On the Eve of a Significant Dollar Devaluation, Bitcoin is Poised for the Final Spark

Original Article Title: BTC: Onchain Data Update + our views on last week's FOMC and the "big picture"

Original Article Author: Michael Nadeau, The DeFi Report

Original Article Translation: Bitpush News

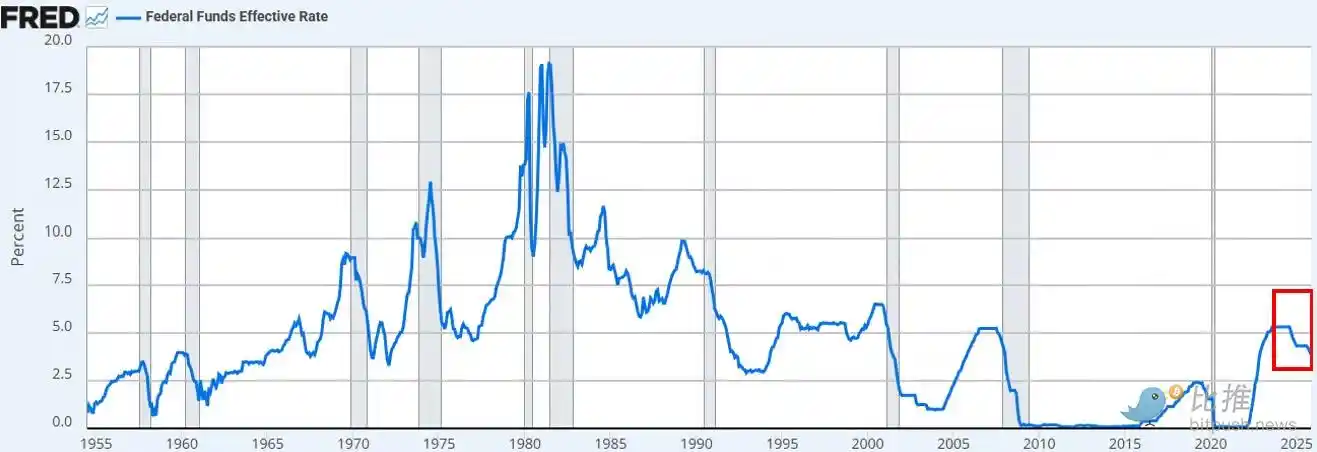

Last week, the Federal Reserve cut interest rates to a target range of 3.50%–3.75%—this move was fully absorbed by the market and largely expected.

What truly surprised the market was the Federal Reserve's announcement to purchase $400 billion in short-term Treasury bills on a monthly basis, which quickly earned the label of "QE-lite" by some.

In today's report, we will delve into what this policy change really means, what it doesn't change, and why this distinction is crucial for risk assets.

Let's get started.

1. "Short-term" Outlook

The Federal Reserve cut rates as expected. This is the third rate cut this year and the sixth since September 2024, totaling a 175 basis point reduction and pushing the federal funds rate to its lowest level in about three years.

In addition to the rate cut, Powell announced that the Fed will begin "reserve management purchases" of short-term Treasury bills at a pace of $400 billion per month starting in December. Given the ongoing strains in the repo market and bank sector liquidity, this move was entirely within our expectations.

The prevailing market view (whether on X platform or CNBC) is that this is a "dovish" policy shift.

The debate on whether the Fed's announcement is equivalent to "money printing," "QE," or "QE-lite" immediately took over social media timelines.

Our Observation:

As a "market observer," we find that the market's psychological state still tends towards "Risk-on" sentiment. In this state, we expect investors to overly fit policy headlines, trying to piece together a bullish logic while overlooking the specific mechanism of how policy translates into actual financial conditions.

Our view is: The Fed's new policy is favorable for the "financial market plumbing," but not favorable for risk assets.

Where do we differ from the market's general perception?

Our views are as follows:

· Short-Term Treasury Purchases ≠ Absorption of Market Duration

The Fed is purchasing short-term Treasury bills, not long-term coupon bonds. This does not remove the market's interest rate sensitivity (duration).

· Has Not Suppressed Long-Term Yields

Although short-term purchases may marginally reduce future long-term bond issuance, it does not help compress the term premium. Currently, about 84% of Treasury issuances are in short-term notes, so this policy does not substantially alter the duration structure investors face.

· Financial Conditions Are Not Broadly Loosened

These reserve management purchases aimed at stabilizing the repo market and bank liquidity will not systematically lower real interest rates, corporate borrowing costs, mortgage rates, or equity discount rates. Their impact is partial and functional, not a broad-based monetary easing.

Therefore, no, this is not QE. This is not financial repression. What needs to be clear is that the abbreviation does not matter; you can call it money printing if you like, but it does not deliberately suppress long-term yields by removing duration — which would push investors towards the riskier end of the curve.

That scenario has not materialized. The price action of BTC and the Nasdaq index since last Wednesday affirm this point.

What would change our view?

We believe BTC (as well as broader risk assets) will have their time in the sun. But that will come post-QE (or whatever the Fed terms the next phase of financial repression).

That moment will arrive when:

· The Fed artificially suppresses the long end of the yield curve (or signals to the market).

· Real Interest Rates Decrease (Due to Rising Inflation Expectations).

· Corporate Borrowing Costs Decline (Powering Tech Stocks/NASDAQ).

· Term Premium Compression (Long-Term Rates Decrease).

· Stock Discount Rates Decrease (Forcing Investors into Longer Duration Risk Assets).

· Mortgage Rates Decline (Driven by Long-End Rate Suppression).

At that point, investors will smell the scent of "Financial Repression" and adjust their portfolios. We are not yet in that environment, but we believe it is coming. While timing is always difficult, our baseline assumption is: volatility will significantly increase in the first quarter of next year.

This is what we see as the short-term landscape.

2. A More Macro View

The deeper issue is not the Fed's short-term policies but the global trade (currency) war and the tension it is creating at the core of the dollar system.

Why?

The U.S. is moving towards the next stage of its strategy: reshoring manufacturing, reshaping global trade balances, and competing in strategic industries like AI. This goal is in direct conflict with the role of the dollar as the world's reserve currency.

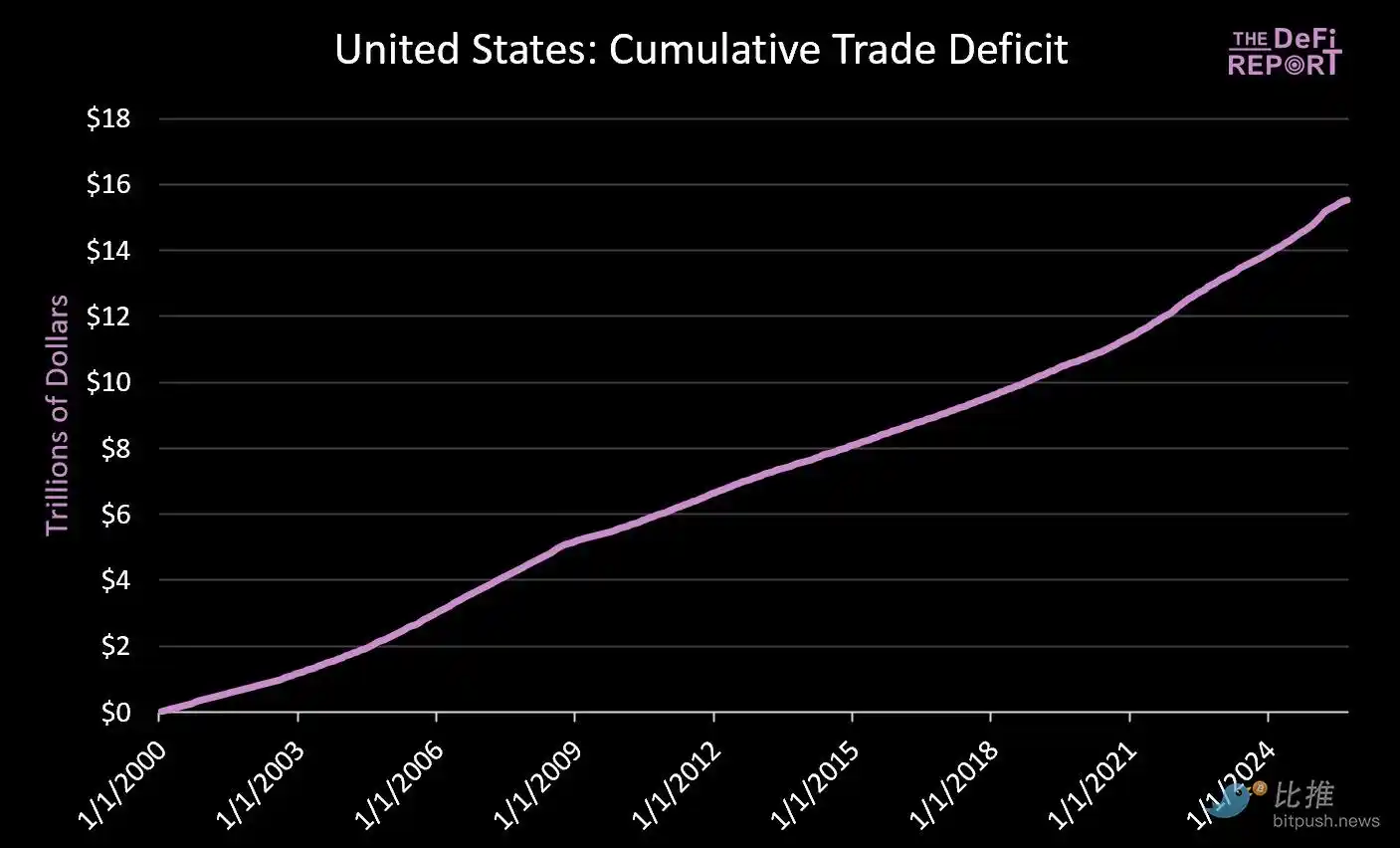

The reserve currency status can only be maintained as long as the U.S. continues to run a trade deficit. Under the current system, the dollar is sent overseas to purchase goods, which then flow back to the U.S. capital markets through treasuries and risk assets. This is the essence of the Triffin Dilemma.

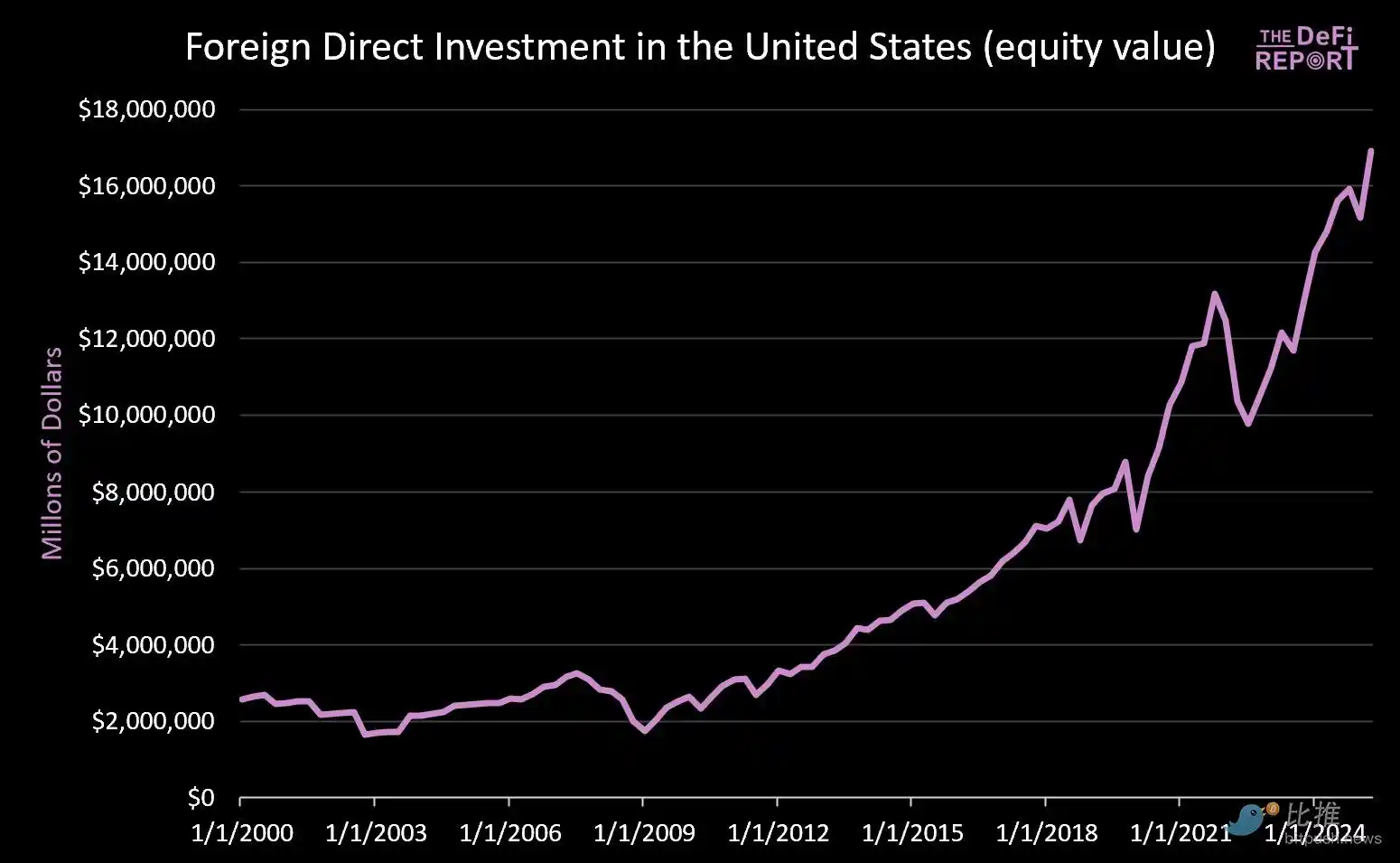

· Since January 1, 2000, the U.S. capital markets have received over $14 trillion (not counting the $9 trillion in bonds currently held by foreigners).

· At the same time, around $16 trillion has flowed offshore to pay for goods.

The effort to reduce the trade deficit will necessarily reduce the cyclical capital flowing back to the U.S. market. While Trump touts promises from Japan and other countries to "invest $550 billion in U.S. industry," what he fails to explain is that Japan's (and other countries') capital cannot simultaneously exist in manufacturing and capital markets.

We believe this tension will not be resolved smoothly. Instead, we expect increased volatility, asset repricing, and ultimately a currency adjustment (i.e., dollar devaluation and a shrinkage in the real value of U.S. Treasuries).

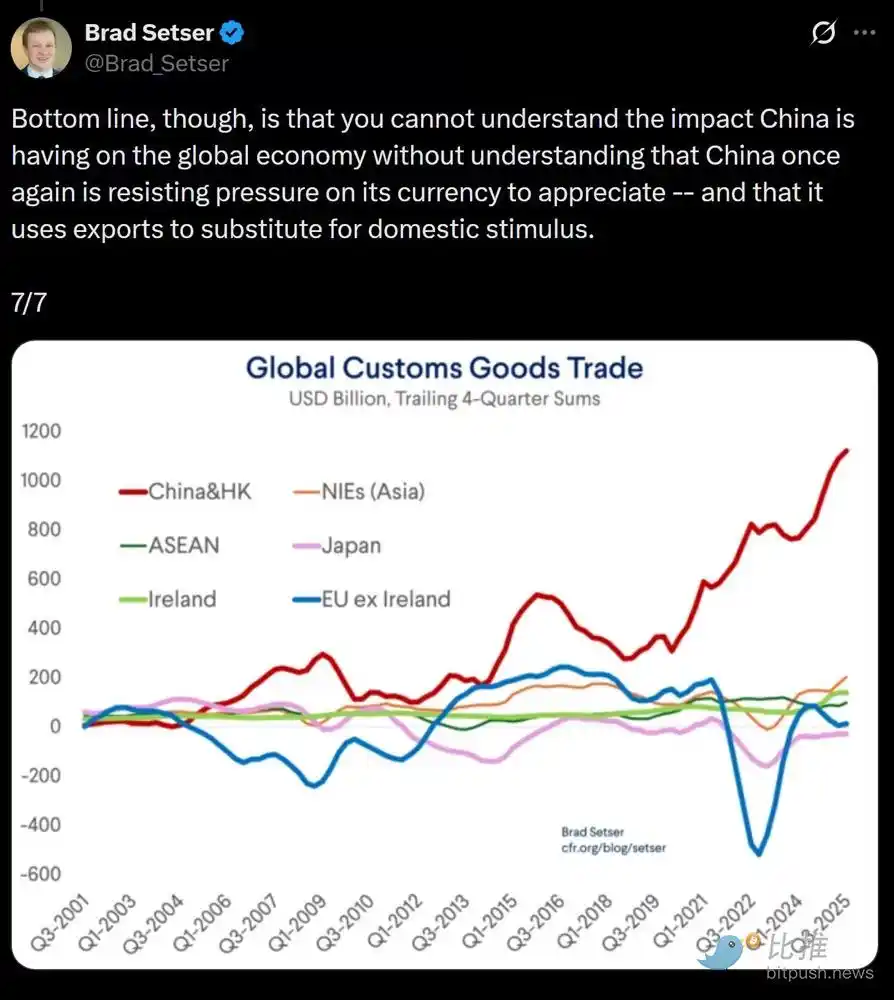

The core point is: China is artificially suppressing the value of the Renminbi (providing its export products with an artificial price advantage), while the U.S. dollar is artificially overvalued due to foreign capital inflows (resulting in relatively cheap import prices).

We believe that to address this structural imbalance, a mandatory devaluation of the U.S. dollar may be imminent. In our view, this is the only viable path to resolve the global trade imbalance.

In a new round of financial repression, the market will ultimately determine which assets or markets qualify as a "store of value."

The key question is, when all the dust settles, whether U.S. Treasury bonds can still play the role of a global reserve asset.

We believe that Bitcoin and other global, non-sovereign stores of value (such as gold) will play a far more significant role than they do now. The reason is that they are scarce and do not rely on any policy credit.

This is what we see as the "macro setup" being established.

You may also like

After Forty Years of Sanctions, How Iran Is Rebooting Financial Channels Through Crypto

Telegram 2025 Financial Report Puzzle: Revenue Soars by 65%, Yet Plagued by $200 Million Loss Due to TON?

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

Crypto and AI: the hidden digital gray market of Xianyu

Crypto and AI: You Can Buy Anything on Xianyu.

Why Is On-Chain Fixed-Rate Lending Hard to Come By? "Basis Swap" Trading Is the Way Out

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.

America's First State-Backed Stablecoin FRNT: Can It Save Wyoming Amid Energy Slump?

Zcash Core Team Exodus Story, Crypto's Own OpenAI Drama

Kinetiq Exclusive Interview: From Hyperliquid's Largest LST Protocol to the "Exchange Factory"

Glassnode New Year Report: $95K Call Option Premium, Bulls Shift to Aggressive Offense

Base contributes 70% of revenue but pays only 2.5% in rent; Superchain may be entering its "forking" countdown

ZCash Team Split, Bank of America Upgrades Coinbase Rating, What's the Overseas Crypto Community Talking About Today?

WEEX Global AI Trading Hackathon Kicks Off: $1.88M Prize Pool Powers the Next Generation of AI Trading Champions

WEEX Labs, the innovation arm of WEEX, a leading global crypto exchange serving over 6.2 million users across 150+ countries, is set to kick off the preliminary round of its flagship global AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by the strong support of world-class sponsors including Amazon Web Services (AWS), the total prize pool has surged from $880,000 to an unprecedented $1,880,000, positioning AI Wars among the largest AI trading hackathons in the crypto industry. At the top of the leaderboard awaits an extraordinary champion prize — a Bentley Bentayga S, already on standby in Dubai, ready to be claimed by the ultimate AI trading victor.

December Exchange Rankings: CEX and DEX Simultaneously Weaken, On-Chain Perpetual Contract Trading Volume Declines by 30%

2025 Market Prediction Retrospective: Total Transaction Volume Exceeds $50 Billion, Duopoly Market Share Exceeds 97.5%

Key Market Info Discrepancy on January 9th - A Must-Read! | Alpha Morning Report

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

After Forty Years of Sanctions, How Iran Is Rebooting Financial Channels Through Crypto

Telegram 2025 Financial Report Puzzle: Revenue Soars by 65%, Yet Plagued by $200 Million Loss Due to TON?

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

Crypto and AI: the hidden digital gray market of Xianyu

Crypto and AI: You Can Buy Anything on Xianyu.

Why Is On-Chain Fixed-Rate Lending Hard to Come By? "Basis Swap" Trading Is the Way Out

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.