Decoding SynFutures, the Base Layer Aggregator

SynFutures is currently the leading derivative project in the Base protocol ecosystem. It recently announced its post-TGE roadmap, revealing that in addition to entering the derivatives space, it will also expand into the spot aggregator track in the future. In the author's opinion, this is a very bold yet highly imaginative business expansion by the team, reminiscent of the Solana ecosystem leader Jupiter.

The Rise of Jupiter

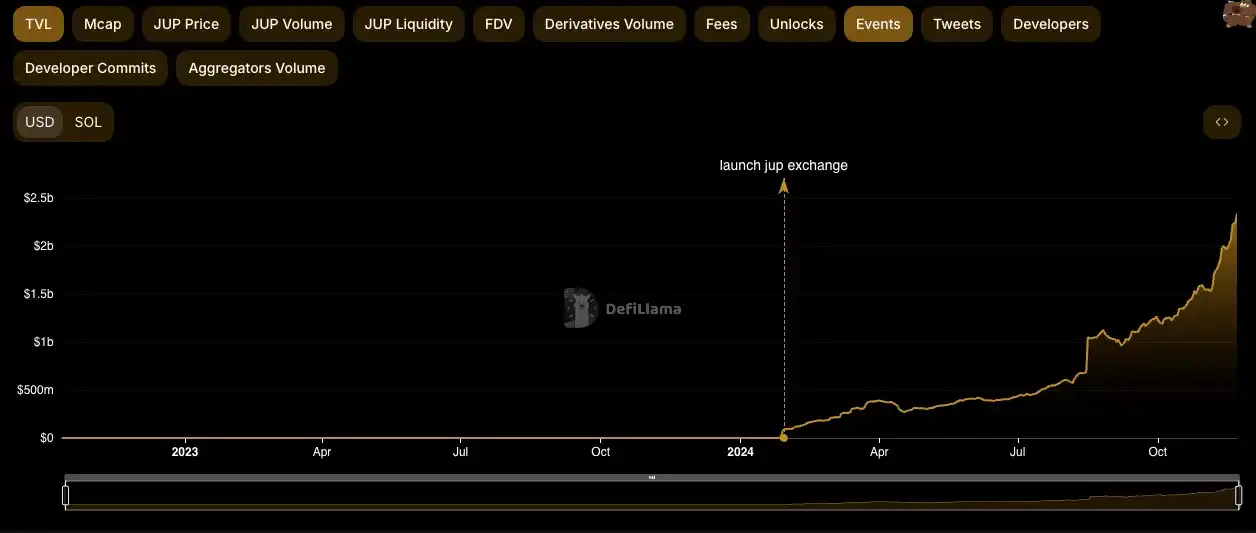

If you have used Solana, you most likely have used Jupiter. Jupiter is the first stop for most users entering the Solana ecosystem, and it can be said to be the **gateway to the Solana ecosystem**. Users can trade spot, trade contracts, purchase JLP, participate in cross-chain activities, and join Launchpad here. Those familiar with Jupiter will know that Jupiter initially only had the spot aggregator business. After the success of this business, it launched contract trading before TGE. Leveraging the impact of airdrops and JLP rewards after TGE, it helped achieve tremendous success in contract trading, becoming a giant spanning multiple tracks in today's Solana ecosystem.

So how did Jupiter achieve such great success today? A significant reason lies in its "diversification strategy," which is not limited to success in one track but rather uses its advantages, resources, brand, and traffic in the original track to horizontally expand into other businesses. Due to its significant first-mover advantage in the Solana ecosystem, it has rapidly become a leader in new fields.

SynFutures at the Core of the Base Ecosystem

From the roadmap currently announced by SynFutures, its current market position and post-TGE development strategy bear many similarities to Jupiter. Firstly, SynFutures is currently the leading derivative track project in the Base ecosystem, and Base can be said to be the hottest project in the L2 ecosystem with the most funds, traffic, and popularity. As the derivative leader SynFutures and the spot leader Aerodrome, there is no doubt that these two projects are best positioned to receive the overflow of public chain momentum, making them the reservoirs of resources in the Base ecosystem. The rapid growth of SynFutures in the Base ecosystem and its importance to the Base ecosystem can also be seen from the data after SynFutures launched on Base:

· Base was launched on July 1st, and its trading volume exceeded $1 billion just 10 days after launch

· The cumulative trading volume is close to $35 billion, with a daily average volume of $230 million

· Q3 trading volume accounts for nearly 50% of the Base network

· The trading volume in the past 24 hours accounts for 72% of the Base network, six times that of the second-place

Becoming the Super App of the Base Ecosystem

Benefiting from its first-mover advantage in various aspects such as users, community, and the market, SynFutures also has the potential to excel in the field of spot aggregation in the Base ecosystem. In the author's view, what SynFutures values is not the trading volume of spot aggregation business but rather the customer acquisition capability in the spot aggregator track. After all, most users do not directly interact with spot DEXs but rather execute trades through aggregators. Spot aggregators are essential tools for on-chain players and serve as hubs for traffic and users. Success in this business can further drive the growth of its futures trading business in terms of users, trading volume, and TVL, as derivative businesses are the most profitable.

Similar to its Jupiter Launchpad business, SynFutures also has the Perp Launched business. In the future, as the demand for listing from projects increases, SynFutures may receive a certain token reward from projects and airdrop them to SynFutures' token stakers. This will incentivize more users to stake, attract more projects to participate in the perp launchpad, and create a positive feedback loop.

Previously, SynFutures has successfully engaged in pilot collaborations for Perp Launchpad with well-known LST, LRT projects such as Lido, Solv Protocol, PumpBTC, top-tier MEME projects such as Cat in a Dogs World (MEW), Degen, and the recently popular AI+MEME project Virtual Protocol on Base. These collaborations have helped projects expand their user base and visibility on the Base chain, receiving rewards from projects and distributing them to SynFutures users. Meanwhile, SynFutures has also established a $1 million Perp Launchpad Grant Program to support emerging projects with listings, event support, etc., helping projects increase their on-chain user base, exposure, and activity.

Base Ecosystem Value Capture Black Hole

And as SynFutures becomes the most crucial reservoir of traffic, users, and funds in the Base ecosystem, its value capture will also reach astonishing levels. In the current scenario of contract-based trading only, its fee revenue in the past 30 days has already surpassed 3.3 million USD, ranking third in the protocol (the third rank being Base Network's Sequencer). As revenue grows with the maturity of its Perp Launchpad and other businesses, SynFutures has a significant opportunity to stand shoulder to shoulder with top protocols like AAVE, MakerDAO, and have more incentive to buy back tokens compared to other protocols.

And we all know that Base is most likely not going to mint tokens due to compliance reasons. But this is actually a good thing for projects in the Base ecosystem because ecosystem valuation and premium will be transferred to other projects within the Base ecosystem. As the flagship of the Base ecosystem, SynFutures, if given the opportunity to be listed on Coinbase like AERO, could potentially be the biggest beneficiary. After all, for the Base ecosystem to grow, it cannot do without Coinbase's support, and the most crucial factor in this process is to find a foothold in this ecosystem. Given that derivatives are a flagship on Base alongside spot trading, its importance to Base is self-evident, and Coinbase is more likely to provide resources to support its further growth, becoming the Killer App of the Base chain.

SynFutures, the Synthesis of the Base Ecosystem

In this scenario, as Jupiter of the Base ecosystem, what is the value proposition of SynFutures? Considering that its official website hints at an upcoming TGE, this is a very interesting question. Taking a spot dex as an example, the valuation of a Solana ecosystem project is approximately twice that of the Base ecosystem.

Therefore, a reasonable valuation of SynFutures on Base would be half of Jupiter's current valuation, roughly reaching around a 5.5 billion USD valuation.

If we take Jupiter's potential into account, some of its businesses are still in the early stage of development, carrying a certain level of unknown risk. Therefore, a calculation based on Jupiter's opening price may be more reasonable. Considering that we are now at the beginning of a bull market and the market sentiment is quite enthusiastic, a valuation of 3 billion US dollars may be a more reasonable price.

From their Discord, it is evident that their Korean community is exceptionally active. SynFutures, backed by well-known investors from both the East and the West such as Pantera, Polychain, Dragonfly, and SIG, has raised over $37.4 million. If there is an opportunity in the future to list on Korean exchanges like Upbit, then this valuation could potentially go even higher, especially considering that we are only at the beginning of a raging bull market.

Epilogue: As We Witness the $100,000 Bitcoin

Bitcoin has finally reached this historic moment, gradually turning the future into reality. With Bitcoin's liquidity overflowing and new funds entering the market, the structural issues in the current altcoin market will change, ushering in a new season of altcoins. In this season, the most anticipated projects are those that can earn real profits, especially those that have found their positioning, have a clear strategy, and are rapidly rising projects, such as Jupiter on Base and the derivatives leader, SynFutures, discussed today.

This article is a contributed submission and does not represent the views of BlockBeats.

Ayrıca bunları da beğenebilirsiniz

Trump’ın World Liberty Financial Token’ı 2025’i %40 Düştü Tamamladı

Key Takeaways: World Liberty Financial, Trump ailesinin kripto portföy projesinin, başlangıçta umut verici olan yatırımları yıl sonunda değer…

Blokzincirler Quantum Tehdidine Hazırlanırken Bitcoin Süreçlerini Tartışıyor

Anahtar teslim projeler ve test ağları yoluyla birçok blokzincir platformu, gelecekteki muhtemel quantum bilgisayar tehditlerine karşı hazırlık yapıyor.…

Eski SEC Danışmanı, RWA’ların Nasıl Uyumlu Hale Getirileceğini Açıklıyor

Key Takeaways RWA (real-world assets) tokenizasyonunda, regülasyonların önemi teknolojiye göre daha ağır basmaktadır ve uyumluluğu sağlamak için önemli…

Kraken IPO ve Kripto’nun ‘Orta Evre’ Döngüsüne Yeniden Can Vermesi

Kraken borsasının 2026 yılında planlanan halka arzı, geleneksel finans dünyasından taze sermaye akışını artırabilir. Bitcoin fiyatları bugüne kadar…

Kripto Piyasasının Düşüşü, VC Değerlemeleri ile Piyasa Değerleri Arasındaki Boşluğu Ortaya Çıkardı

Key Takeaways Birçok blockchain girişimi, önceki özel finansman turlarındaki değerlere kıyasla düşük piyasa değerleriyle işlem görüyor. Kripto piyasasındaki…

HashKey, $250M Yeni Kripto Fonunu Kurdu

HashKey, son kripto fonu olan HashKey Fintech Multi-Strategy Fund IV’in ilk kapanışında 250 milyon dolar toplamayı başardı. Fon,…

Uzatılmış kripto ETF çıkışları, kurumların disengagement’ını gösteriyor: Glassnode

Öne Çıkanlar Bitcoin ve Ether exchange-traded funds (ETF), Kasım başından bu yana sürekli çıkışlar kaydederek, kurumsal yatırımcıların kripto…

Ondo Finance’in, Tokenize Edilmiş Amerikan Hisse Senetlerini Solana’ya Getirme Planı

Önemli Çıkarımlar Ondo, 2026 başında Solana’da tokenleştirilmiş Amerikan hisse senetleri ve ETF’ler (Borsa Yatırım Fonları) sunmayı planlıyor. Tokenler,…

Filipinler, Coinbase ve Gemini’nin VASP Lisanssız Olduğu Yerde Erişimini Engelliyor

Öne Çıkanlar Filipinler’deki regülatörler kripto erişimini sıkılaştırıyor ve uluslararası borsaların yerel lisanslar almasının zorunlu olduğunu belirtiyor. İnternet servis…

Amplify ETFs Stablecoin ve Tokenization ile Ticarette Canlandı

Amplify, stablecoin ve tokenization altyapısı kuran şirketleri izleyen iki yeni borsa yatırım fonunu (ETF) başlattı. Bu fonlar, stablecoinlerden…

JPMorgan, Kripto Ticaretinde Kurumsal Müşteriler için Yenilikler Araştırıyor

JPMorgan, kurumsal müşterilerine yönelik kripto ticaret hizmetlerini değerlendiriyor. CEO Jamie Dimon’un kripto para birimlerine yönelik tavrı değişiyor. ABD’de…

Trend Research, Ethereum ile En Büyük ‘Whales’ Olma Yolunda

Key Takeaways Trend Research, 46,379 ETH daha satın alarak Ethereum varlıklarını 580,000 ETH üzerine çıkardı. Trend Research, halka…

Palmer Luckey’nin Erebor’u 4,3 Milyar Dolar Değerlemeye Ulaştı

Key Takeaways Erebor, Palmer Luckey ve Peter Thiel’in desteklediği dijital banka, 4,35 milyar dolar değerine ulaşarak kripto ve…

El Salvador’ın Bitcoin İşlemleri ve 2025’te Yaşanan Gelişmeler

Öne Çıkanlar El Salvador, 2021’de Bitcoin’i yasal para birimi olarak kabul eden ilk ülke oldu ancak uygulamalar 2025’te…

Price Predictions 12/22: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Key Takeaways Bitcoin, alongside select altcoins, is looking at a recovery phase but is also facing potential sell…

Aave kurucusu Stani Kulechov’un $10M’lik AAVE satın alımı ve yönetişimdeki tartışmalar

Önemli Çıkarımlar Aave kurucusu Stani Kulechov, $10 milyonluk AAVE token satın alımı nedeniyle topluluk tarafından eleştiriliyor. Bu satın…

Trump ailesiyle bağlantılı USD1, Binance’in gelir programını açıklamasıyla 150 milyon dolar arttı

Key Takeaways USD1 stablecoin, Binance’in getiri programının açıklanmasıyla birlikte piyasa değerine 150 milyon dolar ekledi. USD1’in piyasa değeri…

Hong Kong, Sanal Varlık Bayileri ve Saklayıcılar için Lisanslama Rejimlerini İlerletiyor

Hong Kong, sanal varlık ticareti ve saklama hizmeti veren firmalar için lisans gerekliliklerini yürürlüğe koyuyor. Stabilcoin ve tokenizasyon…

Trump’ın World Liberty Financial Token’ı 2025’i %40 Düştü Tamamladı

Key Takeaways: World Liberty Financial, Trump ailesinin kripto portföy projesinin, başlangıçta umut verici olan yatırımları yıl sonunda değer…

Blokzincirler Quantum Tehdidine Hazırlanırken Bitcoin Süreçlerini Tartışıyor

Anahtar teslim projeler ve test ağları yoluyla birçok blokzincir platformu, gelecekteki muhtemel quantum bilgisayar tehditlerine karşı hazırlık yapıyor.…

Eski SEC Danışmanı, RWA’ların Nasıl Uyumlu Hale Getirileceğini Açıklıyor

Key Takeaways RWA (real-world assets) tokenizasyonunda, regülasyonların önemi teknolojiye göre daha ağır basmaktadır ve uyumluluğu sağlamak için önemli…

Kraken IPO ve Kripto’nun ‘Orta Evre’ Döngüsüne Yeniden Can Vermesi

Kraken borsasının 2026 yılında planlanan halka arzı, geleneksel finans dünyasından taze sermaye akışını artırabilir. Bitcoin fiyatları bugüne kadar…

Kripto Piyasasının Düşüşü, VC Değerlemeleri ile Piyasa Değerleri Arasındaki Boşluğu Ortaya Çıkardı

Key Takeaways Birçok blockchain girişimi, önceki özel finansman turlarındaki değerlere kıyasla düşük piyasa değerleriyle işlem görüyor. Kripto piyasasındaki…

HashKey, $250M Yeni Kripto Fonunu Kurdu

HashKey, son kripto fonu olan HashKey Fintech Multi-Strategy Fund IV’in ilk kapanışında 250 milyon dolar toplamayı başardı. Fon,…

Popüler coinler

Güncel Kripto Haberleri

Müşteri Desteği:@weikecs

İş Birliği (İşletmeler):@weikecs

Uzman İşlemleri ve Piyasa Yapıcılar:bd@weex.com

VIP Hizmetler:support@weex.com