Silently claiming the top spot in the Solana DEX market share, how did HumidiFi achieve this?

Original Article Title: "Solana's 'Invisible Champion': Rising to First in Market Share Quietly, How Did Dark Pool HumidiFi Do It?"

Original Article Authors: TATO, azsui

Original Article Translation: Tim, PANews

PANews Editor's Note: PANews Flash on November 3 — HumidiFi's 30-day trading volume surpassed Meteora and Raydium, leading the Solana DEX market. Most of the market is unfamiliar with HumidiFi, and the project's official Twitter account has only 12,000 followers. For this "invisible champion," PANews has organized and translated the relevant content of authors TATO and azsui, including an introduction to the HumidiFi project and the upcoming ICO event.

Body:

What Is Prop AMM? And What Is HumidiFi?

Traditional Automated Market Maker (AMM):

• Allows any user to provide liquidity→earn trading fees

• Uses a passive pricing mechanism (x*y=k constant product formula)

• Requires TVL to achieve deep liquidity

• Liquidity Providers (LPs) face impermanent loss risk

Professional Market Maker Automated Market Maker (Prop AMM):

• All liquidity provided by professional market makers

• Pricing strategy continuously updated and independent of user trading behavior

• Algorithm actively manages inventory like a centralized exchange market maker

• No public liquidity providers (LPs) = retail users do not bear impermanent loss

Core Features of HumidiFi:

• Rapid quote updates, performing multiple repricings per second

• Private order flow mechanism reduces volatility and front-running risk

• Achieves capital efficiency by precisely concentrating liquidity in the highest-demand areas

• Operates entirely on-chain with an algorithm

• Accessible only through the Jupiter route

This can be understood as the on-chain version of Citadel Securities, a fully blockchain-native and permissionless market maker solution.

HumidiFi Achievements

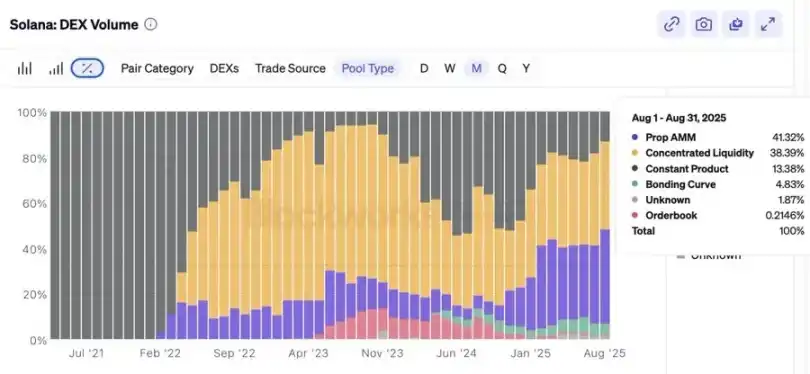

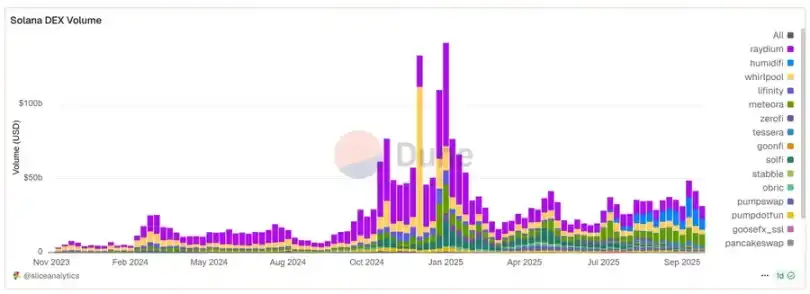

Trading Volume Leadership

• Achieved approximately $1 trillion in total trading volume within 5 months

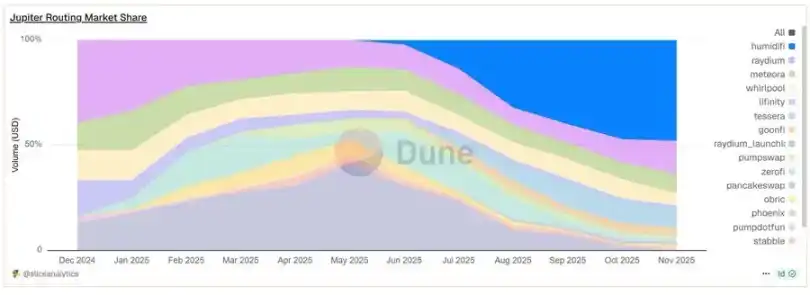

• Accounted for 35% of the total DEX trading volume on the Solana blockchain

• Daily trading volume consistently ranged from $10 billion to $190 billion

• Last month's trading volume reached $340 billion (surpassing the total of Raydium and Meteora)

Execution Quality

• Narrower spread for SOL/USDC compared to Binance

• More competitive quotes → lower slippage, close to minimal price impact

• 99.7% fill rate (almost zero trade failures)

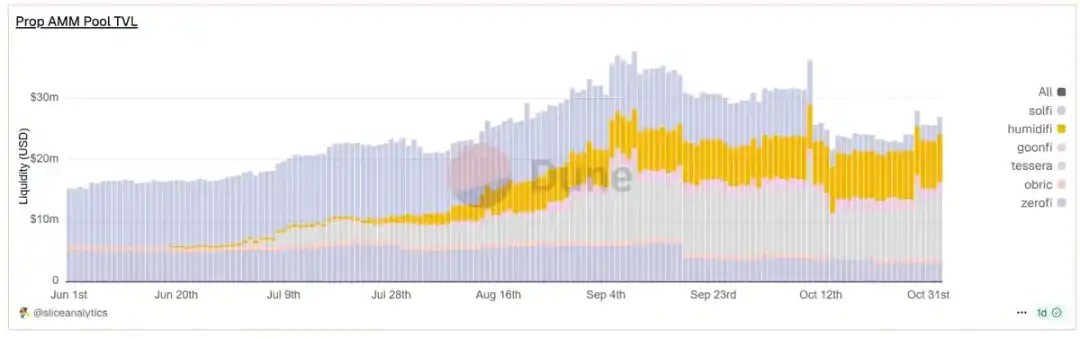

Capital Efficiency Marvel

• Processed $8.19 billion in daily trading volume with only $5.3 million TVL

• Achieved 154x capital efficiency (compared to around 1x for traditional AMMs)

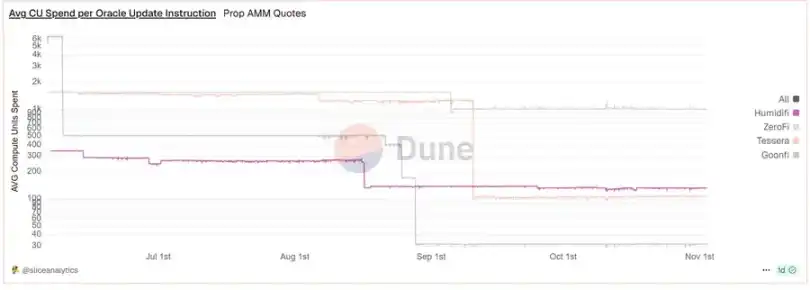

• Oracle updates require only 143 computation units (approximately 1000x lighter than regular swaps)

The result? Users get better prices, without even needing to know that HumidiFi is behind the operation.

Why Choose HumidiFi?

Technological Superiority

• Ultra-lightweight oracle updates require only 143 computation units

• Sub-Millisecond Price Refresh (Competitors take 15-30 seconds)

• Tight liquidity around oracle-based price aggregation = Ultimate capital efficiency

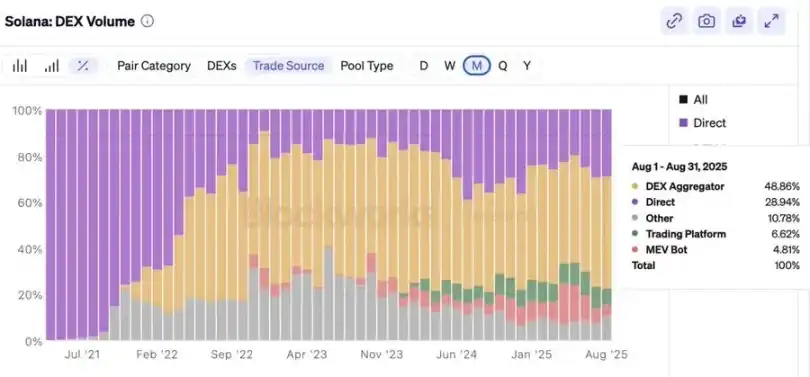

Jupiter Ecosystem Integration Advantage

• Jupiter processes 80%+ of Solana's swap volume

• HumidiFi captures 54.6% of Jupiter's professional market maker route

• Better prices → More routing options → Higher trading volume → Price edge amplification (Flywheel Effect)

Stealth Advantage

• No front-end interface

• Private order flow reduces MEV attack risk

• Anonymous operation = Reduced regulatory target risk

First-Mover Scale Effect

While competitors aim for millions, HumidiFi achieves a billion-asset breakthrough directly. In the DeFi market, liquidity attracts liquidity, and they have seized the initiative.

The Future is Here: HumidiFi Will Lead Solana DeFi Development

In short, it always gives you the best quote. For users, this is our core need.

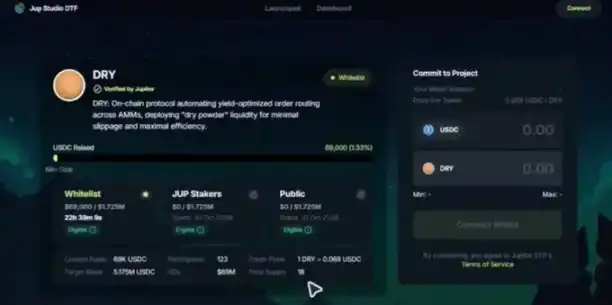

HumidiFi will launch its governance and utility token $WET on Jupiter's latest DTF Launchpad in November (specific date to be determined).

This sale will be conducted at a fixed price and will consist of three stages.

· Whitelist Stage

· $JUP Staker Stage

· Public Sale Stage

The key is that the $WET token has not received any investment from venture capital firms.

This means that if venture capital firms wish to purchase, they must participate in the ICO subscription or purchase from the secondary market after the token is publicly listed.

After the sale, $WET will immediately be available for trading in the liquidity pool on the Meteora platform.

Conclusion

HumidiFi is a professional AMM protocol, accounting for over 50% of total DEX trading volume.

$WET will be the first ICO project on the Jupiter DTF Launchpad platform.

$JUP stakers will be able to participate in this ICO sale.

You may also like

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Blockchains Quietly Brace for Quantum Threat Amid Bitcoin Debate

Key Takeaways Cryptocurrency networks, especially altcoins, are enhancing security to prepare for potential quantum computing threats. Bitcoin faces…

Canton Token Surges Amid DTCC’s Tokenized Treasury Plans

Key Takeaways Canton Coin has surged by approximately 27% due to growing institutional interest and DTCC’s announcement to…

Blockchains Quietly Ready Themselves for the Quantum Threat as Bitcoin Debates Its Timeline

Key Takeaways: Altcoin blockchains, including Ethereum and Solana, are proactively developing defenses against a potential quantum computing threat,…

Canton Coin Rallies as DTCC Introduces Tokenized Treasury Plans

Key Takeaways Canton Coin surged by 27% following DTCC’s announcement of tokenizing US Treasury securities on its Canton…

Canton Token Climbs Amid DTCC’s Tokenized Treasury Plans

Key Takeaways: The Canton Coin experienced a 27% increase following DTCC’s announcement of tokenizing US Treasury securities. The…

Blockchains Quietly Brace for Quantum Threats while Bitcoin Engages in Timeline Debate

Key Takeaways: Diverse blockchains are proactively exploring quantum-resistant technologies, unlike Bitcoin, where consensus on quantum threat response is…

Three Titans Bet $17 Million, FIN Makes Strong Move into Cross-Border Payments

Cryptocurrency as a Christmas Gift? Gen Z Is Reconsidering

Stepping into the Stablecoin Craze After Six Years, He Sees the Shape of the Future of Payments

Over $6 Million Stolen: Trust Wallet Source Code Compromised, How Did Official Version Become Hacker Backdoor?

IOSG Founder: Cryptocurrency's 2025 Performance Will Be 'Nasty,' But It Marks the Beginning of a New Cycle

30 Predictions, Filtered for Five 2026 Crypto Consensus

2025 Crypto Rich List: 12 Big Winners, Who Bet on the Money Maker?

「Macro Master」 Raoul Pal on 30x Growth Under Indexation: Bitcoin Will Eventually Surpass Gold

Uniswap Pay Dispute Escalates, Maple Finance Loan volume Hits All-Time High, What's the Overseas Crypto Community Talking About Today?

Key Market Information Discrepancy on December 25th - A Must-See! | Alpha Morning Report

December 26th Market Key Intelligence, How Much Did You Miss?

Crypto Christmas Heist: Over $6 Million Lost, Trust Wallet Chrome Extension Wallet Hacked Analysis

Blockchains Quietly Brace for Quantum Threat Amid Bitcoin Debate

Key Takeaways Cryptocurrency networks, especially altcoins, are enhancing security to prepare for potential quantum computing threats. Bitcoin faces…

Canton Token Surges Amid DTCC’s Tokenized Treasury Plans

Key Takeaways Canton Coin has surged by approximately 27% due to growing institutional interest and DTCC’s announcement to…

Blockchains Quietly Ready Themselves for the Quantum Threat as Bitcoin Debates Its Timeline

Key Takeaways: Altcoin blockchains, including Ethereum and Solana, are proactively developing defenses against a potential quantum computing threat,…

Canton Coin Rallies as DTCC Introduces Tokenized Treasury Plans

Key Takeaways Canton Coin surged by 27% following DTCC’s announcement of tokenizing US Treasury securities on its Canton…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com