trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

You may also like

Kalshi First Research Report: When Predicting CPI, Crowd Wisdom Beats Wall Street Analysts

CFTC Welcomes New Chairman, Which Way Will Crypto Regulation Go?

Polymarket Announces In-House L2, Is Polygon's Ace Up?

AI Trading Risks in Crypto Markets: Who Takes Responsibility When It Fails?

AI trading is already core market infrastructure, but regulators still treat it as a tool — responsibility always stays with the humans and platforms behind it. The biggest risk in 2025 is not rogue algorithms, but mass-adopted AI strategies that move markets in sync and blur the line between tools and unlicensed advice. The next phase of AI trading is defined by accountability and transparency, not performance — compliance is now a survival requirement, not a constraint.

In Vietnam, USDT’s Use and the Reality of Web3 Adoption

Key Takeaways Vietnam has emerged as a leading nation in the adoption of cryptocurrencies, despite cultural and regulatory…

Beacon Guiding Directions, Torches Contending Sovereignty: A Covert AI Allocation War

Key Takeaways The AI that rules today’s landscape exists in two forms—a centralized “lighthouse” model by major tech…

Decoding the Next Generation AI Agent Economy: Identity, Recourse, and Attribution

Key Takeaways AI agents require the development of robust identity, recourse, and attribution systems to operate autonomously and…

Stability in the Crypto World: Understanding Stablecoin Usage and Its Implications

Key Takeaways Stablecoin use in payments has rapidly increased alongside blockchain technology advancements. Stablecoins USDT and USDC dominate…

Nofx’s Two-Month Journey from Stardom to Scandal: The Open Source Dilemma

Key Takeaways Nofx’s rise and fall in two months highlights inherent challenges in open source projects. A transition…

MiniMax Knocks on the Door of Hong Kong Stock Exchange with Billion-Dollar Valuation

Key Takeaways MiniMax, a prominent AI startup, is rapidly progressing towards an IPO on the Hong Kong Stock…

Coinbase to Acquire The Clearing Company in Prediction Markets Push

Key Takeaways Coinbase is set to acquire The Clearing Company, a prediction markets startup, to expand its product…

When AI Starts Spending Money: Who Will Underwrite Agent Transactions?

When the Prediction Market Shifts from 'Predicting' to 'Revealing the Truth': Delphi Officially Launches Prediction Market Coverage

Key Market Insights from December 19th, How Much Did You Miss Out?

WEEXPERIENCE Whales Night: AI Trading, Crypto Community & Crypto Market Insights

On December 12, 2025, WEEX hosted WEEXPERIENCE Whales Night, an offline community gathering designed to bring together local cryptocurrency community members. The event combined content sharing, interactive games, and project presentations to create a relaxed yet engaging offline experience.

AI Trading Risk in Cryptocurrency: Why Better Crypto Trading Strategies Can Create Bigger Losses?

Risk no longer sits primarily in poor decision-making or emotional mistakes. It increasingly lives in market structure, execution pathways, and collective behavior. Understanding this shift matters more than finding the next “better” strategy.

Whale Effect? Stablecoins are Not Really the Enemy of Bank Deposits

Hands-On Guide to Participating in CZ-Supported predict.fun

Kalshi First Research Report: When Predicting CPI, Crowd Wisdom Beats Wall Street Analysts

CFTC Welcomes New Chairman, Which Way Will Crypto Regulation Go?

Polymarket Announces In-House L2, Is Polygon's Ace Up?

AI Trading Risks in Crypto Markets: Who Takes Responsibility When It Fails?

AI trading is already core market infrastructure, but regulators still treat it as a tool — responsibility always stays with the humans and platforms behind it. The biggest risk in 2025 is not rogue algorithms, but mass-adopted AI strategies that move markets in sync and blur the line between tools and unlicensed advice. The next phase of AI trading is defined by accountability and transparency, not performance — compliance is now a survival requirement, not a constraint.

In Vietnam, USDT’s Use and the Reality of Web3 Adoption

Key Takeaways Vietnam has emerged as a leading nation in the adoption of cryptocurrencies, despite cultural and regulatory…

Beacon Guiding Directions, Torches Contending Sovereignty: A Covert AI Allocation War

Key Takeaways The AI that rules today’s landscape exists in two forms—a centralized “lighthouse” model by major tech…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com