BONK: From Meme Coin to Utility Flywheel

Source: BONK

Key Points

· Bonk was launched at the end of 2022, during a period of Solana's downturn following the FTX debacle. The project distributed 50% of its 1 quadrillion token supply, making it one of the largest airdrops on Solana (with around 500 trillion BONK distributed to approximately 297,000 wallets).

· Initially a Meme token, Bonk quickly gained widespread adoption within the Solana ecosystem and is now integrated into 400+ applications across DeFi, NFTs, gaming, and payments. Close to 1 million wallet addresses hold BONK, demonstrating strong community acceptance.

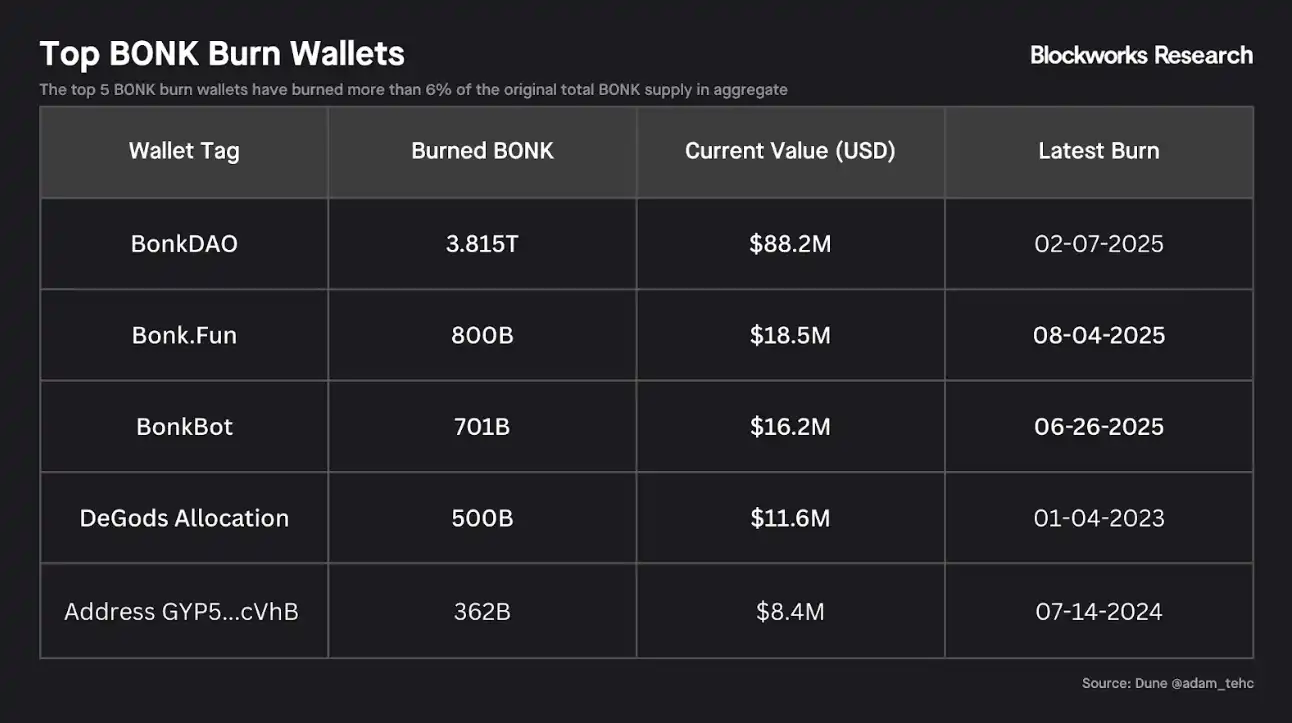

· The difference between BONK and traditional short-lived Meme coins lies in its fee-driven burning mechanism and DAO-driven burn events. Applications like BonkBot and Bonk.fun contributed to a significant portion of the burn, while further reducing circulating supply through mechanisms like Bonk Rewards staking and large-scale events like BURNmas. As a result, BONK's total supply has decreased from 1 quadrillion to around 880 trillion.

· BONK has evolved from a grassroots Meme coin to a financialized asset. Initiatives such as the Osprey Bonk Trust, the upcoming Bonk ETF, and the transformation of Safety Shot into Bonk Treasury Corp demonstrate an increasing pathway for traditional investors to gain exposure. While these tools have reduced circulating supply, they have also introduced new risks related to liquidity, regulatory scrutiny, and market perception.

Origin and Issuance of BONK

The concept of Bonk emerged at the end of 2022, a time when the Solana ecosystem was reeling from the FTX collapse. Solana's price plummeted from around $36 pre-crisis to below $10, with its DeFi activity and TVL experiencing a sharp decline. The broader crypto market was in a deep bear market, with Bitcoin and Ethereum hitting multi-year lows. Meanwhile, Meme coins like DOGE and SHIB, which had skyrocketed in 2021, were gradually losing steam by the end of 2022. The market's confidence in the long-term value of most altcoins was waning, especially when it came to Meme coins.

In this context, the concept of Bonk emerged, aiming to serve as a community-driven Solana Meme coin, rallying community forces to boost Solana's morale.

Bonk officially launched on December 25, 2022, and positioned itself as the 「Dogecoin of Solana for the masses.」 During its issuance, there was no private sale or VC funding; instead, 50% of the 1 quadrillion token supply was airdropped to active Solana ecosystem users, covering nearly 300,000 wallet addresses. This airdrop was one of the largest in Solana's history, targeting the core community group to maximize grassroots user participation.

The explicit goal of this airdrop was to reward the actively engaged Solana community, encompassing various groups within the ecosystem. Notably, core Solana developers also received a small BONK airdrop as a gesture of appreciation. The widespread distribution quickly made BONK one of the most widely held tokens on Solana.

Most of the token supply entered circulation immediately after issuance, with only 21% allocated to early contributors subject to a linear unlocking schedule starting at the end of December 2022, and the remaining small portion will gradually unlock over the coming months, culminating in January 2026. Another significant portion of the token supply, 16%, was allocated to BonkDAO.

Initially composed of a committee of 11 community members and core contributors, BonkDAO manages the DAO treasury's multisig account. The DAO is committed to gradually achieving decentralization and will open up community voting in July 2024 through proposals to burn BONK collected by BonkBot and eventually integrate with the Solana governance platform Realms for community governance voting. Many of BonkDAO's proposals revolve around marketing incentive activities and various token burns (such as Burnmas, BonkBot Burn, November Burn).

The launch of Bonk was accompanied by a surge of speculative interest, and the token was immediately tradable on the Solana DEX. Multiple centralized exchanges quickly listed BONK, including Coinbase, Binance, OKX, Huobi, MEXC, Bybit, Gate.io, all completing their listings in the first week of January 2023. This exchange support helped BONK achieve a multi-billion dollar market cap within weeks.

However, the initial airdrop and listing hype gradually waned in the middle of the year, until late 2023 when Solana saw a broader Meme coin craze, with new tokens like WIF gaining attention, but BONK still maintained its status as the flagship Meme coin on Solana and saw a significant rebound during this period. By the end of 2023, BONK had firmly established its core position in the Solana ecosystem, with price movements often mirroring SOL but with higher volatility.

Integration and Applications

Throughout its journey, Bonk's strategy has been to deeply integrate into the Solana ecosystem, with a dual purpose:

1. To acquire and maintain community attention

2. To build diverse application scenarios, reducing BONK's circulation through fees or burn mechanisms

Here are the key integrations and applications of BONK:

Decentralized Exchanges and Liquidity Pools (January 2023): DEXes on Solana quickly embraced Bonk, with Orca and Raydium leading the way by launching BONK liquidity pools and providing yield incentives. Additionally, a Bonk-branded DEX—BonkSwap—also emerged in early 2023.

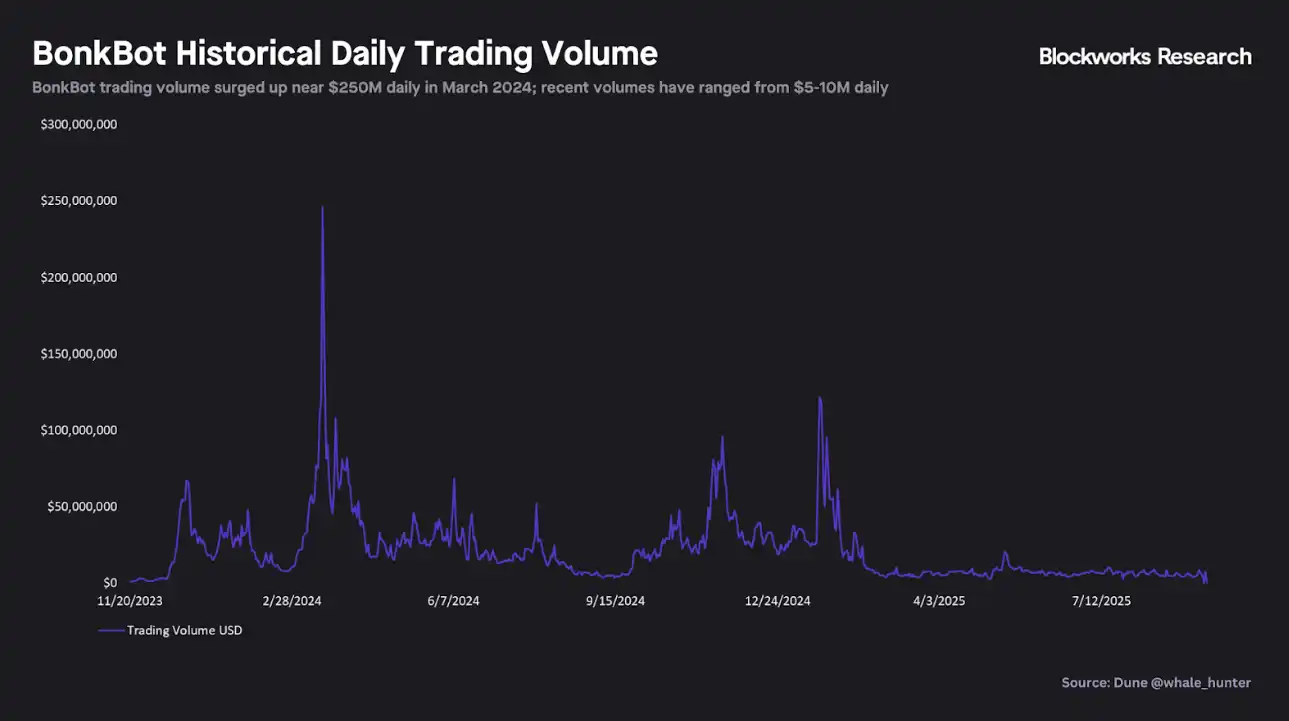

Trading Bot - BonkBot (Mid-2023): One of the most influential applications in the Bonk ecosystem is BonkBot, a Telegram trading bot that we previously mentioned in our trading bot industry report. BonkBot allows users to trade any Solana token via a chat interface, charging a 1% transaction fee and using 10% of it for buybacks and BONK burns. During the Solana Meme coin craze in early 2024, BonkBot was a leading trading bot for several months. Despite subsequent stagnation in the trading bot space, its core users continued to contribute stable fee revenue, supporting BONK burns.

Token Launch Platform – Bonk.fun (Q2 2025): Following Raydium's launch of the modular launch platform LaunchLab, Graphite Protocol partnered with BONK to introduce Bonk.fun, a Bonk-themed launch platform built on the LaunchLab product. Similar to Pump.fun, Bonk.fun allows anyone to permissionlessly launch new SPL tokens and is heavily geared towards meme coin activities.

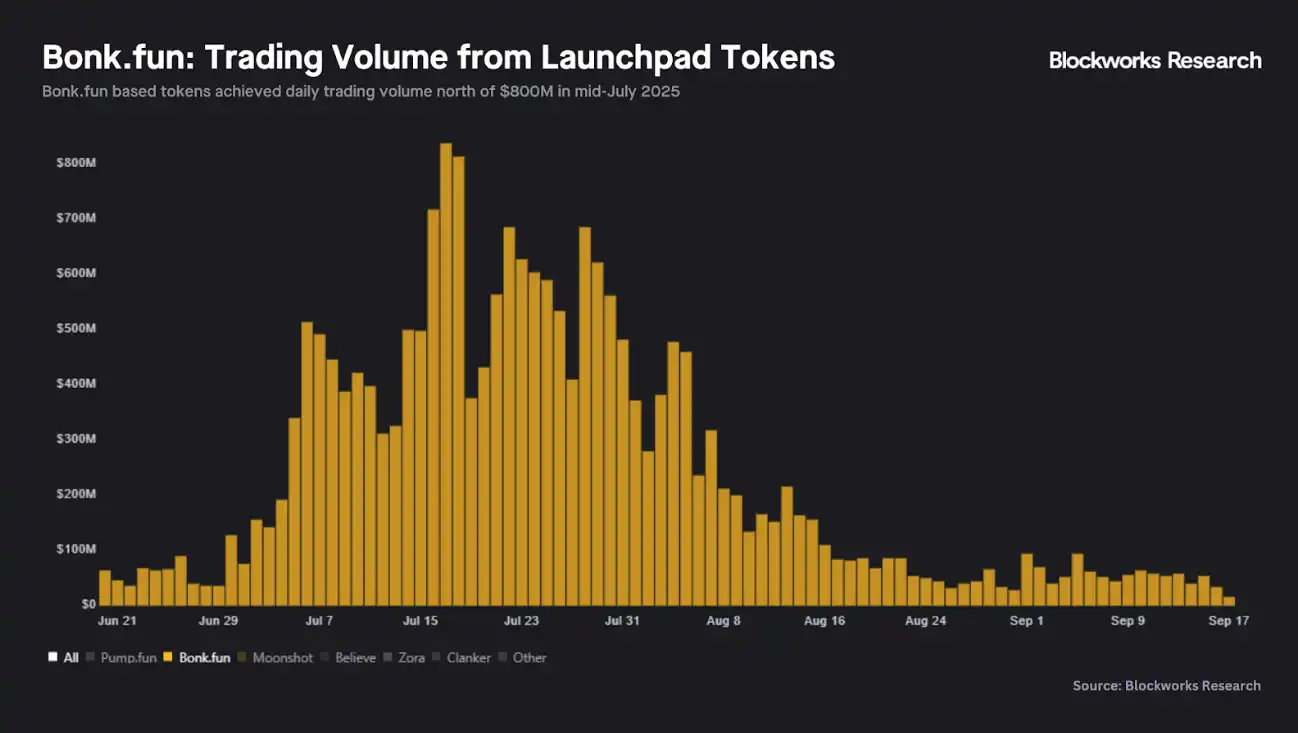

Bonk.fun quickly sparked a frenzy upon its launch, with daily trading volume surpassing $4 billion within weeks. The hype gradually subsided over the following months until early July when Bonk.fun suddenly overtook Pump.fun, capturing over 60% of the Solana launch platform's trading volume at its peak.

Similar to BonkBot, Bonk.fun will allocate a portion of platform-generated fees towards buying back and burning BONK. We will delve deeper into the impact of these key burn-driving factors in subsequent chapters.

Game – Bonk Arena (June 2025): Bonk entered the GameFi space through Bonk Arena, an "earn-to-kill" arcade shooter game developed by Bravo Ready. Bonk Arena launched in June 2025 as a web/browser game where players need to pay 10,000 BONK (approximately $0.15 at launch) to enter the deathmatch, where defeating opponents earns them their betted BONK. 50% of the BONK used in the game is allocated towards token burning, BONK staking rewards, and charitable donations. Bonk Arena is accessible directly through the Phantom wallet and is planned to expand to Solana's Saga mobile and PSG1 gaming handheld.

Fitness App – Moonwalk (2024–2025): Moonwalk is one of the first Real-World Applications (RWA-Fitness) in the BONK ecosystem, gamifying fitness behavior to allow users to earn on-chain rewards through activities like walking, running, and other daily exercises. Moonwalk's long-term goal is to grow the user base of Web3 fitness and convert the average user's daily movements into on-chain behavioral data, providing more authentic user needs and healthy growth metrics for the entire BONK ecosystem. Through Moonwalk, Bonk ventures beyond social or trading applications into the realm of "real-world utility," further expanding BONK's appeal beyond Web3.

Digital Art – Exchange Art: Exchange Art is one of the largest digital art and NFT trading platforms on Solana. In 2025, BONK collaborated with Solana to launch the real-world Crycol Gallery in New York and feature all gallery artworks on Exchange Art, achieving an "online + offline" art exhibition ecosystem. Exchange Art supports artists accepting BONK as a purchasing currency and integrates BONK-related art themes in some events, making BONK part of the Solana NFT culture.

Philanthropy – Buddies for PAWS: Buddies for PAWS is BONK's global animal welfare program, supporting multiple animal protection organizations through a combination of "community donations + BONK official 1:1 matching." This program reinforces BONK's narrative of "from the community, for the community," expands BONK's international influence, and conveys positive brand values to the traditional world. Although donations do not directly lead to burning, the elevation of BONK culture and media dissemination indirectly enhances BONK's social acceptance and long-term value stickiness.

Cross-Chain Bridge: As Bonk grows, it has started expanding to other chains. Cross-chain bridges like Wormhole allow BONK to circulate on Ethereum, BNB Chain, Base, and other chains. By 2025, BONK is available on 13 blockchains through cross-chain bridges or wrapped tokens, significantly improving accessibility. However, Solana remains the core chain of BONK activities.

Multi-Chain Deployment: Bonk is also exploring the launch of DeFi products on different blockchain platforms. Recent plans include launching BONAD on Monad, a Meme coin issuance platform similar to Bonk.fun. In the future, redeploying or expanding Bonk products to more blockchain ecosystems may further drive repurchase and burn pressure on BONK.

This broad integration showcases that Bonk is not just positioned as a Meme coin's vision. By embedding the token in various use cases, Bonk aims to create organic demand beyond pure retail speculation.

Supply-Side Proof: "Deflationary Dog Coin"

Almost all Meme coins tend to fade away after the initial hype, but the Bonk community has chosen to pivot towards building a sustainable ecosystem. By 2024, a new narrative begins to take shape: 「BONK is more than just a Meme coin」, with its core focus on fee generation and token burning mechanism.

Fee Generation and Distribution

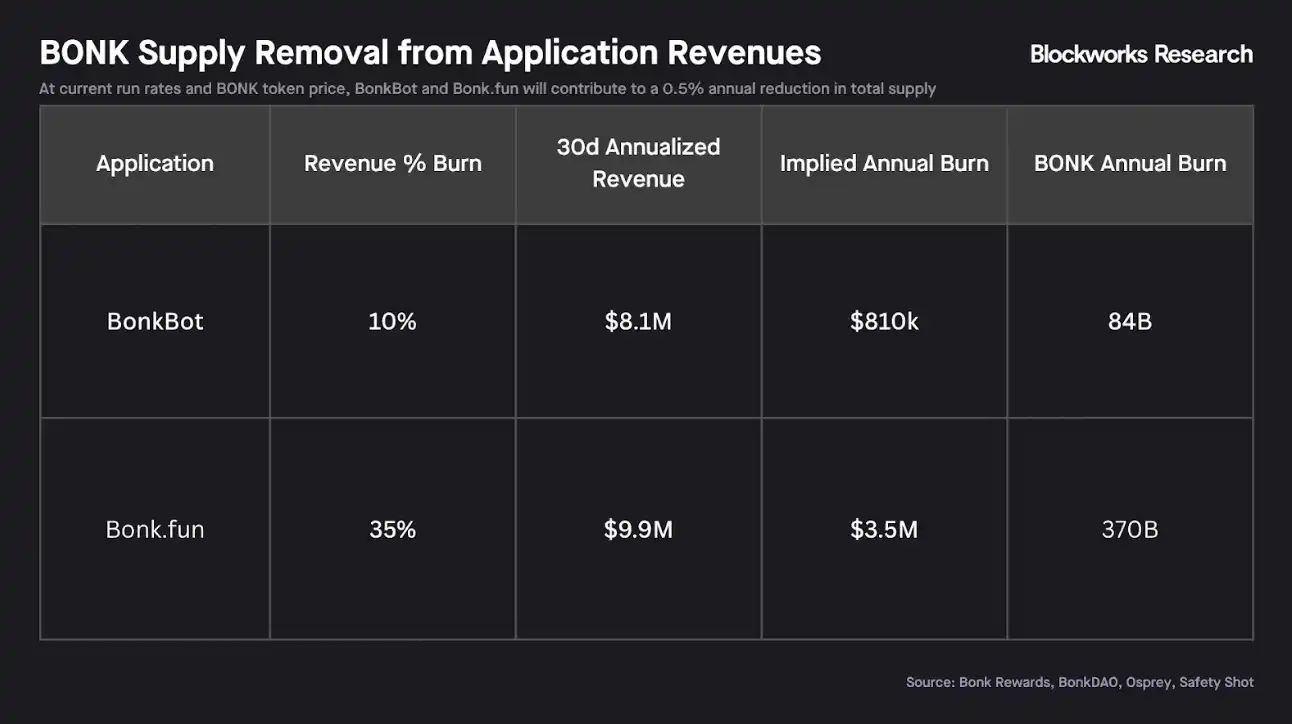

As mentioned earlier, BonkBot and Bonk.fun are the most influential applications driving the use of fees for BONK buyback and burn.

BonkBot charges a fixed 1% fee per transaction:

· Of which 10% is used for market buyback of BONK and burn

· Another 10% is transferred to the BonkDAO multisig wallet

Therefore, 20% of all BonkBot fees directly benefit BONK holders—half through permanent burn and the other half through DAO accumulation (to date, these funds have also been used for burning through governance proposals).

So far, BonkBot has generated a total of over $87M in transaction fees, with about $8.7M used for BONK burn and another $8.7M accumulated in the DAO. While 2024 was the highlight year for BonkBot, recent transaction volumes and fees have significantly dropped. The fees for the past 30 days are approximately $667k, implying an annualized BONK burn of about $810k (if 10% of the DAO allocation is also used for burning, the total amount could reach $1.6M).

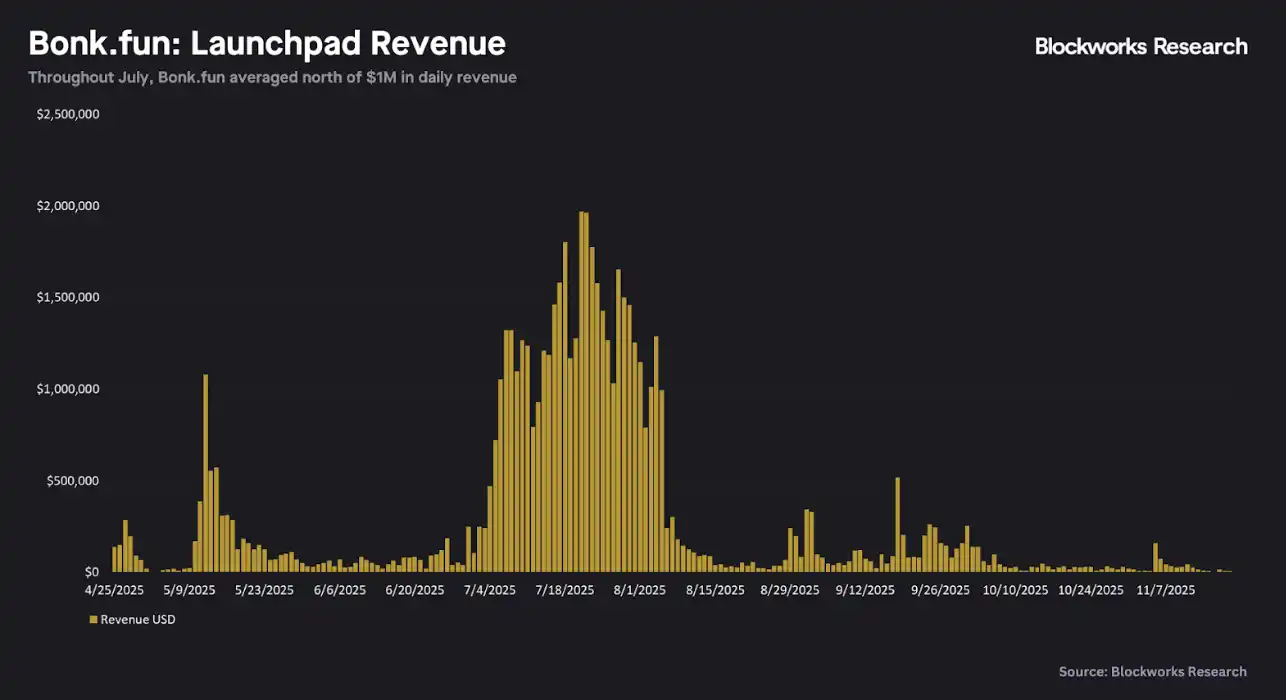

In addition to BonkBot, Bonk.fun became a significant driver of BONK burn in mid-2025. The platform charges a 1% fee on Bonding Curve-based transaction volume. As of August 11, Bonk.fun uses 50% of the transaction fees for market buyback and BONK burn, with the ratio adjusted to 35% later, but Safety Shot commits to reinvesting 90% of its 10% revenue share in purchasing BONK, resulting in an actual buyback and burn ratio of 44%.

As shown in the chart, Bonk.fun experienced a sharp increase in trading volume in July and surpassed Pump.fun in market share, generating over $37M in revenue in just July, with 50% allocated to BONK burning. However, since July, Bonk.fun's activity and revenue have dropped by over 90%. Revenue for the past 30 days is approximately $812k, which means that at a 35% burn rate, the annualized BONK burn is about $3.5M (considering the reinvestment of Safety Shot, the actual burn pressure may be higher).

Other applications in the Bonk ecosystem are relatively niche but generally follow the same pattern: using a portion of the fees for buyback and BONK burning. These applications include BonkSwap, Bonk Arena, Bonk Validator, and other Bonk-associated apps or integrations.

The key takeaways are:

· The burn pressure of Bonk is almost entirely driven by the success of BonkBot and Bonk.fun

· Various small applications have minimal impact on the overall burn rate

Nevertheless, the Bonk core team and community continue to launch new Bonk-related apps, games, and integrations, which provide the potential for future creation of new sources of BONK supply reduction.

Autonomous Burning and Lockup Mechanism

In addition to the main Bonk-related applications, another significant source of burning comes from DAO voting, events, and community/cultural decisions.

· Bonk DAO Burn: The DAO periodically proposes the burning of tokens accumulated in the treasury through revenue sharing. For example, approximately 2.78 trillion BONK was burned by committee vote in April 2024, while around 840 billion BONK was burned in July 2024, which was a community vote (any holder can temporarily stake BONK to participate in voting).

· Burn Event (e.g., BURNmas): BURNmas is an incentive-based marketing event where the DAO commits to burning varying amounts of BONK based on tweets and other social interactions. From November 15 to December 24, 2024, the DAO and the community burned tokens daily, with a target of 1 trillion BONK, ultimately burning 1.69 trillion BONK.

· DeGods Allocation Burn: The entire DeGods airdrop allocation (500 billion BONK) was burned in January 2023. As a Solana NFT project, DeGods was initially included in the BONK airdrop but was burned after it announced its migration to Ethereum, as decided by the community and the Bonk team.

In addition to the burning mechanism, Bonk introduced the Bonk Rewards Lockup (Staking) Mechanism in mid-2024 to incentivize long-term holding. Users can choose lockup periods ranging from 1 month to 1 year, with higher rewards multipliers for longer periods. In return, lockup users receive a share of the Bonk Rewards Pool, funded by the Bonk ecosystem's revenue, with rewards primarily in USDC supplemented by a small amount of BONK, distributed regularly.

Currently, approximately 3.5 trillion BONK are locked up, representing about 4% of the total supply.

Demand-Side Drive: Access to Traditional Financial Products

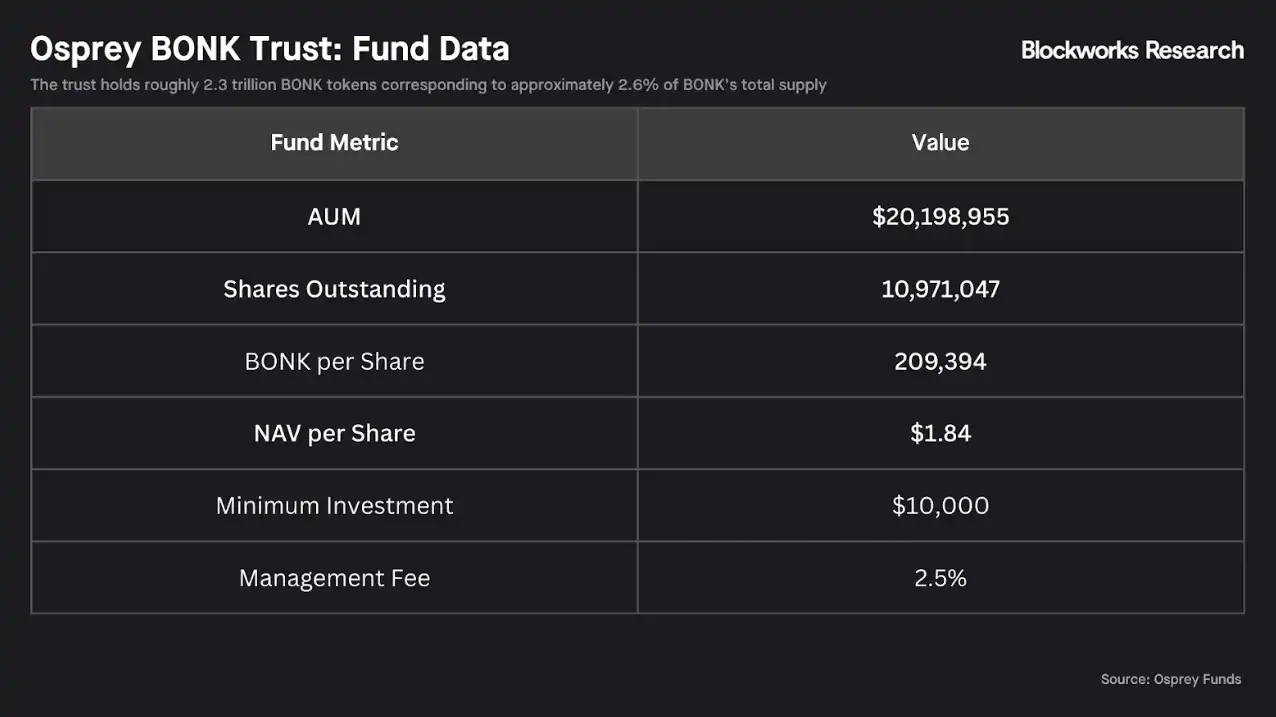

Osprey Bonk Trust was launched by Osprey Funds in October 2024 as a Delaware Grantor Trust aimed at providing indirect exposure to BONK for U.S. accredited investors without holding the token directly. The trust is issued in the form of a 506(c) Private Placement, with a minimum investment of $10,000, an annual management fee of 2.5%, and a closed-end structure (no direct redemption of shares allowed).

As of November 21, 2025, the trust held approximately $20.2 million in assets, corresponding to 10.97 million shares, with each share being backed by about 209,000 BONK.

The trust currently custodies around 23 trillion BONK, representing approximately 2.6% of the total supply, which is a significant share that has been locked up long-term and removed from the market. Osprey has indicated that once the OTCQX listing time and asset requirements are met, the trust is planned to be listed for trading, providing a stock ticker trading mechanism similar to Grayscale's GBTC for public market investors. However, prior to formal listing, liquidity is only achieved through periodic private placements, and due to the lack of a redemption mechanism, the following risks exist:

1. No redemption is possible, and shares can only be traded on the secondary market

2. There may be premium or discount trading post-listing, a risk that has historical precedents in similar closed-end funds (such as GBTC)

In parallel with the trust, Osprey is collaborating with REX Shares to apply for the Bonk ETF, which will directly hold BONK and provide daily creation/redeemability in the primary market. Several Rex-Osprey Meme Coin ETFs, including BONK, TRUMP, DOGE, are expected to commence trading after the SEC's 75-day review window on September 12.

Additionally, Tuttle Capital is advancing a 2x Leveraged Bonk ETF and other leveraged cryptocurrency ETFs, but SEC approval remains uncertain. If approved, these ETFs will offer a compliant, exchange-traded investment channel for BONK, potentially bringing in incremental capital. It is noteworthy that merely on the news of a 2x Bonk ETF in July 2025, the BONK price surged by approximately 10% in a single day, indicating the market's anticipation of a more accessible entryway. Ultimately, the actual impact of these products will need to be observed post-trading launch to assess fund inflow.

In August 2025, the Florida-based health beverage company Safety Shot rebranded as the first publicly traded BONK Digital Asset Treasury Company (DATCO), with BONK as its core treasury asset. The company committed to purchase up to $115M of BONK (approximately 4-5% of total supply), with the initial $25M acquisition completed in partnership with BonkDAO, receiving a 10% revenue share of Bonk.fun. The company subsequently rebranded as Bonk, Inc. (Nasdaq: BNKK) to strengthen its association with the BONK ecosystem.

Bonk, Inc. raised funds through convertible preferred stock and ATM offerings to purchase and hold BONK, committing to reinvest 90% of Bonk.fun revenue into BONK. While BNKK nominally continues its beverage business to maintain listing compliance, its core strategy is to provide traditional investors with a stock exposure to BONK. This move caused significant volatility—stock price dropped nearly 50% on the announcement day, but it provided a public equity market investment channel for BONK until the Bonk ETF listing and drove indiscriminate buying pressure on BONK until fulfilling the $115M acquisition commitment.

The demand-side story of BONK is a case of financialization: an initially grassroots meme coin now entering the traditional financial system through investment trusts, potential ETFs, publicly traded companies, and derivatives markets. These products, if successful, could inject substantial capital into BONK but also introduce new risks such as capital flows, premiums/discounts, regulatory approvals, making the previously purely retail-driven market more complex.

Tokenomics: Supply-Demand Accounting

The total supply of BONK has decreased from the initial 100 trillion to around 88 trillion, primarily due to various burn mechanisms.

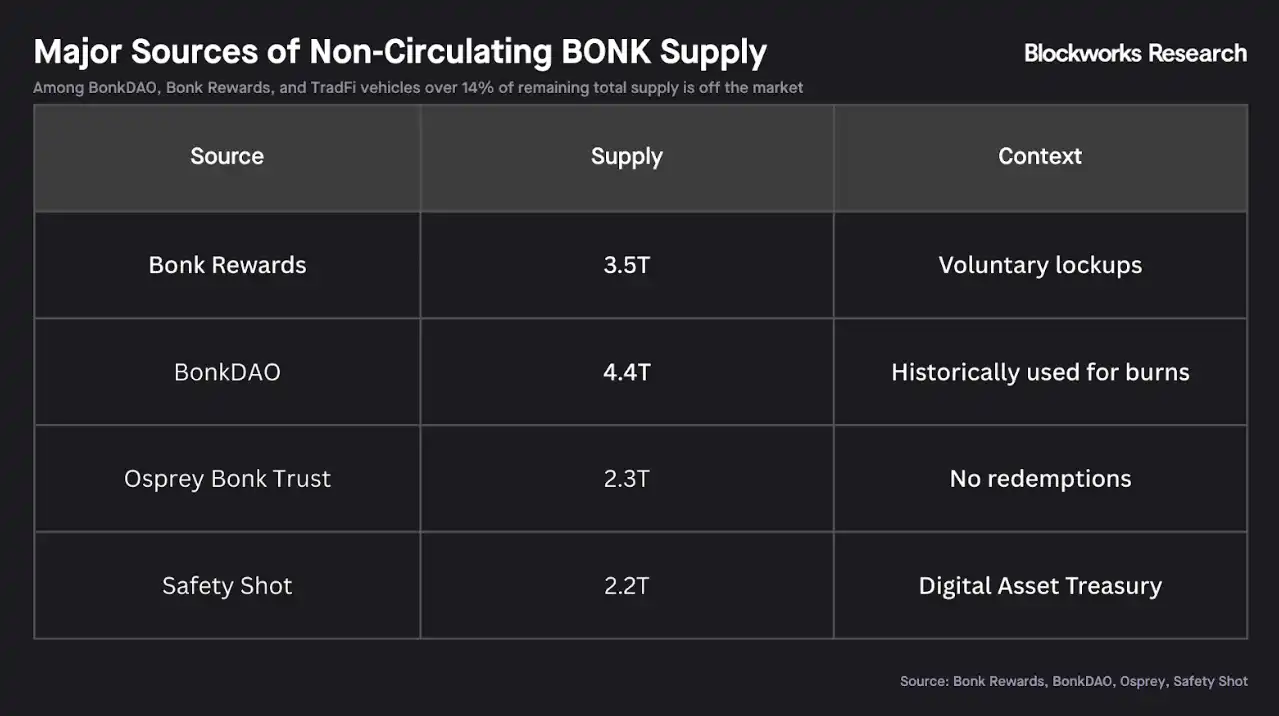

Within this 88 trillion, there are several non-circulating sources:

· Bonk Rewards Lockup

· BonkDAO Staking

· Osprey Bonk Trust and Safety Shot Holdings

Together, these account for over 14% of the remaining total supply, essentially removed from the market.

In addition, the original Bonk Contributors allocation still has around 2 trillion tokens awaiting unlocking, expected to fully unlock in the coming months.

We can also demonstrate their impact on supply by projecting the revenue run rate of BonkBot and Bonk.fun to token supply reduction. Based on the previously calculated 30-day annualized revenue, BonkBot and Bonk.fun are expected to burn approximately 840 billion and 3700 billion BONK per year, totaling about 0.5% of the total supply.

Essentially, Bonk's narrative revolves around limited supply and ongoing burn. Positive catalysts include:

· New lockup tools further reducing circulating supply

· Increased revenue from Bonk-related apps driving accelerated burn

Conversely, if the Bonk ETF goes live and Osprey Bonk Trust initiates a redemption mechanism, or the market share of applications like BonkBot, Bonk.fun decreases further, we expect BONK price to face downward pressure.

Risk Factors

Operational Risk

The value of BONK is increasingly tied to the performance of applications such as BonkBot, Bonk.fun, as they directly impact the burn rate. Whether the Bonk team and community can continue to capture new narratives, launch fee-generating and burn-driven applications, and maintain relevance in the crypto market has become a key driver of success.

This pattern is highly cyclical: it is highly constructive when the product is trending upwards in popularity, but equally reflexive in downturn when the hype subsides. We have observed this phenomenon with BonkBot and Bonk.fun—BONK surged when dominant in these applications, but experienced a decline when market share was taken back by competitors.

Ecosystem Competition Risk

Solana's Meme coin ecosystem is not a monopoly. If a more topical Meme coin emerges (such as the TRUMP earlier this year), users may shift from BONK to other tokens. Similarly, Bonk's products face competition within the Solana ecosystem:

· In 2024, BonkBot was a leader in the bot trading market, but was later marginalized

· Bonk.fun briefly held a majority of the Solana Launchpad market share in July 2025, but Pump.fun quickly regained dominance

If Bonk products continue to lose market share, the narrative of driving fees into burning will be jeopardized. Bonk must maintain cultural relevance while adapting to the increasingly competitive DeFi and trading app ecosystem on Solana.

Reputation and Ethical Risk

Bonk is inherently associated with speculative fervor. If a major scam or rug pull event were to occur under the Bonk brand, it could have repercussions across the entire ecosystem. For example:

· If a malicious token issued on Bonk.fun rugs, users may blame the platform or Bonk

· If a celebrity endorsement of BONK results in a price crash, the media may label it as a "pump and dump"

The team is attempting to position Bonk as community-friendly, but there have been negative cases in Meme coin history, such as celebrity tokens leading to lawsuits, and Crypto Twitter's criticism of "star coins." Additionally, after Safety Shot announced the BONK treasury strategy, the stock price plummeted by nearly 50%, indicating the market may see this move as "not serious." If this narrative spreads (media mocking the Bonk treasury as absurd), it could hinder further adoption, such as Bonk ETF products, and even trigger regulatory scrutiny of Meme coin treasuries.

Conclusion

BONK has evolved from a one-time airdrop to become one of Solana's most influential native assets, showcasing community power, experimental spirit, and widespread integration. Its fee-driven burn + cultural stickiness model gives it a longer lifespan compared to most Meme coins, and the adoption by traditional financial tools marks a new chapter of legitimacy.

However, the future of BONK hinges on whether the community can continue to innovate, uphold cultural moats, and maintain an effective burn mechanism amidst competition and narrative shifts. If successful, BONK will serve as a prime example of how Meme coins can transition into enduring ecosystem assets.

This article is a contribution and does not represent the views of BlockBeats.

You may also like

Aave’s $10M Token Purchase Raises Concerns Over Governance Power

Key Takeaways: Aave founder Stani Kulechov’s $10 million AAVE token purchase sparks debates over governance power concentration. Concerns…

Web3 and DApps in 2026: A Utility-Driven Year for Crypto

Key Takeaways The transition to utility in the crypto sector has set a new path for 2026, emphasizing…

How to Evaluate a Curator?

December 24th Market Key Intelligence, How Much Did You Miss?

Base's 2025 Report Card: Revenue Grows 30X, Solidifies L2 Leadership

From Aave to Ether.fi: Who Captured the Most Value in the On-Chain Credit System?

Venture Capital Post-Mortem 2025: Hashrate is King, Narrative is Dead

DeFi Hasn't Collapsed, So Why Has It Lost Its Allure?

NIGHT, with a daily trading volume of nearly $10 billion, is actually coming from the "has-been" Cardano?

Aave Community Governance Drama Escalates, What's the Overseas Crypto Community Talking About Today?

Key Market Information Discrepancy on December 24th - A Must-See! | Alpha Morning Report

2025 Token Postmortem: 84% Peak at Launch, High-Cap Project Turns into a "Rug Pull" Epicenter?

Polymarket Announces In-House L2, Is Polygon's Ace Up?

Ether pumps to outsiders, dumps in-house. Can Tom Lee's team still be trusted?

Coinbase Joins Prediction Market, AAVE Governance Dispute - What's the Overseas Crypto Community Talking About Today?

Over the past 24 hours, the crypto market has shown strong momentum across multiple dimensions. The mainstream discussion has focused on Coinbase's official entry into the prediction market through the acquisition of The Clearing Company, as well as the intense controversy within the AAVE community regarding token incentives and governance rights.

In terms of ecosystem development, Solana has introduced the innovative Kora fee layer aimed at reducing user transaction costs; meanwhile, the Perp DEX competition has intensified, with the showdown between Hyperliquid and Lighter sparking widespread community discussion on the future of decentralized derivatives.

This week, Coinbase announced the acquisition of The Clearing Company, marking another significant move to deepen its presence in this field after last week's announcement of launching a prediction market on its platform.

The Clearing Company's founder, Toni Gemayel, and the team will join Coinbase to jointly drive the development of the prediction market business.

Coinbase's Product Lead, Shan Aggarwal, stated that the growth of the prediction market is still in its early stages and predicts that 2026 will be the breakout year for this field.

The community has reacted positively to this, generally believing that Coinbase's entry will bring significant traffic and compliance advantages to the prediction market. However, this has also sparked discussions about the industry's competitive landscape.

Jai Bhavnani, Founder of Rivalry, commented that for startups, if their product model proves to be successful, industry giants like Coinbase have ample reason to replicate it.

This serves as a reminder to all entrepreneurs in the crypto space that they must build significant moats to withstand competition pressure from these giants.

Regulated prediction market platform Kalshi launched its research arm, Kalshi Research, this week, aimed at opening its internal data to the academic community and researchers to facilitate exploration of prediction market-related topics.

Its inaugural research report highlights Kalshi's outperformance in predicting inflation compared to Wall Street's traditional models. Kalshi co-founder Luana Lopes Lara commented that the power of prediction markets lies in the valuable data they generate, and it is now time to better utilize this data.

Meanwhile, Kalshi announced its support for the BNB Chain (BSC), allowing users to deposit and withdraw BNB and USDT via the BSC network.

This move is seen as a significant step for Kalshi to open its platform to a broader crypto user base, aiming to unlock access to the world's largest prediction market. Furthermore, Kalshi also revealed plans to host the first Prediction Market Summit in 2026 to further drive industry engagement and development.

The AAVE community recently engaged in heated debates around an Aave Improvement Proposal (AIP) titled "AAVE Tokenomics Alignment Phase One - Ownership Governance," aiming to transfer ownership and control of the Aave brand from Aave Labs to Aave DAO.

Aave founder Stani Kulechov publicly stated his intention to vote against the proposal, believing it oversimplifies the complex legal and operational structure, potentially slowing down the development process of core products like Aave V4.

The community's reaction was polarized. Some criticized Stani for adopting a "double standard" in governance and questioned whether his team had siphoned off protocol revenue, while others supported his cautious stance, arguing that significant governance changes require more thorough discussion.

This controversy highlights the tension between the ideal of DAO governance in DeFi projects and the actual power held by core development teams.

Despite governance disputes putting pressure on the AAVE token price, on-chain data shows that Stani Kulechov himself has purchased millions of dollars' worth of AAVE in the past few hours.

Simultaneously, a whale address, 0xDDC4, which had been quiet for 6 months, once again spent 500 ETH (approximately $1.53 million) to purchase 9,629 AAVE tokens. Data indicates that this whale has accumulated nearly 40,000 AAVE over the past year but is currently in an unrealized loss position.

The founder and whale's increased holdings during market volatility were interpreted by some investors as a confidence signal in AAVE's long-term value.

In this week's top article, Morpho Labs' "Curator Explained" detailed the role of "curators" in DeFi.

The article likened curators to asset managers in traditional finance, who design, deploy, and manage on-chain vaults, providing users with a one-click diversified investment portfolio.

Unlike traditional fund managers, DeFi curators execute strategies automatically through non-custodial smart contracts, allowing users to maintain full control of their assets. The article offered a new perspective on the specialization and risk management in the DeFi space.

Another widely circulated article, "Ethereum 2025: From Experiment to Global Infrastructure," provided a comprehensive summary of Ethereum's development over the past year. The article noted that 2025 is a crucial year for Ethereum's transition from an experimental project to global financial infrastructure. Through the Pectra and Fusaka hard forks, Ethereum achieved significant reductions in account abstraction and transaction costs.

Furthermore, the SEC's clarification of Ethereum's "non-securities" nature and the launch of tokenized funds on the Ethereum mainnet by traditional financial giants like JPMorgan marked Ethereum's gaining recognition from mainstream institutions. The article suggested that whether it is the continued growth of DeFi, the thriving L2 ecosystem, or the integration with the AI field, Ethereum's vision as the "world computer" is gradually becoming a reality.

The Solana Foundation engineering team released a fee layer solution called Kora this week.

Kora is a fee relayer and signatory node designed to provide the Solana ecosystem with a more flexible transaction fee payment method. Through Kora, users will be able to achieve gas-free transactions or choose to pay network fees using any stablecoin or SPL token. This innovation is seen as an important step in lowering the barrier of entry for new users and improving Solana network's availability.

Additionally, a deep research report on propAMM (proactive market maker) sparked community interest. The report's data analysis of propAMMs on Solana like HumidiFi indicated that Solana has achieved, or even surpassed, the level of transaction execution quality in traditional finance (TradFi) markets.

For example, on the SOL-USDC trading pair, HumidiFi is able to provide a highly competitive spread for large trades (0.4-1.6 bps), which is already better than the trading slippage of some mid-cap stocks in traditional markets.

Research suggests that propAMM is making the vision of the "Internet Capital Market" a reality, with Solana emerging as the prime venue for all of this to happen.

The competition in the perpetual contract DEX (Perp DEX) space is becoming increasingly heated.

In its latest official article, Hyperliquid has positioned its emerging competitor, Lighter, alongside centralized exchanges like Binance, referring to it as a platform utilizing a centralized sequencer. Hyperliquid emphasizes its transparency advantage of being "fully on-chain, operated by a validator network, and with no hidden state."

The community widely interprets this as Hyperliquid declaring "war" on Lighter. The technical differences between the two platforms have also become a focal point of discussion: Hyperliquid focuses on ultimate on-chain transparency, while Lighter emphasizes achieving "verifiable execution" through zero-knowledge proofs to provide users with a Central Limit Order Book (CLOB)-like trading experience.

This battle over the future direction of decentralized derivatives exchanges is expected to peak in 2026.

Meanwhile, discussions about Lighter's trading fees have surfaced. Some users have pointed out that Lighter charged as much as 81 basis points (0.81%) for a $2 million USD/JPY forex trade, far exceeding the near-zero spreads of traditional forex brokers.

Some argue that Lighter does not follow a B-book model that bets against market makers, instead anchoring its prices to the TradFi market, and the high fees may be related to the current liquidity or market maker balance incentives. Providing a more competitive spread for real-world assets (RWA) in the highly volatile crypto market is a key issue Lighter will need to address in the future.

The Secret Centralization Landscape of Stablecoin Payments: 85% of Transaction Volume Controlled by Top 1000 Wallets

Why Did Market Sentiment Completely Collapse in 2025? Decoding Messari's Ten-Thousand-Word Annual Report

Market Outlook: The Future of Cryptocurrency by 2026

Key Takeaways The report focuses on the impact of critical factors like Bitcoin, Ethereum, and Solana, alongside regulatory…

Aave’s $10M Token Purchase Raises Concerns Over Governance Power

Key Takeaways: Aave founder Stani Kulechov’s $10 million AAVE token purchase sparks debates over governance power concentration. Concerns…

Web3 and DApps in 2026: A Utility-Driven Year for Crypto

Key Takeaways The transition to utility in the crypto sector has set a new path for 2026, emphasizing…

How to Evaluate a Curator?

December 24th Market Key Intelligence, How Much Did You Miss?

Base's 2025 Report Card: Revenue Grows 30X, Solidifies L2 Leadership

From Aave to Ether.fi: Who Captured the Most Value in the On-Chain Credit System?

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com