Can Coinbase's Retail Investor "New Listing" Bring New Liquidity to the Market?

Original Article Title: "Coinbase Opens 'Initial DEX Offering' to All U.S. Retail Investors: Can It Bring New Liquidity to the Market?"

Original Article Author: Seed.eth

Over the past few years, the cryptocurrency primary market's "Initial DEX Offering" scene has always operated in a regulatory gray area. Since 2018, U.S. users have been almost completely excluded from the token issuance stage. However, this situation is being disrupted.

Less than a month after acquiring the on-chain fundraising platform Echo for $375 million, the cryptocurrency exchange Coinbase has taken another key step. Overnight, its official token sale platform was officially announced, reopening the door for U.S. retail investors to participate in token issuance in compliance.

Coinbase's Initial DEX Offering: A Structural Shift

1. From Rush Buying to Algorithmic Allocation: Enhancing Retail Participation Fairness

Previous mainstream platforms (such as Binance Launchpad, OKX Jumpstart) mostly adopted a "lottery" or "first-come, first-served" mechanism, with project teams more inclined to attract participation from large holders, and whether ordinary users could win the lottery often depended on luck.

The platform launched by Coinbase uses an "algorithmic allocation" mechanism, prioritizing small amount users' purchases, gradually expanding to higher amounts. This design reduces the funding threshold, suppresses high-frequency arbitrageurs, and provides retail investors with a more realistic participation opportunity.

2. Lock-up and Anti-Arbitrage Mechanism: Encouraging Long-term Participation, Preventing Immediate Dumping After Listing

Coinbase sets a mandatory lock-up period for project teams—within six months after issuance, project teams and their affiliates may not engage in OTC transactions or sell tokens. At the same time, the platform introduces incentives for user behavior: if a user sells the received tokens within 30 days after listing, they will be automatically reduced in future allocations by the system.

3. Standardized Information Disclosure: Informed Decision-making Instead of Blindly Following Trends

On the Coinbase platform, project teams must disclose detailed information, including tokenomics, fund usage, team background, development roadmap, and potential risks. This disclosure standard is significantly higher than the information depth of most exchange Launchpads currently.

While other platforms also require some disclosure, most of them focus on marketing materials and basic data, whereas Coinbase standardizes the process, aiming to mirror the IPO market's prospectus. This helps investors truly understand the project they are getting involved in, rather than just betting based on "community hype" or "FOMO sentiment."

4. Platform Token Participation Mechanism: Decentralized Arbitrage Incentive, Return to Value Judgment

Currently, most exchanges require holding platform tokens (such as BNB, OKB) to participate in token sales, where users are often forced to buy platform ecosystem assets to qualify, thus exacerbating platform token price volatility and increasing risk.

Coinbase breaks this "tokenomics reliance": it does not require users to lock up any platform tokens for participation; instead, participation only requires USDC and is entirely fee-less. The platform's revenue comes from a fixed percentage service fee paid by the project teams. This mechanism lets "token sale participation" return to its essence — selecting projects rather than speculating on platforms.

Token Sale Debut: Is Monad Worth Participating In?

The first project on Coinbase's token sale platform is Monad ($MON), which is a high-performance blockchain under development, focusing on parallel computing, extremely high transaction throughput, and full compatibility with the Ethereum Virtual Machine (EVM). Monad is backed by many well-known institutions such as Jump Trading, Placeholder, Lattice, and Dragonfly.

The public sale price this time is set at $0.025, a significant discount compared to the previous pre-market trading price of about $0.06. The market anticipates a 2–3x short-term upside potential, especially under the Coinbase debut halo.

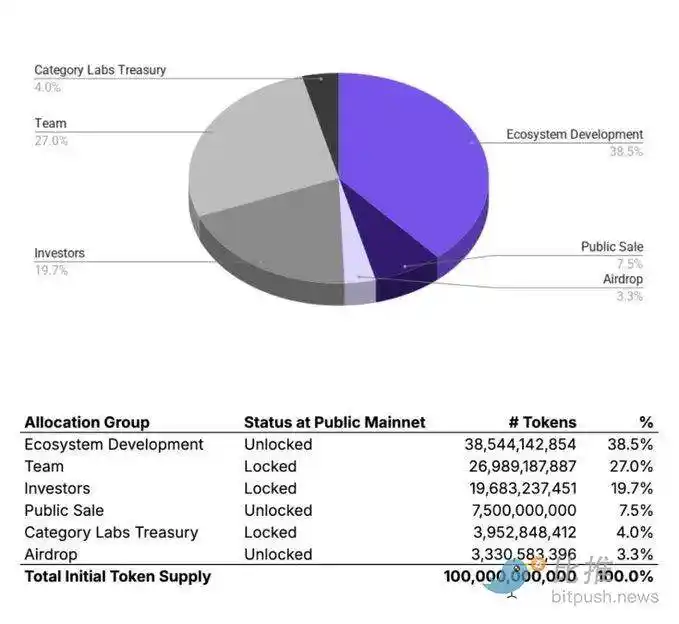

However, it's worth noting that Monad is only releasing 7.5% of the total supply this time, with an estimated valuation of around $2.5 billion, which is relatively high among L1 projects that have not yet launched their mainnet. The ecosystem has yet to be initiated, the development progress is still early, and the future performance remains uncertain.

Additionally, Coinbase's algorithmic allocation mechanism prioritizes small applications, so even if you win the allocation, individual users typically receive a small allocation, limiting actual investment opportunities.

Therefore, for the average investor, Monad is a project with potential, but it does not guarantee a profit. If you choose to participate, it is recommended to control the subscription amount, view the project's development with a medium- to long-term perspective, and pay attention to the ecosystem construction after its mainnet launch.

The Era of Frenzied Internal Looping in CEX

Coinbase's latest move is not an isolated case. In fact, in recent years, most mainstream exchanges have been continuously ramping up their efforts in the "token launch" race, gradually building a "launch loop" from project screening, fundraising design, to trading launch, and ecosystem support. The well-known Binance Launchpad, OKX Jumpstart, Bybit IDO, and others are all representative of this trend.

This evolution from a "spot trading platform" to a "first-level market full-chain service provider" is both the result of the exchange's own business expansion and a reflection of the crypto industry gradually entering a more structured and standardized era.

Below is a comparison of several top exchanges:

It can be seen that the biggest difference between Coinbase and other platforms is that its design approach is closer to the traditional financial market's "IPO + Allocation + Lock-up" process, attempting to guide the entire token issuance ecosystem from the previous "hype logic" towards "institutional development."

Coinbase is not trying to replicate Binance's success but is blazing a new trail to build a new type of token issuance path more suitable for compliant users and long-term investors. The essence of this model lies in injecting stability and predictability into crypto assets through standardized processes and risk control systems.

For the entire crypto industry, Coinbase's launch platform not only helps restore retail investors' confidence but may also become the "front door" for high-quality projects to enter the market in the future, reducing bypassing regulatory gray areas and establishing a new trust foundation in the primary market.

Institutionalized Crypto Primary Market: Can It Sprint Out From Here?

The current industry urgently needs blockbuster projects and requires a system that allows ordinary people to participate fairly and legally in token launches. Coinbase may be opening up a new path for this.

Instead of calling this an "innovation in new project launches," it's more accurate to say Coinbase is posing a question: Can Web3's early-stage funding mechanism be more orderly, fairer, and more rational than speculation, lotteries, or blind investments? It may not succeed immediately, but at least it has opened up a possibility. Whether this opening can become a gateway to mainstream compliant users and high-quality projects in the future remains to be seen.

However, before the feast begins, perhaps we should pour a bucket of cold water: in a market that is already overflowing with new tokens, can it truly be saved by yet another launch platform? Coinbase has redefined the rules of issuance, but perhaps its biggest challenge is to find truly valuable new assets for a saturated market.

You may also like

Trump Targets Fed and Italy’s Caution to Fin-Fluencers: A Comprehensive View

Key Takeaways: President Trump initiates a criminal probe against the Federal Reserve Chairman, questioning alleged resource mismanagement. Coinbase…

Crypto’s Decentralization Promise Falters at Interoperability

Interoperability in crypto exposes a decentralization gap, highlighting the reliance on centralized intermediaries. Users’ understanding of technical infrastructure…

Vitalik Advocates for Ethereum’s Simplified Future with ‘Garbage Collection’

Key Takeaways Vitalik Buterin stresses the need for a ‘garbage collection’ process to reduce Ethereum protocol complexity. The…

Trump Targets Fed, Italy Cautions Influencers: Global Financial Pulse

Key Takeaways: The United States is witnessing a political storm as former President Trump initiates criminal proceedings against…

How AI Crypto Trading Will Transform Human Roles

Key Takeaways AI is revolutionizing crypto trading by automating data-heavy tasks, yet humans still retain key decision-making responsibilities.…

2025 Exchange Rankings: CEX Spot Trading Volume Sees Slight Increase, Binance Maintains Absolute Leadership

Polymarket Exploit Arbitrage, Sonic Airdrop Accidentally Burned by Random Person, What's the Overseas Crypto Community Talking About Today?

Trump Reignites Tariff Storm, Cryptocurrency Market Faces Another 'Black Monday'

Key Market Information Discrepancy on January 19th - A Must-Read! | Alpha Morning Report

Delphi Digital's Top 10 Predictions for 2026: Perp DEX Eats Wall Street, AI Agents Usher in Era of Autonomous Trading

First Zero, First Revival: A Real Story from the WEEX Global AI Trading Hackathon Preliminary Round

WEEX Labs, the innovation arm of the global crypto exchange WEEX, launched the preliminary round of its flagship AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by world-class sponsors including AWS, the prize pool has reached $1.88 million, with a Bentley Bentayga S awaiting the champion in Dubai. Already, 788 elite teams worldwide are battling for a spot in the finals. This is more than a hackathon — it is a real-market stress test for AI trading. Registration remains open until January 18. If you want your AI to face real volatility, this is your moment.

AI in the Crypto Market: How Artificial Intelligence is Changing Trading Strategies

This article explores how AI contributes to these movements and share practical strategies to help you navigate an AI-powered crypto market.

Cross-chain Collaboration: Tom Lee Invests $200 Million, Joins Forces with Global Top Streamer Mr. Beast

Interactive Brokers Integrates USDC, US Bank Questions Stablecoin, What's the Overseas Buzz?

The Genius Stopping Law: Why Did Coinbase Backpedal at the Eleventh Hour?

By seizing the first five seconds of Gold Dog, "Dry Sitting P Junior" earns $430,000 in 30 days.

ThunderChain Resumes Legal Battle as Former CEO Chen Lei Accused of Embezzlement for Cryptocurrency Speculation - What Happened Back Then?

Key Market Intelligence for January 15th, how much did you miss out on?

Trump Targets Fed and Italy’s Caution to Fin-Fluencers: A Comprehensive View

Key Takeaways: President Trump initiates a criminal probe against the Federal Reserve Chairman, questioning alleged resource mismanagement. Coinbase…

Crypto’s Decentralization Promise Falters at Interoperability

Interoperability in crypto exposes a decentralization gap, highlighting the reliance on centralized intermediaries. Users’ understanding of technical infrastructure…

Vitalik Advocates for Ethereum’s Simplified Future with ‘Garbage Collection’

Key Takeaways Vitalik Buterin stresses the need for a ‘garbage collection’ process to reduce Ethereum protocol complexity. The…

Trump Targets Fed, Italy Cautions Influencers: Global Financial Pulse

Key Takeaways: The United States is witnessing a political storm as former President Trump initiates criminal proceedings against…

How AI Crypto Trading Will Transform Human Roles

Key Takeaways AI is revolutionizing crypto trading by automating data-heavy tasks, yet humans still retain key decision-making responsibilities.…