South Korean Crypto KOLs Drive 1,200% $USELESS Rally: How a "Worthless" Token Hit $96M Market Cap

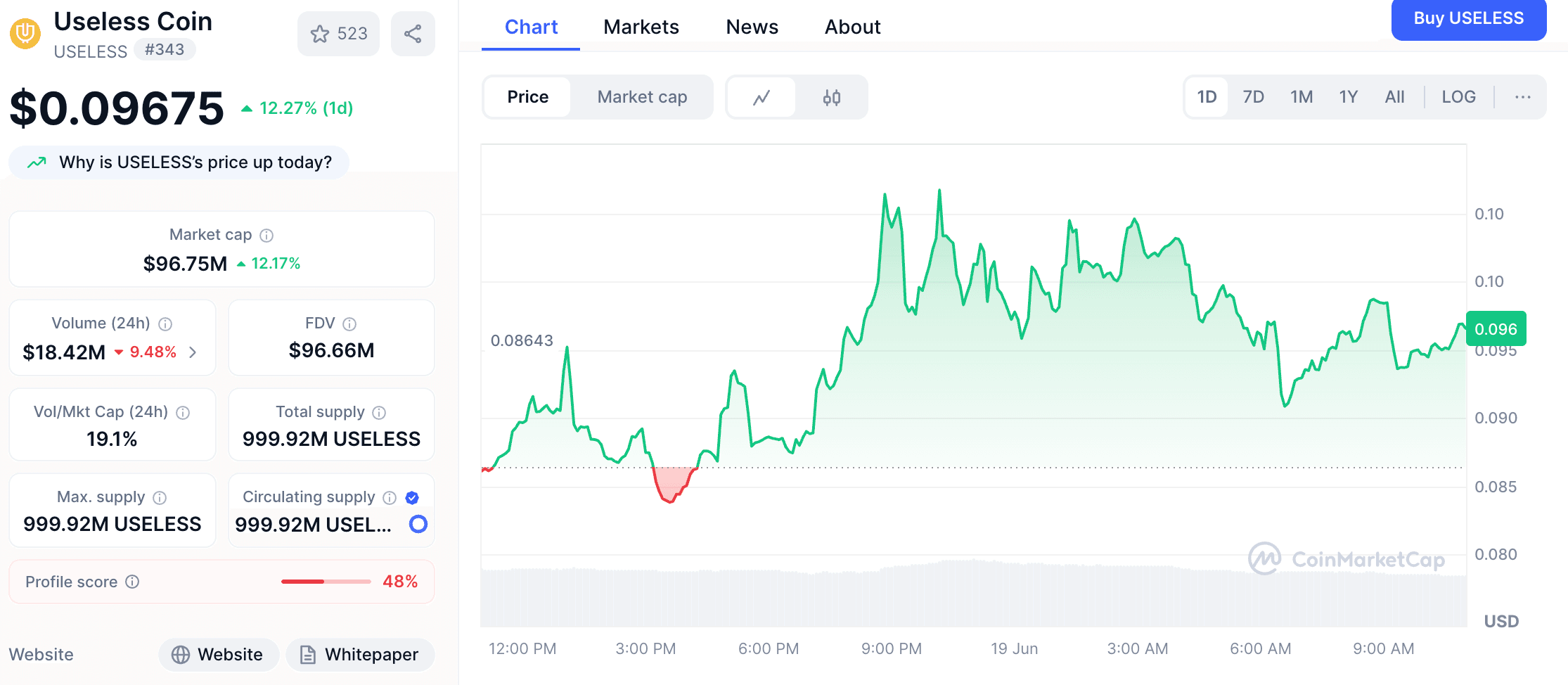

In the ever-evolving cryptocurrency landscape, South Korea's influential role in the altcoin market continues to make waves. The latest example is the remarkable rise of $USELESS, a memecoin experiencing a 12.15% daily surge that's pushed its market cap to nearly $100 million—despite or perhaps because of its transparently ironic name.

South Korean Influence Drives $USELESS Momentum

South Korea has long been known for its outsized impact on cryptocurrency markets, from last year's XRP frenzy that saw 400% price increases to the current fascination with a token that literally brands itself as worthless.

According to Bradley Park, a Seoul-based analyst at DNTV Research who spoke with CoinDesk, the $USELESS phenomenon is closely tied to Korean cryptocurrency key opinion leaders (KOLs).

At the center of this movement is Yeomyung, a prominent Korean KOL and liquidity provider. After investing early in $USELESS and holding through a 50% drawdown, he now boasts significant paper gains and has become the token's largest holder with a 2.8% stake.

"I now hold 2.8% of $USELESS, officially surpassing @theunipcs to become the largest holder. Yet I still won't sell. The era of BONK and USELESS is coming. $pump has always been 'useless'," Yeomyung (@duaud9912) posted on Twitter.

Park explained to CoinDesk: "He made enormous profits during the Trump coin hype, and with $USELESS, he's profiting from providing early liquidity and now just holding and waiting. They're all waiting for centralized exchange listings, because without that, there's no real exit."

This steadfast conviction has inspired copycat trading behavior among retail investors throughout South Korea. Even wallets associated with insiders from Solana's Jupiter platform (JUP) appear to be holding $USELESS.

From "Exit Liquidity" to Market Makers

The $USELESS phenomenon reflects a broader evolution in Korean market behavior.

"I truly believe Korean users are no longer just 'exit liquidity' in this market," Park noted. "They're starting to understand the market and gradually growing into genuine global players."

Another key figure in the $USELESS story is "Bonk Guy," an early promoter of BONK who resurfaced to enthusiastically promote $USELESS on Twitter as prices rebounded. However, some Korean traders, including Park, question his sincerity.

"Bonk Guy was the first to promote LetsBONK," Park said. "But after the price crashed, he went quiet. Now that $USELESS is rebounding, he's suddenly showing interest again."

The rise of Hyperliquid, Kaia, and now Solana-based memecoins like $USELESS indicates that South Korea has evolved beyond being a secondary market.

The Nihilistic Appeal of $USELESS

Unlike XRP's rise, which depended on U.S. regulatory clarity and narratives about deregulation under Trump, the $USELESS boom reflects the market's current attention span and exhaustion.

With no roadmap, no practical utility, and no pretense of building toward a greater vision, $USELESS represents a meme-ified disillusionment—a collective dismissal of traditional cryptocurrency promises and an ironic bet on "nothingness." Paradoxically, this bet seems more honest than many tokens claiming to change the world.

Trump Backs GENIUS Act

In related news, President Trump voiced support for the GENIUS Act on Tuesday via Truth Social. Having already passed the Senate with bipartisan support, Trump called the bill a crucial step in advancing American leadership in digital assets.

Trump urged the House to pass the legislation "at lightning speed" without modifications, demanding the bill reach his desk "with no delays, no attachments."

This stance demonstrates strong executive support for the "Guiding and Establishing National Innovation for U.S. Stablecoins Act," which introduces reserve and compliance requirements for USD-backed stablecoin issuers and represents the first major cryptocurrency legislation to pass the Senate.

Coinbase Launches Merchant Payment Platform

Coinbase (COIN) released Coinbase Payments on Wednesday—a new merchant payment solution built on its Ethereum Layer-2 network, Base.

According to CoinDesk, the platform is designed for global e-commerce platforms like Shopify, enabling 24/7 USDC stablecoin payments without merchants needing blockchain expertise. Features include gas-free stablecoin checkout, an e-commerce API engine, and an on-chain payment protocol.

Coinbase states the system aims to replicate traditional payment rails while reducing costs and offering around-the-clock settlement. This move positions Coinbase to compete with fintech companies like Stripe and PayPal in modernizing payments with blockchain infrastructure.

The release also deepens Coinbase's partnership with USDC issuer Circle (CRCL). Following the announcement, Circle's stock rose 25%, while Coinbase shares increased by 16%. Coinbase noted that stablecoins processed $30 trillion in transactions last year—triple the previous year—and is betting that programmable, dollar-pegged payments will continue disrupting the global financial system.

Market Dynamics

Despite escalating tensions between Israel and Iran, Bitcoin showed resilience with a V-shaped recovery, climbing back above $105,000. Strong ETF inflows and key support at $103,650 highlight institutional confidence amid market volatility.

Ethereum rose 4%, holding steady above $2,500. Record staking volumes and continued fund accumulation demonstrate strengthening investor confidence despite geopolitical tensions.

As traditional markets show mixed results, with gold slightly down and indexes responding cautiously to Fed policy statements, the cryptocurrency market—particularly in South Korea—continues to forge its own path with phenomena like $USELESS capturing both attention and capital.

You may also like

Monero Surges: Breaking Above $680 with an 18% Increase

Key Takeaways Monero (XMR) has been on the rise, gaining approximately 18% in the past 24 hours. The…

Ethereum Experiences Price Drop Amid Broader Crypto Sell-Off

Key Takeaways Ethereum recorded a less severe price drop than other cryptocurrencies during a recent market sell-off. Analysts…

$H Project Team Withdraws Massive H Tokens from Exchanges

Key Takeaways $H project team removed H tokens worth $23.5 million from exchanges in 24 hours. The primary…

Cryptocurrency Trading and Market Trends

Key Takeaways Current cryptocurrency trading landscape offers diverse opportunities for investors. Technological innovations continue to drive market evolution,…

Cryptocurrency Exchange Security and Trends

Key Takeaways Cryptocurrency exchanges have increasingly become targets of cyber-attacks, necessitating robust security measures. Market trends indicate a…

Error Prevented Content Extraction: Causes and Solutions

Key Takeaways Excessive requests can result in blocked access to data sources. Ensuring adherence to API usage policies…

Understanding the Impact of the Crypto Market and Exchange Dynamics

Key Takeaways The cryptocurrency market remains highly volatile with frequent significant fluctuations in value. Exchange platforms play a…

BlockSec Detects Abnormal YO Protocol Transaction on Ethereum

Key Takeaways An anomaly occurred on YO Protocol resulting in the exchange of approximately $3.84 million worth of…

traders anticipate Fed May Accelerate Rate Cuts

Key Takeaways Traders are speculating that the Federal Reserve could implement an interest rate cut before May due…

Justin Sun Withdraws 200 Million USDC from HTX

Key Takeaways Blockchain entrepreneur Justin Sun has withdrawn a significant amount of 200 million USDC from the HTX…

Ethereum Whale Extends Holdings with Additional ETH Acquisition

Key Takeaways An Ethereum whale has recently increased their holdings by 1,299.6 ETH. This transaction brings the whale’s…

Bitcoin Surges Past $92,000 Amid Fed Turmoil and Geopolitical Tensions

Key Takeaways Bitcoin’s price increased by 1.5%, surpassing $92,000 as geopolitical and financial narratives impact the market. Increased…

BlackRock Transfers BTC and ETH to Coinbase

Key Takeaways BlackRock has recently conducted a significant transaction involving cryptocurrency deposits into Coinbase. The transaction included the…

Suspected Insider Trades $NYC Token and Incurs Losses

Key Takeaways A wallet suspected of insider trading purchased $NYC tokens shortly before an official announcement by ex-NYC…

Huobi HTX Criticizes Flow Project Team’s Decision on Asset Transfer

Key Takeaways Huobi HTX has condemned the Flow (FLOW) project team’s unilateral asset transfer actions. On December 27,…

Whale Withdraws 5,894 ETH Worth $18.33 Million from Kraken

Key Takeaways A significant movement of 5,894 ETH, valued at $18.33 million, has been observed from Kraken by…

80% of oil income settled in stablecoins, Venezuela makes USDT its second currency

A Decade-Old Crypto Veteran, Zcash Is Facing a Midlife Crisis Too

In youth, restraint in the name of compliance; in midlife, wealth—and thoughts of divorce.

Monero Surges: Breaking Above $680 with an 18% Increase

Key Takeaways Monero (XMR) has been on the rise, gaining approximately 18% in the past 24 hours. The…

Ethereum Experiences Price Drop Amid Broader Crypto Sell-Off

Key Takeaways Ethereum recorded a less severe price drop than other cryptocurrencies during a recent market sell-off. Analysts…

$H Project Team Withdraws Massive H Tokens from Exchanges

Key Takeaways $H project team removed H tokens worth $23.5 million from exchanges in 24 hours. The primary…

Cryptocurrency Trading and Market Trends

Key Takeaways Current cryptocurrency trading landscape offers diverse opportunities for investors. Technological innovations continue to drive market evolution,…

Cryptocurrency Exchange Security and Trends

Key Takeaways Cryptocurrency exchanges have increasingly become targets of cyber-attacks, necessitating robust security measures. Market trends indicate a…

Error Prevented Content Extraction: Causes and Solutions

Key Takeaways Excessive requests can result in blocked access to data sources. Ensuring adherence to API usage policies…