Life Insights in a Transaction

Original Article Title: Life lessons from trading

Original Article Author: thiccy, cofounder of scimitar capital

Translation: SpecialistXBT, BlockBeats

Editor's Note: Trading is a mirror, reflecting the relationship between people and reality. This article, on the surface, is about how to survive in the market, but in reality, it explores a more universal life theme: how to recognize your strengths, how to calibrate your understanding of the world, how to make decisions in uncertainty, and how to maintain humanity in a zero-sum game. The author says, "In a sense, everyone is a trader," as we all bet on the future with incomplete information, the only difference being the form of the chips.

1) Traders make money by speculating on fund flows.

2) There are many ways to win in the speculation game:

Some people can quickly read new information

Some people can quickly make speculations

Some people can accurately process new information

Some people can quickly identify patterns

Some people can see patterns that others cannot

Some people can accurately interpret others' predictions

Some people have a network of insiders who can gossip about fund flows

Some people can chase funds that others cannot, do not want to, or do not know how to chase

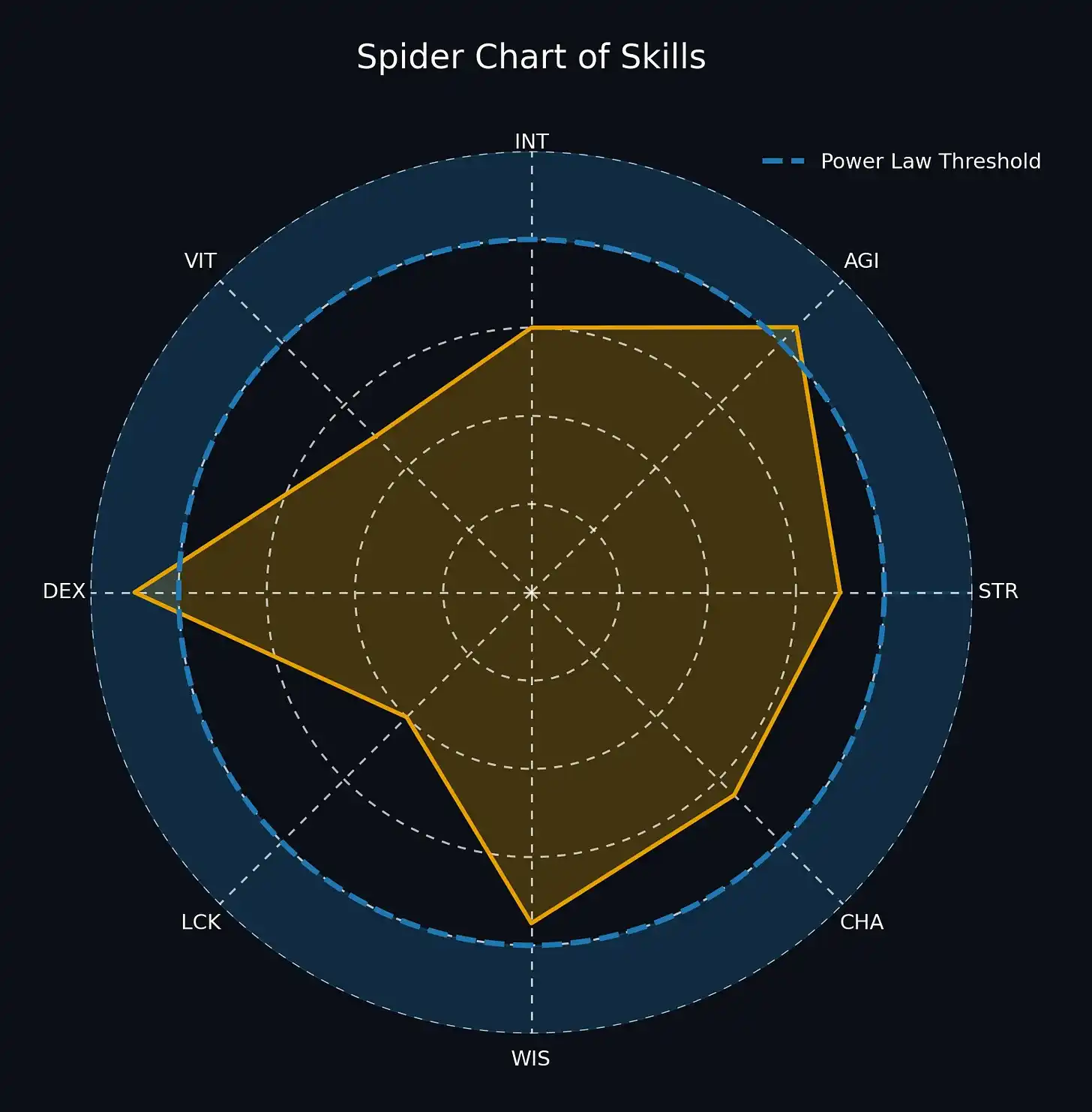

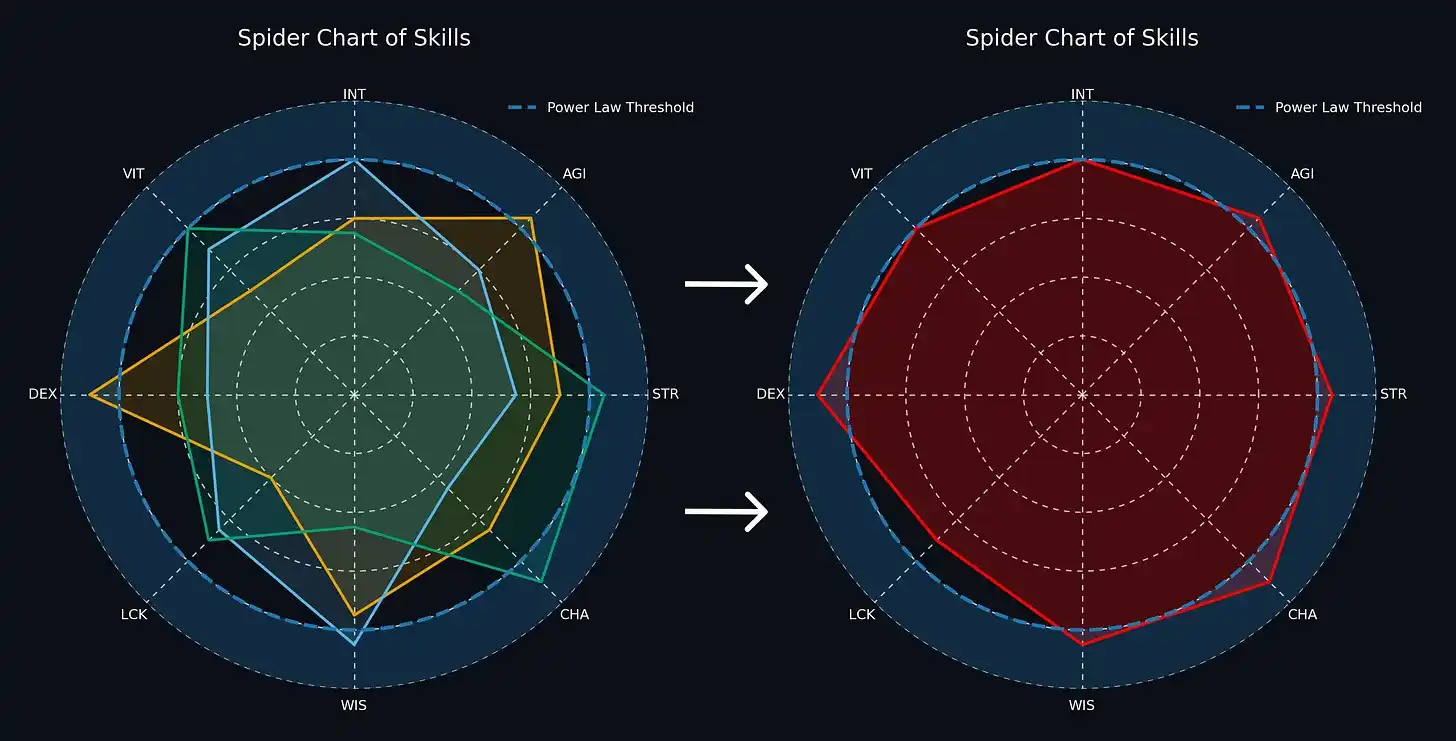

3) Each skill is called an "edge," and you can think of each skill as a attribute value in the game.

4) This game is winner-takes-all. If you want to continue making money, you need to fill in the attribute circles and cross the power law threshold.

5) Team hunting is easier. Overlaying everyone's best skills can cross more thresholds. A great trading team is a positive-sum game. The whole is greater than the sum of its parts.

6) Trust is built through constantly escalating trust tests. Calibrating the scale of trust tests is crucial. Too large will lead you to be scammed, too small will hinder the compounding growth of the relationship. Generosity is very useful. Most people in trading will feel lonely, so making this process fun is a valuable skill.

7) If you want to win, you must be willing to sacrifice everything. In reality, most people are not that eager for success, and that's okay.

8) Only play games that you can learn to consistently win. Honestly calibrate your abilities and your true level of ability in the world. Achieving a world-class level in any game requires intense focus, courage, and often rare talents shaped from childhood. Most importantly, find a game that suits your specific strengths. Playing a game that doesn't suit you is the most common tragedy in this industry. Trading has swallowed up and spit out millions of people, wasting their prime years and scattering their stories to the wind.

9) The guessing game always becomes increasingly difficult over time as it is an adaptive Darwinian system. People learn, knowledge spreads, advantages decay, winners grow, and losers perish.

10) Survivorship bias is everywhere. Always ask yourself why someone smarter, better connected, or faster than you didn't seize this opportunity before you.

11) Most market participants are just flipping coins at each other. Occasionally, someone will flip twenty heads in a row, looking like a genius, and then trigger a wave of blind followers.

12) Your best trades will be swift and fierce.

13) Trading exposes your deepest insecurities to yourself and the world. It is a rapid reckoning of reality and your place within it. In a sense, everyone is a trader. We make calculated decisions with incomplete information, manage drawdowns to avoid bankruptcy, and convert our natural advantages into returns. Almost everything boils down to aligning your understanding of yourself with your understanding of the world. Many people underestimate their most potent unique traits and take on too little risk when building a life around those traits.

14) Envy is the most potent emotion of the internet age. Handled well, it can quickly copy effective things from the best people. Handled poorly, it generates scarcity-driven anxiety and fatigue.

15) With the passage of trading time, you'll realize the eventual need to build an identity founded on something stable. Identities built on talent or a "niche perspective" are quickly challenged. Identities based on a problem-solving thought process are more sustainable, even if they sacrifice novelty and excitement.

16) Only paranoiacs survive. Panic before others. Always have an exit plan. Avoid deep drawdowns. Stay humble, leaving room for the unknown unknowns. Recognize when you're selling tail risk. Maintain liquidity. Respect counterparty risk. Respect path dependence.

17) People often build a man-made paradise around the goals they chase and a man-made hell around the anxieties they evade. This framework can inspire a temporary outburst of motivation, but it is not a sustainable way of life. The sense of scarcity and anxiety can distort decision-making, making you susceptible to ideological capture.

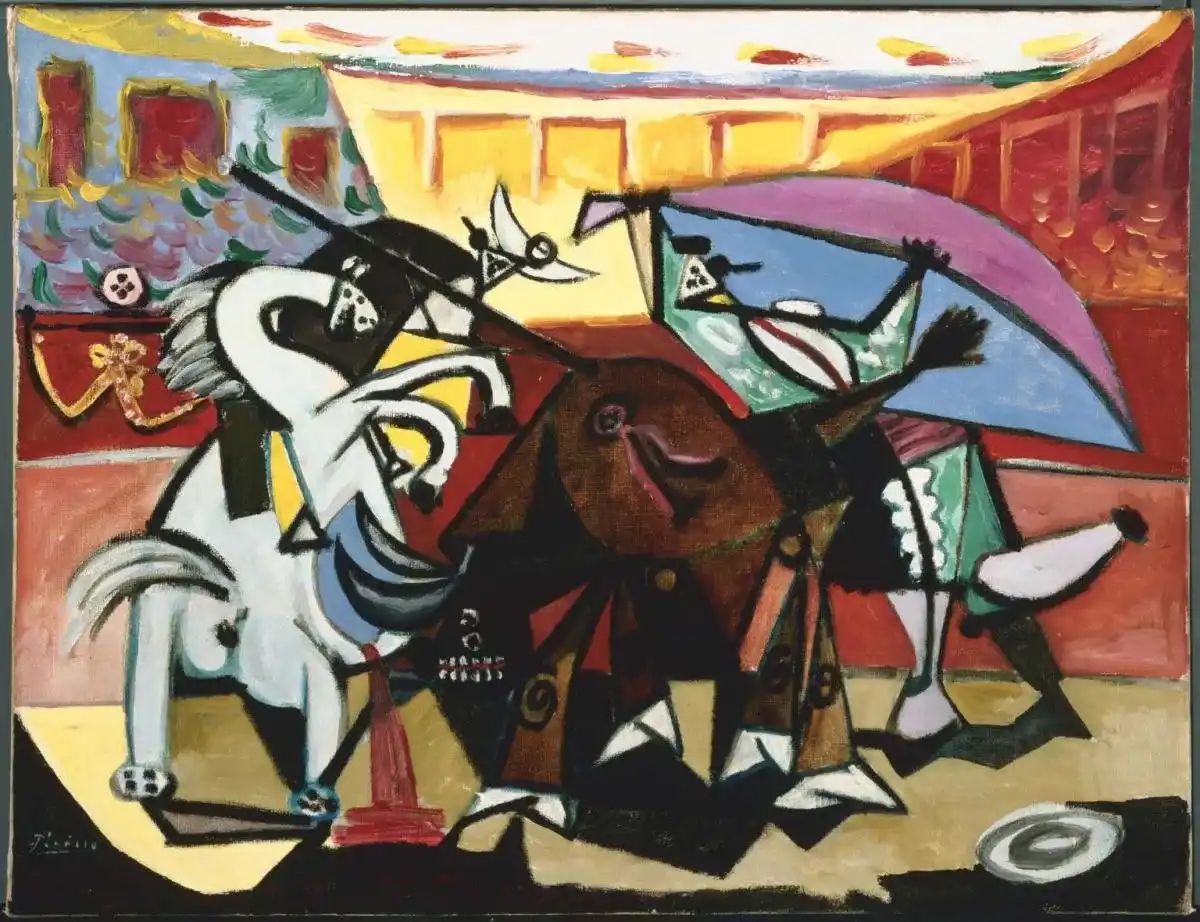

18) Trading is a zero-sum game within a larger positive-sum game. While each trade has a winner and a corresponding loser, the market as a whole allocates resources in space and time, aiding in the development of civilization. The emergent goals of a complex system are often only clear in hindsight. If you are too cynical about the futility of what you are doing, you will be spiritually annihilated and depleted.

19) It is challenging to see the big picture clearly. You are an individual ant trying to understand the collective behavior of the ant colony. Price and price action are a low-dimensional projection of a vast machine. The market fluctuates for various reasons, but we simplify views, compressing them into a single concise narrative.

20) Money can change a lot of things, but not everything. When you understand what truly changes and what remains constant, you will experience the pain of growth.

21) Profiting in trading means your view of the world is closer to reality than the average market participant. However, seeing through the essence in one market does not mean you can do the same in another. The ability to transfer across markets is a higher-order skill: discovering and capitalizing on advantages, insight into adverse selection, and knowing where the power-law critical points lie.

22) Those who make a living from trading often age rapidly. The mental stress cost is high. Make a conscious effort to take care of yourself. Without health, money loses its meaning.

23) Winning streaks often mask bad habits that will eventually backfire over time. Losing streaks will make you question the entire process. Do not get too excited at the peak or disheartened at the trough.

24) The world is in a constant state of decay. Reality is ever-changing, and everyone's models will become outdated and misaligned. That's why there's always room for young, success-hungry, and obsessed individuals to make money. People are like their life's moving average. Short windows are the first to capture new trends, even if what they capture is partly noise.

25) The market trains you to see self-reinforcing and self-correcting loops where you look.

26) Most of the excess opportunities in the modern market ultimately stem from people trying to fill the void of existential meaning.

27) I am grateful to be able to play this game with friends and reap rewards from it. Life is indeed beautiful.

You may also like

HashKey Secures $250M for New Crypto Fund Amid Strong Institutional Interest

Key Takeaways HashKey Capital successfully secured $250 million for the initial close of its fourth crypto fund, showcasing…

Hong Kong Moves Forward with Licensing Regimes for Virtual Asset Dealers and Custodians

Key Takeaways Hong Kong’s FSTB and SFC are implementing new licensing requirements for virtual asset dealers and custodians…

Kalshi First Research Report: When Predicting CPI, Crowd Wisdom Beats Wall Street Analysts

Are Those High-Raised 2021 Projects Still Alive?

High Fees, Can't Beat the Market Even After Paying 10x More, What Exactly Are Top Hedge Funds Selling?

AI Trading Risks in Crypto Markets: Who Takes Responsibility When It Fails?

AI trading is already core market infrastructure, but regulators still treat it as a tool — responsibility always stays with the humans and platforms behind it. The biggest risk in 2025 is not rogue algorithms, but mass-adopted AI strategies that move markets in sync and blur the line between tools and unlicensed advice. The next phase of AI trading is defined by accountability and transparency, not performance — compliance is now a survival requirement, not a constraint.

Twitter 上的「虚假流量」是指通过操纵关注者数量、喜欢和转发等指标来人为增加一条推文的影响力和可信度。下面是一些常见的制造虚假流量的方法: 1. <b>购买关注者:</b> 一些用户会通过购买关注者来迅速增加他们的关注者数量,从而让他们的账号看起来更受欢迎。 2. <b>使用机器人账号:</b> 制造虚假流量的另一种常见方法是使用机器人账号自动执行喜欢、转发和评论等互动操作,从而提高一条推文的互动量。 3. <b>推文交换:</b> 一些用户之间会进行推文交换,即互相喜欢、转发对方的推文...

Facing Losses: A Trader’s Journey to Redemption

Key Takeaways Emotional reactions to trading losses, such as increasing risks or exiting the market entirely, often reflect…

Nofx’s Two-Month Journey from Stardom to Scandal: The Open Source Dilemma

Key Takeaways Nofx’s rise and fall in two months highlights inherent challenges in open source projects. A transition…

Coinbase to Acquire The Clearing Company in Prediction Markets Push

Key Takeaways Coinbase is set to acquire The Clearing Company, a prediction markets startup, to expand its product…

Understand Tokenization, Differentiating Between the DTCC Model and the Direct Ownership Model

When AI Starts Spending Money: Who Will Underwrite Agent Transactions?

Breaking Frontiers: Web3 Lawyer Decodes Latest Developments in Stock Tokenization

Whale Effect? Stablecoins are Not Really the Enemy of Bank Deposits

Dialogue with Gen Z Fintech Entrepreneur Christian: Eager for iteration speed and radical candor, financial worldview is more important than what to choose, "Young people should have a sense of awe"

AI Trading Bots and Copy Trading: How Synchronized Strategies Reshape Crypto Market Volatility

Retail crypto traders have long faced the same challenges: poor risk management, late entries, emotional decisions, and inconsistent execution. AI trading tools promised a solution. Today, AI-powered copy trading systems and breakout bots help traders size positions, set stops, and act faster than ever. Beyond speed and precision, these tools are quietly reshaping markets — traders aren’t just trading smarter, they’re moving in sync, creating a new dynamic that amplifies both risk and opportunity.

MSCI’s Potential Index Exclusion Threatens Crypto Treasury Companies with Massive Sell-Off

Key Takeaways MSCI’s consideration to exclude crypto treasury companies from its indexes could trigger up to $15 billion…

The US Supreme Court's Tariff Ruling is Imminent, With Trump Issuing Frequent Warnings, Could He Be on the Verge of Losing?

HashKey Secures $250M for New Crypto Fund Amid Strong Institutional Interest

Key Takeaways HashKey Capital successfully secured $250 million for the initial close of its fourth crypto fund, showcasing…

Hong Kong Moves Forward with Licensing Regimes for Virtual Asset Dealers and Custodians

Key Takeaways Hong Kong’s FSTB and SFC are implementing new licensing requirements for virtual asset dealers and custodians…

Kalshi First Research Report: When Predicting CPI, Crowd Wisdom Beats Wall Street Analysts

Are Those High-Raised 2021 Projects Still Alive?

High Fees, Can't Beat the Market Even After Paying 10x More, What Exactly Are Top Hedge Funds Selling?

AI Trading Risks in Crypto Markets: Who Takes Responsibility When It Fails?

AI trading is already core market infrastructure, but regulators still treat it as a tool — responsibility always stays with the humans and platforms behind it. The biggest risk in 2025 is not rogue algorithms, but mass-adopted AI strategies that move markets in sync and blur the line between tools and unlicensed advice. The next phase of AI trading is defined by accountability and transparency, not performance — compliance is now a survival requirement, not a constraint.

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com