Why Does the Price of Bitcoin Rise When the US Government Shuts Down?

The U.S. Government Shutdown has officially entered a record-breaking 36th day.

Over the past two days, global financial markets have experienced a downturn. The Nasdaq, Bitcoin, tech stocks, the Nikkei Index, and even safe-haven assets like Treasury bonds and gold have not been spared.

Fear has gripped the markets, while Washington politicians continue to bicker over the budget. Is there a connection between the U.S. Government Shutdown and the global financial market decline? The answer is emerging.

This is not a typical market pullback but a liquidity crisis triggered by the government shutdown. With fiscal spending frozen, hundreds of billions of dollars are locked in the Treasury's accounts, unable to flow into the market, disrupting the financial system's circulation.

The "True Culprit" of the Downturn: The Treasury's "Black Hole"

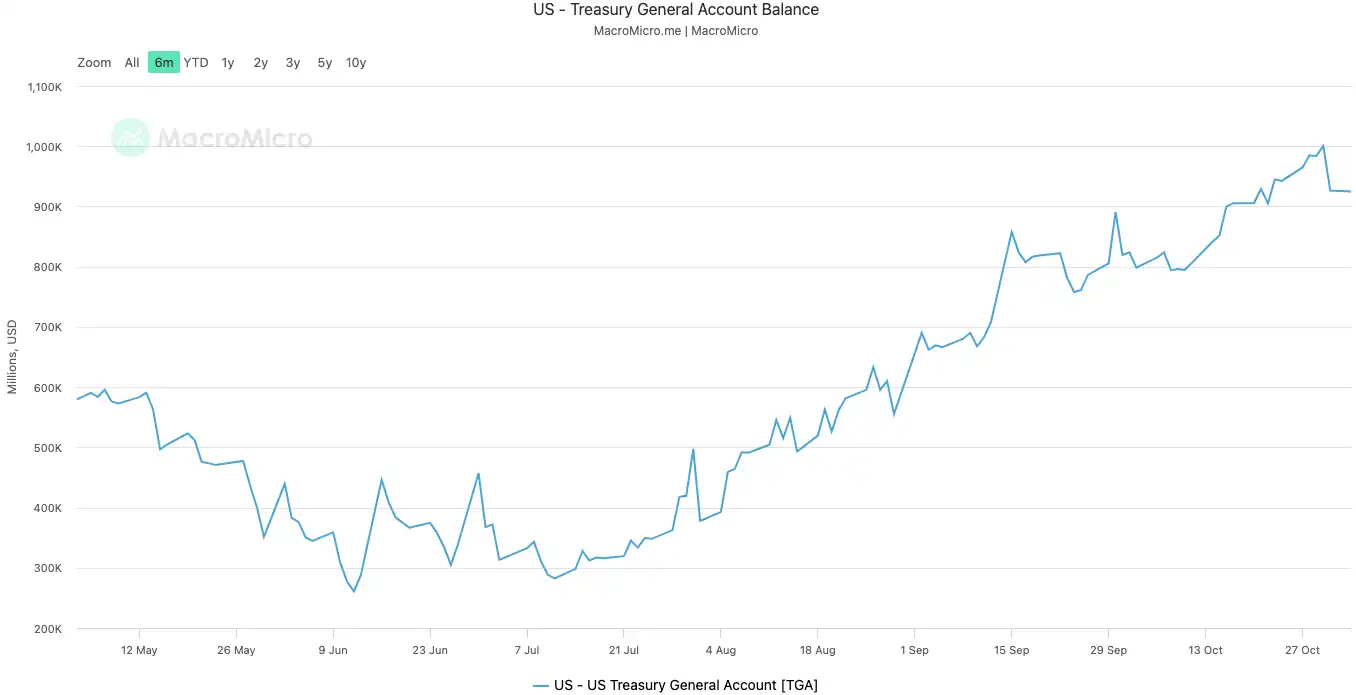

The U.S. Treasury's General Account, known as the TGA, can be understood as the U.S. government's central checking account held at the Federal Reserve. All federal revenues, whether from taxes or the issuance of Treasury securities, are deposited into this account.

Similarly, all government expenditures, from paying civil-servant salaries to defense spending, are disbursed from this account.

Under normal circumstances, the TGA serves as a fund's relay station, maintaining a dynamic balance. The Treasury receives money and promptly spends it, with funds flowing into the private financial system, becoming bank reserves, providing liquidity to the market.

The government shutdown has disrupted this cycle. While the Treasury continues to receive money through taxes and bond issuance, the TGA balance keeps growing. However, as most government agencies are closed due to Congress's failure to approve a budget, the Treasury cannot spend as planned. The TGA has turned into a financial black hole, receiving but not releasing funds.

Since the shutdown began on October 10, 2025, the TGA balance has expanded from around $800 billion to over $1 trillion by October 30. In just 20 days, over $200 billion has been sucked out of the market and locked in the Fed's vault.

U.S. Government's TGA Balance | Image Source: MicroMacro

Analysts suggest that the government shutdown has drained nearly $700 billion of liquidity from the market within a month. This effect is comparable to multiple rounds of Fed rate hikes or accelerated quantitative tightening.

When the reserve of the banking system is heavily siphoned off by the TGA, both the ability and willingness of banks to lend decrease significantly, leading to a surge in the market's funding cost.

The first to feel the chill are always those assets most sensitive to liquidity. The cryptocurrency market crashed after the shutdown on October 11, with the liquidation scale approaching $20 billion. Tech stocks also teetered this week, with the Nasdaq index falling 1.7% on Tuesday, plummeting after Meta and Microsoft's earnings reports.

The global financial market decline is the most tangible manifestation of this invisible tightening.

The System is "Running a Fever"

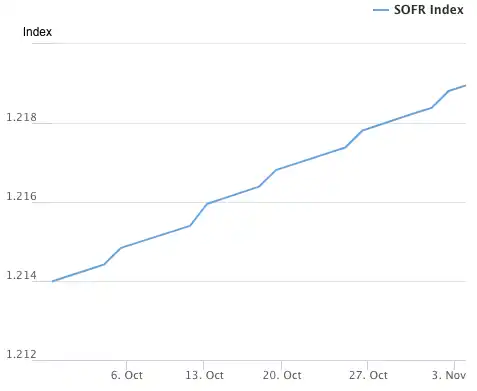

The TGA is the "cause" of the liquidity crisis, and the soaring overnight repo rate is the most direct symptom of the financial system "running a fever."

The overnight repo market is where banks lend short-term funds to each other, serving as the capillary of the entire financial system, with its rate being the most authentic indicator of the tightness of the banking system's "money root."

During times of abundant liquidity, interbank borrowing is easy and rates are stable. However, when liquidity is drained, banks run out of money and are willing to pay a higher price to borrow overnight.

Two key indicators clearly show how severe this high fever is:

The first indicator is the SOFR (Secured Overnight Financing Rate). On October 31, the SOFR surged to 4.22%, marking the largest daily increase in a year.

This rate is not only above the Federal Reserve's target range of 0-4.00%, but it is also 32 basis points higher than the effective federal funds rate, reaching its highest level since the market crisis in March 2020. The actual borrowing cost in the interbank market has spiraled out of control, far exceeding the central bank's policy rate.

Secured Overnight Financing Rate (SOFR) Index | Source: Federal Reserve Bank of New York

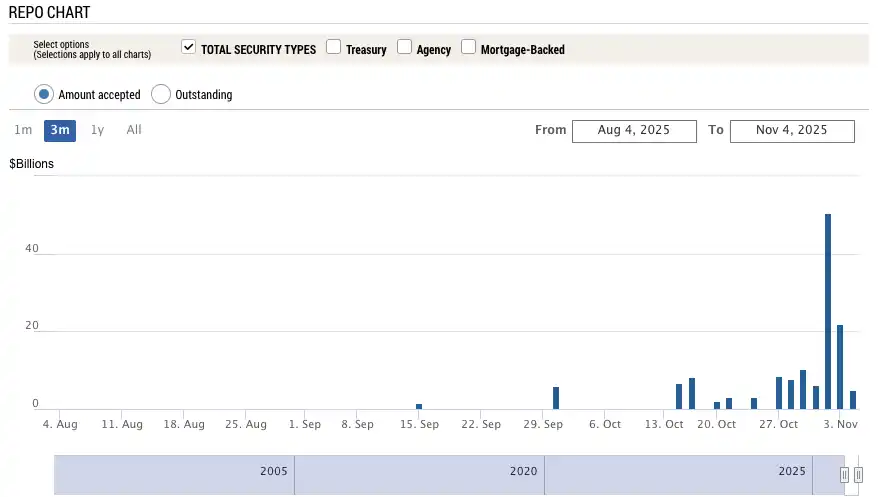

The second, even more astonishing indicator, is the amount of the Federal Reserve's SRF (Standing Repo Facility) usage. The SRF is an emergency liquidity tool provided by the Federal Reserve to banks so that when they can't borrow in the market, they can pledge high-grade bonds to the Fed in exchange for cash.

On October 31, SRF usage surged to $503.5 billion, hitting the highest level since the March 2020 pandemic crisis. The banking system has plunged into a severe dollar shortage, having to knock on the Fed's last resort window.

Sustainable Repo Facility (SRF) Usage|Source: Federal Reserve Bank of New York

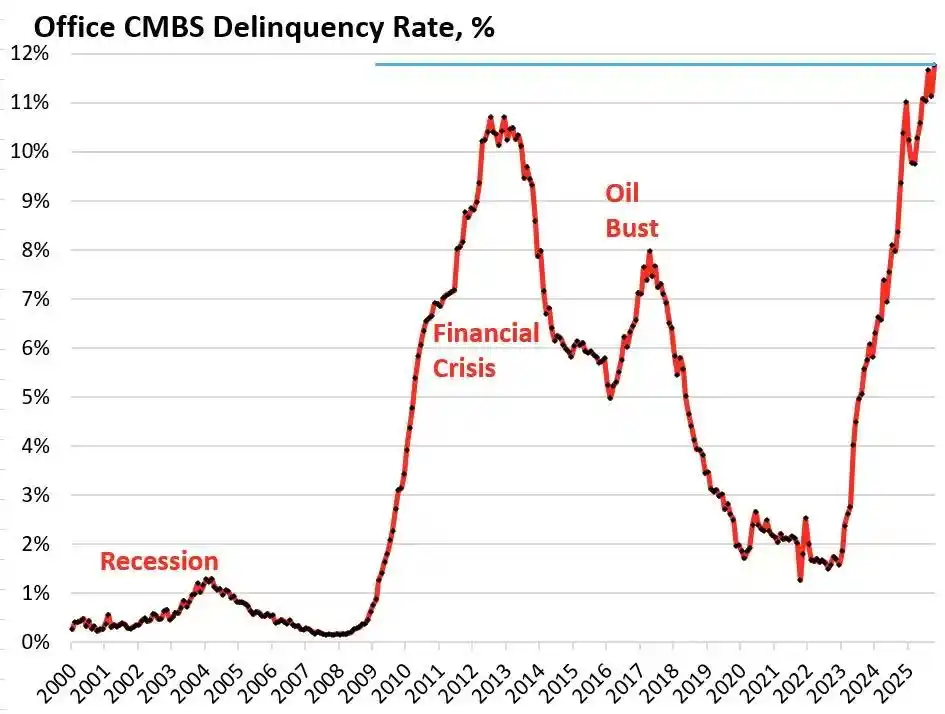

The overheating of the financial system is now transmitting pressure to the vulnerable sectors of the real economy, triggering long-dormant debt landmines. Currently, the two most dangerous areas are commercial real estate and auto loans.

According to data from research firm Trepp, the default rate for U.S. office CMBS commercial real estate mortgage-backed securities reached 11.8% in October 2025, hitting not only a historic high but also surpassing the peak of 10.3% during the 2008 financial crisis. In just three years, this number has surged nearly 10 times from 1.8%.

Default Rate of U.S. Office CMBS Commercial Real Estate Mortgage-Backed Securities|Source: Wolf Street

The Bravern Office Commons in Bellevue, Washington, is a typical case. This office building, once fully leased by Microsoft, was valued at $605 million in 2020. Now, with Microsoft's departure, the valuation has plummeted by 56% to $268 million and has entered default proceedings.

This most severe commercial real estate crisis since 2008 is spreading systemic risk throughout the entire financial system through regional banks, real estate investment trusts (REITs), and pension funds.

On the consumer side, the alarm bells for auto loans have also gone off. New car prices have soared to an average of over $50,000, and subprime borrowers are facing loan interest rates as high as 18-20%, ushering in a wave of defaults. As of September 2025, the default rate for subprime auto loans has approached 10%, and the overall auto loan delinquency rate has grown by over 50% in the past 15 years.

Under the pressure of high interest rates and inflation, the financial situation of America's lower-income consumers is rapidly deteriorating.

From the invisible tightening of the Treasury General Account (TGA), to the systemic overheating of overnight rates, to the debt landmines in commercial real estate and auto loans, a clear crisis transmission chain has emerged. The spark unexpectedly ignited by Washington's political deadlock is now setting off the structural weaknesses that have long existed within the U.S. economy.

How Are Traders Viewing the Market Outlook?

Facing this crisis, the market has fallen into a deep division. Traders stand at a crossroads, passionately debating the future direction.

The bearish camp represented by Mott Capital Management believes that the market is facing a liquidity shock comparable to the end of 2018. Bank reserve levels have dropped to a dangerous point, similar to the situation during the market turbulence caused by the Federal Reserve balance sheet reduction in 2018. As long as the government shutdown continues and the Treasury General Account (TGA) keeps draining liquidity, the market's pain will not end. The only hope lies in the Quarterly Refinancing Announcement (QRA) that the Treasury is expected to release on November 2nd. If the Treasury decides to lower the target balance of the TGA, it could release over $150 billion in liquidity into the market. However, if the Treasury maintains or increases the target, the market's winter could become even longer.

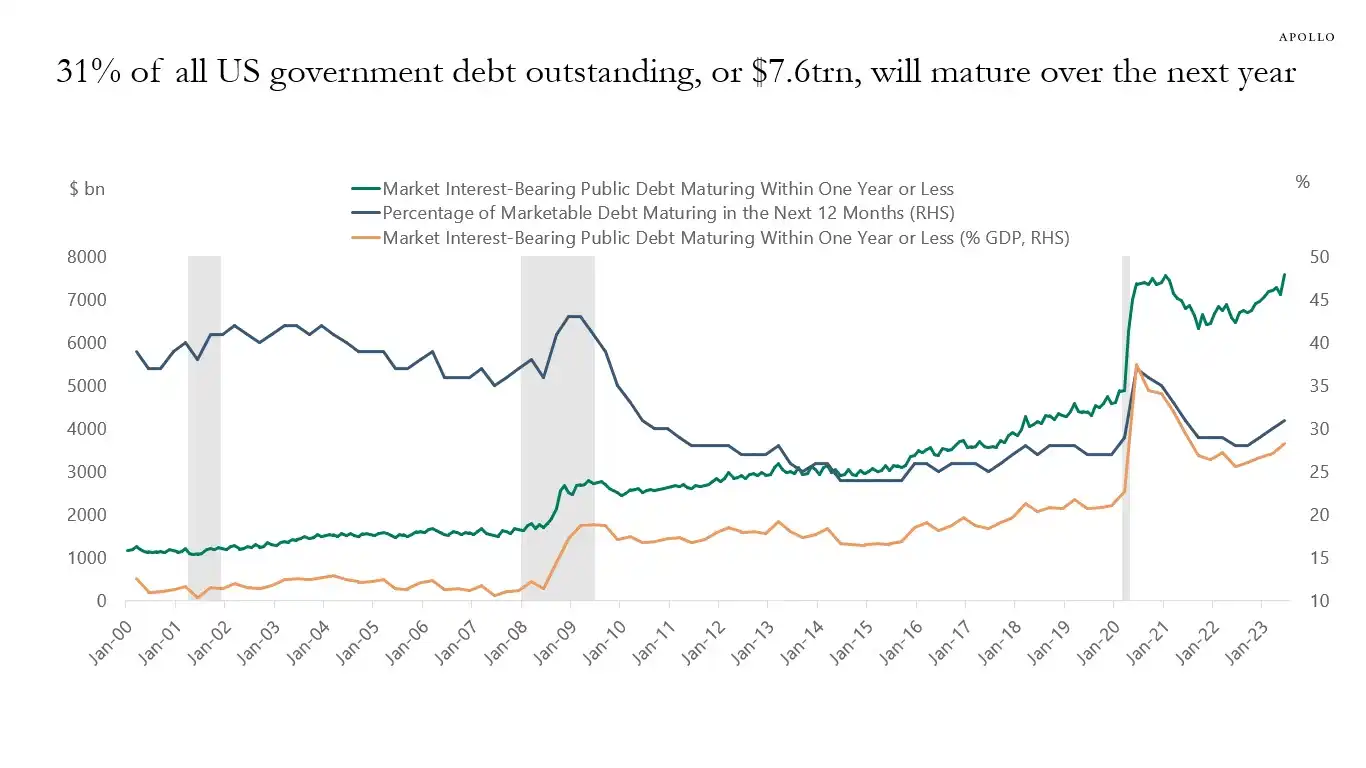

The optimistic camp led by renowned macro analyst Raoul Pal has put forward a fascinating theory called the "Pain Trade Window." He acknowledges that the current market is in a painful liquidity squeeze window but firmly believes that a liquidity flood will follow. Over the next 12 months, the U.S. government has up to $10 trillion in debt to roll over, forcing it to ensure market stability and liquidity.

31% of U.S. government debt (approximately $7 trillion) will mature in the next year, and with new debt issuance, the total amount could reach $10 trillion|Image Source: Apollo Academy

Once the government shutdown ends, suppressed hundreds of billions of dollars in fiscal spending will flood into the market like a deluge, and the Federal Reserve's Quantitative Tightening (QT) may also come to a technical end, and even reverse.

To gear up for the midterm elections in 2026, the U.S. government will stimulate the economy at any cost, including interest rate cuts, relaxed bank regulations, and the passage of cryptocurrency bills. With China and Japan also continuing to expand liquidity, the world will witness a new round of monetary easing. The current pullback is just a shakeout in the bull market, and the true strategy should be to buy on the dips.

Mainstream institutions like Goldman Sachs and Citigroup hold a relatively neutral view. They generally expect the government shutdown to end within the next one to two weeks. Once the deadlock is broken, the substantial cash locked up in the TGA will be swiftly released, easing the market's liquidity pressure. However, the long-term direction still depends on the Treasury's QRA announcement and the Fed's subsequent policies.

History seems to be repeating itself. Whether it was the taper tantrum of 2018 or the repo crisis of September 2019, both ultimately ended with the Fed's surrender and re-injection of liquidity. This time, facing dual pressures of political deadlock and economic risks, policymakers seem to have once again arrived at a familiar crossroads.

In the short term, the fate of the market hangs on the whims of Washington politicians. But in the long run, the global economy seems to be deeply trapped in a cycle of debt-monetization-bubble that it cannot escape from.

This crisis, unexpectedly triggered by the government shutdown, may only be the prelude to the next round of a larger-scale liquidity deluge.

You may also like

Countdown to Midterm Elections: Will the US Crypto Bill Pass the Test?

2025 Crypto Rich List: 12 Big Winners, Who Bet on the Money Maker?

「Macro Master」 Raoul Pal on 30x Growth Under Indexation: Bitcoin Will Eventually Surpass Gold

Why is the U.S. Embracing Crypto? The Answer May Lie in $37 Trillion Debt

Galaxy's 26 Predictions for Next Year: Bitcoin to Reach New ATH, Stablecoin Transaction Volume to Surpass ACH System

Key Market Information Discrepancy on December 25th - A Must-See! | Alpha Morning Report

Blockchains Quietly Prepare for Quantum Threat as Bitcoin Debates Timeline

Key Takeaways: Several blockchains, including Ethereum, Solana, and Aptos, are actively preparing for the potential threat posed by…

Three Signs that Bitcoin is Discovering its Market Bottom

Key Takeaways: Indicators suggest the selling pressure on Bitcoin is diminishing, hinting at a potential bottom. With improving…

Trump’s World Liberty Financial Token Ends 2025 Significantly Down

Key Takeaways World Liberty Financial, led by the Trump family, witnessed its token value drop by over 40%…

Kraken IPO and M&A Deals to Reignite Crypto’s ‘Mid-Stage’ Cycle

Key Takeaways: Kraken’s upcoming IPO may draw significant interest and capital from traditional finance (TradFi) investors, boosting the…

Extended Crypto ETF Outflows Indicate Institutional Pullback: Glassnode

Key Takeaways: Recent outflows from Bitcoin and Ether ETFs suggest a withdrawal of institutional interest. Institutional disengagement has…

HashKey Secures $250M for New Crypto Fund Amid Strong Institutional Interest

Key Takeaways HashKey Capital successfully secured $250 million for the initial close of its fourth crypto fund, showcasing…

JPMorgan Explores Cryptocurrency Trading for Institutional Clients

Key Takeaways JPMorgan Chase is considering introducing cryptocurrency trading services to its institutional clientele, marking a notable shift…

El Salvador’s Bitcoin Dreams Faced Reality in 2025

Key Takeaways El Salvador’s ambitious Bitcoin strategy, introduced in 2021, faced significant challenges and revisions by 2025, particularly…

Price Predictions for 12/22: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Key Takeaways: Bitcoin’s recovery efforts are met with strong resistance, indicating potential bearish trends at higher levels. Altcoins…

Bitcoin Perpetual Open Interest Surges as Traders Look Forward to Year-End Rally

Key Takeaways Bitcoin perpetual open interest has risen to 310,000 BTC, reflecting a bullish sentiment among traders as…

What Happened in Crypto Today: Insights on Bitcoin, IMF, and Ether ETFs

Key Takeaways Anthony Pompliano anticipates a stable Bitcoin price trajectory in the coming year due to its lack…

Kalshi First Research Report: When Predicting CPI, Crowd Wisdom Beats Wall Street Analysts

Countdown to Midterm Elections: Will the US Crypto Bill Pass the Test?

2025 Crypto Rich List: 12 Big Winners, Who Bet on the Money Maker?

「Macro Master」 Raoul Pal on 30x Growth Under Indexation: Bitcoin Will Eventually Surpass Gold

Why is the U.S. Embracing Crypto? The Answer May Lie in $37 Trillion Debt

Galaxy's 26 Predictions for Next Year: Bitcoin to Reach New ATH, Stablecoin Transaction Volume to Surpass ACH System

Key Market Information Discrepancy on December 25th - A Must-See! | Alpha Morning Report

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com