December 3rd Market Key Intelligence, How Much Did You Miss?

Featured News

1.XRP Ledger Reduces Base Reserve from 10 XRP to 1 XRP to Lower User Barrier

2.Aave TVL Hits All-Time High Amid Soaring Deposit Rates

3.Wintermute Associated Address Buys 2,366,000 AIXBT 15 Hours Ago

4.USDe Surpasses DAI to Become the Third-Largest Market Cap Stablecoin

5.Sources: Trump to Announce SEC Chair Nominee as Early as Tomorrow

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

[COINBASE] Today, Coinbase became a trending topic, mainly due to several key developments. The platform announced a new partnership with Apple Pay, allowing users to directly purchase cryptocurrency via Apple Pay, a move that was well received. Additionally, the U.S. government transferred a significant amount of Bitcoin to Coinbase, sparking speculation about potential sell-offs. Furthermore, Coinbase listed the meme coin MOODENG, leading to market discussions and speculation about possible future coin listings.

[MOODENG] As a Solana-based meme coin, MOODENG gained attention for being included in Coinbase's listing plans, causing its price and trading volume to surge. Its market cap skyrocketed from $300 million just a few months ago to a valuation poised to surpass $1 billion, prompting market discussions about its role as a key player in the meme coin space, similar to Dogecoin. This listing also fueled speculation about other potential meme coins to be listed in the future, such as PNUT and CHILLGUY. While questions remain about its long-term sustainability, this listing is seen as a positive signal for the meme coin market, attracting the attention of both retail and institutional investors.

[LINK] LINK has received widespread attention due to its recent price surge, breaking key resistance levels and hitting new all-time highs, becoming a hot topic of discussion. The discussion has emphasized LINK's partnerships with several major financial institutions (such as Swift, UBS Group, and the Central Bank of Brazil), highlighting its significant role in bridging traditional finance and blockchain technology. This narrative has sharply contrasted LINK's actual progress in institutional partnerships with XRP's perceived lack of momentum. Additionally, the integration of LINK with Europe's first tokenized securities trading platform and its increasing adoption in the financial sector have also become focal points of interest.

[AVAX] Today's discussion about AVAX has focused on its significant price increase, surpassing $50, accompanied by predictions of further growth in the future. The upcoming Avalanche9000 network upgrade scheduled for December 16 has been a focal point, with the upgrade promising enhanced interoperability and custom L1 chain creation features. The community holds an optimistic view of AVAX's potential to surpass other cryptocurrencies (such as XRP) in institutional adoption. Furthermore, the Avalanche ecosystem is expanding through new projects and partnerships (including the gaming and NFT sectors), contributing to its growing popularity.

Threads & Tweets

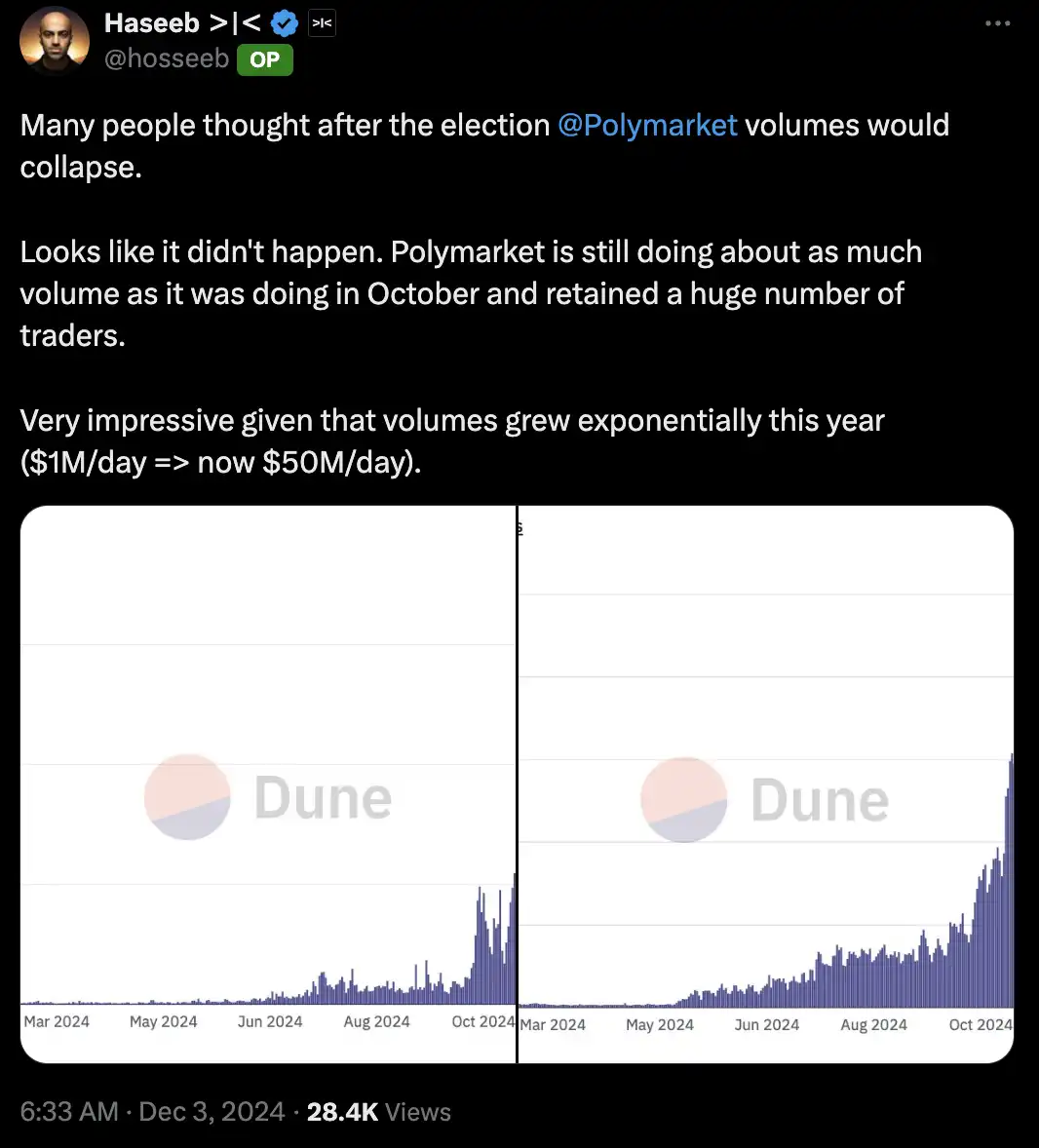

1. Polymarket data not as bleak as the market expected; @hosseeb

2. The sound barrier of Crypto Twitter, @loomdart

Featured Articles

1. "Arthur Hayes: Making ICO Great Again"

Arthur Hayes

In this article, Arthur Hayes dissects the rise and fall of ICOs in the cryptocurrency industry from a sharp perspective and offers insights into why ICOs could return to their former glory. He keenly points out that over-reliance on centralized exchanges and venture capital-backed overvalued projects has become a hindrance to the industry's development. Drawing a comparison between Meme coins and ICOs' capital formation mechanisms, he advocates for a return to decentralization and the high-risk, high-reward ethos of crypto projects. Through an interpretation of technological potential and viral spread, Arthur Hayes once again demonstrates his foresight into the industry's future development.

2. "WSJ: Risks of MicroStrategy Stock Leverage Emerging Behind Bitcoin Frenzy"

By zhouzhou, BlockBeats

This article analyzes the leveraged funds launched by Tuttle Capital and Defiance ETFs, focusing on MicroStrategy stock to amplify its returns associated with Bitcoin. These funds use derivatives and options for leverage but face liquidity issues, leading to underperformance. Investors are disappointed with the funds' deviation in performance, and critics warn that these funds exacerbate MicroStrategy's stock price volatility, posing risks that could lead to losses.

Top Gainers & Losers

Token price fluctuations on December 3, sorted and ranked by trading volume

Top Gainer

1. $HBAR

2. $MOODENG

3. $ONDO

Top Loser

1. $ZEREBRO

2. $WEXO

3. $CLANKER

On-Chain Data

Weekly on-chain fund flows on December 3

You may also like

Telegram 2025 Financial Report Puzzle: Revenue Soars by 65%, Yet Plagued by $200 Million Loss Due to TON?

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

Crypto and AI: the hidden digital gray market of Xianyu

Crypto and AI: You Can Buy Anything on Xianyu.

Why Is On-Chain Fixed-Rate Lending Hard to Come By? "Basis Swap" Trading Is the Way Out

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.

America's First State-Backed Stablecoin FRNT: Can It Save Wyoming Amid Energy Slump?

Zcash Core Team Exodus Story, Crypto's Own OpenAI Drama

Kinetiq Exclusive Interview: From Hyperliquid's Largest LST Protocol to the "Exchange Factory"

Glassnode New Year Report: $95K Call Option Premium, Bulls Shift to Aggressive Offense

Base contributes 70% of revenue but pays only 2.5% in rent; Superchain may be entering its "forking" countdown

ZCash Team Split, Bank of America Upgrades Coinbase Rating, What's the Overseas Crypto Community Talking About Today?

WEEX Global AI Trading Hackathon Kicks Off: $1.88M Prize Pool Powers the Next Generation of AI Trading Champions

WEEX Labs, the innovation arm of WEEX, a leading global crypto exchange serving over 6.2 million users across 150+ countries, is set to kick off the preliminary round of its flagship global AI trading hackathon, AI Wars: WEEX Alpha Awakens, on January 12, 2026. Backed by the strong support of world-class sponsors including Amazon Web Services (AWS), the total prize pool has surged from $880,000 to an unprecedented $1,880,000, positioning AI Wars among the largest AI trading hackathons in the crypto industry. At the top of the leaderboard awaits an extraordinary champion prize — a Bentley Bentayga S, already on standby in Dubai, ready to be claimed by the ultimate AI trading victor.

December Exchange Rankings: CEX and DEX Simultaneously Weaken, On-Chain Perpetual Contract Trading Volume Declines by 30%

2025 Market Prediction Retrospective: Total Transaction Volume Exceeds $50 Billion, Duopoly Market Share Exceeds 97.5%

Key Market Info Discrepancy on January 9th - A Must-Read! | Alpha Morning Report

Aster Coin: A Deep Dive into Its Price, Potential, and Why It’s Catching Eyes in 2026

Have you ever stumbled upon a crypto project that seems poised for growth amid market volatility, only to…

Left Hand BTC, Right Hand AI Computing Power: The Gold and Oil of the Data Intelligence Era

Wyoming’s FRNT Stablecoin Launches — First State-Backed Stablecoin Hits Market

Key Takeaways Wyoming leads innovation in the U.S. by launching the first state-backed stablecoin, FRNT, representing a pivotal…

Telegram 2025 Financial Report Puzzle: Revenue Soars by 65%, Yet Plagued by $200 Million Loss Due to TON?

North Korean Hackers Enjoy 'Fat Years': Stole Record Amount in 2025, With Money Laundering Cycle of About 45 Days

Crypto and AI: the hidden digital gray market of Xianyu

Crypto and AI: You Can Buy Anything on Xianyu.

Why Is On-Chain Fixed-Rate Lending Hard to Come By? "Basis Swap" Trading Is the Way Out

What’s Driving Crypto Markets in Early 2026: Market Swings, AI Trading, and ETF Flows?

Imagine checking Bitcoin and Ethereum prices in a day — one minute up 5%, the next down 4%. Sharp moves, quick reversals, and sensitivity to macro signals marked the first week of 2026. After an early-year rally, both assets pulled back as markets recalibrated expectations around U.S. monetary policy and institutional flows. For traders — including those relying on AI or automated systems — this period offered a vivid reminder: abundant signals do not guarantee clarity. Staying disciplined in execution is often the real challenge.