Perp DEX Showdown: Who Is the Winner?

Original Article Title: The Perp DEX Wars of 2025: Hyperliquid, Aster, Lighter, and EdgeX

Original Article Author: @stacy_muur

Translation: Peggy, BlockBeats

Editor's Note: The decentralized perpetual contract exchange (Perp DEX) track has undergone drastic changes in the past year: from Hyperliquid's absolute dominance to the rise of Aster, Lighter, and EdgeX, the market landscape is being reshaped.

This article provides an in-depth analysis of the four major platforms from the perspectives of technical architecture, key metrics, risk events, and long-term viability, aiming to help readers see the "truth behind the data" rather than relying solely on trading volume rankings.

The following is the original article:

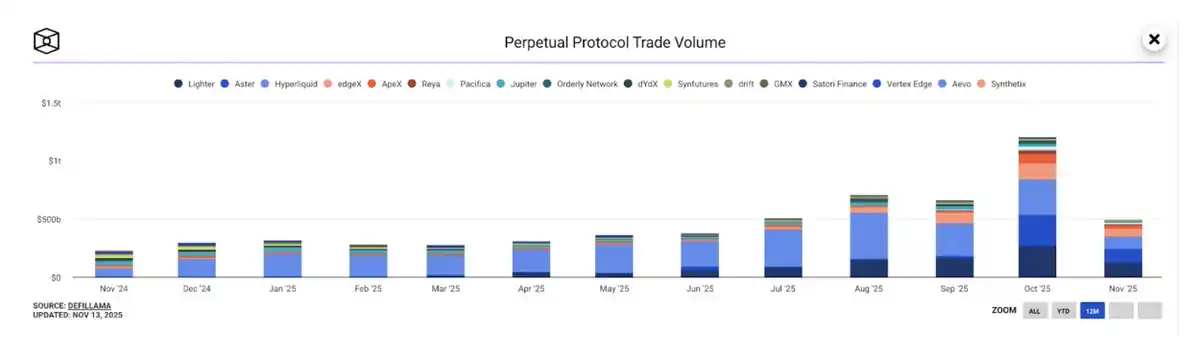

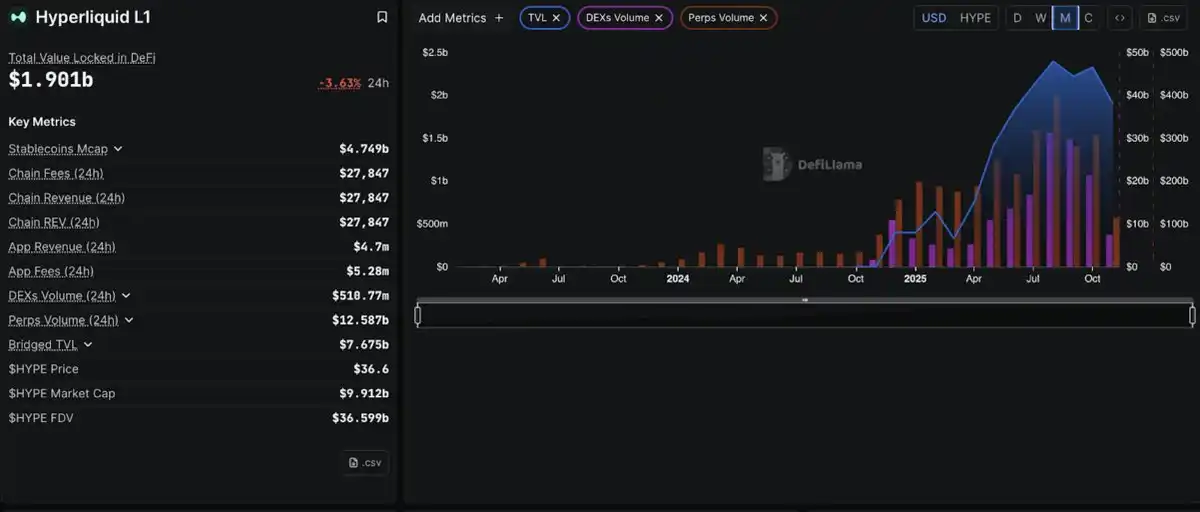

In 2025, the decentralized perpetual contract (perp DEX) market experienced explosive growth. In October 2025, the monthly trading volume of perpetual contract DEX surpassed $12 trillion for the first time, quickly attracting high attention from retail traders, institutional investors, and venture capital funds.

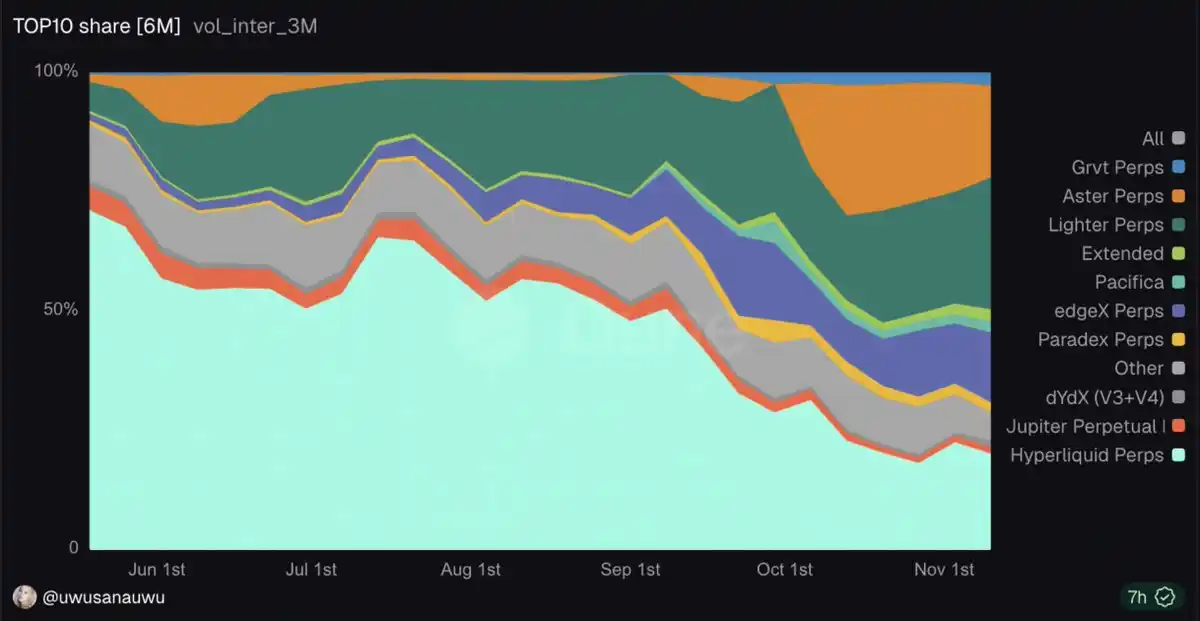

Over the past year, Hyperliquid almost monopolized the lead, reaching its peak in May this year, occupying 71% of on-chain perpetual contract trading volume. However, by November, its market share had plummeted to only 20%, with emerging competitors quickly seizing territory:

- Lighter: 27.7%

- Aster: 19.3%

- EdgeX: 14.6%

In this rapidly evolving ecosystem, the four dominant players have already emerged, engaging in fierce competition for industry dominance:

@HyperliquidX – The veteran champion of on-chain perpetual contracts

@Aster_DEX – The massive trading volume, controversy-ridden "rocket"

@Lighter_xyz – The disruptor with zero fees and native zk

@edgeX_exchange – The "dark horse" quietly aligned with institutions

This in-depth investigation aims to dispel the fog, dissecting the technical strength, key metrics, controversial focus, and long-term viability of each platform.

Part 1: Hyperliquid, the Undisputed Champion

Why Hyperliquid Reigns Supreme

Hyperliquid has solidified its position as the industry-leading decentralized perpetual contract trading platform, with a peak market share exceeding 71%. Despite competitors grabbing headlines with explosive trading volume growth, Hyperliquid remains a foundational pillar of the entire perpetual contract DEX ecosystem.

Technological Foundation

Hyperliquid's advantage stems from a revolutionary architectural decision: creating a custom Layer 1 blockchain designed specifically for derivative trading. Its HyperBFT consensus mechanism achieves sub-second order confirmation and supports 200,000 transactions per second, performance comparable to or even surpassing centralized exchanges.

The Truth About Open Interest

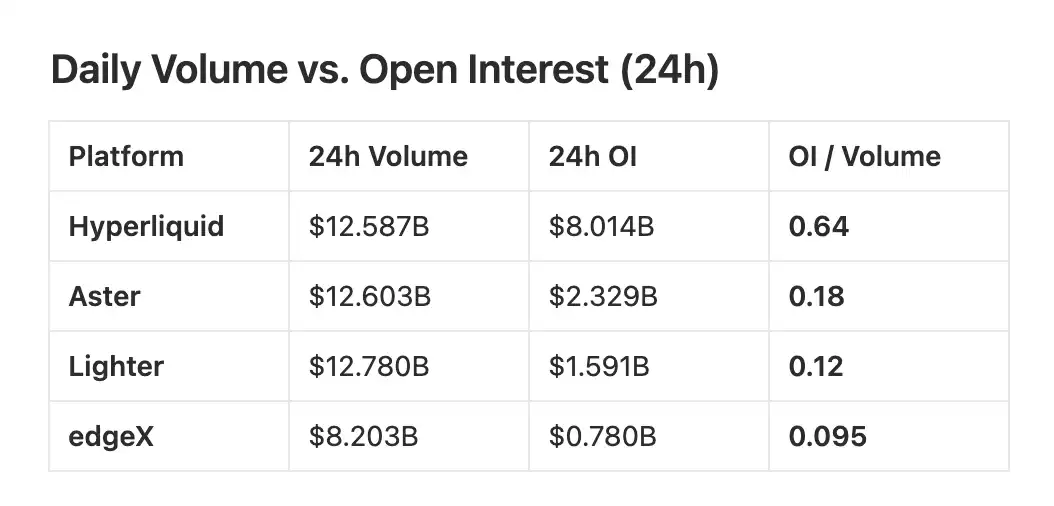

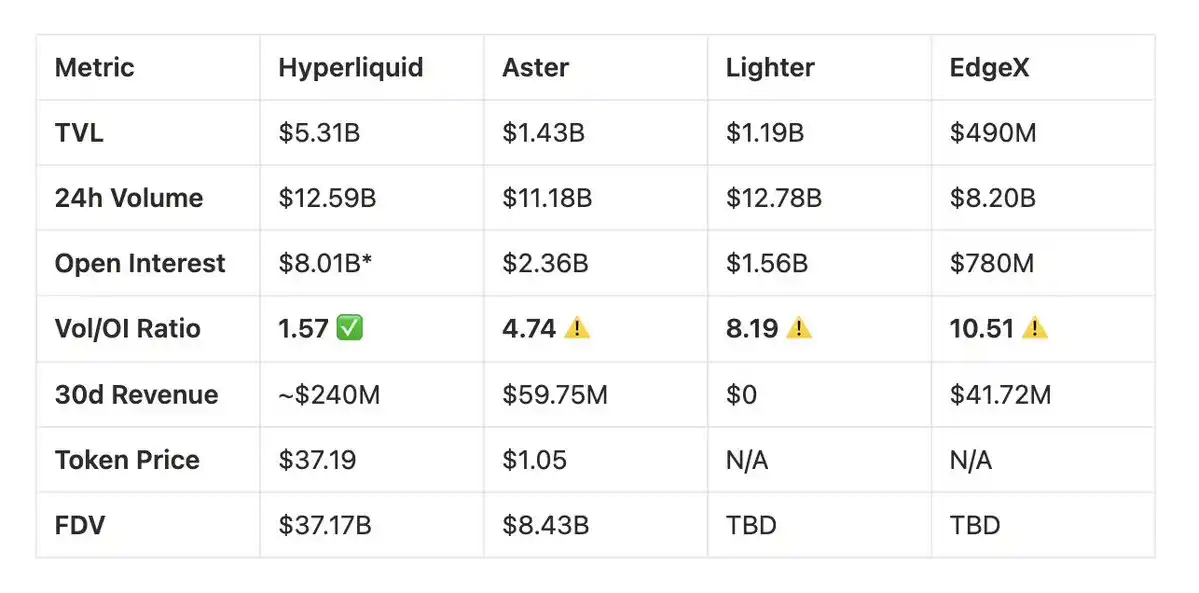

Competitors often attract attention with astounding 24-hour trading volumes, but the true indicator of capital deployment is Open Interest (OI), which represents the total value of all perpetual contracts still held.

Trading volume indicates activity, while Open Interest indicates capital commitment.

According to 21Shares data, as of September 2025: Aster occupies approximately 70% of total trading volume; Hyperliquid temporarily dropped to around 10%

However, this is only a volume advantage, and trading volume is the most easily manipulated metric through incentives, rebates, market maker frequent trading, or even "wash trading" behavior.

The latest 24-hour Open Interest data shows:

-Hyperliquid: $8.014B

-Aster: $2.329B

-Lighter: $1.591B

-edgeX: $780.41M

Total OI for the top four platforms: $12.714B

Hyperliquid's share: approximately 63%

This means that Hyperliquid holds nearly two-thirds of the entire market's Open Interest, surpassing the combined total of Aster, Lighter, and edgeX.

Open Interest Market Share (24h)

- Hyperliquid: 63.0%

- Aster: 18.3%

- Lighter: 12.5%

- edgeX: 6.1%

This metric reflects traders' willingness to hold funds overnight rather than purely for incentive mining or high-frequency trading.

Hyperliquid: High OI/Volume ratio (around 0.64), indicating a significant amount of trading volume translating into sustained open positions.

Aster & Lighter: Low ratios (around 0.18 and 0.12), suggesting frequent trading but minimal fund retention, typical of incentive-driven behavior rather than stable liquidity provision.

Full Picture

Trading Volume (24h): Indicates short-term activity

Open Interest (24h): Indicates retained risk capital

OI/Volume Ratio (24h): Reveals genuine trading vs incentive-driven trading

Across all OI-related metrics, Hyperliquid emerges as the structural leader: highest open interest; largest share of committed funds; strongest OI/Volume ratio; total OI exceeding the sum of the latter three platforms

While trading volume rankings may fluctuate, open interest unveils the true market frontrunner, which is Hyperliquid.

Real-World Validation

During the liquidation event in October 2025, $190 billion in positions were liquidated, and Hyperliquid maintained zero downtime during the peak trading volume.

Institutional Recognition

21Shares has submitted the Hyperliquid (HYPE) product application to the U.S. SEC and listed a regulated HYPE ETP on the Swiss stock exchange. These developments (including coverage on platforms like CoinMarketCap) indicate increasing institutional access to HYPE. The HyperEVM ecosystem is also expanding, although public data has not yet validated claims of "180+ projects" or "$4.1B TVL."

Conclusion

Based on the current record-keeping, exchange listings, and ecosystem growth, Hyperliquid demonstrates a strong momentum and increasing institutional recognition, further solidifying its position as a leading DeFi derivatives platform.

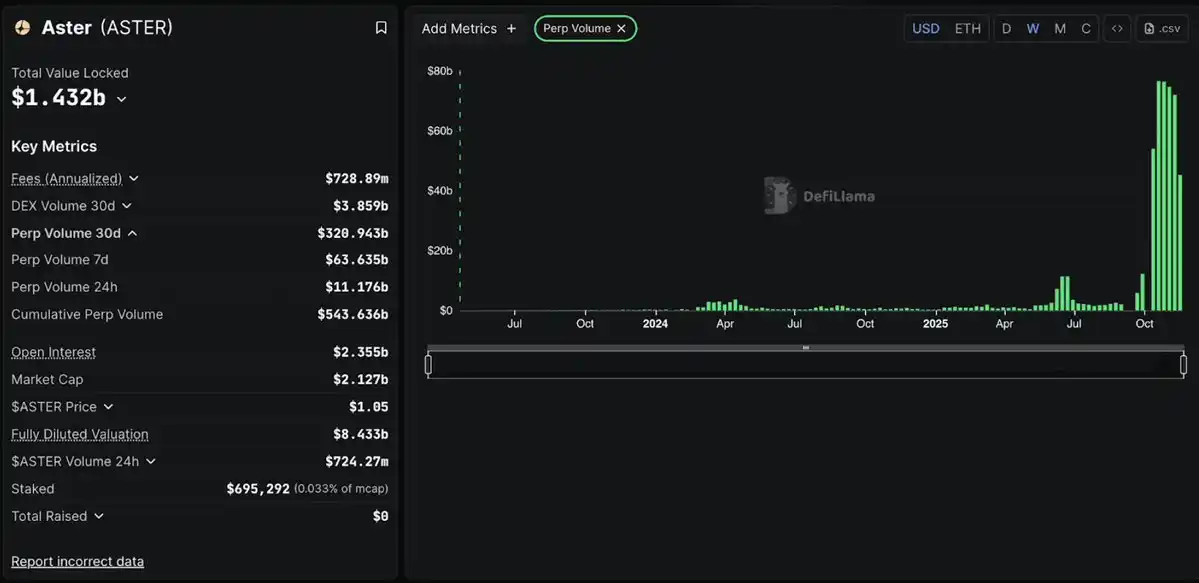

Part 2: Aster, Explosive Growth Amid Controversy

Aster's Positioning

Aster is a multi-chain perpetual contract trading platform that launched in early 2025 with a clear goal: to provide users with high-speed, high-leverage derivative trading on networks such as BNB Chain, Arbitrum, Ethereum, and Solana without the need for cross-chain asset transfers.

The project did not start from scratch but rather originated from the merger of Asterus and APX Finance at the end of 2024, combining APX's mature perpetual contract engine with Asterus's liquidity technology.

Explosive Rise

Aster launched on September 17, 2025, at $0.08 and skyrocketed to $2.42 in just one week, a staggering 2800% increase. The daily trading volume surged past $700 billion at its peak, temporarily dominating the entire perpetual contract DEX market.

The fuel for this "rocket"? CZ. The founder of Binance supported Aster through YZi Labs and personally tweeted to boost it, causing the token's price to soar. In the first 30 days of trading, Aster's cumulative trading volume exceeded $320 billion, briefly capturing over 50% market share.

DefiLlama Delisting Incident

On October 5, 2025, as the most trusted data source in the crypto industry, DefiLlama delisted Aster's data due to its trading volume being nearly identical to Binance's trading volume (1:1 correlation).

Real trading platforms exhibit natural fluctuations, and perfect correlation only means one thing: data manipulation.

Evidence includes:

- Trading volume patterns perfectly synchronized with Binance (across all pairs like XRP, ETH, etc.)

- Aster's refusal to provide trading data, making it impossible to verify the authenticity of trades

- 96% of ASTER tokens concentrated in 6 wallets

- Transaction Volume/OI Ratio as high as 58+ (Healthy level should be below 3)

ASTER token immediately dropped by 10%, from $2.42 to approximately $1.05

Aster's Defense

CEO Leonard claimed that this correlation was only due to "airdrop users" hedging on Binance. But if true, why refuse to provide public data as proof?

Weeks later, Aster relisted, but DefiLlama warned: "It's still a black box, we can't verify the data."

Its Actual Offerings

To be fair, Aster does have some technical highlights: 1001x leverage; hidden orders; multi-chain support (BNB, Ethereum, Solana); stakable collateral

Furthermore, Aster is building the Aster Chain based on zero-knowledge proofs for privacy protection. However, even great technology cannot cover up fake metrics.

Conclusion

Concrete evidence:

- Perfect correlation with Binance = Wash trading

- Lack of transparency = Concealment of facts

- 96% token concentration = High centralization

- DefiLlama delisting = Reputation collapse

Aster captured significant value through CZ's hype and fake trading volume but failed to establish a real infrastructure. Perhaps surviving due to Binance support, its reputation has been permanently damaged.

To Traders: High risk, you are betting on CZ's narrative, not real growth. Please set strict stop losses.

To Investors: Avoid, too many red flags, there are better options in the market (e.g., Hyperliquid).

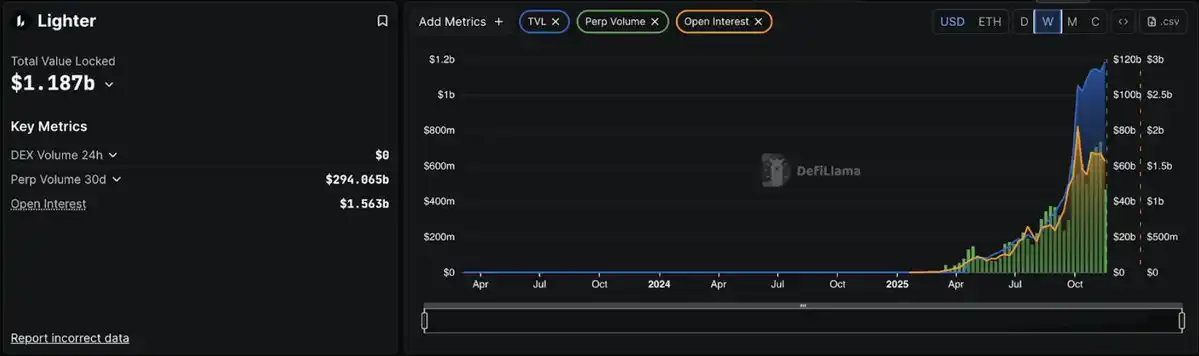

Part Three: Lighter, Impressive Tech, Doubtful Metrics

Technological Advantages

Lighter is unique. Founded by a former Citadel engineer and backed by Peter Thiel, a16z, and Lightspeed (raised $68 million, $15 billion valuation), its core technology involves encrypting every transaction using Zero-Knowledge Proofs (ZK).

As an Ethereum Layer 2 (L2), Lighter inherits Ethereum's security through an "escape hatch" mechanism—even if the platform fails, users can still retrieve funds via smart contract. Application chains on L1 do not have this security feature.

Lighter launched on October 2, 2025, and within weeks, its TVL surpassed $11 billion, with a daily trading volume of $70-80 billion and over 56,000 users.

Zero Fees = Aggressive Strategy

Lighter charges 0 fees for both Maker and Taker transactions, completely disrupting the decision-making of fee-sensitive traders.

The strategy is simple: to capture market share through an unsustainable economic model, build user loyalty, and subsequently achieve profitability.

October 11 Stress Test

10 days after the mainnet launch, the crypto market experienced its largest liquidation event in history, with $190 billion in positions liquidated.

Good news: The system remained operational during a 5-hour turmoil, with LLP providing liquidity as competitors retreated.

Bad news: The database crashed after 5 hours, leading to a 4-hour platform outage.

Worse news: LLP incurred losses, while Hyperliquid's HLP and EdgeX's eLP were profitable.

Founder Vlad Novakovski explained: The original plan was to upgrade the database on Sunday, but the intense Friday fluctuations prematurely crippled the old system.

Volume Manipulation

Data strongly suggests wash trading behavior:

- 24-hour trading volume: $127.8 billion

- Open interest (OI): $15.91 billion

- Volume/OI ratio: 8.03

- Healthy range = below 3, suspicious above 5, 8.03 is extremely abnormal.

Comparison:

Hyperliquid: 1.57 (Natural)

EdgeX: 2.7 (Moderate)

Aster: 5.4 (Concerning)

Lighter: 8.03 (Severe wash trading)

For every $1 deployed by traders, $8 in trading volume is generated—indicative of frequent flipping for wash trading, not actual positions held.

30-day data validation: $2.94 trillion trading volume vs. $470 billion cumulative OI = 6.25 ratio, still significantly above a reasonable level.

Airdrop Question

The Lighter loyalty program is highly aggressive. Loyalty points will be converted to LITER tokens at TGE (expected in Q4 2025/Q1 2026). The OTC market values points at $5-100+, with a potential airdrop value of tens of thousands of dollars, explaining the explosive trading volume.

Key question: What will happen after TGE? Will users stay or will trading volume collapse?

Conclusion

Advantages:

Cutting-edge technology (ZK verification in place)

Zero fees = a true competitive advantage

Inherited Ethereum security

Top-tier team with capital backing

Concerns:

8.03 transaction volume/OI ratio = severe wash trading

LLP incurred losses in stress testing

4-hour downtime raised questions

Post-airdrop user retention not validated

Key difference from Aster: No wash trading accusations, no DeFiLlama delisting. The high ratio reflects aggressive but temporary incentives, not systematic fraud.

Bottom Line Assessment: Lighter boasts world-class technology but is shrouded in suspicious metrics. Can they convert wash traders into real users? Tech says "can," history says "maybe not."

To wash traders: Good opportunity before TGE.

To investors: Wait 2-3 months after TGE, observe if trading volume sustains.

Probability assessment: 40% become a top-three platform, 60% devolve into another "wash farm," just with better underlying technology.

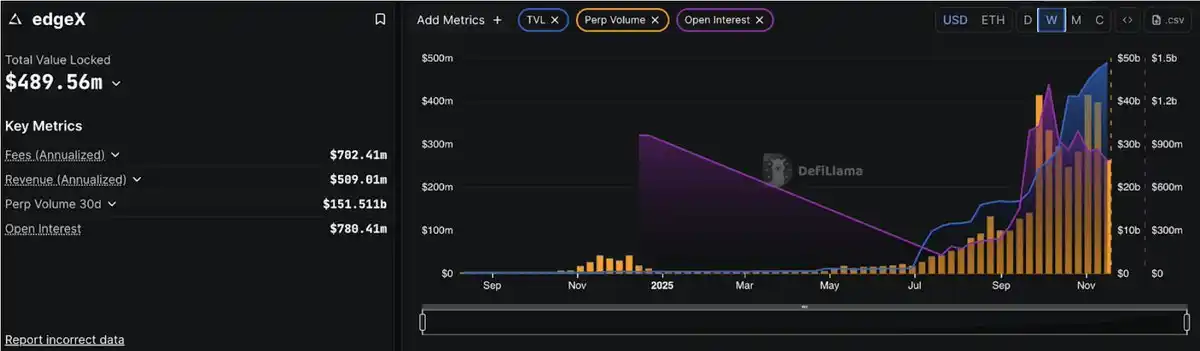

Part Four: EdgeX, Institutional-Grade Pro Player

Amber Group's Advantages

EdgeX operates differently. It originates from Amber Group's incubator (managing $50 billion AUM), with team members from Morgan Stanley, Barclays, Goldman Sachs, Bybit. This isn't "crypto-native" learning finance but traditional finance (TradFi) experts bringing institutional experience into DeFi.

Amber's market-making DNA directly empowers EdgeX: deep liquidity, tight spreads, and execution quality rivaling centralized exchanges. The platform launched in September 2024 with a clear goal: achieve CEX-level performance without sacrificing self-custody.

Built on StarkEx (StarkWare's mature ZK engine), EdgeX can process 200,000 orders per second, with latencies below 10 milliseconds, on par with Binance's speed.

Lower Fees Than Hyperliquid

EdgeX excels in fees compared to Hyperliquid:

Taker Fee: EdgeX 0.038% vs Hyperliquid 0.045%

Maker Fee: EdgeX 0.012% vs Hyperliquid 0.015%

For a trader with a monthly volume of $10 million, savings can amount to $7,000-$10,000 per year, and at the retail order level (<$6 million), EdgeX offers better liquidity, tighter spreads, and lower slippage.

Real Revenue, Healthy Metrics

Unlike Lighter's zero-fee model or Aster's questionable data, EdgeX has created real, sustainable revenue:

TVL: $4.897 billion

24-Hour Trading Volume: $82 billion

Open Interest (OI): $7.8 billion

30-Day Revenue: $41.72 million (147% QoQ growth)

Annualized Revenue: $5.09 billion (second only to Hyperliquid)

Trading Volume/OI Ratio: 10.51 (seemingly high, but requires in-depth analysis)

At first glance, 10.51 may seem high, but context is crucial: EdgeX initially employed an aggressive incentive program to drive liquidity at launch, and as the platform matures, this ratio is steadily improving. More importantly, EdgeX has maintained healthy revenue during this period, proving the presence of real traders rather than pure wash traders.

October Stress Test

During the market crash on October 11th ($190 billion liquidated), EdgeX performed exceptionally:

No downtime (Lighter had 4 hours of downtime)

eLP Treasury remained profitable (Lighter's LLP suffered losses)

Liquidity Provider Annualized Return Rate 57% (industry-leading)

The eLP (EdgeX Liquidity Pool) demonstrated outstanding risk management capabilities during extreme volatility, remaining profitable while competitors faced difficulties.

EdgeX Differentiation Advantages

Multi-Chain Flexibility: Supports Ethereum L1, Arbitrum, BNB Chain; Collateral supports USDT and USDC; Cross-chain deposits and withdrawals (Hyperliquid limited to Arbitrum).

Best Mobile Experience: Official iOS and Android apps (not available on Hyperliquid), simple interface for easy position management anytime.

Asian Market Strategy: Actively positioning in the Asian market through localized support and participation in Korea Blockchain Week, seizing the region overlooked by Western competitors.

Transparent Incentive Program: 60% Trading Volume, 20% Referrals, 10% TVL/Treasury, 10% Liquidation/OI

Clear Statement: "No volume mining rewards," and the metrics validate this—trading volume/OI ratio is improving, not deteriorating.

Challenges

Market Share: Only accounts for 5.5% of perpetual contract DEX open interest, to grow, more aggressive incentives (risk of score manipulation) or major partnerships are required.

Lack of "Killer Feature": EdgeX performs well in all aspects but lacks disruptive innovation, presenting itself as a "business-class" option, professional but not dazzling.

Unable to Compete with Lighter on Fees: Zero fees make EdgeX's "lower than Hyperliquid" advantage less attractive.

Late TGE Timing: Expected in Q4 2025, missing out on the initial airdrop frenzy.

Conclusion

EdgeX is the choice for professional users—reliability triumphs over flashiness.

Advantages:

Amber Group institutional support

$5.09 billion annual revenue

Treasury profitability in stress tests, APY up to 57%

Fees lower than Hyperliquid

No volume mining scandals, clean metrics

Multi-chain support + Best mobile experience

Concerns:

Small market share (5.5% OI)

Trading volume/OI ratio still high (but improving)

Lack of unique selling points

Pressure from zero fee competition

Target Audience:

Asian traders needing localized support

Institutional User, Emphasizing Amber Liquidity

Conservative Trader, Prioritizing Risk Management

Mobile-First User

LP Investor Seeking Stable Returns

Bottom Line Assessment: EdgeX is poised to capture a 10-15% market share in the Asian market, among institutions and conservative traders. It will not threaten Hyperliquid's dominant position, but it doesn't need to—it is building a sustainable, profitable niche market.

Think of it as the "Kraken of Perpetual Contract DEX": Not the largest, not the flashiest, but sturdy, professional, and highly valued by mature users who prioritize execution quality.

For Yield Farmers: Moderate opportunity, less intense competition compared to other platforms.

For Investors: Suitable for small position diversified investments, low risk, low return.

Comparative Analysis: Perp DEX Wars

Trading Volume/Open Interest (OI) Analysis

Industry Standard: Healthy Ratio ≤ 3

Hyperliquid: 1.57 ✅ Indicates a strong organic trading pattern

Aster: 4.74 ⚠️ Slightly high, reflecting significant incentive activities

Lighter: 8.19 ⚠️ High ratio implies incentive-driven trading

EdgeX: 10.51 ⚠️ Points plan impact is evident, but showing improvement

Market Share: Open Interest Distribution

Total Market: Approximately $13B OI

Hyperliquid: 62% - Market Leader

Aster: 18% - Strong Second Tier

Lighter: 12% - Continued Growth

EdgeX: 6% - Focused on a niche market

Platform Overview

Hyperliquid - Seasoned Leader

Controls 62% market share, stable metrics

Annual Revenue $2.9B, active buyback program

Community Ownership Model, Reliable Performance

Advantages: Market Leadership, Sustainable Economic Model

Rating: A+

Aster - High Growth, High Uncertainty

Strong Integration with BNB Ecosystem, CZ Endorsement

Faced DefiLlama Data Scrutiny in October 2025

Multi-chain Strategy Driving Adoption

Advantages: Ecosystem Support, Retail User Coverage

Concerns: Need to Monitor Data Transparency Issues

Rating: C+

Lighter - Technology Vanguard

Zero Fee Model, Advanced ZK Verification

Top-tier Investors (Thiel, a16z, Lightspeed)

Prior to TGE Stage (2026 Q1), Limited Performance Data

Advantages: Technological Innovation, Ethereum L2 Security

Concerns: Business Model Sustainability, User Retention Post Airdrop

Rating: Not Completed (Awaiting TGE Performance)

EdgeX - Institution-driven

Endorsed by Amber Group, Professional-grade Execution

$509M Annualized Revenue, Stable Treasury Performance

Asia Market Strategy, Mobile-first

Advantages: Institutional Reputation, Steady Growth

Concerns: Small Market Share, Competitive Positioning

Rating: B

Investment Considerations

Exchange Selection:

Hyperliquid: Deepest Liquidity, Reliability Validation

Lighter: Zero Fees, Suitable for High-frequency Traders

EdgeX: Lower Fees than Hyperliquid, Excellent Mobile Experience

Aster: Multi-chain Flexibility, BNB Ecosystem Integration

Token Investment Timeline:

HYPE: Now Available, $37.19

ASTER: Trading at $1.05, watch for future developments

LITER: TGE 2026 Q1, metrics to be evaluated post-launch

EGX: TGE 2025 Q4, observe initial performance

Key Takeaways

Market Maturity: Clear differentiation in the Perp DEX space, with Hyperliquid establishing dominance through sustainable metrics and community collaboration.

Growth Strategies: Each platform targets different user demographics—Hyperliquid (Professional), Aster (Retail/Asia), Lighter (Tech), EdgeX (Institutional).

Metrics Focus: Metrics such as Trading Volume/OI ratio and Revenue Generation Ratio can better reflect performance than mere trading volume.

Future Outlook: Post-TGE performance of Lighter and EdgeX will determine long-term competitiveness; Aster's future hinges on addressing transparency issues and maintaining ecosystem support.

You may also like

Hyperliquid Introduces Direct ETH Deposits and Withdrawals for Enhanced Spot Trading

Key Takeaways Hyperliquid has officially rolled out direct Ethereum deposits and withdrawals, streamlining its spot trading capabilities. The…

Hyperliquid Revolutionizes DeFi with Advanced Blockchain Solutions

Key Takeaways Hyperliquid is transforming decentralized finance (DeFi) with high-performance solutions and an emphasis on perpetual futures trading.…

Market Correction Impacts Meme Coins: WhiteWhale Declines by 75%

Key Takeaways WhiteWhale has experienced a significant drop, losing 32.3% of its value in the past 24 hours,…

Backers Seek Refunds as Trove Abandons Hyperliquid Integration for Solana

Key Takeaways: Trove pivots to Solana after raising over $11.5 million for Hyperliquid integration, leading to refund demands.…

The opening price is expected to drop by 75%, perhaps the first project to be rug pulled this year.

Key Market Intelligence on January 19th, how much did you miss out on?

Discontent Among Trove Backers as Project Shifts from Hyperliquid to Solana

Key Takeaways Trove Markets, originally building on Hyperliquid, is facing backlash for its unexpected shift to Solana, leading…

2025 Exchange Rankings: CEX Spot Trading Volume Sees Slight Increase, Binance Maintains Absolute Leadership

Delphi Digital's Top 10 Predictions for 2026: Perp DEX Eats Wall Street, AI Agents Usher in Era of Autonomous Trading

Layoffs of 30%, But Spending $250 Million to Buy a Company - What Is Polygon Thinking?

Which Protocols Drained the Crypto Market in 2025?

Binance Alpha to Launch Empire of Sight (Sight) on January 14

Key Takeaways Binance Alpha will kick off the trading of Empire of Sight (Sight) at 16:00 (UTC+8) on…

Today’s Trump Tariff Decision and Economic Data Releases

Key Takeaways The U.S. Supreme Court is set to rule on a significant Trump tariff case that could…

Binance Wallet Partners with Aster, Launches Seamless On-chain Perpetual Contract Trading

Key Takeaways: Binance Wallet has integrated with Aster to offer a streamlined and stable perpetual contract trading feature…

ASTER’s Largest Long Position on Hyperliquid Faces Significant Challenges

Key Takeaways A significant long position on ASTER is experiencing notable floating losses, revealing the volatility of crypto…

Flashbot Whale “pension-usdt.eth” Liquidates ETH Long, Profits $4.728 Million

Key Takeaways A Binance whale known as “pension-usdt.eth” successfully closed a 20,000 ETH long position, netting a profit…

Aster Experiences Over 5% Surge Amid Binance’s New Feature Announcement

Key Takeaways Aster saw a rapid increase of over 5% in its price, largely due to Binance launching…

The “20 Million Bandit” and “Shanzhai Air Force Leader” Bearish on LTC with Massive Short Positions

Key Takeaways Notable crypto entities, the “20 Million Bandit” and “Shanzhai Air Force Leader”, have significantly increased their…

Hyperliquid Introduces Direct ETH Deposits and Withdrawals for Enhanced Spot Trading

Key Takeaways Hyperliquid has officially rolled out direct Ethereum deposits and withdrawals, streamlining its spot trading capabilities. The…

Hyperliquid Revolutionizes DeFi with Advanced Blockchain Solutions

Key Takeaways Hyperliquid is transforming decentralized finance (DeFi) with high-performance solutions and an emphasis on perpetual futures trading.…

Market Correction Impacts Meme Coins: WhiteWhale Declines by 75%

Key Takeaways WhiteWhale has experienced a significant drop, losing 32.3% of its value in the past 24 hours,…

Backers Seek Refunds as Trove Abandons Hyperliquid Integration for Solana

Key Takeaways: Trove pivots to Solana after raising over $11.5 million for Hyperliquid integration, leading to refund demands.…