Buying the Crypto Dip: A Risky Gamble or Smart Move?

Imagine walking into your favorite store and finding everything on your wish list at half price. Sounds like a dream, right? That’s exactly what buying the dip crypto strategy feels like. Instead of discounted clothes or gadgets, you're scooping up digital assets when their prices drop—with the goal of profiting when the market recovers.

But why does this strategy matter? For crypto investors, buying the crypto dip offers a chance to maximize gains by entering the market at lower price points. That said, timing and a clear buy the dip crypto strategy are crucial.

In this guide, we break down what buy the dip meaning crypto really entails, how to do it wisely, and the common mistakes you should avoid.

Key takeaways:

- Buying the dip means purchasing cryptocurrencies during temporary price declines, aiming to profit from eventual recoveries. Think of it as buying crypto on sale when the market is fearful.

- Success depends on strategy. Analyze trends, use tools like RSI and the Fear and Greed Index, and always understand why a dip is happening.

- Steer clear of emotional decisions, avoid chasing every dip, and stay informed. Focus on quality assets and stick to a predetermined budget.

What does “Buying the Dip” Mean in Crypto?

Buying the dip refers to purchasing cryptocurrencies after their prices have fallen—usually during a market correction, a negative news cycle, or a broader downturn. For example, if Bitcoin drops from $80,000 to $60,000 due to short-term uncertainty, a strategic trader may see this as a buying opportunity rather than a setback.

Why? Historically, crypto markets have shown resilience and often bounce back—sometimes surpassing previous highs. This gives investors who bought during the dip a chance to benefit from the upward momentum.

How to Identify the Right Time to Buy the Dip?

1. Understand Market Trends

Cryptocurrency markets move in cycles—bull markets (rising prices) and bear markets (falling prices). During bear markets, prices dip more frequently, creating potential opportunities. However, it’s important to distinguish a temporary dip from a sustained downtrend.

Trying to buy at the very bottom can be like catching a falling knife. Understanding market context helps you avoid entering too early.

Pro tip: Use trading volume as a guide. High volume during a dip often signals a strong correction and possible rebound. Low volume may indicate further declines.

2. Analyze Historical Price Data

Past performance can offer clues about future behavior. Technical analysis tools such as the RSI (Relative Strength Index) and Bollinger Bands can help identify oversold conditions—when an asset may be due for a rebound.

For instance, if Bitcoin has repeatedly found support around a certain price level in the past, that zone might present a good entry point during future dips.

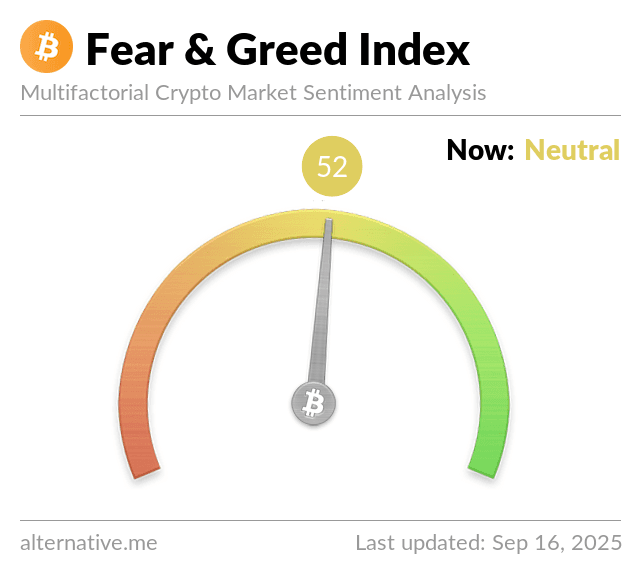

3. Use the Fear and Greed Index

This sentiment indicator ranges from extreme fear to extreme greed. When the market is in “extreme fear,” prices are often depressed, which can signal a buying opportunity. Think of it as a crypto Black Friday—when fear keeps others away, you might find discounted deals.

That said, when greed dominates, prices may be overextended, and a correction could be near.

4. Evaluate Why the Dip Happened

Not every price drop is a good opportunity. Some dips are caused by short-term factors like regulatory news or macroeconomic events. Others may stem from fundamental issues like a project’s failure, a hack, or loss of community trust.

- Temporary dip: Bitcoin drops after negative headlines but fundamentals remain strong.

- Risky dip: An altcoin collapses because the development team abandons the project.

Always know the story behind the dip.

5. Set a Budget and Stick to It

It can be tempting to go all in during a big dip, but that significantly increases risk. Instead, consider dollar-cost averaging (DCA)—investing a fixed amount at regular intervals regardless of price.

For example, if you have $1,000 to invest, you could spread it over five weeks ($200 per week). This way, you avoid the stress of timing the market and reduce your average entry price over time.

Common Mistakes to Avoid When Buying the Dip

1. Emotional Trading

Fear and excitement are poor advisors. Panic buying or selling often locks in losses or causes you to overpay. Stay calm, stick to your strategy, and avoid making decisions based on short-term mood swings.

Tip: Before you buy, pause and assess. Is this a temporary dip or a sign of a deeper issue?

2. Chasing Every Dip

Not all dips are worth buying. Some cryptocurrencies may not recover due to weak fundamentals, low liquidity, or loss of relevance. Instead, focus on the best crypto to buy during the dip—established projects with strong use cases and community support.

It’s like shopping during a sale—just because something is cheap doesn’t mean it’s worth buying.

3. Ignoring Market News

Prices don’t move in a vacuum. Significant events—such as new regulations, exchange outages, or technological upgrades—can drive market sentiment. Stay informed through trusted news sources and community discussions.

Missing key news might mean misunderstanding whether a dip is a buying opportunity or a red flag.

What are the Advantages of Buying the Dip?

- Potential for higher returns: Buying low and selling high is the core of profit-making. Dips let you enter at attractive prices.

- Lower entry point: You can accumulate more coins with the same amount of money compared to all-time highs.

- Long-term growth potential: Strong cryptocurrencies like Bitcoin and Ethereum have historically recovered from downturns and reached new highs.

- Psychological edge: Buying when others are fearful can be a confident, disciplined move that pays off over time.

What are the Disadvantages of Buying the Dip?

- Further declines possible: Prices can keep falling after you buy. It’s hard to time the absolute bottom.

- High volatility: Crypto is inherently unstable. What looks like a dip may be the start of a longer crash.

- Requires research and patience: Not every asset will recover. You need to pick wisely and be prepared to hold.

FAQ

1. Is buying the crypto dip risky?

Yes, especially if the market continues to fall. Always assess the reason for the dip and never invest more than you can afford to lose.

2. How do I know when a crypto has bottomed out?

You can use tools like RSI, support levels, and volume analysis—but no one can consistently pinpoint the exact bottom. Avoid perfectionism.

3. Is buying the dip good for beginners?

Yes, if done carefully. Start with small amounts, use dollar-cost averaging, and focus on learning. Avoid investing large sums based on emotion.

4. What is the best crypto to buy on the dip?

Typically, major cryptocurrencies with strong fundamentals—like Bitcoin and Ethereum—are considered safer choices during market dips. Always do your own research before deciding the best cryptos to buy in the dip.

5. Can automation help with buying the dip?

Some traders use a buy the dip crypto bot to automate entries during price drops, but this requires technical knowledge and carries additional risk.

6. Is there such a thing as buy the dip crypto prediction?

While many analysts share buy the dip crypto price prediction content, it's important to remember that no prediction is guaranteed. Use them as references, not certainties.

Further reading

- How to Trade Crypto Responsibly?

- How to Protect Your Cryptocurrency : 5 Simple Steps

- 5 Exit Strategies for Traders

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

You may also like

Gainers

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com

WE-Launch

WE-Launch