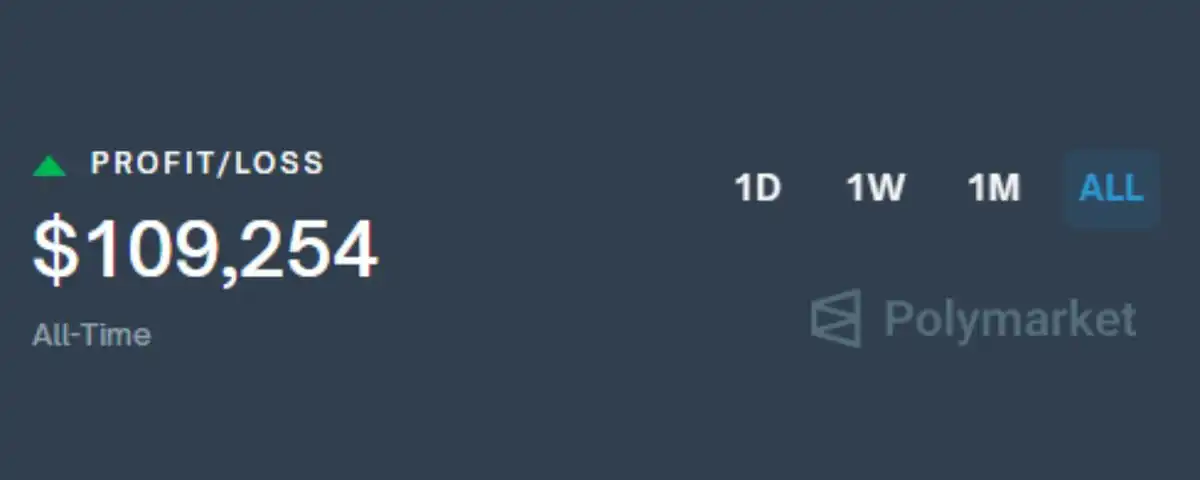

How Did I Make $100,000 in 3 Months on Polymarket?

Original Title: How I Made $100k Arbitraging Between Prediction Markets (Full Guide)

Original Author: @PixOnChain, Crypto Researcher

Original Translation: Deep in Motion

Abstract: Leveraging price differences between prediction markets for arbitrage, combining swift action and early exit strategies to earn risk-free profits

Editor's Note: This article details the author's strategy of earning $100k through arbitrage between prediction markets. The author utilizes price differences across platforms for the same event, locking in risk-free profits, with a focus on pricing errors in multi-outcome markets. Key steps include identifying spreads, swift action, automated monitoring, and early exits for APY optimization. The author emphasizes the importance of niche markets, volatility, and thorough rule scrutiny, providing an efficient Web3 arbitrage guide.

The following is the original content (lightly edited for readability):

Most people gamble on prediction markets.

I make money through arbitrage.

Here is my specific strategy to earn $100k from decentralized, inefficient prediction markets—completely devoid of gambling.

Step One: Understand the Rules

Prediction markets allow you to bet on real-world outcomes.

· "Will Ethereum reach $5000 by December?"

· "Will MrBeast run for president?"

· "Will Kanye West launch his own token?"

Each market has its own participant base.

Each group has its own biases.

This means that pricing for the same event on different platforms... will vary.

Herein lies the arbitrage opportunity.

If platform A's "Yes" price is 40 cents, and platform B's "No" price is 55 cents...

You can lock in a 5-cent profit regardless of the outcome.

This is arbitrage.

But there are even better opportunities...

Step 2: Find Your Edge

For me, what works well is the multi-outcome markets.

These markets are where issues are most likely to arise.

For example:

· Who will win this weekend's F1 race?

· Which party will win the UK General Election?

· Who will be the next one eliminated on the reality show?

More outcomes = higher complexity = more pricing errors.

In theory, the sum of the probabilities of all outcomes should be 100%.

In reality? I often see the market sum up to 110%.

Why? Because most platforms embed a hidden fee—the 'overround'.

Plus, many platforms let the crowd determine the odds.

This leads to lucrative yet inefficient arbitrage opportunities.

Step 3: How to Identify an Arbitrage Opportunity

The rules are as follows:

You find pricing for the same event on different platforms. Select the lowest price for each outcome. If the sum is less than 1 dollar, you've found an arbitrage opportunity.

Let me show you a real example.

Market: Who will be the next Pope?

Two platforms are running this market simultaneously.

Prices are as follows:

Polymarket/Myriad

We select the lowest price for each outcome:

· Pietro Parolin: 35.2 cents (Myriad)

· Luis Antonio Tagle: 30 cents (Polymarket)

· Others: 32.7 cents (Myriad)

· Total: 97.9 cents

You buy into all three outcomes.

One of them must prevail.

You guarantee to get back 1 dollar.

Profit: 2.1 cents per transaction = 2.1% risk-free return.

This is arbitrage.

You are not betting on who will become the Pope. You are betting on two platforms not being able to agree on the pricing of a potential candidate. When they disagree — you profit.

P.S. This is not the best opportunity, just one I found today.

Myriad has low liquidity, but two platforms still show a similar spread.

If you monitor more markets, you will find bigger opportunities.

I usually only enter when the Annual Percentage Yield (APY) is above 60% (APY = (spread / settlement days) × 365).

The market spread is 2.1%, with a settlement time of 29 days:

(0.021 / 29) × 365 ≈ 26.4% APY

Not good enough for me.

Locking funds for a month for only 26% APY? Pass.

But if the same spread settles in 7 days?

That's over 100% APY — I'm in.

How to find these high APY opportunities?

Step Four: Race Against Time

Predicting market arbitrage is a game of timing. Once a price discrepancy occurs, you usually have only minutes, not hours.

· Someone posts a rumor.

· One market updates its price.

· Another market lags behind.

This delay is your entire advantage. If possible — automate this part.

At the beginning, I had 7 platform tabs open simultaneously. I refreshed like a maniac. Used price alerts on Discord, Telegram, Twitter.

Sometimes, I could spot the spread just by muscle memory. The faster you act, the more you earn. Hesitate for 5 minutes, and the spread is gone.

The best spread I caught was 18%, and the trade volume was substantial.

Make sure you have enough liquidity available to deploy in each market and understand all fees.

Step Five: Early Exit

Most people wait for the outcome to be revealed. I don't. I've already made most of my profit when the outcome is unknown.

Assume I bought all outcomes at 94 cents. This locks in a 6-cent spread. One of the outcomes will pay out at $1.

But I don't have to wait.

If the market tightens — those same shares can now be sold for 98 cents or 99 cents collectively — I exit.

This is only effective when all outcome prices remain stable.

If one outcome skyrockets and the others plummet, there is no opportunity to exit.

So I need to monitor the entire portfolio. I exit when the total value goes up.

This can significantly increase your APY and allow you to rotate between different markets more quickly.

Additional Tips

· Look for overlapping events (e.g., "Trump wins the 2024 election" and "Republican victory") — hidden arbitrage opportunities are right there.

· Target small markets — more pricing errors, less competition.

· Use less popular platforms — more spreads, bigger advantages, plus potential airdrop rewards.

· Carefully read settlement rules — one word can change the outcome.

· Always triple-check the order book and your buy-in price. Include all fees in your calculations.

It took me 2.5 months to earn $100,000.

Some weeks had no opportunities. Some weeks were non-stop busy.

The larger the market fluctuation, the bigger the spread.

So if the market is quiet, don't rush, keep looking. There will always be another mispriced market.

Original tweet link: Tweet Link

You may also like

Lido DAO’s Increased Development and Market Dynamics Elevate LDO Price

Key Takeaways Lido DAO’s development activities have surged by 690%, signifying substantial growth. The Lido DAO token (LDO)…

Hyperliquid Whales Shift Strategies: BTC Longs Decline, ETH Shorts Dominate

Key Takeaways A significant reduction in Bitcoin long positions has been observed on Hyperliquid, with large holders decreasing…

Token VS Equity: The Aave Controversy

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Trust Wallet Browser Extension Security Incident Leads to Losses

Key Takeaways Trust Wallet identified a significant security breach in its browser extension version 2.68. Approximately over $6…

Bitcoin Surges Toward $90,000 as $27 Billion Crypto Options Expire

Key Takeaways Bitcoin’s price is nearing the $90,000 mark amid increased market activity following the holiday lull. The…

Bitcoin Options Set to Expire, Potentially Altering Price Beyond $87,000 Range

Key Takeaways A historic Bitcoin options expiry event, valued at $236 billion, is set to occur, potentially impacting…

Ethereum Price Prediction: Whales Accumulate as Market Awaits Key Break

Key Takeaways Ethereum’s price remains in a “no-trade zone” between $2,800 and $3,000 amid low market activity. Whale…

Matrixport Predicts Limited Downside for Bitcoin Amid Market Caution

Key Takeaways Matrixport’s report suggests Bitcoin’s downside risks are decreasing, with the market moving towards a phase where…

Bitcoin and Ethereum Options Expiry Shakes Market Stability

Key Takeaways The largest options expiry in cryptocurrency history is occurring today, involving over $27 billion in Bitcoin…

Trust Wallet Hack Results in $3.5 Million Loss for Major Wallet Holder

Key Takeaways A significant Trust Wallet hack led to the theft of $3.5 million from an inactive wallet.…

PancakeSwap Launches LP Rewards on Base Network

Key Takeaways PancakeSwap has introduced liquidity provider (LP) rewards for 12 v3 pools on the Base network, facilitated…

BDXN Wallets Deposit $400,000 in Tokens to Multiple Exchanges

Key Takeaways BDXN project wallets have transferred approximately $400,000 worth of tokens to various exchanges. The transfers involve…

Crypto Derivatives Volume Skyrockets to $86 trillion in 2025 as Binance Dominates

Key Takeaways Cryptocurrency derivatives volume has surged to an astronomical $86 trillion in 2025, equating to an average…

Ethereum in 2026: Glamsterdam and Hegota Forks, Layer 1 Scaling, and More

Key Takeaways Ethereum is poised for crucial developments in 2026, particularly with the Glamsterdam and Hegota forks. Glamsterdam…

Social Engineering in the Crypto Universe: Safeguarding Your Assets in 2025

Key Takeaways Social engineering, a psychological manipulation tactic, has been the leading cause of crypto asset theft in…

Kraken IPO to Rekindle Crypto’s ‘Mid-Stage’ Cycle: A Comprehensive Analysis

Key Takeaways: Kraken’s anticipated IPO in 2026 could significantly attract fresh capital from traditional financial investors, marking a…

Lido DAO’s Increased Development and Market Dynamics Elevate LDO Price

Key Takeaways Lido DAO’s development activities have surged by 690%, signifying substantial growth. The Lido DAO token (LDO)…

Hyperliquid Whales Shift Strategies: BTC Longs Decline, ETH Shorts Dominate

Key Takeaways A significant reduction in Bitcoin long positions has been observed on Hyperliquid, with large holders decreasing…

Token VS Equity: The Aave Controversy

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Trust Wallet Browser Extension Security Incident Leads to Losses

Key Takeaways Trust Wallet identified a significant security breach in its browser extension version 2.68. Approximately over $6…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com