「Zero Fee」 Illusion: Lighter Nodes Shifted Costs with High Latency

Original Article Title: Lighter's "0% Fees" Are Actually 5-10x More Expensive Than Other Exchanges

Original Article Author: @PerpetualCow, Crypto Influencer

Original Article Translation: AididiaoJP, Foresight News

There's a saying in the market: If a product is free, then you are the product.

Lighter DEX is currently promoting "zero fees" to retail traders. It sounds too good to be true, and indeed it is.

However, what Lighter didn't prominently display is the toll structure behind these "free" trades.

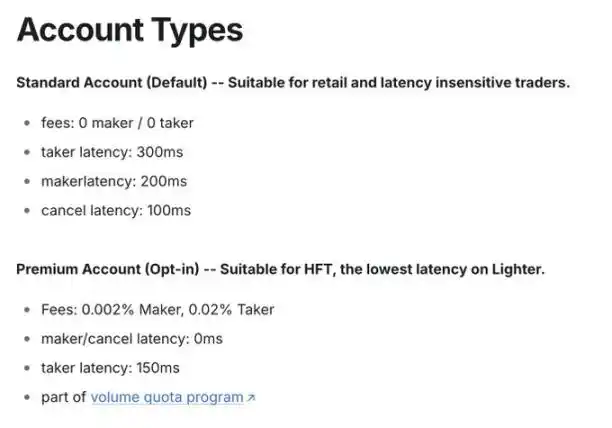

Lighter offers two account types: once you understand how the toll structure works, you'll realize that the 0% fee is actually the most expensive tier on the platform.

That 200-300 millisecond delay is the crux of their business model.

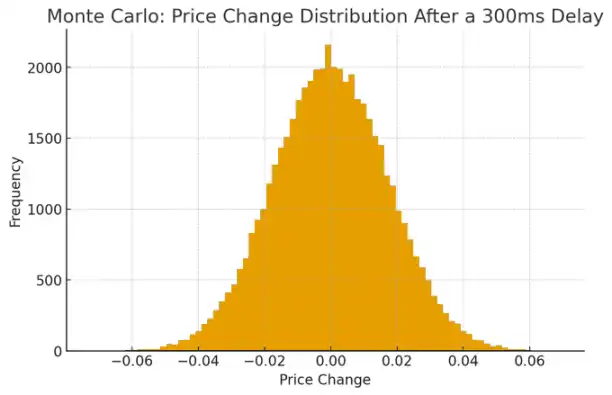

What Does 300 Milliseconds Really Mean?

An average human blink takes about 100-150 milliseconds. By the time you blink twice, faster traders have already captured price movements, adjusted positions, and engaged in a trade against you.

The crypto market is highly volatile, with typical volatility levels (50-80% annualized), causing prices to move about 0.5 to 1 basis point per second.

This means that within 300 milliseconds, market noise alone can cause prices to move on average 0.15-0.30 basis points.

The True Cost of "Free"

If we quantify it:

Academic research on adverse selection costs (Glosten & Milgrom, Kyle's Lambda, etc.) indicates that the informational advantage of informed traders is usually 2-5 times the magnitude of price random walk.

If the random slippage within 300 milliseconds is about 0.2 basis points, then adverse selection would add an additional 0.4-1.0 basis points.

For active traders and liquidity providers, the actual costs are roughly as follows:

· Standard Account Actual Cost: 6–12 basis points (0.06%–0.12%) per transaction

· Advanced Account Actual Cost: 0.2–2 basis points (0.002%–0.02%) per transaction

The cost of a "free" account is 5–10 times higher than that of a paid account.

Zero transaction fee is just a marketing number; the real cost is hidden in the latency.

The advanced account is actually more cost-effective, without a doubt

In any case, the standard account (0% fee) is not the preferable choice.

It is not suitable for small retail investors, large holders, scalpers, day traders, or even passive investors. Especially not for liquidity providers, or anyone, for that matter.

"I am just a small retail investor; I don't need an advanced infrastructure."

Wrong.

Small retail investors are more vulnerable to slippage. If you trade with $1,000 and lose 10 basis points per trade, it is like losing $1 each time. After 50 trades, 5% of your account will silently disappear.

"I don't trade frequently; latency doesn't affect me."

Also wrong.

If you don't trade frequently, the cost of an advanced account is negligible anyway.

Yet even in a few trades, the execution price you receive is still worse. Since the cost of avoiding such losses is almost zero, why accept any disadvantage?

Directly upgrade to an advanced account.

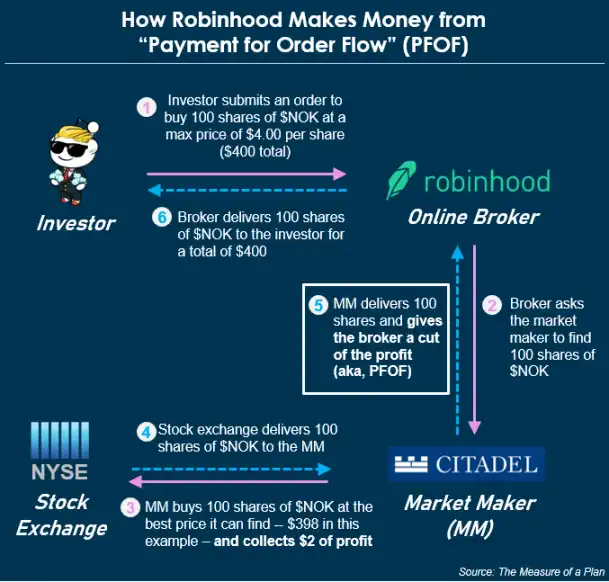

This model has a precedent

The traditional financial markets have long witnessed this tactic, known as payment for order flow.

@RobinhoodApp once attracted retail investors with "commission-free trading," then routed orders to liquidity providers, allowing them to profit by trading against the uninformed orders of retail investors, thus popularizing this model.

Lighter's model is structurally similar to this. Standard accounts do not receive free trades; they receive slower trades. This latency is transformed into profit by faster participants.

The trading platform does not need to charge you a fee because you are actually paying with execution quality.

What Lighter Did Right and Wrong

Lighter did not conceal latency data, as it was clearly stated in the documentation.

However, transparency does not equal clarity.

By highlighting "0% Fee" in the headline but burying "300ms Latency" in the fine print, Lighter employed a strategy focused on registration conversion rates rather than user understanding.

Most retail traders do not understand the implications of latency, are unaware of adverse selection, and naturally cannot calculate the equivalent actual cost.

Lighter is clear about this.

Advanced accounts are more cost-effective in every way compared to the standard "zero-fee" account—there is no debate about this.

You may also like

Venture Capital Post-Mortem 2025: Hashrate is King, Narrative is Dead

Are Those High-Raised 2021 Projects Still Alive?

High Fees, Can't Beat the Market Even After Paying 10x More, What Exactly Are Top Hedge Funds Selling?

Key Market Information Discrepancy on December 24th - A Must-See! | Alpha Morning Report

CFTC Welcomes New Chairman, Which Way Will Crypto Regulation Go?

Absorb Polymarket Old Guard, Coinbase Plunges Into Prediction Market Abyss

Why Did Market Sentiment Completely Collapse in 2025? Decoding Messari's Ten-Thousand-Word Annual Report

In Vietnam, USDT’s Use and the Reality of Web3 Adoption

Key Takeaways Vietnam has emerged as a leading nation in the adoption of cryptocurrencies, despite cultural and regulatory…

Facing Losses: A Trader’s Journey to Redemption

Key Takeaways Emotional reactions to trading losses, such as increasing risks or exiting the market entirely, often reflect…

Beacon Guiding Directions, Torches Contending Sovereignty: A Covert AI Allocation War

Key Takeaways The AI that rules today’s landscape exists in two forms—a centralized “lighthouse” model by major tech…

Exploring the Automated Market-Making Mechanism of Snowball Meme Coin

Key Takeaways Snowball is a new meme coin leveraging an automated market-making mechanism to utilize transaction fees for…

Decoding the Next Generation AI Agent Economy: Identity, Recourse, and Attribution

Key Takeaways AI agents require the development of robust identity, recourse, and attribution systems to operate autonomously and…

The State of Cryptocurrency Valuations in 2025

Key Takeaways In 2025, 85% of new tokens saw their valuations fall below their initial issuance value. The…

Nofx’s Two-Month Journey from Stardom to Scandal: The Open Source Dilemma

Key Takeaways Nofx’s rise and fall in two months highlights inherent challenges in open source projects. A transition…

MiniMax Knocks on the Door of Hong Kong Stock Exchange with Billion-Dollar Valuation

Key Takeaways MiniMax, a prominent AI startup, is rapidly progressing towards an IPO on the Hong Kong Stock…

Trump’s World Liberty Financial Token Ends 2025 Down Over 40%

Key Takeaways World Liberty Financial, a Trump family crypto project, faces substantial losses in 2025. The project initially…

JPMorgan Explores Crypto Trading for Institutional Clients: A Potential Paradigm Shift

Key Takeaways JPMorgan Chase is contemplating entering the cryptocurrency trading market for institutional clients, signifying a major shift…

Fintechs’ Prediction Market Add-ons and the Risk of User Churn: Insights from Inversion CEO

Key Takeaways Fintech platforms like Robinhood are increasingly adding prediction markets, which may result in higher user churn…

Venture Capital Post-Mortem 2025: Hashrate is King, Narrative is Dead

Are Those High-Raised 2021 Projects Still Alive?

High Fees, Can't Beat the Market Even After Paying 10x More, What Exactly Are Top Hedge Funds Selling?

Key Market Information Discrepancy on December 24th - A Must-See! | Alpha Morning Report

CFTC Welcomes New Chairman, Which Way Will Crypto Regulation Go?

Absorb Polymarket Old Guard, Coinbase Plunges Into Prediction Market Abyss

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com