MicroStrategy Pauses Bitcoin Buys Amidst Massive Equity Offering Push

The crypto world’s most prominent Bitcoin accumulator, MicroStrategy, has signaled a shift in its immediate strategy, opting to pause its Bitcoin acquisition activities last week. This move coincides with a significant push to bolster its capital through a substantially upsized equity offering, redirecting focus and resources.

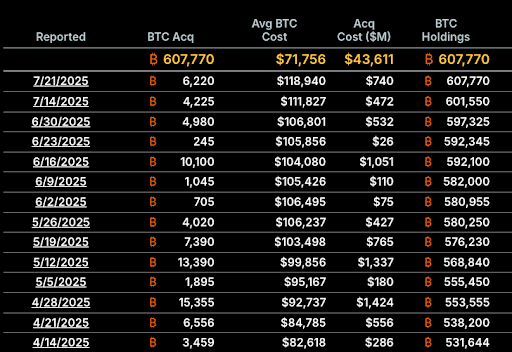

As the world’s largest public holder of Bitcoin, MicroStrategy reported no new Bitcoin purchases in the past week. This decision comes despite the digital asset experiencing notable volatility and testing new all-time highs mid-July. The company’s substantial Bitcoin holdings remained unchanged at 607,770 BTC as of last Monday, according to a filing with the U.S. Securities and Exchange Commission (SEC).

Interestingly, the pause in MicroStrategy’s buying did not deter Bitcoin’s upward momentum. The cryptocurrency saw its price climb from approximately $118,000 to over $119,000 throughout the week. This resilience occurred even amidst MicroStrategy’s inactivity and reports of an 80,000 BTC sale by an early investor on Friday, according to CoinGecko data.

July Bitcoin Acquisitions Plummet 39% Month-Over-Month

Last week’s hiatus highlights a broader trend of decelerated buying activity for MicroStrategy throughout July. The company documented just two Bitcoin acquisitions for the month: a purchase of 4,225 BTC on July 14th and another 6,220 BTC on July 21st, totaling 10,445 BTC. This figure represents a significant 39% drop compared to the 17,075 BTC acquired in June.

The acquisition pace in prior months was even more robust, with purchases of 26,695 BTC in May and 25,370 BTC in April. Prior to skipping buys in the first week of July, MicroStrategy had previously reported no purchases in the first week of April as well.

The company bought even more Bitcoin in the previous months, reporting purchases of 26,695 BTC in May and 25,370 BTC in April.

Prior to skipping the buy in the first week of July, Strategy previously reported no buys in the first week of April.

Upsized STRC Offering Signals Strategic Capital Reallocation

The slowdown in MicroStrategy’s Bitcoin purchasing strategy directly correlates with its aggressive capital raising efforts. Last Friday, the company announced it had upsized its Series A perpetual stretch preferred stock (STRC) offering to an impressive $2.521 billion, a substantial increase from its initially planned $500 million.

Priced at $90 per share, the issuance and sale are slated to settle on Tuesday, subject to customary closing conditions.

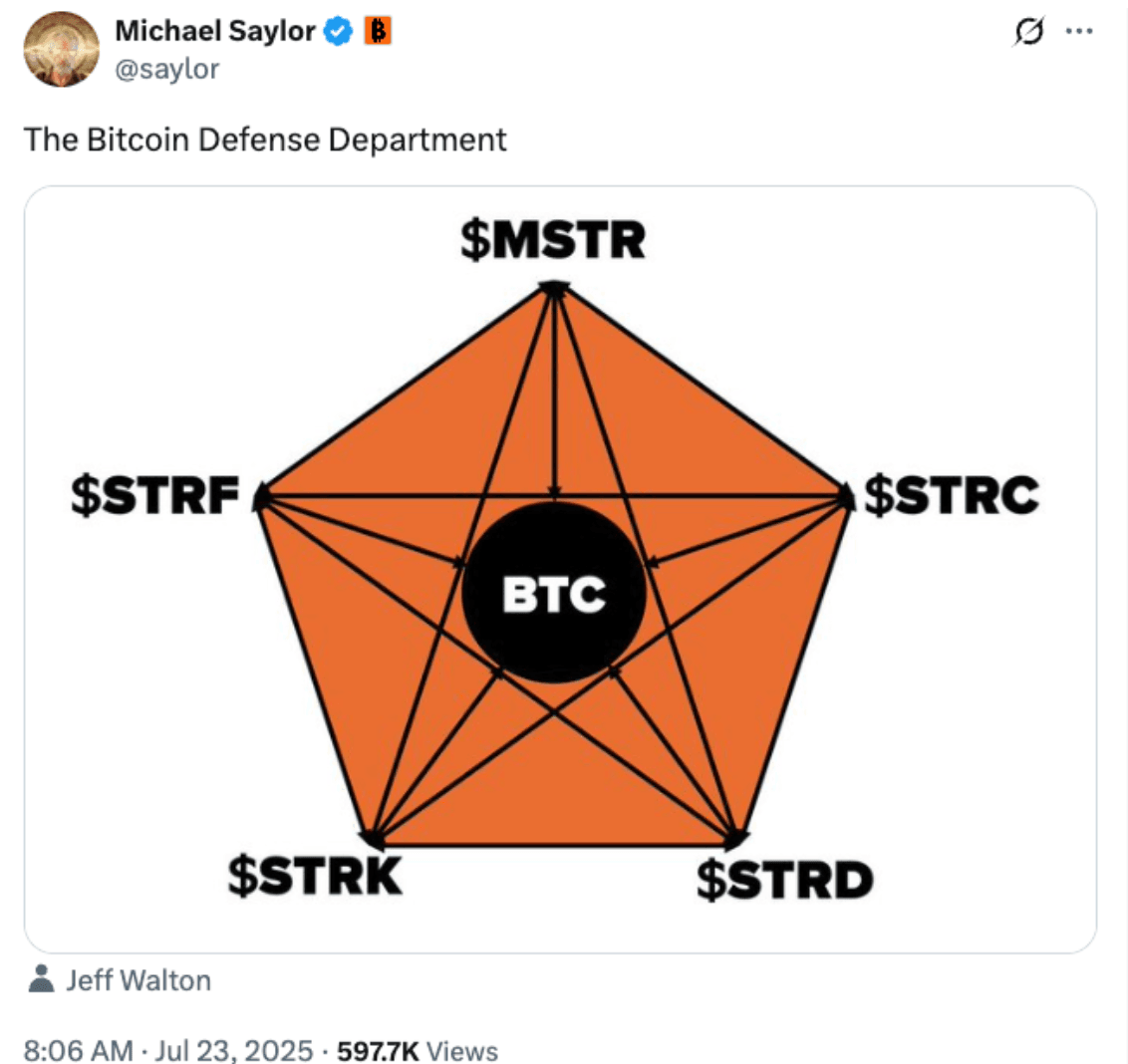

Similar to four previous MicroStrategy offerings, including the Series A perpetual strike preferred stock (STRK), the new STRC program functions as an equity-raising mechanism. Its core purpose is to empower the company to gradually sell newly issued shares, thereby generating capital to continue its Bitcoin accumulation strategy.

Michael Saylor, MicroStrategy’s co-founder, took to X (formerly Twitter) on Wednesday to refer to STRC as one of the four pillars of the company’s “Bitcoin defense department.” This statement underscores the strategic importance of this financing round in supporting MicroStrategy’s long-term commitment to Bitcoin, even as its immediate purchasing cadence adjusts.

You may also like

AI Avatar (AIAV) Coin Price Prediction & Forecasts for January 2026 – Up 25% in a Day, Can It Sustain the Rally?

AI Avatar (AIAV) Coin has been turning heads in the crypto space after a sharp 24.95% surge in…

AssetX Labs (AXLT) Coin Price Prediction & Forecasts for January 2026: Potential Surge After December 2025 Launch?

AssetX Labs (AXLT) Coin burst onto the scene with its launch on December 25, 2025, positioning itself as…

Ecorpay Token (ECOR) Coin Price Prediction & Forecasts for January 2026 – Potential Rally Amid Payment Sector Growth

Ecorpay Token (ECOR) has been making waves since its launch on December 24, 2025, as a revolutionary multi-blockchain…

ForTON (FRT) Coin Price Prediction & Forecasts for January 2026 – Fresh Launch Sparks Potential Rally

ForTON (FRT) just hit the market on December 31, 2025, as a fresh entrant in the TON ecosystem,…

Mind Predict (MKIT) Coin Price Prediction & Forecasts for January 2026: Could It Surge 50% Post-Launch?

Mind Predict (MKIT) Coin has just hit the crypto scene, launching on December 31, 2025, as the first…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…

PAX Gold Price Prediction 2025: What Investors Need to Know About PAXG Crypto’s Future

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold-backed…

PAX Gold Price Graph: Tracking Historical Trends and Forecasting Future Movements in 2026

As a crypto investor who’s watched gold-backed assets evolve since the early days of blockchain, I’ve seen how…

Paxos Gold Staking: A Beginner’s Guide to Earning Rewards with PAXG Crypto in 2026

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold…

Where to Buy Pax Gold (PAXG): Your Complete Guide to Getting Started with This Gold-Backed Crypto

Have you ever thought about owning gold without dealing with the hassle of storing heavy bars in a…

Paxos Gold Price Prediction 2026: Insights and Forecasts for PAXG Investors

Ever wondered how you could own a piece of gold without ever touching a physical bar? That’s the…

Paxful Razer Gold: How to Trade Gaming Credits for Crypto and Exploring PAX Gold as a Digital Alternative

Ever wondered how gamers in places like Indonesia and Nigeria turn their Razer Gold credits into real cryptocurrency?…

Paxful Gold Explained: Trading Razer Gold on Paxful and Why PAXG Crypto Stands Out as True Digital Gold

Ever stumbled upon the term “paxful gold” while hunting for ways to trade digital assets or gaming credits,…

How to Buy PAXG: Your Step-by-Step Guide to Getting Started with Pax Gold Crypto

Ever wondered how you could own a piece of gold without dealing with the hassle of storing heavy…

Is PAXG Legit? Unpacking the Reliability of Paxos Gold Token in 2026

As someone who’s spent years trading crypto and watching markets shift like tides, I remember the first time…

Is PAXG a Good Investment in 2026? Weighing the Pros, Cons, and Gold-Backed Potential

As someone who’s been trading crypto since the early days of Ethereum, I’ve seen plenty of tokens come…

PAXG Whitepaper: Exploring the Foundations of Pax Gold Crypto and Its Gold-Backed Stability

Have you ever wondered how a digital token can give you real ownership of physical gold without ever…

PAXG Crypto: Your Guide to Paxos Gold Token and Its Role in the 2026 Crypto Market

Ever wondered how you could own gold without dealing with heavy bars or secure vaults? That’s where PAXG…

AI Avatar (AIAV) Coin Price Prediction & Forecasts for January 2026 – Up 25% in a Day, Can It Sustain the Rally?

AI Avatar (AIAV) Coin has been turning heads in the crypto space after a sharp 24.95% surge in…

AssetX Labs (AXLT) Coin Price Prediction & Forecasts for January 2026: Potential Surge After December 2025 Launch?

AssetX Labs (AXLT) Coin burst onto the scene with its launch on December 25, 2025, positioning itself as…

Ecorpay Token (ECOR) Coin Price Prediction & Forecasts for January 2026 – Potential Rally Amid Payment Sector Growth

Ecorpay Token (ECOR) has been making waves since its launch on December 24, 2025, as a revolutionary multi-blockchain…

ForTON (FRT) Coin Price Prediction & Forecasts for January 2026 – Fresh Launch Sparks Potential Rally

ForTON (FRT) just hit the market on December 31, 2025, as a fresh entrant in the TON ecosystem,…

Mind Predict (MKIT) Coin Price Prediction & Forecasts for January 2026: Could It Surge 50% Post-Launch?

Mind Predict (MKIT) Coin has just hit the crypto scene, launching on December 31, 2025, as the first…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…