$ETH price headed for $4K showdown: Is this time different?

Ether (ETH) is showing renewed strength, with bullish fundamentals and technicals aligning for a potential breakout above the critical $4,000 level.

Key Takeaways:

ETF inflows & institutional demand could fuel the push past $4,000

Growing network activity and rising TVL confirm strong utility demand

Bull flag breakout suggests a $5,000 target if resistance breaks

After three failed attempts since February 2024, ETH now faces its $4,000 test with stronger tailwinds—including record ETF interest and improving on-chain metrics—hinting at an imminent breakout.

ETH/USD daily chart. Source: Cointelegraph

“With $4,000 now within arm’s reach, the big question is: will Ethereum blast through or break down?” said popular Defipeniel analyst in a July 22 post on X.

According to the analyst, reducing ETH supply on exchanges, increasing staked ETH post-Shanghai upgrade and high ETF demand provide a “cocktail of bullish energy” required to push ETH past $4,000.

Big ETF inflows and treasury demand

Institutional interest in ETH has risen considerably in recent weeks, driven by record-breaking ETF inflows and corporate treasury adoption.

US-based spot Ethereum ETFs have seen unprecedented demand, with single-day inflows reaching a record $727 million on July 16 and cumulative net inflows exceeding $9.33 billion since their July 2024 launch.

These investment products continue to show strength, drawing $452.72 million in net inflows on Friday and extending their inflow streak to 16 consecutive trading days, according to data from SoSoValue.

Ethereum’s network activity shows strength

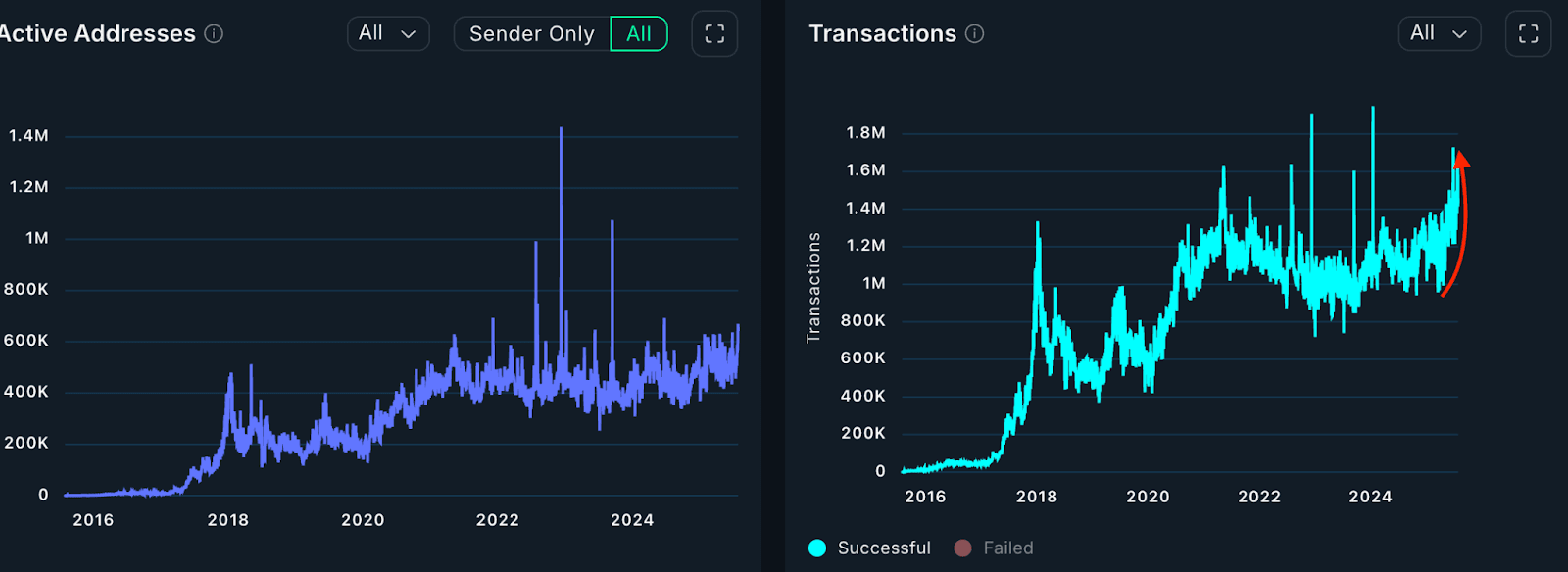

Ethereum’s network fundamentals are near record highs, with daily average transactions climbing to 1.62 million on Friday from 932,000 over the past three months, representing a 73% increase, as per data from Nansen. Daily active addresses rose to a 12-month high of 670,000 on Saturday.

Ethereum daily transactions and active addresses count. Source: Nansen

You may also like

Nockchain (NOCK) Coin Price Prediction & Forecasts for December 2025: Surging 14% Amid Meme Token Buzz

Nockchain (NOCK) Coin has just hit the scene on the Base chain, launching today at 12:00 UTC on…

JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin Price Prediction & Forecasts for December 2025 – Steady Climb Post-Launch

The JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin just hit the market on December 23, 2025, offering tokenized…

REALGARRYTAN Coin Price Prediction & Forecasts for December 2025 – Fresh Launch Sparks Meme Token Rally Potential

The REALGARRYTAN Coin, a new meme token tied to Garry Tan and launched on the Base chain just…

Walmart Tokenized Stock (Ondo) (WMTON) Coin Price Prediction & Forecasts for December 2025 – Could It Rebound After Recent Dip?

As of December 2025, Walmart Tokenized Stock (Ondo) (WMTON) Coin has just hit the market, offering tokenized exposure…

What is Costco Tokenized Stock (COSTON) Coin?

The Costco Tokenized Stock, known by its abbreviation COSTON, has made its way to WEEX, officially listed on…

Goldman Sachs Tokenized Stock (Ondo) (GSON) Coin Price Prediction & Forecasts for December 2025 – Surge Potential Amid RWA Momentum

The Goldman Sachs Tokenized Stock (Ondo) (GSON) Coin has been making waves in the real-world asset (RWA) space,…

Linde plc Tokenized Stock (Ondo) (LINON) Coin Price Prediction & Forecasts for December 2025 and Beyond

Linde plc Tokenized Stock (Ondo) (LINON) Coin has just entered the spotlight as a tokenized version of Linde…

What is Linde plc Tokenized Stock (LINON) Coin?

The Linde plc Tokenized Stock (LINON) coin has been a noteworthy addition to the crypto trading landscape with…

ServiceNow Tokenized Stock (Ondo) (NOWON) Token Price Prediction & Forecasts for December 2025: Could It Rally Amid RWA Momentum?

The ServiceNow Tokenized Stock (Ondo) (NOWON) Token just hit the market today, December 23, 2025, at 18:10 UTC,…

What is ServiceNow Tokenized Stock (NOWON) Coin?

ServiceNow Tokenized Stock, abbreviated as NOWON, is the latest crypto asset to be listed on WEEX, available for…

Nike Tokenized Stock (Ondo) (NKEON) Token Price Prediction & Forecasts for December 2025 – Potential Rebound Amid Market Volatility?

Nike Tokenized Stock (Ondo) (NKEON) has been making waves in the real-world asset (RWA) space by tokenizing shares…

What is Nike Tokenized Stock (NKEON) Coin?

The Nike Tokenized Stock (NKEON) Coin, listed on WEEX, offers an innovative way for non-US retail and institutional…

Salesforce Tokenized Stock (Ondo) (CRMON) Coin Price Prediction & Forecasts for December 2025: Could It Surge Amid RWA Momentum?

As a seasoned crypto investor who’s traded through multiple bull and bear cycles, I’ve seen how tokenized assets…

What is Salesforce Tokenized Stock (CRMON) Coin?

The Salesforce Tokenized Stock (CRMON) Coin offers a unique opportunity for crypto enthusiasts to dive into the world…

JPMorgan Chase Tokenized Stock (Ondo) Coin Price Prediction & Forecasts for December 2025: Riding the Wave of Tokenized Assets

JPMorgan Chase Tokenized Stock (Ondo) Coin has been making waves in the real-world assets (RWA) space, especially with…

What is JPMorgan Chase Tokenized Stock (JPMON) Coin?

The JPMorgan Chase Tokenized Stock (JPMON) Coin is making waves in the cryptocurrency world with its recent listing…

RAI Token Price Prediction & Forecasts for December 2025 – Potential Rally After Fresh Launch?

As a seasoned crypto investor who’s been trading since the early days of Ethereum, I’ve watched countless tokens…

What is RAI Token (RAI) Coin?

In an exciting development for digital agriculture enthusiasts, the RAI Token (RAI) has been newly listed on WEEX.…

Nockchain (NOCK) Coin Price Prediction & Forecasts for December 2025: Surging 14% Amid Meme Token Buzz

Nockchain (NOCK) Coin has just hit the scene on the Base chain, launching today at 12:00 UTC on…

JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin Price Prediction & Forecasts for December 2025 – Steady Climb Post-Launch

The JPMorgan Chase Tokenized Stock (Ondo) (JPMON) Coin just hit the market on December 23, 2025, offering tokenized…

REALGARRYTAN Coin Price Prediction & Forecasts for December 2025 – Fresh Launch Sparks Meme Token Rally Potential

The REALGARRYTAN Coin, a new meme token tied to Garry Tan and launched on the Base chain just…

Walmart Tokenized Stock (Ondo) (WMTON) Coin Price Prediction & Forecasts for December 2025 – Could It Rebound After Recent Dip?

As of December 2025, Walmart Tokenized Stock (Ondo) (WMTON) Coin has just hit the market, offering tokenized exposure…

What is Costco Tokenized Stock (COSTON) Coin?

The Costco Tokenized Stock, known by its abbreviation COSTON, has made its way to WEEX, officially listed on…

Goldman Sachs Tokenized Stock (Ondo) (GSON) Coin Price Prediction & Forecasts for December 2025 – Surge Potential Amid RWA Momentum

The Goldman Sachs Tokenized Stock (Ondo) (GSON) Coin has been making waves in the real-world asset (RWA) space,…

Popular coins

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com