Pendle 2025: Pathway to the Peak

Foreword

Since its inception in mid-2020, the Pendle team has been dedicated to bringing innovation in fixed income to the DeFi market. In the volatile crypto market, our start was not easy, but in the blink of an eye, it has been almost five years.

As a veteran of the crypto industry, we have continuously broken through and grown, overcoming many challenges. I am deeply proud of the team's efforts and accomplishments, and I believe that we will continue to maintain a strong growth trajectory in the future.

Next, I will summarize for you:

· Key Achievements of Pendle in 2024

· Pendle's Three Core Strategies

1. Highlights of the V2 Version

2. Development of the Citadels Project

3. Plans for Boros

· Ultimate Vision

Key Achievements of Pendle in 2024

Building the Fixed Income Market

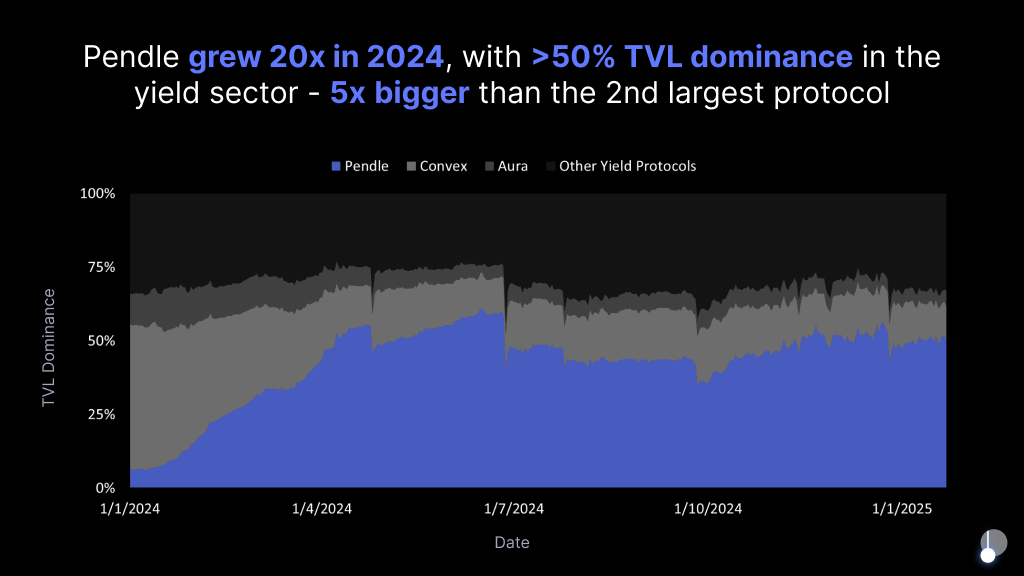

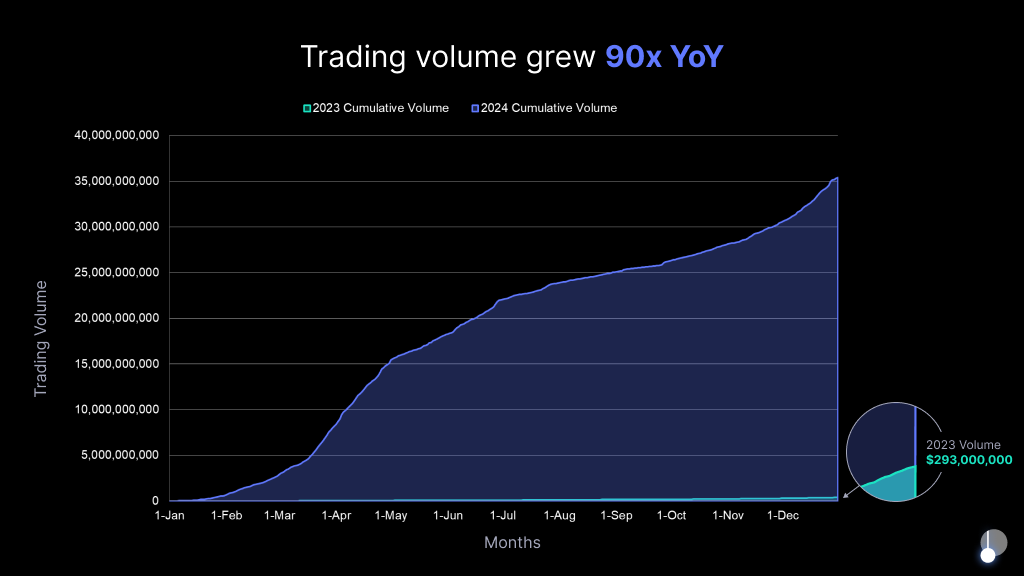

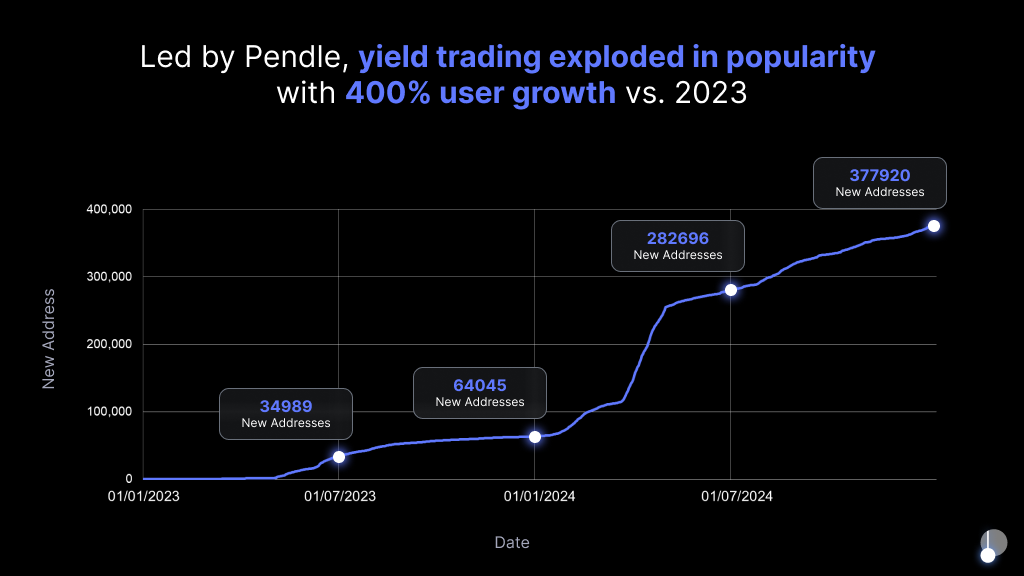

2024 was a crucial turning point in Pendle's development journey, where we witnessed a significant demand for the fixed income market and successfully scaled the protocol from millions to billions.

At the beginning of the year, Pendle's TVL was $230 million, and by the end of the year, it had surged to $4.4 billion, achieving a 20x growth. Meanwhile, the daily trading volume skyrocketed from $1.1 million in 2023 to $964 million in 2024, almost a 100x increase. User trust also deepened gradually, with the total PT positions exceeding $100 million.

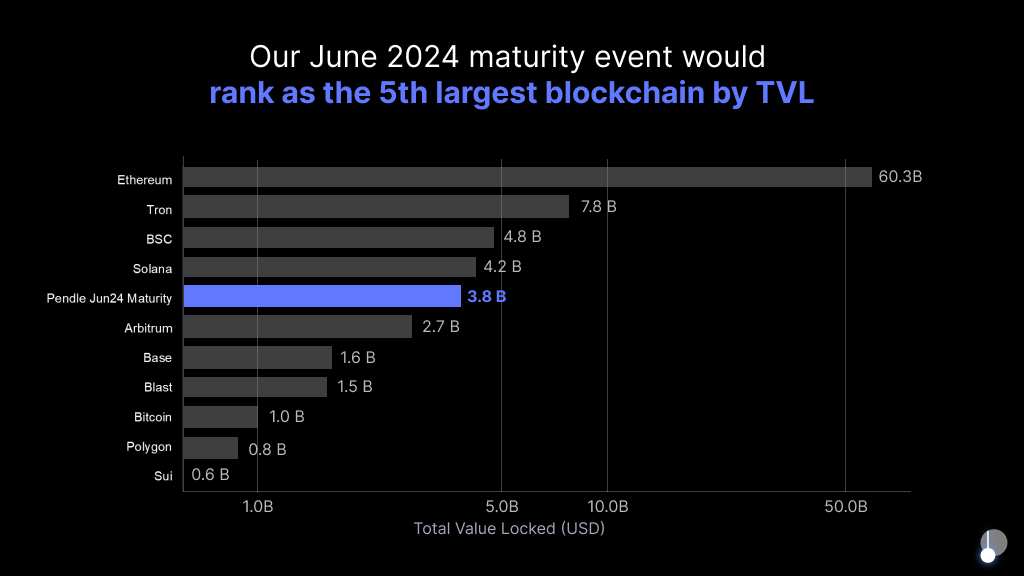

In a significant expiration event in June 2024, Pendle smoothly handled a $3.8 billion-worth position expiring in just a few days, demonstrating the protocol's efficient operational capabilities.

In terms of TVL, Pendle's scale is comparable to a blockchain, ranking even as the world's fifth-largest chain after Ethereum, Solana, Tron, and BNB Chain.

Today, Pendle has become one of the major protocols in the DeFi space, leading not only in TVL but also dominating a significant portion of the DeFi yield market.

In 2024, Pendle not only successfully pioneered the Yield Guild concept but also made it one of the most crucial pillars in the DeFi market.

Pendle Driving the DeFi Ecosystem

In 2024, Pendle expanded to five blockchain networks, with nearly 200 pools live, covering various expiration dates. We continued to grow at an average rate of adding 4 markets per week, reaching a total of 121 active markets by the end of 2024, a 2.5x increase from the previous year.

However, Pendle not only achieved a breakthrough in quantity; these markets also became core liquidity venues for many other projects.

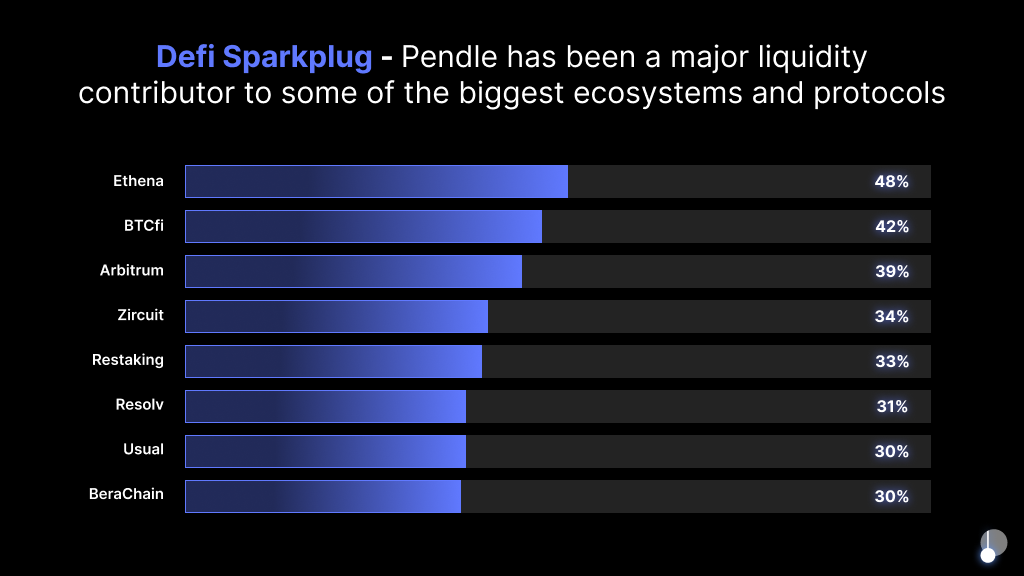

Today, Pendle has become a significant force driving the DeFi narrative and new protocol developments. Protocols like Ethena have 48% of their TVL provided by Pendle; 42% of all BTC rehypothecation is deposited through Pendle; Usual's scale has grown from $3 billion to $12 billion, with around 30% of the growth attributed to Pendle.

Not just individual protocols, blockchain ecosystems like Arbitrum, Zircuit, and Berachain have also gained liquidity through Pendle.

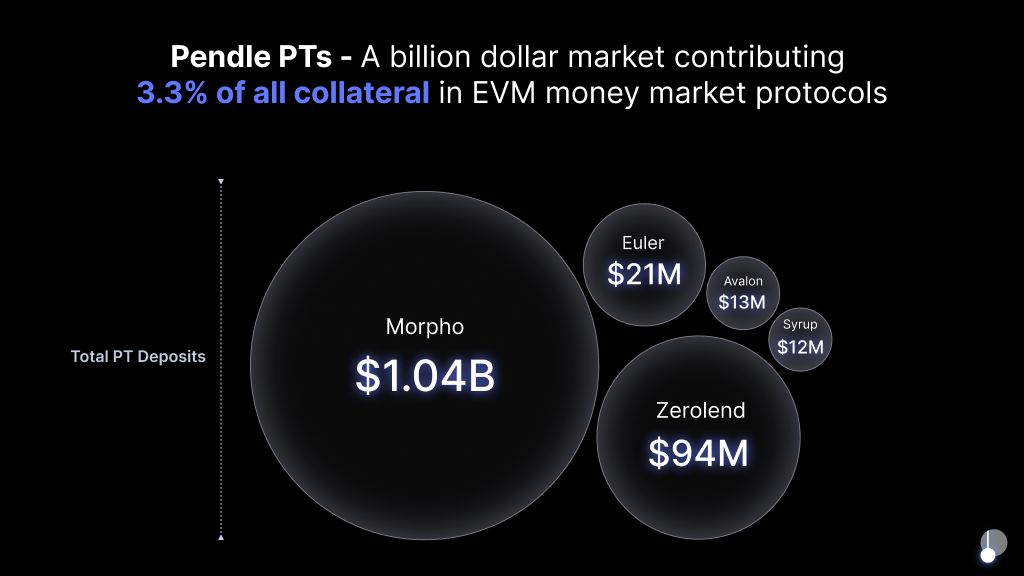

Pendle's PT economy has now grown into a $1.2 billion secondary market, representing 3.3% of all collateral in EVM chain borrowing markets. Around 20% of Morpho deposits are facilitated through Pendle.

Overall, where there is yield, there is Pendle.

While we have made significant strides in 2024 to establish Pendle as a leading Yield Guild platform, this is just the beginning.

Three Core Global Leading Strategies

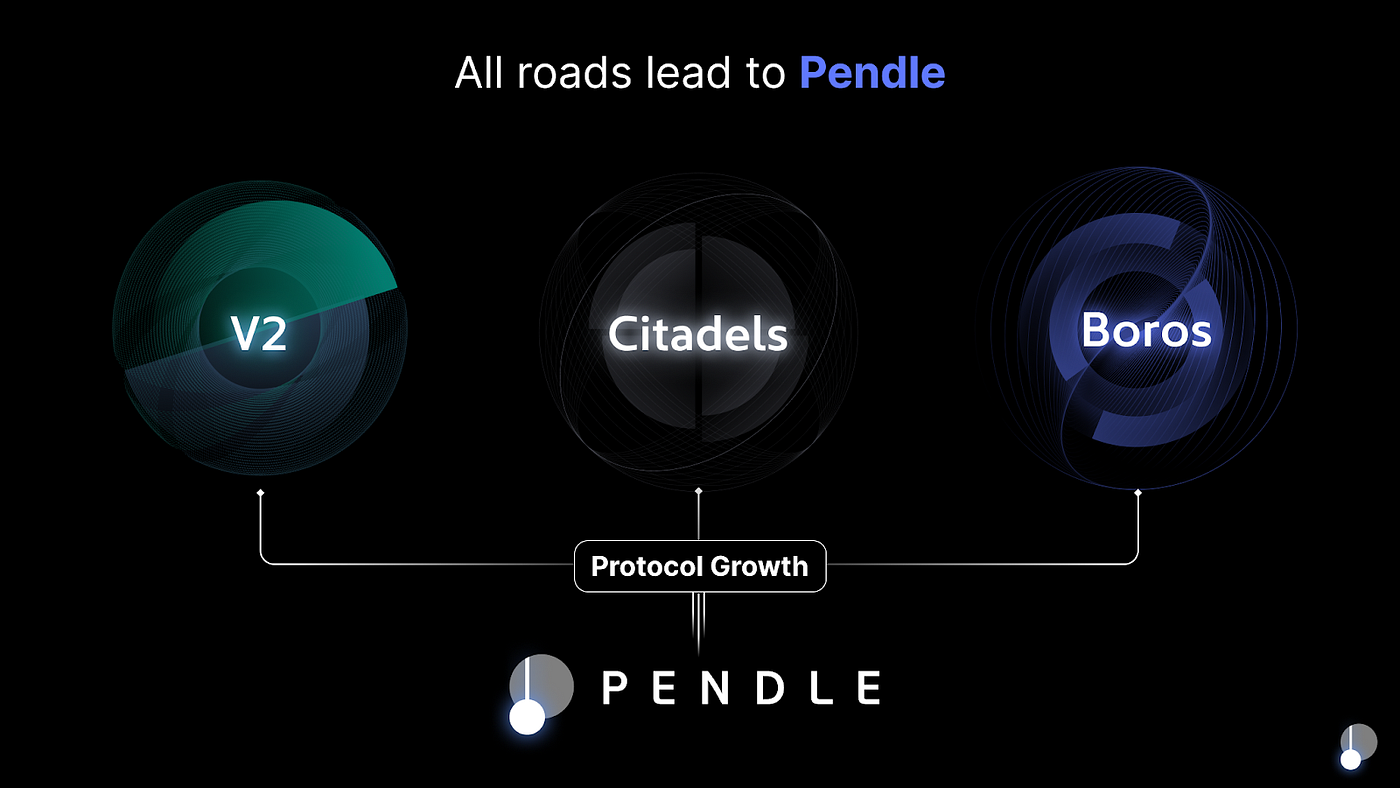

Improvements in the V2 Version

The DeFi ecosystem generates approximately $17.7 billion in on-chain revenue annually, but currently Pendle only captures less than 5% of this share. While we have already achieved significant milestones, there is still tremendous room for future growth.

As such, the V2 version will introduce the following three major improvements:

1. Openness

We will further open up the protocol's permissionless deployment feature, allowing external users to create and manage their own yield markets through our platform. Through this initiative, Pendle's expansion rate will accelerate, attracting more community participation.

2. Dynamic Fees

To ensure the pool remains optimal during interest rate fluctuations, we will introduce a dynamic fee rebalancing mechanism to optimize the protocol's long-term sustainability.

3. vePENDLE Improvements

We will enhance the functionality of vePENDLE, expand participation channels, allowing more users to engage flexibly in protocol governance, and enhance its role in terms of liquidity.

Currently, the V2 version, after thorough validation, will continue to serve as a key pillar of Pendle in the DeFi yield market. With its strong foundation, we will adopt a more aggressive and ambitious product expansion strategy this year.

This also leads us towards the next strategic direction, which is to build the Citadels project as a vanguard for the next generation of users.

Vision of the Citadels Project

Pendle has already accumulated billions of dollars in trading volume, with the future goal to move towards a multi-trillion-dollar market.

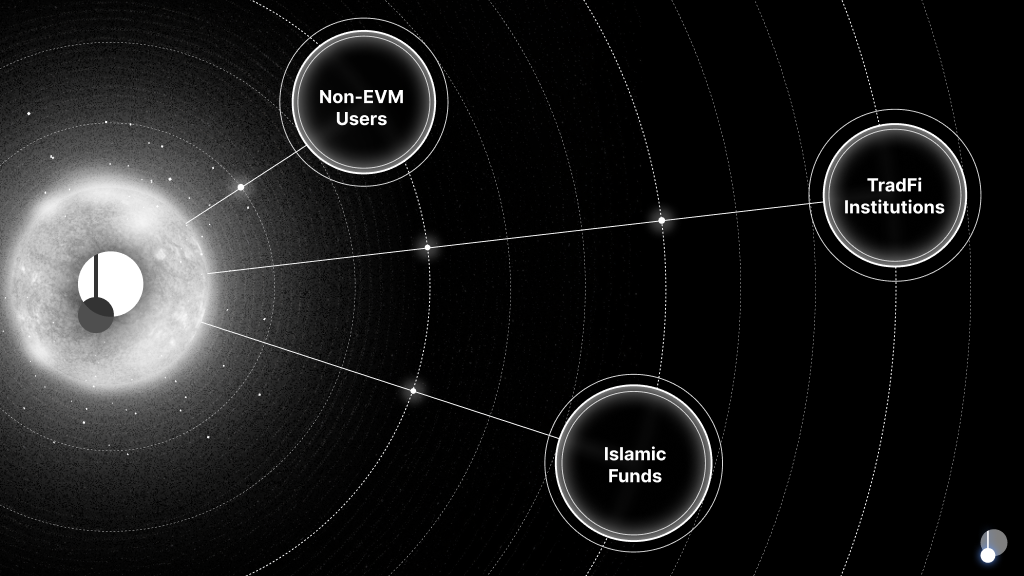

Currently, Pendle mainly serves DeFi users within the EVM ecosystem. However, as the DeFi market continues to grow, we see broader opportunities, and the Citadels project is designed to seize these opportunities.

We aim to provide users with the best experience no matter how they choose to interact with DeFi's yield layer.

Where there's yield, there's Pendle.

So far, Pendle V2 has become one of the largest protocols in the DeFi market, capturing only about 5% of DeFi yields. The global interest rate derivatives market is valued at up to $558 trillion, 30,000 times the size of our current yield market. If Citadels can capture even a small portion of this market, Pendle can achieve exponential growth. In the future, Pendle will focus on dominating the global yield market and breaking through the current limitations of DeFi.

Here are the directions of three Citadels projects:

1. Extension to Non-EVM Chains

We will be the first to expand Pendle's PT products to non-EVM chains such as Solana, TON, and HYPE, attracting millions of potential users in these ecosystems and bringing new growth opportunities to Pendle.

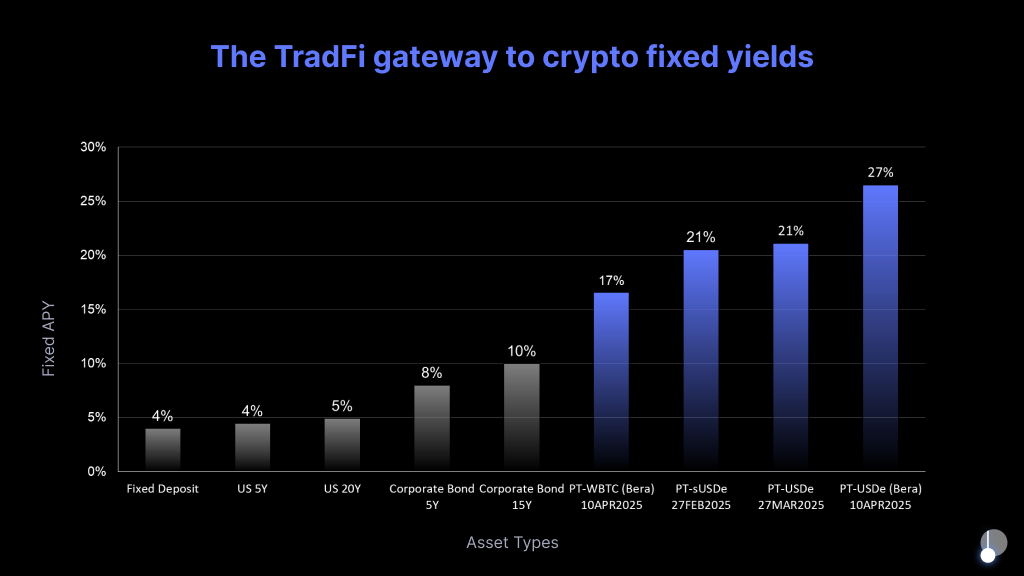

2. TradFi Expansion

We will design compliant products to open up Pendle's yield market to traditional financial institutions, providing the best encrypted fixed-income opportunities. Our collaboration with Ethena is a great start.

3. Exploration of Islamic Finance

The Islamic finance industry is valued at $3.9 trillion, and we plan to tailor yield products compliant with Sharia law for this market, further expanding the global market coverage.

Outlook for Boros

A Disruption That Truly Makes an Impact

As participants who have experienced multiple market cycles, we understand that no matter how the market changes, building and deploying are always at the core of development. However, with each cycle's progress, our industry is also evolving, and now is the best time to push the technological limits.

At Pendle, we believe that the most transformative applications of blockchain are those that can solve real-world problems and are more efficient than traditional finance, especially in markets that still lack liquidity, transparency, and openness.

We believe Boros is one such application that will leverage blockchain technology to provide functionalities that are hard to achieve in traditional finance.

Targeting the Largest Source of Yield

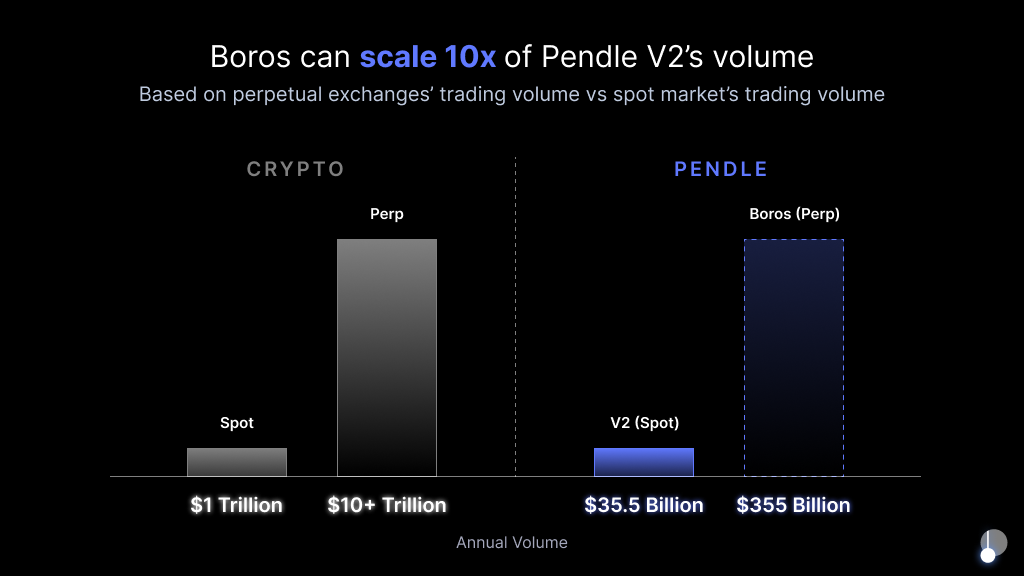

As the largest yield platform, we have witnessed firsthand the explosive demand for yield trading. Pendle V2's yield market has already shown tremendous potential, thanks to the market's demand for hedging and speculative yield.

Boros will further expand in this area. It will be able to support any type of yield, whether from DeFi, CeFi, or even traditional finance, such as LIBOR or mortgage rates, greatly expanding Pendle's market coverage and redefining the possibilities of the yield market.

Firstly, Boros will focus on the cryptocurrency market's largest yield source—funding rates.

Every day, the cryptocurrency perpetual contracts have $150 billion in open interest, generating or paying funding rates every second. The market has a daily trading volume of $200 billion, which is 10 times that of the spot market. The yield potential in this market far exceeds V2's current spot market.

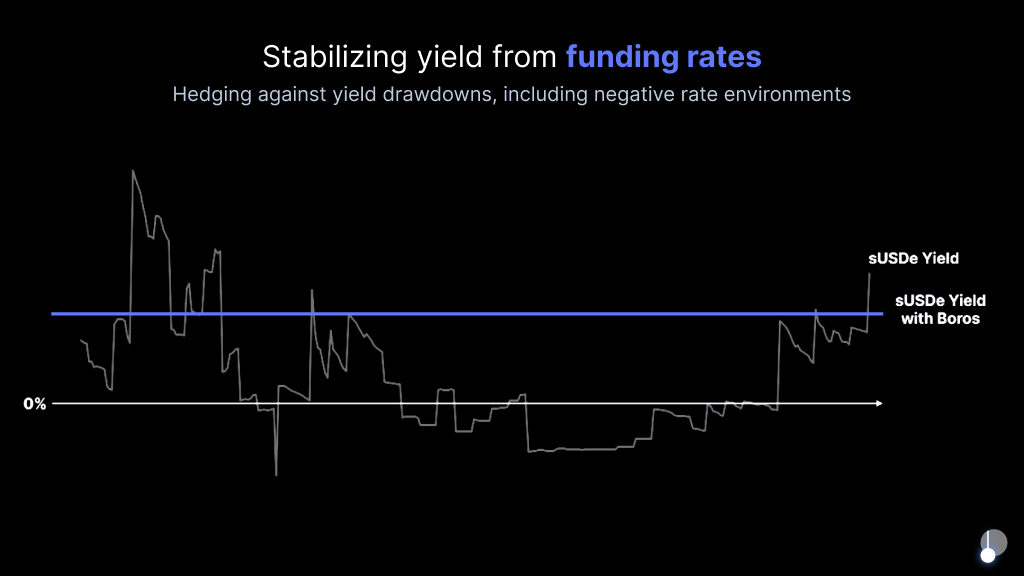

Currently, there is no reliable way to hedge funding rates at scale. Ethena is an example, where the protocol's yield and sustainability heavily rely on funding rate fluctuations, operating at a scale of billions of dollars. Through Boros, Ethena can lock in a fixed funding rate, ensuring stability in large-scale operations.

Boros allows for rate trading by swapping floating yield streams for fixed yield streams (and vice versa) until maturity.

Another intriguing market is TRUMP's launch on a perpetual contract platform, where traders pay up to approximately 20,000% annualized funding rate to maintain a long position, greatly compressing profit margins. Boros provides a new tool to help TRUMP/USDT perpetual contract traders hedge the floating funding rate, turning it into a fixed payment.

Meanwhile, arbitrage traders can now capture these high-yield opportunities and secure fixed returns.

Boros provides traders with a new standard that allows them to better control and optimize funding rate yields.

What is the Role of $PENDLE?

Where there is yield, there is Pendle.

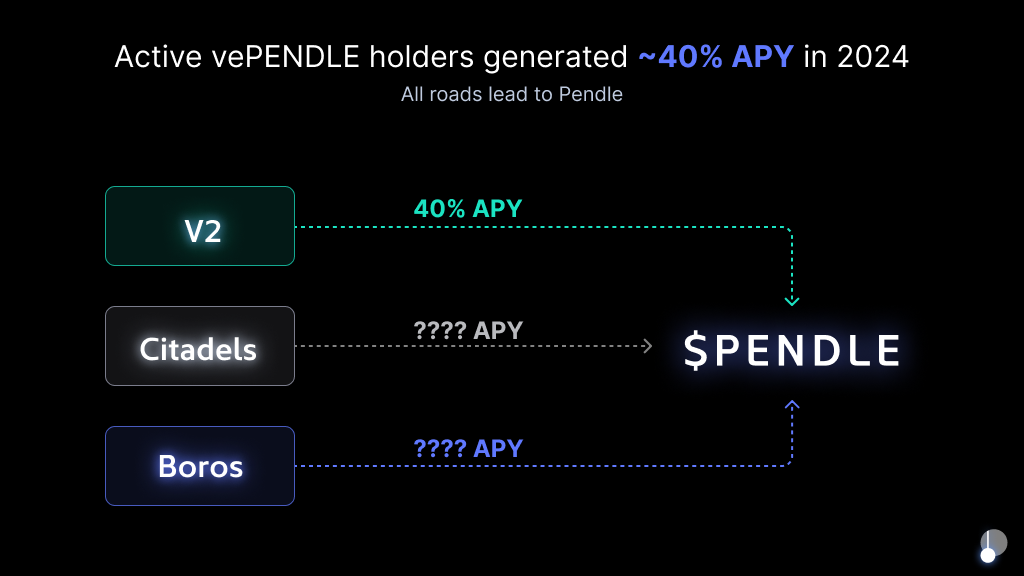

As our ecosystem expands, the value generated by the protocol's three pillars - V2, Citadels, and Boros - will flow into vePENDLE.

Last year, active vePENDLE holders were the biggest beneficiaries of Pendle's growth, with an annualized yield of around 40%, not including the $6.1 million airdrop distributed in December 2024.

Ultimate Vision

Pendle's original vision was clear: to become a leading yield trading protocol. This vision remains our core, but as we build at scale, Pendle's mission has grown.

Pendle aims to be your gateway to accessing yield.

Whether you are a DeFi speculator or a sovereign wealth fund in the Middle East, Pendle will act as the gateway for users to participate in yield trading. We offer protocols, interfaces, and tools covering the entire yield process, whether in DeFi or CeFi.

Our 2025 roadmap includes bold new initiatives, with Citadels and Boros as entirely new verticals. While we strive to achieve these goals, we also recognize that things may not go entirely as planned. When faced with obstacles, we will adjust, reevaluate, and find a way forward, as we have done over the past few years.

The 2025 market will be filled with noise and volatility, with many disruptions and moments of panic. During these times, we will focus on our mission: scaling V2, increasing PT distribution levels, and unlocking Boros' potential. We will not compete on someone else's terms but stay true to our direction and reach our objectives.

By taking a long-term view and surpassing immediate challenges, we are confident that Pendle is on the right track to becoming the "sole yield layer."

The mission is not yet complete — but we will accomplish it.

TN

Pendle CEO and Co-Founder

You may also like

$COIN Joins S&P 500, but Coinbase Isn't Celebrating

On May 13, S&P Dow Jones Indices announced that Coinbase would officially replace Discover Financial Services in the S&P 500 on May 19. While other companies like Block and MicroStrategy, closely tied to Bitcoin, were already part of the S&P 500, Coinbase became the first cryptocurrency exchange whose primary business is in the index. This also signifies that cryptocurrency is gradually moving from the fringes to the mainstream in the U.S.

On the day of the announcement, Coinbase's stock price surged by 23%, surpassing the $250 mark. However, just 3 days later, Coinbase was hit by two consecutive events: a hack where employees were bribed to steal customer data and a demand for a $20 million ransom, and an investigation by the U.S. Securities and Exchange Commission (SEC) into the authenticity of its claim of having over 100 million "verified users" in its securities filings and marketing materials. These two events acted as mini-bombs, and at the time of writing, Coinbase's stock had already dropped by over 7.3%.

Coincidentally, Discover Financial Services, being replaced by Coinbase, can also be considered the "Coinbase" of the previous payment era. Discover is a U.S.-based digital banking and payment services company headquartered in Illinois, founded in 1960. Its payment network, Discover Network, is the fourth largest payment network apart from Visa, Mastercard, and American Express.

In April, after the approval of the acquisition of Discover by the sixth-largest U.S. bank, Capital One, this well-established digital banking company of over 60 years smoothly handed over its S&P 500 "seat" to this emerging cryptocurrency "bank." This unexpected coincidence also portrayed the handover between the new and old eras in Coinbase's entry into the S&P 500, resembling a relay race scene. However, this relay baton also brought Coinbase's accumulated "external troubles and internal strife" to a tipping point.

Over the past decade, cryptocurrency exchanges have been the most stable "profit machines." They play a role in providing liquidity to the entire industry and rely on trading fees to sustain their operations. However, with the comprehensive rollout of ETF products in the U.S. market, this profit model is facing unprecedented challenges. As the leader in the "American stack," with over 80% of its business coming from the U.S., Coinbase is most affected by this.

Starting from the approval of Bitcoin and Ethereum spot ETFs, traditional financial capital has significantly onboarded users and funds that originally belonged to exchanges in a more cost-effective, compliant, and transparent manner. The transaction fee revenue of cryptocurrency exchanges has started to decline, and this trend may further intensify in the coming months.

According to Coinbase's 2024 Q4 financial report, the platform's total trading revenue was $417 million, a 45% year-on-year decrease. The contribution of BTC and ETH's trading revenue dropped from 65% in the same period last year to less than 50%.

This decline is not a result of a decrease in market enthusiasm. In fact, since the approval of the Bitcoin ETF in January 2024, the inflow of BTC into the U.S. market has continued to reach new highs, with asset management giants like BlackRock and Fidelity rapidly expanding their management scale. Data shows that BlackRock's iShares Bitcoin ETF (IBIT) alone has surpassed $17 billion in assets under management. As of mid-May 2025, the cumulative net inflow of 11 major institutional Bitcoin spot ETFs on the market has exceeded $41.5 billion, with a total net asset value of $1214.69 billion, accounting for approximately 5.91% of the total Bitcoin market capitalization.

Institutional investors and some retail investors are shifting towards ETF products, partly due to compliance and tax considerations. On one hand, ETFs have much lower trading costs compared to cryptocurrency exchanges. While Coinbase's spot trading fee rate varies annually in a tiered manner but averages around 1.49%, for example, the management fee for IBIT ETF is only 0.25%, and the majority of ETF institution fees fluctuate around 0.15% to 0.25%.

In other words, the more rational users are, the more likely they are to move from exchanges to ETF products, especially for investors aiming for long-term holdings.

According to multiple sources, several institutions, including VanEck and Grayscale, have submitted applications to the SEC for a Solana (SOL) ETF, with some institutions also planning to submit an XRP ETF proposal. Once approved, this may trigger a new round of fund migration. According to a report submitted by Coinbase to the SEC, as of April, the platform's trading revenue from XRP and Solana accounted for 18% and 10%, nearly one-third of the platform's fee revenue.

However, the Bitcoin and Ethereum ETFs passed in 2024 also reduced the fees for these two tokens on Coinbase from 30% and 15% to 26% and 10%, respectively. If the SOL and XRP ETFs are approved, it will further undermine the core fee revenue of exchanges like Coinbase.

The expansion of ETF products is gradually weakening the financial intermediary status of cryptocurrency exchanges. From their original roles as matchmakers and clearers to now gradually becoming mere "on-ramps and off-ramps" for funds, exchanges are seeing their marginal value squeezed by ETFs.

On May 12, 2025, SEC Chairman Paul S. Atkins gave a keynote speech at the Tokenization and Cryptocurrency Working Group roundtable. The theme of his speech revolved around "It is a new day at the SEC," where he indicated that the SEC would not approach enforcement and regulation the same way as before but would instead pave the way for cryptocurrency assets in the U.S. market.

With signs of cryptocurrency compliance such as the SEC's "NEW DAY" declaration, an increasing number of traditional brokerages are attempting to enter the cryptocurrency industry. One of the most representative cases is the well-known U.S. brokerage Robinhood, which began expanding its crypto business in 2018. By the time of its IPO in 2021, Robinhood's crypto business revenue accounted for over 50% of the company, with a significant boost from the Dogecoin "moonshot" promoted by Musk.

In Q1 2025 earnings report, Robinhood showcased strong growth, especially in revenue from cryptocurrency and options trading. Fueled by Trump's Memecoin, cryptocurrency-related revenue reached $250 million, nearly doubling year-over-year. Consequently, Robinhood Gold subscription users reached 3.5 million, a 90% increase from the previous year, with the rapid growth of Robinhood Gold providing the company with a stable source of income.

Meanwhile, RobinHood is actively pursuing acquisitions in the cryptocurrency space. In 2024, it announced a $2 billion acquisition of the long-standing European cryptocurrency exchange Bitstamp. Additionally, Canada's largest cryptocurrency CEX, WonderFi, which recently went public on the Toronto Stock Exchange, also announced its integration with RobinHood Crypto. After obtaining virtual asset licenses in the UK, Canada, Singapore, and other markets, RobinHood has taken a proactive approach in the compliant cryptocurrency trading market.

Furthermore, an increasing number of brokerage firms are exploring the same path. Futu Securities, Tiger Brokers, and others are also dipping their toes into cryptocurrency trading, with some having applied for or obtained the VA license from the Hong Kong SFC. Although their user bases are currently small, traditional brokerages have a natural advantage in user trust, regulatory licenses, and low fee structures. This could pose a threat to native cryptocurrency platforms in the future.

In April 2025, security researchers discovered that some Coinbase user data was leaked on the dark web. While the platform initially responded by attributing it to a "technical misinformation," it still raised concerns among users regarding its security and privacy protection. Just two days before Dow Jones Indexes announced Coinbase's addition to the S&P 500 Index, on May 11, 2025, Coinbase received an email from an unknown threat actor claiming to have obtained customer account information and internal documents, demanding a $20 million ransom to keep the data private. Subsequent investigations confirmed the data breach.

Cybercriminals obtained the data by bribing overseas customer service agents and support staff, mainly in "non-U.S. regions such as India." These agents abused their access to Coinbase's internal customer support system and stole customer data. As early as February this year, blockchain detective ZachXBT revealed on X platform that between December 2024 and January 2025, Coinbase users lost over $65 million to social engineering scams, with the actual amount potentially higher.

Among the victims was a well-known figure, 67-year-old Ed Suman, an established artist in the art world for nearly two decades, having been involved in the creation of artworks such as Jeff Koons' "Balloon Dog" sculpture. Earlier this year, he fell victim to an impersonation scam involving fake Coinbase customer support, resulting in a loss of over $2 million in cryptocurrency. ZachXBT critiqued Coinbase for its inadequate handling of such scams, noting that other major exchanges have not faced similar issues and recommending Coinbase to enhance its security measures.

Amidst a series of ongoing social engineering incidents, although there has not been any impact on user assets at the technical level so far, it has raised concerns among many retail and institutional investors. Especially institutions holding massive assets on Coinbase. Just considering the U.S. BTC ETF institutions, as of mid-May 2025, they collectively hold nearly 840,000 BTC, and 75% of these are custodied by Coinbase. If we price BTC at $100,000, this amount reaches a staggering $63 billion, which is equivalent to the nominal GDP of two Iceland in the year 2024.

In addition, Coinbase Custody also serves over 300 institutional clients, including hedge funds, family offices, pension funds, and endowments. As of the Q1 2025 financial report, Coinbase's total assets under management (including institutional and retail clients) reached $404 billion. The specific amount of institutional custodied assets was not explicitly disclosed in the latest report, but it should still be over 50% based on the Q4 2024 report.

Once this security barrier is breached, not only could the rate of user attrition far exceed expectations, but more importantly, institutional trust in it would undermine the foundation of its business. Therefore, after a hacking event, Coinbase's stock price plummeted significantly.

Facing a decline in spot trading fee revenue, Coinbase is also accelerating its transformation, attempting to find growth opportunities in derivatives and emerging assets. Coinbase acquired a stake in the options platform Deribit at the end of 2024 and announced the official launch of perpetual contract products in 2025. This acquisition fills in Coinbase's gap in options trading and its relatively small global market share.

Deribit has a strong presence in non-U.S. markets, especially in Asia and Europe. The acquisition has enabled Coinbase to gain a dominant position in bitcoin and ethereum options trading on Deribit, accounting for approximately 80% of the global options trading volume, with daily trading volume remaining above $2 billion.

Meanwhile, 80-90% of Deribit's customer base consists of institutional investors, with their professionalism and liquidity in the Bitcoin and Ethereum options market highly favored by institutions. Coinbase's compliance advantage, coupled with its already robust institutional ecosystem, makes it even more suitable. By using institutions as an entry point, it can face the squeeze from giants like Binance and OKX in the derivatives market.

Facing a similar dilemma is Kraken, which is attempting to replicate Binance Futures' model in non-U.S. markets. Since the derivatives market relies more on professional users, fee rates are relatively higher and stickiness is stronger, making it a significant source of revenue for exchanges. In the first half of 2025, Kraken completed the acquisition of TradeStation Crypto and a futures exchange, aiming to build a complete derivatives trading ecosystem to hedge the risk of declining spot transaction fee income.

With the surge of Memecoin in 2024, Binance, OKX, and various CEX platforms began massively listing small-market-cap, highly volatile tokens to activate active trading users. Due to the wealth effect and trading activity of Memecoins, Coinbase was also forced to join the battle, successively listing popular tokens from the Solana ecosystem such as BOOK OF MEME and Dogwifhat. Although these coins are controversial, they are frequently traded, with fee rates several times higher than mainstream coins, serving as a "blood-boosting" method for spot trading.

However, due to its status as a publicly traded company, this practice is a riskier endeavor for Coinbase. Even in the current crypto-friendly environment, the SEC is still investigating whether tokens like SOL, ADA, and SAND constitute securities.

In addition to the forced transformation strategies carried out by the aforementioned CEXs, they are also starting to lay out RWAs and the most talked-about stablecoin payment fields, such as the PYUSD launched through a collaboration between Coinbase and Paypal, Coinbase's support for the Euro stablecoin EURC by Circle that complies with EU MiCA regulatory requirements, or the USD1 launched through a collaboration between Binance and WIFL. In the increasingly crowded trading field, many CEXs have shifted their focus from just the trading market to the application field.

The golden age of transaction fees has quietly ended, and the second half of the crypto exchange platform game has silently begun.

Arthur Hayes: Why I'm Betting on ETH While the Market Is Obsessed with SOL

Key Market Insights for May 16th, how much did you miss out on?

May 16 Key Market Information Gap, A Must-Read! | Alpha Morning Report

Key Market Intelligence on May 14th, how much did you miss out on?

1.Binance Alpha Launches HIPPO, BLUE, and Other Tokens

2.Believe Ecosystem Tokens See General Rise, LAUNCHCOIN Surges Over 250% in 24 Hours

3.Tiger Securities Introduces Cryptocurrency Deposit and Withdrawal Service, Supports Mainstream Cryptocurrencies such as BTC and ETH

4.Current Bitcoin Rally Possibly Driven by Institutions, Retail Traders Yet to Join

5.Binance Wallet's New TGE Privasea AI Participation Requires a 198 Point Threshold, with a Point Consumption of 15

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on its new creator revenue-sharing model: the platform will allocate 50% of PumpSwap revenue to token creators, sparking varied reactions from users. Some criticize the move as insufficient or even misleading, while others view it as a positive step the platform is taking to reward creators. Meanwhile, PUMP faces market pressure from emerging competitors like LetsBONKfun and Raydium, which are rapidly gaining market share. Users also express concerns about PUMP's sustainability and potential regulatory risks in the U.S., with discussions extending to the platform's impact on the entire memecoin ecosystem.

COINBASE: Today, Coinbase became the first crypto company to join the S&P 500 Index, replacing Discover Financial Services, sparking widespread industry attention. The entire crypto community views this milestone as a significant development, signaling that crypto assets are further integrating into the mainstream financial system. The news has sparked lively discussions on Twitter, with many users pointing out that this may attract more institutional investors to enter the Bitcoin and other cryptocurrency markets.

XRP: XRP became the focal point of today's crypto discussion, with its significant market movements and strategic advances drawing attention. XRP has surpassed USDT to become the third-largest cryptocurrency by market capitalization, sparking market excitement and discussions about its future potential. The surge in market capitalization and price is believed to be related to increasing institutional interest, deepening strategic partnerships, and its role in the crypto ecosystem. Additionally, XRP's integration into multiple financial systems and its potential as a macro asset class are also seen as key factors driving the current market sentiment.

DYDX: Today's discussions about DYDX mainly focused on the dYdX Yapper Leaderboard launched by KaitoAI. The leaderboard aims to identify the most active community participants, with a total of $150,000 in rewards to be distributed over the first three seasons. This initiative has sparked broad community participation, with many users discussing the potential rewards and the incentive effect on the DYDX ecosystem. Meanwhile, progress on the ethDYDX to dYdX native chain migration and historical airdrop events have also been topics of discussion.

1. "What Is 'ICM'? Holding Up the $4 Billion Market Cap Solana's New Narrative"

Overnight, the hottest narrative in the crypto space has become "Internet Capital Markets," with a host of crypto projects and founders, led by the Solana ecosystem's new Launchpad platform Believe, releasing this phrase. Together with "Believe in something," it has become the new slogan heralding the onset of a bull market. What exactly is the so-called "Internet Capital Market," will it become a short-lived hype phrase like the Base ecosystem's previous Content Coin, and what related targets are available for selection?2.《LaunchCoin Surges 20x in One Day, How Did Believe Create a $200M Market Cap Shiba Inu After Going to Zero?|100x Retrospective》

LAUNCHCOIN broke through a $200 million market cap today, with the long-lost liquidity and such a high market cap "Memecoin" almost bringing half of the on-chain crypto community CT into the fray. The community is crazily discussing this token, with half of it being FOMO and the other half being FUD. This token, originally issued by Believe founder Ben Pasternak under his personal identity, transformed into a new platform token after a renaming. From once going to zero to a $200 million market cap, what happened in between?May 14 On-chain Fund Flow

Deconstructing Binance Alpha2.0's New "Asia-Led Liquidity Mining" Model

Binance Alpha Points Gameplay Overtakes on the Inside Track, Sweeping 90% of the Web3 Wallet Market

RWA Evergreen Product Crisis: Why is the GLP Model Doomed to Collapse Under RWA Evergreen?

Week 16 On-Chain Data: Intensifying Structural Supply-Demand Imbalance, Data Reveals Solid Blueprint for Next Bull Run?

President's 'Official' Coin Issuance, Market Performance 'Desensitized'; Trump's Crypto Empire Lacks Novelty

Sui Q1 Advanced Report: The Rise of BTCfi Infrastructure, the Boom of Lending Protocols, and the Future of Rollup-Based Scalability

Crypto Developer: The Trump Family's Coin Minting Real Estate Business

Gate.io MemeBox has officially integrated with the Solana ecosystem, providing lightning-fast on-chain asset trading.

SignalPlus Macro Analysis: The Tariff-Torn M2 Narrative and the Return of TradFi-Style FOMO

Taking Stock of the Top 10 Emerging Launchpad Platforms: Who Will Succeed in Disrupting Pump.fun?

After El Salvador's President Nayib Bukele signed it, which U.S. states have been **"good, good"** in advancing Bitcoin strategic reserve legislation?

GoRich Officially Launched: On-Chain Transactions with Zero Barrier to Entry, Even Beginners Can Catch 100x Meme Coins

PENGU Experiences Strong Rebound from Bottom with 360% Surge, How Will the Fat Penguin Leverage IP Marketing for a Comeback?

$COIN Joins S&P 500, but Coinbase Isn't Celebrating

On May 13, S&P Dow Jones Indices announced that Coinbase would officially replace Discover Financial Services in the S&P 500 on May 19. While other companies like Block and MicroStrategy, closely tied to Bitcoin, were already part of the S&P 500, Coinbase became the first cryptocurrency exchange whose primary business is in the index. This also signifies that cryptocurrency is gradually moving from the fringes to the mainstream in the U.S.

On the day of the announcement, Coinbase's stock price surged by 23%, surpassing the $250 mark. However, just 3 days later, Coinbase was hit by two consecutive events: a hack where employees were bribed to steal customer data and a demand for a $20 million ransom, and an investigation by the U.S. Securities and Exchange Commission (SEC) into the authenticity of its claim of having over 100 million "verified users" in its securities filings and marketing materials. These two events acted as mini-bombs, and at the time of writing, Coinbase's stock had already dropped by over 7.3%.

Coincidentally, Discover Financial Services, being replaced by Coinbase, can also be considered the "Coinbase" of the previous payment era. Discover is a U.S.-based digital banking and payment services company headquartered in Illinois, founded in 1960. Its payment network, Discover Network, is the fourth largest payment network apart from Visa, Mastercard, and American Express.

In April, after the approval of the acquisition of Discover by the sixth-largest U.S. bank, Capital One, this well-established digital banking company of over 60 years smoothly handed over its S&P 500 "seat" to this emerging cryptocurrency "bank." This unexpected coincidence also portrayed the handover between the new and old eras in Coinbase's entry into the S&P 500, resembling a relay race scene. However, this relay baton also brought Coinbase's accumulated "external troubles and internal strife" to a tipping point.

Over the past decade, cryptocurrency exchanges have been the most stable "profit machines." They play a role in providing liquidity to the entire industry and rely on trading fees to sustain their operations. However, with the comprehensive rollout of ETF products in the U.S. market, this profit model is facing unprecedented challenges. As the leader in the "American stack," with over 80% of its business coming from the U.S., Coinbase is most affected by this.

Starting from the approval of Bitcoin and Ethereum spot ETFs, traditional financial capital has significantly onboarded users and funds that originally belonged to exchanges in a more cost-effective, compliant, and transparent manner. The transaction fee revenue of cryptocurrency exchanges has started to decline, and this trend may further intensify in the coming months.

According to Coinbase's 2024 Q4 financial report, the platform's total trading revenue was $417 million, a 45% year-on-year decrease. The contribution of BTC and ETH's trading revenue dropped from 65% in the same period last year to less than 50%.

This decline is not a result of a decrease in market enthusiasm. In fact, since the approval of the Bitcoin ETF in January 2024, the inflow of BTC into the U.S. market has continued to reach new highs, with asset management giants like BlackRock and Fidelity rapidly expanding their management scale. Data shows that BlackRock's iShares Bitcoin ETF (IBIT) alone has surpassed $17 billion in assets under management. As of mid-May 2025, the cumulative net inflow of 11 major institutional Bitcoin spot ETFs on the market has exceeded $41.5 billion, with a total net asset value of $1214.69 billion, accounting for approximately 5.91% of the total Bitcoin market capitalization.

Institutional investors and some retail investors are shifting towards ETF products, partly due to compliance and tax considerations. On one hand, ETFs have much lower trading costs compared to cryptocurrency exchanges. While Coinbase's spot trading fee rate varies annually in a tiered manner but averages around 1.49%, for example, the management fee for IBIT ETF is only 0.25%, and the majority of ETF institution fees fluctuate around 0.15% to 0.25%.

In other words, the more rational users are, the more likely they are to move from exchanges to ETF products, especially for investors aiming for long-term holdings.

According to multiple sources, several institutions, including VanEck and Grayscale, have submitted applications to the SEC for a Solana (SOL) ETF, with some institutions also planning to submit an XRP ETF proposal. Once approved, this may trigger a new round of fund migration. According to a report submitted by Coinbase to the SEC, as of April, the platform's trading revenue from XRP and Solana accounted for 18% and 10%, nearly one-third of the platform's fee revenue.

However, the Bitcoin and Ethereum ETFs passed in 2024 also reduced the fees for these two tokens on Coinbase from 30% and 15% to 26% and 10%, respectively. If the SOL and XRP ETFs are approved, it will further undermine the core fee revenue of exchanges like Coinbase.

The expansion of ETF products is gradually weakening the financial intermediary status of cryptocurrency exchanges. From their original roles as matchmakers and clearers to now gradually becoming mere "on-ramps and off-ramps" for funds, exchanges are seeing their marginal value squeezed by ETFs.

On May 12, 2025, SEC Chairman Paul S. Atkins gave a keynote speech at the Tokenization and Cryptocurrency Working Group roundtable. The theme of his speech revolved around "It is a new day at the SEC," where he indicated that the SEC would not approach enforcement and regulation the same way as before but would instead pave the way for cryptocurrency assets in the U.S. market.

With signs of cryptocurrency compliance such as the SEC's "NEW DAY" declaration, an increasing number of traditional brokerages are attempting to enter the cryptocurrency industry. One of the most representative cases is the well-known U.S. brokerage Robinhood, which began expanding its crypto business in 2018. By the time of its IPO in 2021, Robinhood's crypto business revenue accounted for over 50% of the company, with a significant boost from the Dogecoin "moonshot" promoted by Musk.

In Q1 2025 earnings report, Robinhood showcased strong growth, especially in revenue from cryptocurrency and options trading. Fueled by Trump's Memecoin, cryptocurrency-related revenue reached $250 million, nearly doubling year-over-year. Consequently, Robinhood Gold subscription users reached 3.5 million, a 90% increase from the previous year, with the rapid growth of Robinhood Gold providing the company with a stable source of income.

Meanwhile, RobinHood is actively pursuing acquisitions in the cryptocurrency space. In 2024, it announced a $2 billion acquisition of the long-standing European cryptocurrency exchange Bitstamp. Additionally, Canada's largest cryptocurrency CEX, WonderFi, which recently went public on the Toronto Stock Exchange, also announced its integration with RobinHood Crypto. After obtaining virtual asset licenses in the UK, Canada, Singapore, and other markets, RobinHood has taken a proactive approach in the compliant cryptocurrency trading market.

Furthermore, an increasing number of brokerage firms are exploring the same path. Futu Securities, Tiger Brokers, and others are also dipping their toes into cryptocurrency trading, with some having applied for or obtained the VA license from the Hong Kong SFC. Although their user bases are currently small, traditional brokerages have a natural advantage in user trust, regulatory licenses, and low fee structures. This could pose a threat to native cryptocurrency platforms in the future.

In April 2025, security researchers discovered that some Coinbase user data was leaked on the dark web. While the platform initially responded by attributing it to a "technical misinformation," it still raised concerns among users regarding its security and privacy protection. Just two days before Dow Jones Indexes announced Coinbase's addition to the S&P 500 Index, on May 11, 2025, Coinbase received an email from an unknown threat actor claiming to have obtained customer account information and internal documents, demanding a $20 million ransom to keep the data private. Subsequent investigations confirmed the data breach.

Cybercriminals obtained the data by bribing overseas customer service agents and support staff, mainly in "non-U.S. regions such as India." These agents abused their access to Coinbase's internal customer support system and stole customer data. As early as February this year, blockchain detective ZachXBT revealed on X platform that between December 2024 and January 2025, Coinbase users lost over $65 million to social engineering scams, with the actual amount potentially higher.

Among the victims was a well-known figure, 67-year-old Ed Suman, an established artist in the art world for nearly two decades, having been involved in the creation of artworks such as Jeff Koons' "Balloon Dog" sculpture. Earlier this year, he fell victim to an impersonation scam involving fake Coinbase customer support, resulting in a loss of over $2 million in cryptocurrency. ZachXBT critiqued Coinbase for its inadequate handling of such scams, noting that other major exchanges have not faced similar issues and recommending Coinbase to enhance its security measures.

Amidst a series of ongoing social engineering incidents, although there has not been any impact on user assets at the technical level so far, it has raised concerns among many retail and institutional investors. Especially institutions holding massive assets on Coinbase. Just considering the U.S. BTC ETF institutions, as of mid-May 2025, they collectively hold nearly 840,000 BTC, and 75% of these are custodied by Coinbase. If we price BTC at $100,000, this amount reaches a staggering $63 billion, which is equivalent to the nominal GDP of two Iceland in the year 2024.

In addition, Coinbase Custody also serves over 300 institutional clients, including hedge funds, family offices, pension funds, and endowments. As of the Q1 2025 financial report, Coinbase's total assets under management (including institutional and retail clients) reached $404 billion. The specific amount of institutional custodied assets was not explicitly disclosed in the latest report, but it should still be over 50% based on the Q4 2024 report.

Once this security barrier is breached, not only could the rate of user attrition far exceed expectations, but more importantly, institutional trust in it would undermine the foundation of its business. Therefore, after a hacking event, Coinbase's stock price plummeted significantly.

Facing a decline in spot trading fee revenue, Coinbase is also accelerating its transformation, attempting to find growth opportunities in derivatives and emerging assets. Coinbase acquired a stake in the options platform Deribit at the end of 2024 and announced the official launch of perpetual contract products in 2025. This acquisition fills in Coinbase's gap in options trading and its relatively small global market share.

Deribit has a strong presence in non-U.S. markets, especially in Asia and Europe. The acquisition has enabled Coinbase to gain a dominant position in bitcoin and ethereum options trading on Deribit, accounting for approximately 80% of the global options trading volume, with daily trading volume remaining above $2 billion.

Meanwhile, 80-90% of Deribit's customer base consists of institutional investors, with their professionalism and liquidity in the Bitcoin and Ethereum options market highly favored by institutions. Coinbase's compliance advantage, coupled with its already robust institutional ecosystem, makes it even more suitable. By using institutions as an entry point, it can face the squeeze from giants like Binance and OKX in the derivatives market.

Facing a similar dilemma is Kraken, which is attempting to replicate Binance Futures' model in non-U.S. markets. Since the derivatives market relies more on professional users, fee rates are relatively higher and stickiness is stronger, making it a significant source of revenue for exchanges. In the first half of 2025, Kraken completed the acquisition of TradeStation Crypto and a futures exchange, aiming to build a complete derivatives trading ecosystem to hedge the risk of declining spot transaction fee income.

With the surge of Memecoin in 2024, Binance, OKX, and various CEX platforms began massively listing small-market-cap, highly volatile tokens to activate active trading users. Due to the wealth effect and trading activity of Memecoins, Coinbase was also forced to join the battle, successively listing popular tokens from the Solana ecosystem such as BOOK OF MEME and Dogwifhat. Although these coins are controversial, they are frequently traded, with fee rates several times higher than mainstream coins, serving as a "blood-boosting" method for spot trading.

However, due to its status as a publicly traded company, this practice is a riskier endeavor for Coinbase. Even in the current crypto-friendly environment, the SEC is still investigating whether tokens like SOL, ADA, and SAND constitute securities.

In addition to the forced transformation strategies carried out by the aforementioned CEXs, they are also starting to lay out RWAs and the most talked-about stablecoin payment fields, such as the PYUSD launched through a collaboration between Coinbase and Paypal, Coinbase's support for the Euro stablecoin EURC by Circle that complies with EU MiCA regulatory requirements, or the USD1 launched through a collaboration between Binance and WIFL. In the increasingly crowded trading field, many CEXs have shifted their focus from just the trading market to the application field.

The golden age of transaction fees has quietly ended, and the second half of the crypto exchange platform game has silently begun.

Arthur Hayes: Why I'm Betting on ETH While the Market Is Obsessed with SOL

Key Market Insights for May 16th, how much did you miss out on?

May 16 Key Market Information Gap, A Must-Read! | Alpha Morning Report

Key Market Intelligence on May 14th, how much did you miss out on?

1.Binance Alpha Launches HIPPO, BLUE, and Other Tokens

2.Believe Ecosystem Tokens See General Rise, LAUNCHCOIN Surges Over 250% in 24 Hours

3.Tiger Securities Introduces Cryptocurrency Deposit and Withdrawal Service, Supports Mainstream Cryptocurrencies such as BTC and ETH

4.Current Bitcoin Rally Possibly Driven by Institutions, Retail Traders Yet to Join

5.Binance Wallet's New TGE Privasea AI Participation Requires a 198 Point Threshold, with a Point Consumption of 15

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on its new creator revenue-sharing model: the platform will allocate 50% of PumpSwap revenue to token creators, sparking varied reactions from users. Some criticize the move as insufficient or even misleading, while others view it as a positive step the platform is taking to reward creators. Meanwhile, PUMP faces market pressure from emerging competitors like LetsBONKfun and Raydium, which are rapidly gaining market share. Users also express concerns about PUMP's sustainability and potential regulatory risks in the U.S., with discussions extending to the platform's impact on the entire memecoin ecosystem.

COINBASE: Today, Coinbase became the first crypto company to join the S&P 500 Index, replacing Discover Financial Services, sparking widespread industry attention. The entire crypto community views this milestone as a significant development, signaling that crypto assets are further integrating into the mainstream financial system. The news has sparked lively discussions on Twitter, with many users pointing out that this may attract more institutional investors to enter the Bitcoin and other cryptocurrency markets.

XRP: XRP became the focal point of today's crypto discussion, with its significant market movements and strategic advances drawing attention. XRP has surpassed USDT to become the third-largest cryptocurrency by market capitalization, sparking market excitement and discussions about its future potential. The surge in market capitalization and price is believed to be related to increasing institutional interest, deepening strategic partnerships, and its role in the crypto ecosystem. Additionally, XRP's integration into multiple financial systems and its potential as a macro asset class are also seen as key factors driving the current market sentiment.

DYDX: Today's discussions about DYDX mainly focused on the dYdX Yapper Leaderboard launched by KaitoAI. The leaderboard aims to identify the most active community participants, with a total of $150,000 in rewards to be distributed over the first three seasons. This initiative has sparked broad community participation, with many users discussing the potential rewards and the incentive effect on the DYDX ecosystem. Meanwhile, progress on the ethDYDX to dYdX native chain migration and historical airdrop events have also been topics of discussion.

1. "What Is 'ICM'? Holding Up the $4 Billion Market Cap Solana's New Narrative"

Overnight, the hottest narrative in the crypto space has become "Internet Capital Markets," with a host of crypto projects and founders, led by the Solana ecosystem's new Launchpad platform Believe, releasing this phrase. Together with "Believe in something," it has become the new slogan heralding the onset of a bull market. What exactly is the so-called "Internet Capital Market," will it become a short-lived hype phrase like the Base ecosystem's previous Content Coin, and what related targets are available for selection?2.《LaunchCoin Surges 20x in One Day, How Did Believe Create a $200M Market Cap Shiba Inu After Going to Zero?|100x Retrospective》

LAUNCHCOIN broke through a $200 million market cap today, with the long-lost liquidity and such a high market cap "Memecoin" almost bringing half of the on-chain crypto community CT into the fray. The community is crazily discussing this token, with half of it being FOMO and the other half being FUD. This token, originally issued by Believe founder Ben Pasternak under his personal identity, transformed into a new platform token after a renaming. From once going to zero to a $200 million market cap, what happened in between?May 14 On-chain Fund Flow