Is the Shift Away from "Buying the Dip" Strategy the Reason Behind Bitcoin's Recent Drop?

Original Article Title: Why did Bitcoin's largest buyers suddenly stop accumulating?

Original Article Author: Oluwapelumi Adejumo, Crypto Slate

Original Article Translation: Luffy, Foresight News

Throughout most of 2025, Bitcoin's support level seemed unshakable due to the unexpected alliance between Corporate Digital Asset Treasuries (DAT) and Exchange-Traded Funds (ETF), collectively forming the support foundation.

Enterprises acquired Bitcoin through issuing stocks and convertible bonds, while ETF inflows quietly absorbed new supply. Together, they built a robust demand foundation that helped Bitcoin withstand the pressure of a tightening financial environment.

Now, this foundation is beginning to weaken.

On November 3, Charles Edwards, the founder of Capriole Investments, posted on X platform that as institutional accumulation slowed down, his bullish outlook has diminished.

He pointed out: "For the first time in 7 months, institutional net inflows fell below daily mining supply, a concerning development."

Bitcoin Institutional Buying Volume, Source: Capriole Investments

Bitcoin Institutional Buying Volume, Source: Capriole Investments

Edwards stated that even though other assets outperform Bitcoin, this indicator remains a key reason for his optimism.

However, currently, around 188 corporate treasuries hold significant Bitcoin positions, with many companies having a relatively single-focused business model besides Bitcoin exposure.

Bitcoin Treasury Accumulation Slows Down

No company represents corporate Bitcoin trading better than the recently renamed "Strategy," formerly known as MicroStrategy.

Led by Michael Saylor, this software manufacturer has transformed into a Bitcoin treasury company, currently holding over 674,000 bitcoins, securing its position as the world's largest single corporate holder.

However, its buying pace has significantly slowed down in recent months.

In the third quarter, Strategy only increased its Bitcoin holdings by about 43,000 coins, the lowest quarterly purchase amount this year. Considering that the company's Bitcoin purchases during this period plummeted to only a few hundred coins, this number is not surprising.

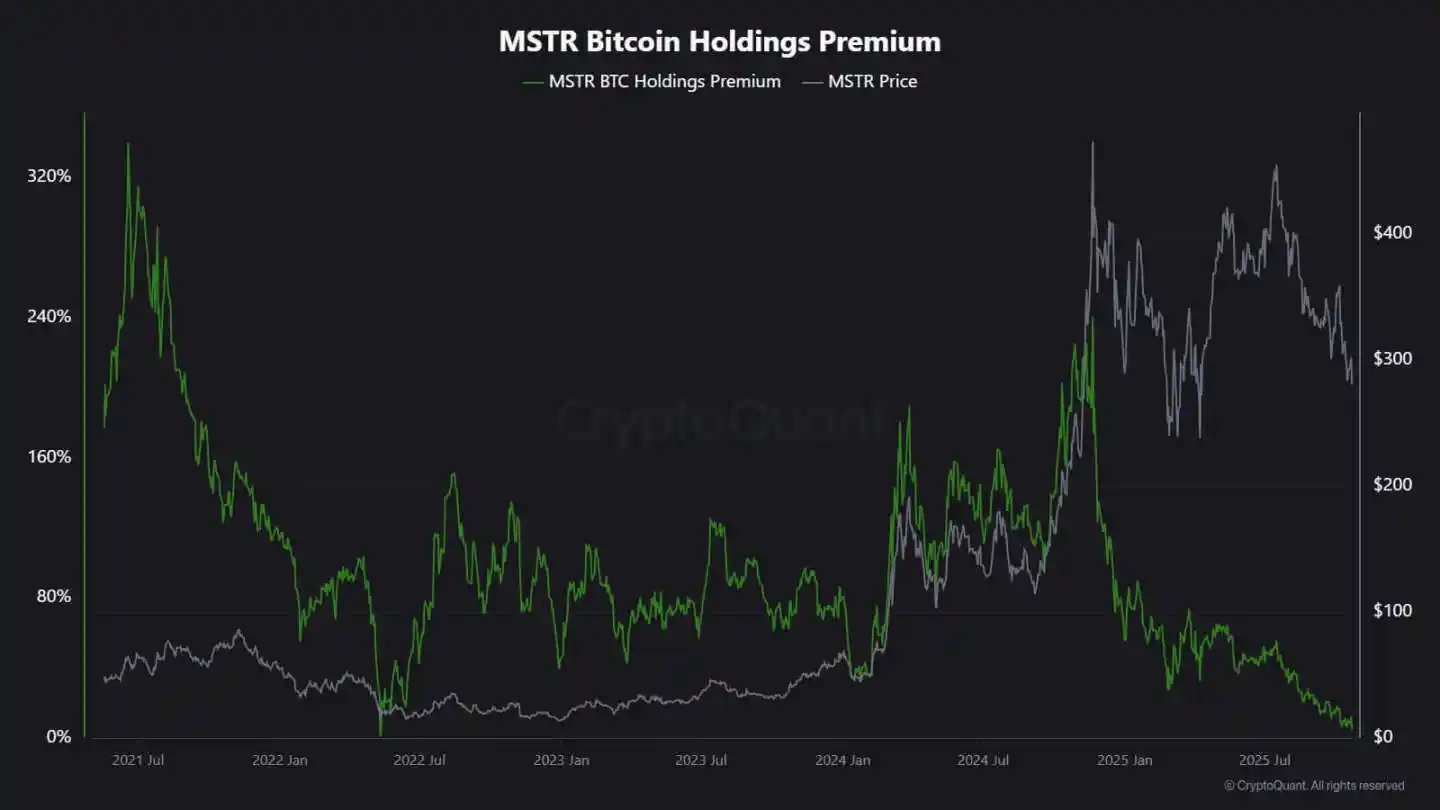

CryptoQuant analyst J.A. Maarturn explained that the slowdown in accumulation may be related to Strategy's Net Asset Value (NAV) decline.

He stated that investors had previously paid a high "NAV premium" for each $1 of Bitcoin on Strategy's balance sheet, essentially allowing shareholders to benefit from Bitcoin's price appreciation through leverage. However, this premium has significantly narrowed since mid-year.

With the dwindling valuation premium, issuing new shares to purchase Bitcoin no longer brings significant appreciation, and the incentive for corporate financing to increase holdings has decreased accordingly.

Maarturn pointed out: "The funding difficulty has increased, and the stock issuance premium has dropped from 208% to 4%."

Strategy Stock Premium, Source: CryptoQuant

Meanwhile, the cooling trend in accumulation is not limited to Strategy.

Tokyo-listed company Metaplanet previously followed the model of this U.S. pioneer, but after a significant drop in the stock price, the recent trading price is below its Bitcoin holdings' market value.

In response, the company approved a stock repurchase plan and introduced new funding guidance to expand its Bitcoin treasury. This move demonstrates the company's confidence in its balance sheet, but also highlights that investors' enthusiasm for the "crypto treasury" business model is waning.

In fact, the slowdown in Bitcoin treasury accumulation has led to some corporate mergers.

Last month, asset management firm Strive announced the acquisition of smaller-scale Bitcoin treasury company Semler Scientific. After the merger, these companies will hold nearly 11,000 Bitcoins.

These cases reflect structural constraints rather than wavering beliefs. When stock or convertible bond issuance no longer commands a market premium, capital inflows dry up, and corporate accumulation naturally slows down.

How Are ETF Flows Doing?

Long seen as the "New Supply Absorber," the spot Bitcoin ETF has also shown similar signs of weakness.

Throughout much of 2025, these financial investment tools dominated net demand, with subscription volume consistently outpacing redemption volume, especially during Bitcoin's surge to an all-time high.

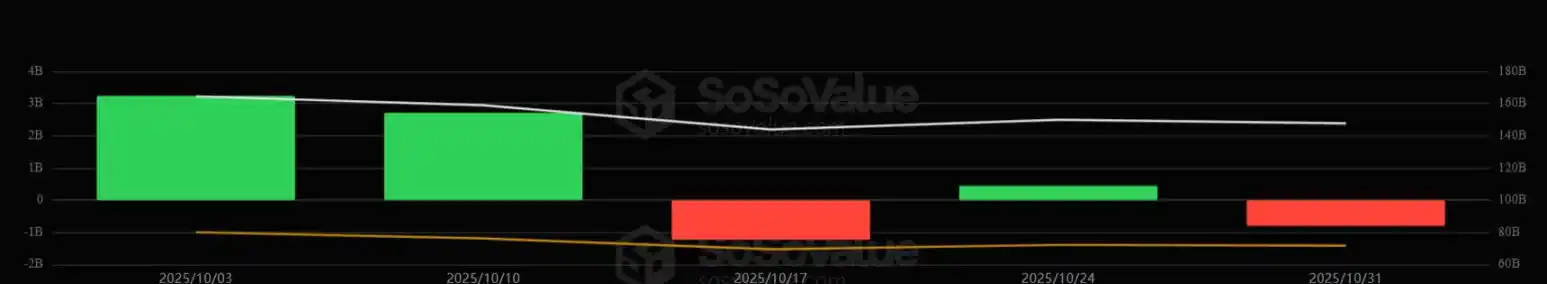

However, by late October, their fund flows became unstable. Influenced by interest rate expectations, portfolio managers adjusted positions, risk departments reduced exposure, and some weekly fund flows turned negative. This volatility marked a new phase of behavior for Bitcoin ETFs.

The macro environment has tightened, hopes for rapid rate cuts have gradually faded, and liquidity conditions have cooled. Nevertheless, the market demand for Bitcoin exposure remains strong but has shifted from "steady inflows" to "pulsed inflows."

SoSoValue's data clearly reflects this shift. In the first two weeks of October, cryptocurrency asset investment products attracted nearly $6 billion in inflows; however, by the end of the month, with redemptions exceeding $20 billion, some of the inflows were wiped out.

Bitcoin ETF Weekly Fund Flows, Source: SoSoValue

This pattern indicates that Bitcoin ETFs have matured into a true two-way market. They can still provide deep liquidity and institutional access channels but are no longer just one-way accumulation tools.

When macro signals fluctuate, ETF investors' exit speed may be just as rapid as their entry speed.

Market Impact on Bitcoin

This shift does not necessarily mean that Bitcoin will experience a decline, but it does indicate increased volatility. As the absorption capacity of corporations and ETFs weakens, Bitcoin's price trajectory will be increasingly influenced by short-term traders and macro sentiment.

Edwards believes that, in this scenario, new catalysts—such as monetary easing, regulatory clarity, or a return of stock market risk appetite—could reignite institutional buying.

However, at present, marginal buyers are more cautious, making price discovery more sensitive to the global liquidity cycle.

The impact is primarily manifested in two aspects:

First, the structural buy orders that once served as support are diminishing. During periods of insufficient absorption, intraday volatility may intensify as there is a lack of stable buyers to curb volatility. The halving in April 2024 technically reduced new supply, but without sustained demand, scarcity alone cannot guarantee price increases.

Second, Bitcoin's correlated features are shifting. As the balance sheet accumulation cools off, the asset may once again follow overall liquidity cycle dynamics. Periods of rising real rates and a strong dollar could create price pressure, while loose conditions could see it reestablishing leadership in risk-on rallies.

Essentially, Bitcoin is re-entering a macro reflexivity phase, behaving more like a high-beta risk asset rather than digital gold.

At the same time, all this does not negate Bitcoin's long-term narrative as a scarce, programmable asset. Instead, it reflects the increasing influence of institutional dynamics—entities that shielded Bitcoin from retail-driven volatility are now tightening its correlation with broader capital markets, cementing its mainstream portfolio allo-cation.

The coming months will test whether Bitcoin can hold its store of value characteristics in the absence of corporate and ETF auto-matic inflows.

By historical analogy, Bitcoin has often exhibited adaptability. As one demand channel wanes, another emerges—whether from sovereign reserves, fintech integration, or retail re-engagement in a macro easing cycle.

You may also like

Bitcoin Surges Past Key Levels—Potential Liquidations Loom

Key Takeaways Bitcoin could trigger $1.71 billion in short liquidation on major CEXs if it surpasses $92,262. Conversely,…

Bitcoin Faces Rare Fourth Consecutive Monthly Decline

Key Takeaways Bitcoin is on the brink of its fourth consecutive monthly decline, a situation unseen since the…

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

Fed’s January Rate Decision and Bitcoin’s Outlook

Key Takeaways The Federal Reserve is anticipated to announce its first interest rate decision for 2026, with market…

Cathie Wood Boosts Investment in Cryptocurrency Stocks

Key Takeaways Cathie Wood’s ARK Invest has significantly increased its investment in Coinbase, Circle, and Bullish to the…

USD Weakens as DXY Falls Below 97, Boosting Bitcoin Prospects

Key Takeaways The US Dollar Index (DXY) dropped below 97, reaching its lowest level since September of the…

Global Risks Influence Bitcoin Fluctuations: QCP Asia’s Insight

Key Takeaways Persistent macroeconomic uncertainties cause global markets to retreat into risk-off mode. Japanese bond yields surge to…

Digital Asset Fund Outflows Lead to Market Volatility

Key Takeaways Digital asset funds experienced net outflows of $1.73 billion last week, the largest since mid-November last…

Bitcoin Losses Reach $4.5 Billion – Highest in Three Years

Key Takeaways Bitcoin has recorded a realized loss of $4.5 billion, marking the highest level in three years.…

Bitcoin Movement Highlights Prominent Anonymous Transfers

Key Takeaways A significant movement involving 200.48 BTC, valued at approximately $17.6 million, was observed, transferring funds between…

Cryptocurrency Market Experiences $766 Million in Liquidations Over 24 Hours

Key Takeaways The last 24 hours saw global crypto liquidations reaching $766 million, with long positions counting for…

Solana Staking Surges to Record High Amid Price Challenges

Key Takeaways Solana’s staking ratio has reached an all-time high of 70%, indicating strong confidence from long-term holders.…

Bitcoin Price Falls Amid Government Shutdown Concerns

Key Takeaways Bitcoin’s price has dropped below $88,000 due to heightened fears of a U.S. government shutdown. Market…

Crypto Analyst Warns of Bitcoin’s Critical Support Test

Key Takeaways Bitcoin’s price recently broke below a significant ascending channel, raising market fears. Bitcoin lost the crucial…

CME Gap Highlights Bitcoin’s Volatility and Market Dynamics

Key Takeaways Bitcoin’s price experienced a significant drop at the start of the week, creating a notable $2,900…

Justin Sun Boosts River Token with $8 Million Investment

Key Takeaways Justin Sun has invested $8 million into River Protocol, significantly impacting the token’s performance. Following the…

U.S. Government Shutdown Threat Impacts Bitcoin and Crypto Markets

Key Takeaways The risk of a U.S. government shutdown has surged, with predicted odds now approaching 80% as…

Bitcoin Ventures into Volatility as Bulls Face $86K BTC Reckoning

Key Takeaways Bitcoin prices took a downturn, stirring market uncertainties and concerns about macroeconomic volatility. A potential U.S.…

Bitcoin Surges Past Key Levels—Potential Liquidations Loom

Key Takeaways Bitcoin could trigger $1.71 billion in short liquidation on major CEXs if it surpasses $92,262. Conversely,…

Bitcoin Faces Rare Fourth Consecutive Monthly Decline

Key Takeaways Bitcoin is on the brink of its fourth consecutive monthly decline, a situation unseen since the…

Penguin Token Sells Off Amid Market Fluctuations

Key Takeaways A significant PENGUIN token holder has started liquidating their holdings, resulting in $40,000 worth of tokens…

Fed’s January Rate Decision and Bitcoin’s Outlook

Key Takeaways The Federal Reserve is anticipated to announce its first interest rate decision for 2026, with market…

Cathie Wood Boosts Investment in Cryptocurrency Stocks

Key Takeaways Cathie Wood’s ARK Invest has significantly increased its investment in Coinbase, Circle, and Bullish to the…

USD Weakens as DXY Falls Below 97, Boosting Bitcoin Prospects

Key Takeaways The US Dollar Index (DXY) dropped below 97, reaching its lowest level since September of the…