Bloomberg: $1.3 Billion Accounting Loss, Is Tom Lee's Ethereum Bet Facing Collapse?

Original Title: Tom Lee's Big Crypto Bet Buckles Under Mounting Market Strain

Original Author: Sidhartha Shukla, Bloomberg

Original Translation: Chopper, Foresight News

The Ethereum corporate treasury experiment is currently on the verge of collapse.

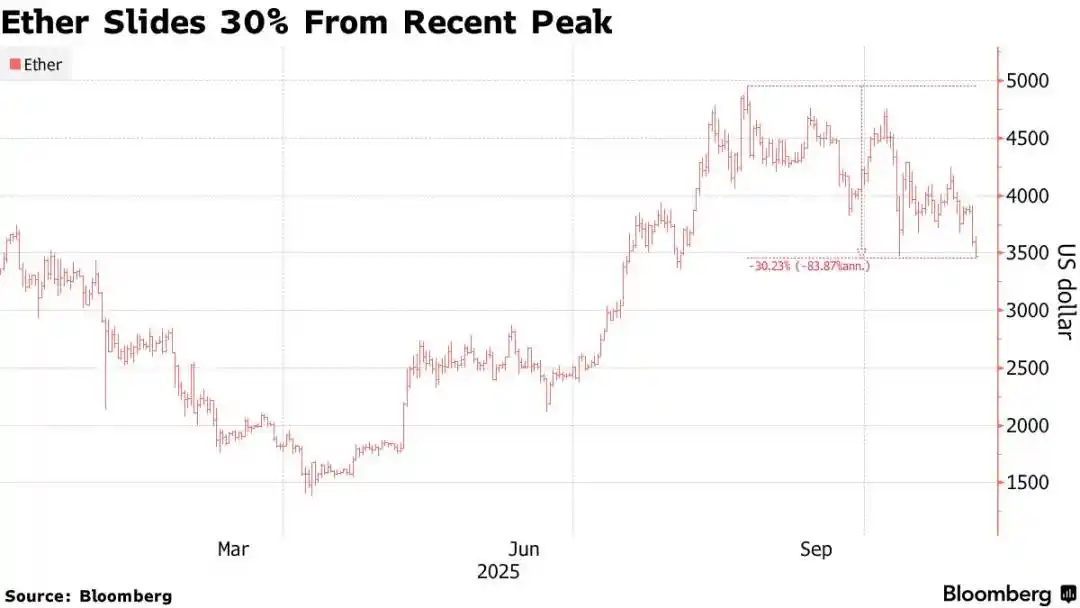

The world's second-largest cryptocurrency dropped below $3,300 on Tuesday, in sync with the market's benchmarks such as Bitcoin and tech stocks. This decline has pushed Ethereum's price down by 30% from its August peak, falling to levels before the large-scale corporate buy-in, further solidifying its bearish trend.

According to research firm 10x Research, this reversal has put Ethereum's most fervent corporate supporter, Bitmine Immersion Technologies Inc., at a staggering $1.3 billion paper loss. This publicly traded company, backed by billionaire Peter Thiel and led by Wall Street analyst Tom Lee, whose strategy mimicked Michael Saylor's Bitcoin treasury model, purchased 3.4 million Ethereum at an average price of $3,909. Today, Bitmine's treasury is fully deployed and facing increasing pressure.

10x stated in its report, "For months, Bitmine has been driving the market narrative and fund flows. Now with its treasury fully deployed, facing a paper loss of over $1.3 billion, and no available additional funds."

The report notes that retail investors who bought Bitmine stock at a premium to net asset value (NAV) have suffered even greater losses, and the market's willingness to catch falling knives is limited.

Lee did not immediately respond to a request for comment, and representatives from Bitmine did not respond immediately either.

Bitmine's bet is far from a simple asset-liability trade. Behind the company's accumulation is a grander vision: the transition of digital assets from speculative tools to corporate financial infrastructure, thereby cementing Ethereum's position in the mainstream financial realm. Supporters believe that by integrating Ethereum into a publicly traded company's asset treasury, enterprises will help build an entirely new decentralized economy. In this economic system, code replaces contracts, and tokens serve as assets.

This logic drove the summer bull run. Ethereum's price once approached $5000, and only in July and August, Ethereum ETFs attracted over $90 billion in inflows. However, after the crypto market crash on October 10, the situation reversed: according to Coinglass and Bloomberg compiled data, Ethereum ETFs saw outflows of $8.5 billion, and Ethereum futures' open interest decreased by $16 billion.

Lee had previously predicted that Ethereum would reach $16,000 by the end of this year.

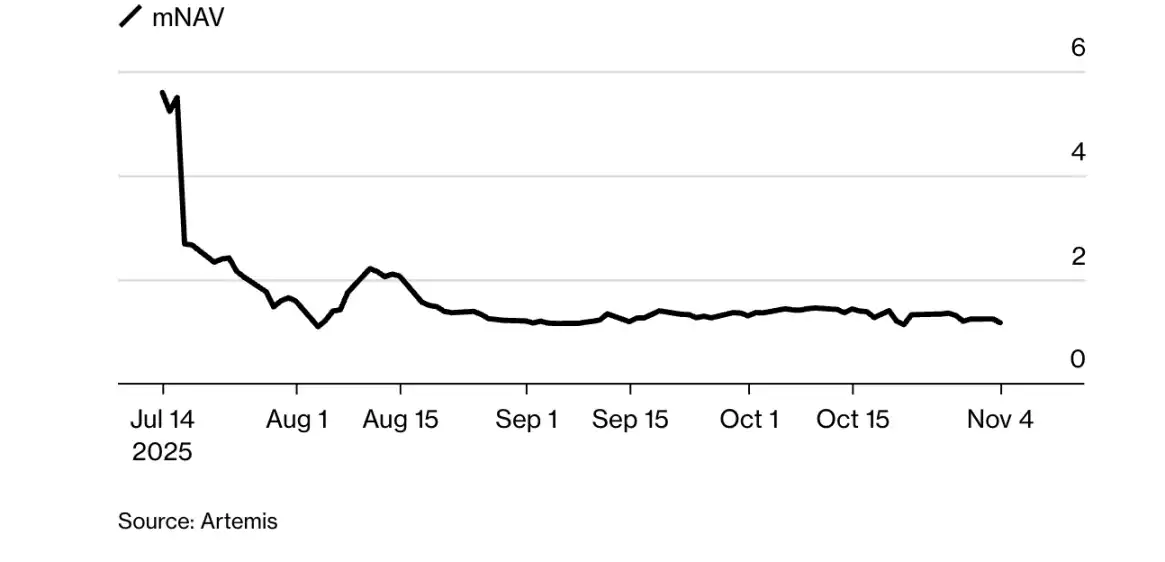

Bitmine's Net Asset Value (mNAV) Premium Decline

According to Artemis data, Bitmine's market cap to net asset value multiple has plummeted from 5.6 in July to 1.2, with its stock price falling 70% from its peak. Similar to other Bitcoin-related companies before it, Bitmine's stock price is now closer to its underlying asset value, as the market reevaluates the once high valuation of its crypto asset balance sheet.

Last week, another publicly traded Ethereum treasury company, ETHZilla, sold $40 million worth of Ethereum holdings to buy back shares, aiming to bring its modified Net Asset Value (mNAV) ratio back to a normal level. The company stated in a press release at that time: "ETHZilla plans to use the proceeds from the remaining Ethereum sales for further share buybacks and intends to continue selling Ethereum to repurchase shares until the discount to Net Asset Value normalizes."

Despite the price decline, Ethereum's long-term fundamentals appear to remain strong: its on-chain value processed still exceeds that of all competing smart contract networks, and the staking mechanism gives the token both yield attributes and deflationary properties. However, as competitors like Solana gain momentum, ETF flows reverse, and retail interest wanes, the narrative of "institutional stability in cryptocurrency prices" is gradually losing relevance.

You may also like

Lido DAO’s Increased Development and Market Dynamics Elevate LDO Price

Key Takeaways Lido DAO’s development activities have surged by 690%, signifying substantial growth. The Lido DAO token (LDO)…

Hyperliquid Whales Shift Strategies: BTC Longs Decline, ETH Shorts Dominate

Key Takeaways A significant reduction in Bitcoin long positions has been observed on Hyperliquid, with large holders decreasing…

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Bitcoin Surges Toward $90,000 as $27 Billion Crypto Options Expire

Key Takeaways Bitcoin’s price is nearing the $90,000 mark amid increased market activity following the holiday lull. The…

Bitcoin Options Set to Expire, Potentially Altering Price Beyond $87,000 Range

Key Takeaways A historic Bitcoin options expiry event, valued at $236 billion, is set to occur, potentially impacting…

Ethereum Price Prediction: Whales Accumulate as Market Awaits Key Break

Key Takeaways Ethereum’s price remains in a “no-trade zone” between $2,800 and $3,000 amid low market activity. Whale…

Matrixport Predicts Limited Downside for Bitcoin Amid Market Caution

Key Takeaways Matrixport’s report suggests Bitcoin’s downside risks are decreasing, with the market moving towards a phase where…

Bitcoin and Ethereum Options Expiry Shakes Market Stability

Key Takeaways The largest options expiry in cryptocurrency history is occurring today, involving over $27 billion in Bitcoin…

Trust Wallet Hack Results in $3.5 Million Loss for Major Wallet Holder

Key Takeaways A significant Trust Wallet hack led to the theft of $3.5 million from an inactive wallet.…

PancakeSwap Launches LP Rewards on Base Network

Key Takeaways PancakeSwap has introduced liquidity provider (LP) rewards for 12 v3 pools on the Base network, facilitated…

Crypto Derivatives Volume Skyrockets to $86 trillion in 2025 as Binance Dominates

Key Takeaways Cryptocurrency derivatives volume has surged to an astronomical $86 trillion in 2025, equating to an average…

Ethereum in 2026: Glamsterdam and Hegota Forks, Layer 1 Scaling, and More

Key Takeaways Ethereum is poised for crucial developments in 2026, particularly with the Glamsterdam and Hegota forks. Glamsterdam…

Kraken IPO to Rekindle Crypto’s ‘Mid-Stage’ Cycle: A Comprehensive Analysis

Key Takeaways: Kraken’s anticipated IPO in 2026 could significantly attract fresh capital from traditional financial investors, marking a…

Fed Q1 2026 Outlook: Potential Impact on Bitcoin and Crypto Markets

Key Takeaways: Federal Reserve’s policies could exert significant pressure on cryptocurrencies if rate cuts halt in early 2026.…

Tips for Crypto Newcomers, Veterans, and Skeptics from a Bitcoiner’s Journey

Key Takeaways Understanding the basics of blockchain and decentralized finance is crucial before investing in cryptocurrency. Newcomers should…

Quantum Computing in 2026: No Crypto Doomsday, Time to Prepare

Key Takeaways: Quantum computing still poses a theoretical risk to cryptocurrency security, but immediate threats are minimal due…

El Salvador’s Bitcoin Aspirations Brought Closer to Earth in 2025

Key Takeaways: Early Ambitions vs. Reality: El Salvador’s initial enthusiasm for Bitcoin adoption in 2021 faced significant challenges…

Lido DAO’s Increased Development and Market Dynamics Elevate LDO Price

Key Takeaways Lido DAO’s development activities have surged by 690%, signifying substantial growth. The Lido DAO token (LDO)…

Hyperliquid Whales Shift Strategies: BTC Longs Decline, ETH Shorts Dominate

Key Takeaways A significant reduction in Bitcoin long positions has been observed on Hyperliquid, with large holders decreasing…

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Bitcoin Surges Toward $90,000 as $27 Billion Crypto Options Expire

Key Takeaways Bitcoin’s price is nearing the $90,000 mark amid increased market activity following the holiday lull. The…

Bitcoin Options Set to Expire, Potentially Altering Price Beyond $87,000 Range

Key Takeaways A historic Bitcoin options expiry event, valued at $236 billion, is set to occur, potentially impacting…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com