FOMC December 2025 Rate Cut Analysis: Impact on Bitcoin Price and Crypto Market for WEEX Users

The Federal Open Market Committee (FOMC) meeting on December 10, 2025 concluded with a widely anticipated 25 basis points (0.25%) rate cut, bringing the federal funds target range to 3.50%–3.75%. This marks the third consecutive rate cut in 2025, signaling the Fed’s ongoing effort to balance inflation control with supporting economic growth. Leading up to the announcement, Bitcoin prices had been hovering near $90,000, and following the rate cut, BTC briefly spiked above $94,000 before stabilizing around its current level of ~$90,000. This price movement reflects a moderate market reaction, as traders had largely priced in the expected rate cut.

Understanding the FOMC: Why Crypto Traders Should Care About Federal Reserve Decisions

The FOMC, or Federal Open Market Committee, is the policy-making branch of the U.S. Federal Reserve, responsible for setting the direction of U.S. monetary policy, including interest rates and liquidity operations. The committee meets eight times per year to assess economic conditions and determine whether monetary policy should be tightened or loosened. Decisions by the FOMC directly affect traditional financial markets such as equities, bonds, and currencies, and indirectly influence crypto markets, including Bitcoin and altcoins, because interest rate changes affect liquidity, risk appetite, and global capital flows. For WEEX users, staying informed about FOMC actions is crucial, as these events can drive short-term volatility and shape longer-term crypto market trends.

The December 2025 FOMC Rate Cut: Background and Detailed Analysis

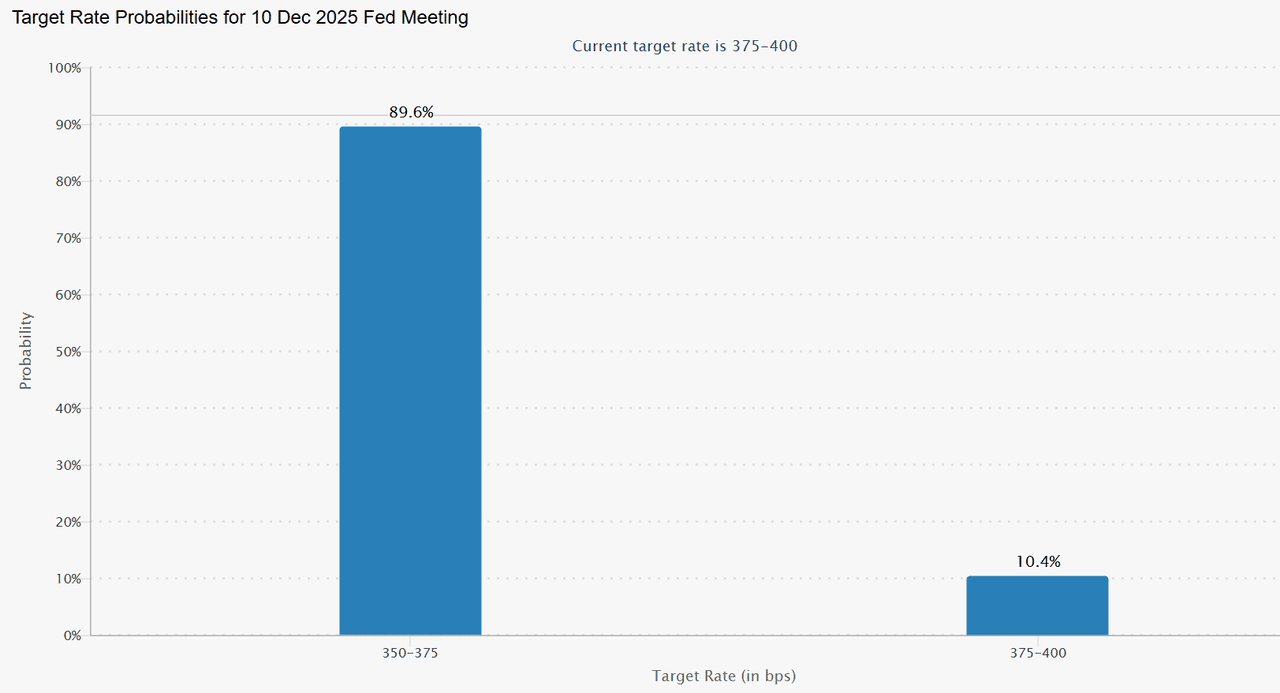

The Federal Reserve’s December 2025 FOMC meeting delivered the anticipated 25-basis-point rate cut, lowering the federal funds target range to 3.50%–3.75%. Because CME FedWatch had already priced in nearly a 90% probability of this move, markets—especially crypto—showed limited reaction. BTC briefly spiked above $94,000 before stabilizing around its current level of ~$90,000. The macro backdrop also explains the Fed’s caution: job growth has slowed, the unemployment rate has risen to 4.4%, and inflation remains above target but is driven mainly by one-off tariff effects rather than broad price pressures. Powell noted that consumer spending and business investment remain resilient, yet the labor market is clearly losing momentum, raising downside risks. These mixed signals shaped a tone of policy restraint rather than confidence.

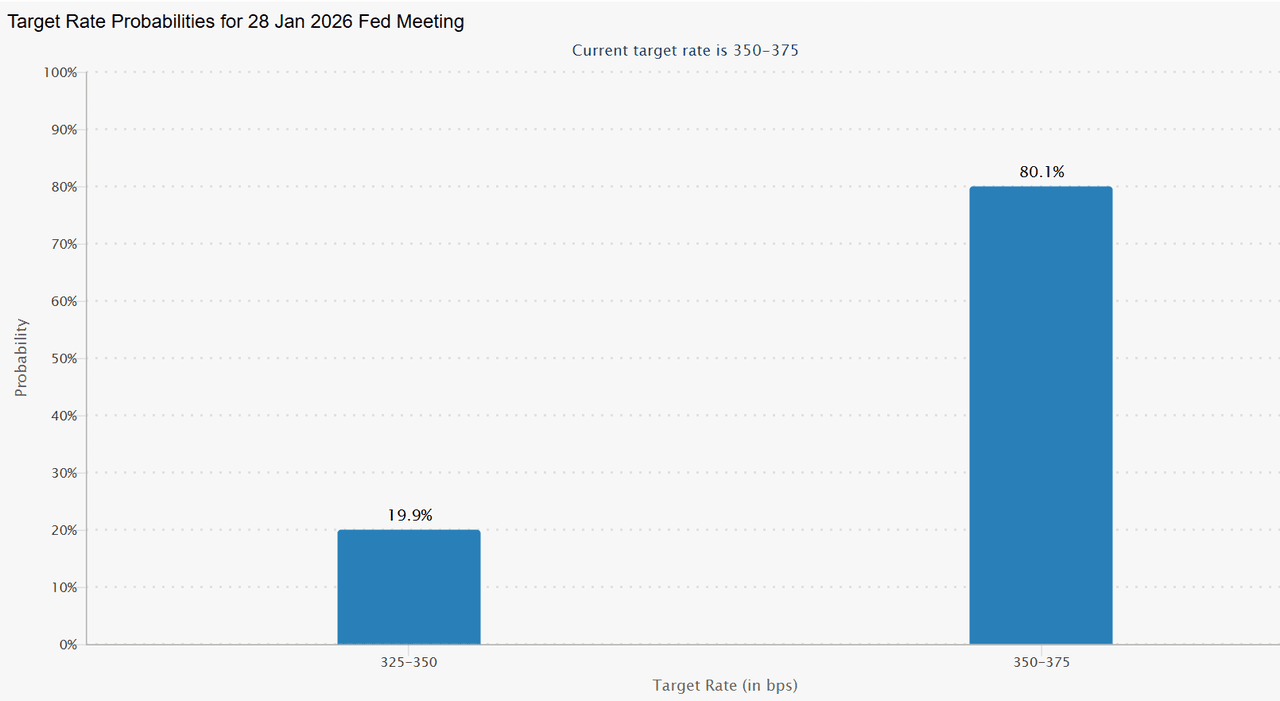

Equally important, the Fed signaled it is not committing to a rate-cut cycle. At the time of writing, FedWatch priced just a 19.9% chance of another 25bps cut at the next FOMC, versus an 80.1% likelihood of holding rates steady—an abrupt shift from the near-certainty of easing before this meeting. On liquidity, the Fed announced $40B in T-bill purchases for the first month and continued repo/RRP tools to maintain ample reserves, but Powell stressed these are technical operations, not QE. With no surprise, no strong forward guidance, and no meaningful liquidity injection, the meeting delivered little for risk assets to latch onto. For Bitcoin and broader crypto, this data-dependent, one-and-wait stance explains why price action remained muted despite the headline rate cut.

Impact of the FOMC Rate Cut on Bitcoin and the Crypto Market

Crypto markets historically rally when the Fed delivers unexpected dovish surprises, and this meeting contained none. Even the Fed’s liquidity measures—including $40B in T-bill purchases and expanded repo operations—were understood as routine reserve management rather than true stimulus, meaning no significant liquidity wave is expected to lift BTC or altcoins in the near term. Overall, while the December decision improves the macro setting compared to earlier in the year, the absence of new dovish catalysts explains why Bitcoin did not deliver a significant post-FOMC rally.

WEEX User Takeaways: How to Navigate Crypto Markets Post-FOMC

For WEEX users, the December FOMC rate cut offers several actionable insights for navigating the current market environment. With volatility often spiking around major policy events, traders should maintain realistic expectations—especially when outcomes are fully priced in, as seen with Bitcoin’s muted reaction. For those seeking a more steady approach amid uncertainty, WEEX Auto Earn provides a flexible, hands-free way to grow USDT holdings. Once activated, it automatically captures daily balance snapshots, applies tiered interest rates with no lock-up, and deposits earnings the next day. New users who complete KYC verification can also access exclusive introductory APR rates up to 100% within designated limits — offering both stability and enhanced yield potential as markets digest the post-FOMC landscape.

About WEEX

Founded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 150 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200+ spot trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Follow WEEX on social media

Telegram: WeexGlobal Group

YouTube: @WEEX_Global

TikTok: @weex_global

Instagram: @WEEX Exchange

Discord: WEEX Community

You may also like

After Forty Years of Sanctions, How Iran Is Rebooting Financial Channels Through Crypto

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.

Glassnode New Year Report: $95K Call Option Premium, Bulls Shift to Aggressive Offense

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

Solana Price Prediction: Morgan Stanley Just Filed for a SOL ETF – Is This the Beginning of Wall Street’s Next Crypto Obsession?

Key Takeaways Morgan Stanley’s filing for a SOL-based ETF signifies growing institutional interest in cryptocurrencies beyond Bitcoin, boosting…

Binance Launches Regulated Gold and Silver Perpetual Futures Settled in USDT

Key Takeaways: Binance has introduced its first regulated perpetual futures contracts, which are tied to traditional assets like…

Ondo Finance Price Prediction – ONDO Anticipated to Decrease to $0.331411 by Jan 12, 2026

Key Takeaways The prediction for Ondo Finance (ONDO) indicates a significant price decline to $0.331411, translating to a…

Capital Inflows into Bitcoin: An Examination of Current Trends and Future Implications

Key Takeaways Institutional long-term holding strategies have reshaped Bitcoin’s traditional market cycles. Capital inflows into Bitcoin have dried…

From Manus' Shihong onwards, those Coinsquare interns

All these uncommon things in the crypto world are listed on Idle Fish

The old altcoin script is outdated, take you to decipher the new market structure

Key Market Information Discrepancy on January 8th - A Must-See! | Alpha Morning Report

Rumble Launches Crypto Wallet in Collaboration with Tether, Boosting Share Value

Key Takeaways: Rumble’s latest innovation integrates cryptocurrency tipping for content creators directly within its platform. Built in partnership…

Babylon Labs Secures $15 Million from a16z Crypto to Enhance Bitcoin Collateral Framework

Key Takeaways Babylon Labs has successfully raised $15 million from a16z crypto to further develop and expand its…

Crypto Markets Today: Bitcoin Slides as Asia-Led Sell-Off Hits Altcoins

Key Takeaways: Bitcoin could not surpass the $94,500 mark and fell to roughly $91,530, contributing to a wider…

Start-of-the-Year Crypto Rally Stalls: What’s Next?

Key Takeaways The initial crypto market boost at the start of 2026 has lost momentum, primarily due to…

Strategy’s STRC Preferred Stock Rebounds to $100: Potential Catalyst for Bitcoin Purchases

Key Takeaways STRC, the perpetual preferred equity of Strategy, returns to $100, the first time since November. This…

After Forty Years of Sanctions, How Iran Is Rebooting Financial Channels Through Crypto

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.

Glassnode New Year Report: $95K Call Option Premium, Bulls Shift to Aggressive Offense

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

Solana Price Prediction: Morgan Stanley Just Filed for a SOL ETF – Is This the Beginning of Wall Street’s Next Crypto Obsession?

Key Takeaways Morgan Stanley’s filing for a SOL-based ETF signifies growing institutional interest in cryptocurrencies beyond Bitcoin, boosting…