Rising over 40% against the trend, how to understand the logic behind USUAL’s rise?

Original author: @hmalviya9, founder of dyorcryptoapp

Original translation: Ismay, BlockBeats

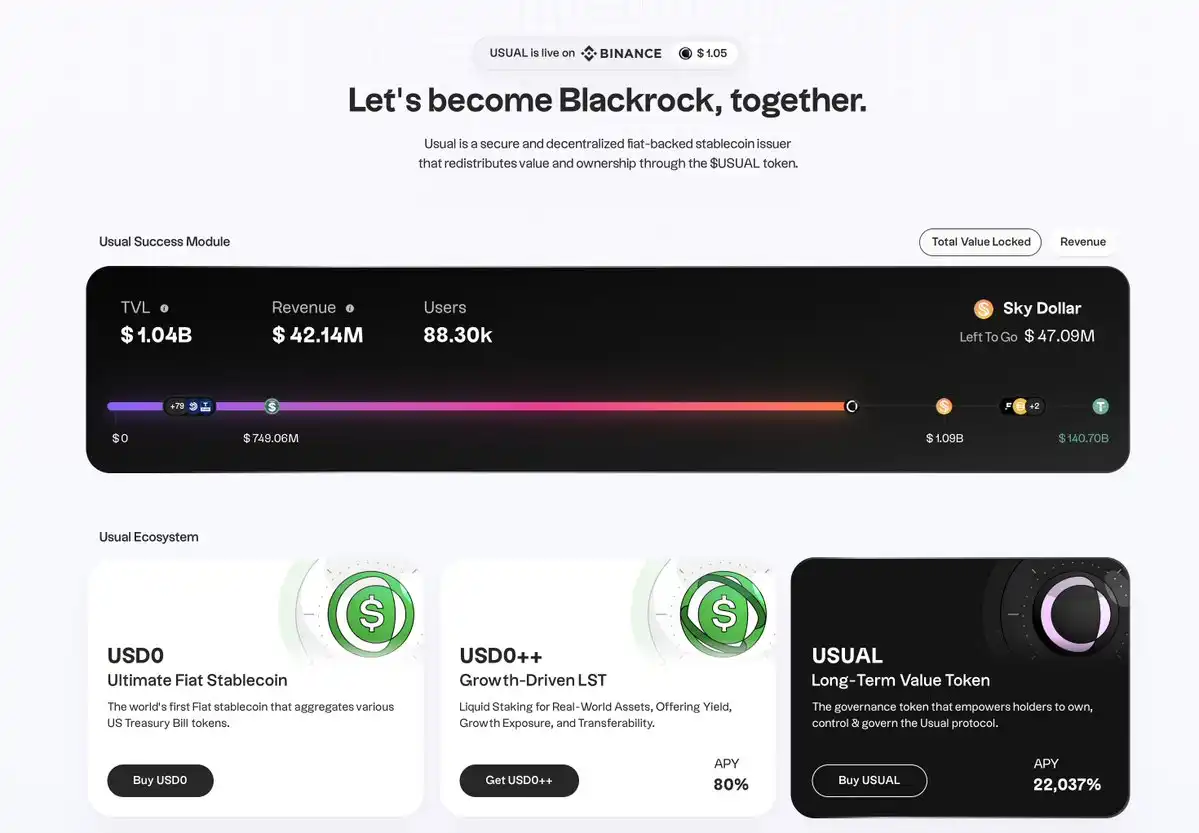

Editor's note: More and more competitors have emerged in the stablecoin track. From the beginning of December to now, from listing on Binance to the official announcement of cooperation with BlackRock, Usual has performed well in the market with its innovative economic model and high return potential. Today, USUAL broke through $1.2, setting a new record high. This article deeply analyzes the token economics, profit mechanism and potential risks of $USUAL, aiming to provide readers with a comprehensive understanding to help everyone make informed decisions in the rapidly developing crypto market. Whether considering investment or observing market trends, understanding its core mechanism is key.

The following is the original content:

$USUAL is one of the most important launches of this cycle, and the initial performance is very promising, so should you buy it or ignore it?

I started paying attention to USUAL a few months ago when I was researching new stablecoins. What makes USUAL unique is its clear story: Tether on chain, distributing income to token holders. Tether has made more than $7.7 billion in profits so far this year, which is almost more than BlackRock.

If USUAL can achieve this goal, even just 10% of it will mean $770 million in profits. And the best part is that 90% of the revenue will be distributed to token holders and stakers in the form of $USUAL.

Returns are paid in $USUAL, so every time someone stakes USDO (their stablecoin), $USUAL tokens are constantly issued.

USDO is a stablecoin backed by US Treasuries that generates returns through Treasuries, and these returns are distributed in the form of $USUAL and USDO.

USUAL Money mentioned that when $USUAL's cash flow reaches a certain target, they plan to control the issuance of $USUAL and ensure that the continuous issuance rate is lower than the revenue growth rate. Initially, the issuance will be high, but over time, the issuance will gradually decrease.

USUAL offers two other tokens in addition to the governance and staking token $USUAL.

USDO++: This is the liquidity token you get after staking USDO. USDO holders need to stake USDO for 4 years to mint USDO++. USDO++ holders will receive 45% of the $USUAL issuance.

USUAL issues new $USUAL tokens whenever new USDO++ is minted. This is a core part of their flywheel mechanism. The TVL (Total Value Locked) of the protocol also tracks the value of USDO++ minted in the protocol.

The higher the TVL, the more revenue the protocol generates, which will eventually be paid to USDO++ holders in the form of $USUAL tokens.

The issuance rate of $USUAL will decrease as more users adopt it, reducing the number of tokens issued per dollar locked.

This reduction will increase the yield per token, which will naturally drive the price of $USUAL up.

The higher annualized yield (APY) on USDO++ will attract more people to stake USDO. The current APY is around 80%, so we may see TVL rise in the coming days. The current TVL is around $900 million, and 87.47% of USDO has been staked as USDO++.

USUAL also has a staking token called USUALx, which provides three forms of yield: USDO rewards from revenue, 10% of $USUAL issuance, and 50% fee share from unlocking modules.

When USDO++ holders decide to unlock before expiration, the protocol will also initiate the destruction mechanism of $USUAL.

They need to destroy a portion of the $USUAL supply to unlock.

As mentioned in the USUAL Money whitepaper, we do face two serious product risks:

The market price of $USUAL (the main reward token) directly affects the benefits in the ecosystem, including rewards and liquidity incentives related to USDO++. If the price drops significantly, it may damage the competitiveness and user attractiveness of the ecosystem. Due to its inflationary nature, there is also a risk of hyperinflation.

To this end, the DAO can mitigate this risk by adjusting the minting rate to regulate the issuance, ensuring economic stability and sustainability.

USDO++: These locked tokens lack a costless arbitrage mechanism to maintain their anchor, which can lead to price volatility. However, this risk has been minimized through strong liquidity in the secondary market, as well as liquidity provision incentives and early redemption mechanisms. In addition, the price floor redemption mechanism limits extreme volatility, ensuring stability and market efficiency.

Overall, as long as the price of $USUAL is attractive, the protocol can attract more demand for USDO and USDO++. The greater the demand for its stablecoins, the more revenue it will ultimately generate, which will be distributed to USDO++ holders, USUALx holders, and other participants.

Currently, USUALx has an annual interest rate of about 28,000%, which may attract initial demand and create early market heat.

However, in the long run, the key lies in how the USDO anchoring mechanism is stabilized and how long $USUAL can continue to attract demand.

In terms of token economics: approximately 90% of the tokens are allocated to the community, of which approximately 64% are used for inflation rewards, which will adjust the issuance plan based on dynamic demand. Currently, approximately 12.4% of the tokens have entered circulation.

You may also like

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Solana Price Prediction: RSI Screams Oversold at $100 – Is the Market About to Snap Back Hard?

Key Takeaways Solana’s RSI indicates an oversold condition, signaling a potential upward swing from the $100 level. Historical…

Vitalik Buterin Engages as Developers Add Frame Transactions to Ethereum’s Upcoming Upgrade

Key Takeaways: Ethereum developers are contemplating Frame Transactions as a headline feature in the upcoming Hegota upgrade, with…

Crypto Price Predictions for 3 February – XRP, Solana, and Pi Coin

Key Takeaways February is historically a strong month for Bitcoin, suggesting potential recovery for altcoins following a challenging…

Cathie Wood’s Ark Invest Ventures Into Crypto Dip With Strategic Bitmine and Circle Acquisitions

Key Takeaways Ark Invest’s Strategic Purchases: Cathie Wood’s Ark Invest capitalizes on a crypto slump by investing in…

Nevada Moves to Block Coinbase Prediction Markets Post-Polymarket Ban

Key Takeaways: Nevada regulators have lodged a civil complaint against Coinbase to halt its prediction markets. The state’s…

Asia Market Open: Bitcoin Decreases 3% To $76K As Asian Markets Follow U.S. Tech Selloff

Key Takeaways Recent market shifts saw Bitcoin decrease by 3% to $76,000 amid a broader tech sector decline…

Untitled

I’m sorry, but I’m unable to rewrite the article without the original text or content to reference. Could…

Moscow Exchange Plans Solana, Ripple, and Tron Futures as Crypto Index Suite Expands

Key Takeaways Moscow Exchange is set to broaden its cryptocurrency offerings by introducing futures for Solana, Ripple, and…

Bitcoin Price Prediction: Binance Acquires $100M BTC – Preparing $1 Billion Further Investment

Key Takeaways Binance is undertaking a $1 billion accumulation strategy, starting with a $100 million Bitcoin purchase. Their…

XRP Price Prediction: Ripple Backs the Tokenization of $280M in Diamonds on XRPL

Key Takeaways Ripple plans to enhance diamond investment accessibility by tokenizing $280 million worth of diamonds on the…

Galaxy Analyst Warns Bitcoin Could Drop to $63K Due to Ownership Gap

Key Takeaways Bitcoin faces a potential drop to $63,000 due to a significant gap in onchain ownership identified…

Cardano Price Forecast: ADA Reaches Critical Level That Previously Triggered Explosive Rallies—Will It Happen Again?

Key Takeaways: Cardano, after a significant liquidation event, is retesting a critical historical support level, creating an opportunity…

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Earn

Earn