Pendle Weekly Report Overview: Pendle releases new Boros features and year-end airdrop plan, and vePENDLE users who lock up vePENDLE receive multiple income incentives

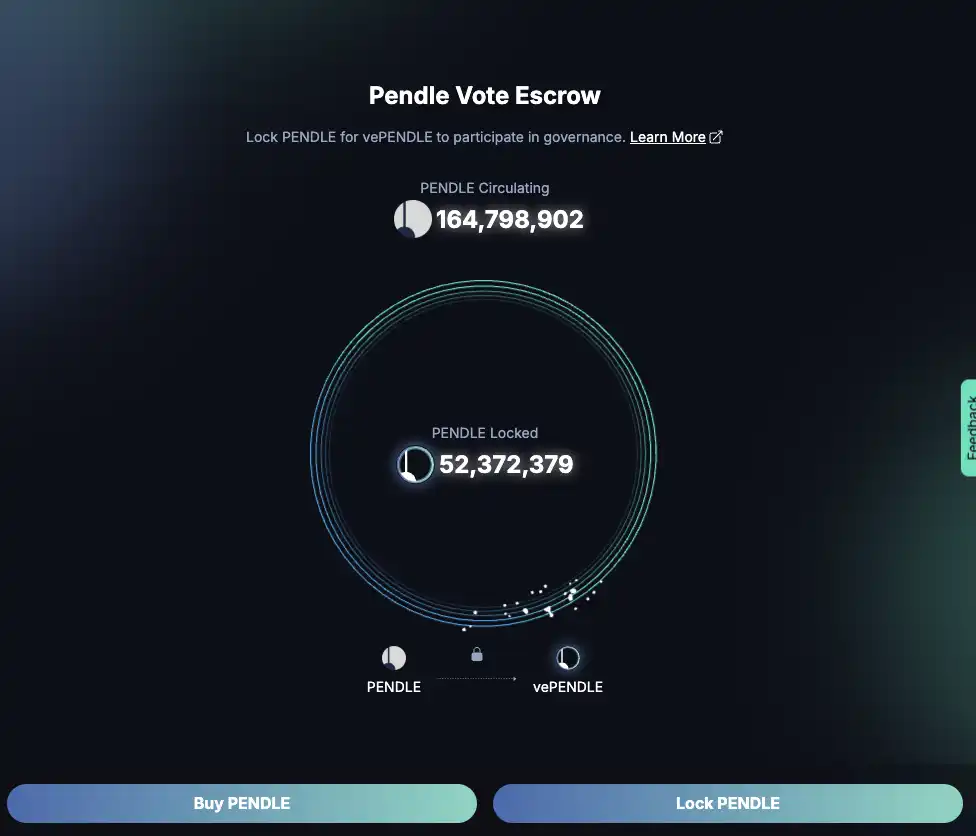

According to official news, since November 28, the Pendle platform has generated more than $1.15 million in fee income, bringing significant benefits to vePENDLE holders. Currently, about 30% of PENDLE tokens are locked as vePENDLE, and 80% of the fees generated by the platform are allocated to vePENDLE holders. The average lock-up time of vePENDLE reaches 388 days, further highlighting the long-term confidence of the community. The total amount of PENDLE in circulation in the market is currently 164,798,902, and the total amount of locked PENDLE is 52,372,379.

Users who support the appropriate funding pool for voting can enjoy an annualized rate of return of up to 4,399% (MUXLP pool). Additionally, users can increase their pool’s base annualized yield by 2.5x.

Pendle’s Upcoming Feature: Boros

Pendle will be launching a new feature next year, Boros. Boros (formerly Pendle V3) will support trading of new yield assets and introduce leverage through margin trading capabilities, enabling unprecedented capital efficiency on any yield type, including off-chain yields. This will provide users with more trading opportunities and a higher leverage trading experience, while increasing platform fee income, all of which will be distributed to vePENDLE holders.

With Boros, Pendle is opening the next major chapter in the yield space, starting with a critical but underdeveloped type of yield in crypto – funding rates.

Perpetual swaps exchanges trade $150-200 billion per day, and funding rates play a major role in shaping traders’ strategies. With Boros, traders will be able to trade funding rates with flexibility and precision, enabling previously unattainable levels of sophistication. This innovation will not only redefine Pendle’s product range, but is also expected to reshape one of the world’s largest and most active markets.

Boros introduces a completely new infrastructure that runs alongside the existing Pendle V2, which will continue to be optimized and improved. We envision a future where traders and market makers incorporate Boros as part of their core yield strategies.

For example, there is currently no reliable way to hedge funding rates at scale. Take Ethena as an example, the yield and sustainability of the protocol depends heavily on the volatility of funding rates, which often involve billions of dollars in notional capital. .

The emergence of Boros changes this situation, providing an active and capital-efficient solution that enables traders to achieve absolute control and predictability of returns. Taking Ethena as an example, they can get a fixed funding rate return by hedging on Boros. From another perspective, speculators can use leverage to trade the volatility of funding rates and obtain potential excess returns, unlocking a new strategy space in the interest rate dimension.

The funding rate is just one of many new starting points for Boros. With the synergy of Boros and V2, the Pendle ecosystem is going all out to redefine the framework of DeFi returns.

Year-end Airdrop Benefits

Pendle will launch a large-scale airdrop at the end of the year, and each vePENDLE holder will receive airdrop rewards based on the points collected by the protocol. The vePENDLE holding snapshot will be taken at 23:59 (UTC) on December 31, 2024, and the corresponding tokens will be distributed proportionally.

Please note that this airdrop is only for individual vePENDLE holders, and third-party liquidity lockers will not be included in the airdrop.

Tokens to be distributed include:

More tokens may be added before the snapshot date.

The accumulated income and points since the announcement of the Boros function will also be distributed to vePENDLE's liquidity lockers to further incentivize user participation.

Pendle is continuously improving its core competitiveness in the field of decentralized finance through rich functional upgrades, generous user incentive plans and innovative revenue models. Community members are welcome to actively participate, lock vePENDLE, and enjoy more benefits and benefits.

You may also like

Key Market Information Discrepancy on January 15th - A Must-See! | Alpha Morning Report

Alibaba Backed Latin America Stablecoin Company, Why VelaFi?

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

US Senate Agriculture Committee Schedules January 27 for Crypto Market Structure Hearing

Key Takeaways The Senate Agriculture Committee will release its crypto market structure bill on January 21, followed by…

Key Market Information Discrepancy on January 14th – A Must-See! | Alpha Early Report

Key Takeaways Bitcoin reached a new milestone, hitting $96,000, while Ethereum surpassed $3,300. Privacy coins such as ORDI…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…

A Developer’s Three-Year Gamble on Base and the Turn Towards Solana

Key Takeaways: Base’s promise to support developers fell short, leading many to seek more supportive ecosystems. Developer frustration…

ETHGas Foundation Coin Issuance: Examining the Emotional Transaction Mechanism and Global Insights

Key Takeaways Zama’s token auction on CoinList is polarizing, showcasing potential for future applications amidst short-term market skepticism.…

a16z Secures $15 Billion: Redefining Venture Capital Through Visionary Storytelling

Key Takeaways a16z Raises Capital: The firm has raised an astronomical $15 billion, marking a significant point in…

Founder of DeepSeek’s Magic Square Quantitative Strategy Achieved a 56.55% Return in 2025

Key Takeaways Huansquare Quant, led by Liang Wenfeng, achieved a 56.55% return in 2025. The fund’s assets under…

Analyst: MSTR is the “Mullet” of this Bitcoin Bull Cycle, Acting as a Bitcoin Pressure Relief

MSTR absorbed significant volatility in this Bitcoin cycle, easing potential pressure on Bitcoin itself. Michael Saylor’s strategic issuance…

XMR Surges Over 50% in One Week: Who’s Buying?

Key Takeaways Monero (XMR) defies regulatory pressures, marking a 262% increase since January 2025, reaching an all-time high…

BitGo’s Revenue Surges with Upcoming IPO as Institutional Interest Grows

Key Takeaways BitGo, a major player in cryptocurrency custody, aims to raise $201 million through a U.S. IPO…

The New Era in Bitcoin Core Development: The Rise of Core Maintainer TheCharlatan

Key Takeaways Integration of a New Maintainer: For the first time in three years, a new Bitcoin Core…

Bitwise CIO Predicts Parabolic Bitcoin Surge with Sustained ETF Demand

Key Takeaways Prolonged demand for Bitcoin ETFs may lead to a parabolic rise in Bitcoin’s price, drawing parallels…

Binance Alpha to Launch Empire of Sight (Sight) on January 14

Key Takeaways Binance Alpha will kick off the trading of Empire of Sight (Sight) at 16:00 (UTC+8) on…

Today’s Trump Tariff Decision and Economic Data Releases

Key Takeaways The U.S. Supreme Court is set to rule on a significant Trump tariff case that could…

Binance Wallet Partners with Aster, Launches Seamless On-chain Perpetual Contract Trading

Key Takeaways: Binance Wallet has integrated with Aster to offer a streamlined and stable perpetual contract trading feature…

Key Market Information Discrepancy on January 15th - A Must-See! | Alpha Morning Report

Alibaba Backed Latin America Stablecoin Company, Why VelaFi?

AI Crypto Trading in 2026: How AI Agents Use Stablecoins for Capital Management and Settlement

Learn how AI agents use stablecoins for crypto trading in 2026 — managing capital, settling transactions, and operating across exchanges and DeFi protocols.

US Senate Agriculture Committee Schedules January 27 for Crypto Market Structure Hearing

Key Takeaways The Senate Agriculture Committee will release its crypto market structure bill on January 21, followed by…

Key Market Information Discrepancy on January 14th – A Must-See! | Alpha Early Report

Key Takeaways Bitcoin reached a new milestone, hitting $96,000, while Ethereum surpassed $3,300. Privacy coins such as ORDI…

Tether Freezes $182 Million in Assets in a Day: Is USDT Still a Neutral Coin?

Key Takeaways Tether recently froze $182 million in USDT across five wallets on the Tron blockchain, raising questions…