Coin Metrics: Analyzing Circle's IPO Filing and $USDC's On-Chain Footprint

Original Article Title: New State of the Network: Unpacking Circle's IPO Filing and $USDC's On-Chain Footprint

Original Article Author: Tanay Ved, Coin Metrics

Original Article Translation: Shan Ou Ba, Golden Finance

Key Points:

· Circle generated $1.7 billion in revenue in 2024, with 99% coming from interest income on USDC reserves. Distribution costs paid to partners such as Coinbase and Binance totaled $1.01 billion, reflecting the crucial role of exchanges in expanding USDC coverage.

· USDC's total supply has rebounded to $60 billion, with a 30-day average transfer volume of $40 billion, indicating market confidence and cross-chain adoption recovery. However, USDC remains highly sensitive to interest rate fluctuations, competitive pressures, and regulatory developments.

· The use of USDC on major exchanges continues to grow, currently representing 29% of Binance's spot trading volume, thanks to Circle's strategic partner relationships.

· Looking ahead, the next phase for Circle may depend on diversifying revenue sources from passive interest income to active sources related to tokenized assets, payment infrastructure, and capital market integration.

Introduction

Circle is the largest stablecoin issuer in the United States and the company behind the $60 billion USDC, recently filed for an IPO, providing a window into the financial health and strategic outlook of this foundational company in the cryptocurrency space. As the only direct exposure to the fastest-growing vertical in the cryptocurrency space in the public markets, Circle's filing comes at a crucial moment. While the IPO may still face delays due to market conditions, it coincides with stablecoin legislation taking shape and increasing competition between issuers and blockchain.

In this article, we dissect key points from Circle's IPO filing and combine them with on-chain data for USDC to understand how Circle generates revenue, how factors like interest rates impact its business, and the role of platforms like Coinbase and Binance in shaping USDC distribution. We also explore USDC's on-chain footprint to assess Circle's positioning in an increasingly competitive landscape.

Circle Financial Overview

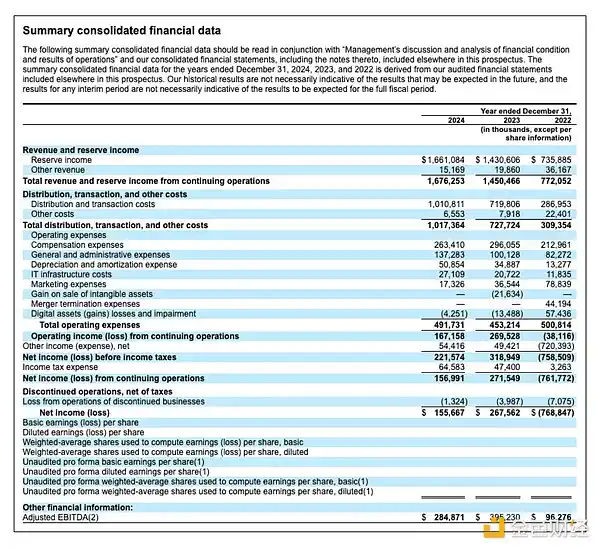

From its origins as a Bitcoin payment app to becoming a leading stablecoin issuer and crypto infrastructure provider, Circle has gone through a series of challenges in its 12-year evolution. After experiencing explosive revenue growth in 2021 (450%) and 2022 (808%), the growth rate slowed in 2023, when USDC was impacted by the collapse of a Silicon Valley bank, resulting in an 88% revenue increase. By the end of 2024, Circle reported revenue of $1.7 billion, a 15% year-over-year growth, indicating its shift towards a more sustainable expansion.

Source: Circle S-1 Filing

However, profitability saw a decline, with net income and adjusted EBITDA decreasing by 42% and 28%, to $157 million and $285 million, respectively. Notably, Circle's financial data shows that its revenue is highly concentrated on interest income from reserves, while distribution costs to partners like Coinbase and Binance amounted to around $1.01 billion. Nevertheless, these factors contributed to the resurgence of USDC's supply, which grew by 80% over the year, reaching $440 billion.

USDC On-Chain Growth

USDC is at the core of Circle's business, launched in 2018 through a joint venture with Coinbase. USDC is a tokenized representation of the US dollar, allowing end-users to store value in digital form and transact on blockchain networks, enabling near-instant, low-cost settlements. It operates on a fully reserved basis, backed by highly liquid assets (such as short-term US Treasuries, overnight repurchase agreements, and cash held with regulated financial institutions) in a 1:1 ratio.

Source: Coin Metrics Network Data Pro & Coin Metrics Labs

The total supply of USDC has grown to around $600 billion, making it the second-largest stablecoin, behind only Tether's USDT. Although its market share came under pressure in 2023, it has since rebounded to 26%, reflecting a recovery in market confidence. Approximately $400 billion (65%) is issued on Ethereum, around $95 billion on Solana (15%), about $37.5 billion on Base Layer-2 (6%), with the rest issued on blockchains like Arbitrum, Optimism, Polygon, Avalanche, among others.

The circulation speed and transfer volume of USDC have also shown remarkable growth, with a 30-day average reaching around $400 billion. In 2025, most of the USDC transfer volume occurs on Base and Ethereum, sometimes accounting for up to 90% of the adjusted total transfer volume.

Source: Coin Metrics Network Data Pro

These metrics indicate that as stablecoins serve as an emerging market dollar substitute and with the proliferation of payment and financial technology infrastructure, the usage of USDC is increasing. They also reflect Circle's cross-chain strategy, with USDC widely present on major blockchains and supported by interoperability tools like Cross-Chain Transfer Protocol (CCTP).

Reserve Composition and Sensitivity to Interest Rates

For every USDC dollar issued, Circle invests the backing reserve in a range of highly liquid, low-risk assets, such as short-term U.S. Treasuries and cash deposits. This structure enables Circle to earn revenue from the reserve while ensuring liquidity for USDC holders and stability for redemptions. In its filing, Circle revealed that it earned $1.6 billion in reserve income in 2024, representing 99% of its total revenue and highlighting a high concentration of its revenue structure in interest rates.

Most of USDC's reserves are held in the Circle Reserve Fund, which is a U.S. Securities and Exchange Commission-registered government money market fund managed by BlackRock. Based on Circle's monthly attestation, financial statements, and the aforementioned BlackRock Circle Reserve Fund, as of April 11th, approximately $535 billion (about 88%) of the USDC reserves consist of U.S. Treasuries and overnight repurchase agreements with multiple financial institutions, all with maturities of less than 2 months. Additionally, 11% of its reserves include cash held in regulated banks.

Source: Circle Transparency & BlackRock Circle Reserve Fund

Based on the $1.6 billion reserve income generated from Circle's approximately $440 billion reserve assets in 2024, the implied annualized yield is around 3.6%. If interest rates remain near current levels, assuming the USDC supply remains stable or grows, Circle's reserve income may remain stable.

Our previous article focusing on the decrease in USDC supply during a rising interest rate environment revealed the high correlation between Circle's reserve revenue and prevailing interest rates, indicating that its revenue model is highly sensitive to interest rate changes. While the effective federal funds rate in 2024 is expected to be between 4.58% and 5.33%, what does this mean for Circle in a declining rate environment? In its S-1 filing, Circle estimates that a mere 1% interest rate decrease could result in a $441 million reduction in stablecoin reserve revenue, a key risk outlined in the filing.

Given that Circle retains all revenue — unlike issuers such as Ethena and Maker, which distribute interest to holders — its business model remains highly sensitive to future interest rate fluctuations, competitive pressures, and regulatory evolution.

Distribution, Distribution, Distribution

The Role of Coinbase and Binance

Circle's IPO application also revealed the importance of partners like Coinbase and Binance in driving the adoption of USDC. In 2024, their distribution costs amounted to $1.01 billion, a significant 40% increase from 2023 and a 150% increase from 2022.

While Coinbase's relationship with Circle is well known, the filing shed light on the financial closeness between the two. In 2024, Coinbase earned $908 million from USDC-related activities, accounting for approximately 13.8% of its total revenue. Under the revenue-sharing agreement with Circle, Coinbase earns 100% of the interest on USDC held on its platform and 50% of the interest held elsewhere.

The USDC supply held on the Coinbase platform is currently at 20%, up from 5% in 2022, suggesting that most of the economic benefits accrue to Coinbase. The filing also disclosed a one-time payment of $60.25 million to Binance, aimed at promoting distribution in a similar manner.

Source: Coin Metrics Market Data Feed

Looking at trading activity on major partner platforms, USDC currently represents over 29% of Binance's spot trading volume (approximately $6.2 billion), surpassing FDUSD after its recent unpegging. It trails only behind USDT, which accounts for about 50% of Binance's trading volume. On Coinbase, USDC drives around 90% of the merged USD and USDC market's spot trading.

Despite the high cost, Circle's distribution efforts have translated into significant exchange-level adoption—driving USDC liquidity and trusted on-chain trading volumes of over $100 billion.

Beyond Exchanges: Empowering DeFi and Commerce

Viewing the supply held in smart contracts versus externally owned accounts (EOA) separately reveals the distribution of USDC across Ethereum wallets and applications. Currently, about $30 billion is held by EOA, a 66% increase, while about $10 billion is in smart contracts, a 42% increase from a year ago. The growth in EOA balances may reflect the increase in exchange custodianship and individual user holdings, while the growth in smart contracts indicates USDC's utility as collateral in the DeFi lending market and a liquidity source for decentralized exchanges (DEX).

Source: Coin Metrics Network Data Pro

USDC continues to play a foundational role in the DeFi lending market, with over $5 billion locked in protocols like Aave, Spark, and Morpho (representing supplied but not borrowed USDC). For collateralized debt protocols like Maker (now Sky), about $4 billion in USDC also backs the issuance of Dai/USDS through its price stability module.

Source: Coin Metrics ATLAS & Reference Rates

Likewise, USDC is a key liquidity source for various DEX pools facilitating trading of stable value assets. It is also increasingly underpinning on-chain FX markets, especially as other fiat-pegged stablecoins like Circle's compliant-to-MiCA-regulation EURC make strides.

Source: Coin Metrics DEX Data

Conclusion

The on-chain growth of USDC reflects the recovery of market confidence, but Circle's prospectus also highlights key challenges, particularly high distribution costs and heavy reliance on interest income. To maintain its growth momentum in a low-interest-rate environment, Circle is committed to diversifying its revenue through proactive product lines such as Circle Mint and expanding into the tokenized asset infrastructure space through the acquisition of the largest issuer of tokenized money market funds, Hashnote.

With the increasing regulatory clarity, especially with the U.S. Securities and Exchange Commission (SEC) stating its position that stablecoins are not securities, Circle is well-positioned. However, it now faces intensifying competition from offshore issuers like Tether and a new wave of U.S.-based challengers hoping to capitalize on the policy shift momentum. While Circle's valuation is still to be determined, its IPO will mark the first time the public markets can directly invest in stablecoin infrastructure growth.

You may also like

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Never Underestimate the Significance of the US Stablecoin 'Infrastructure Bill'

If the US stablecoin bill, the "GENIUS Act," passes smoothly this time, its significance will be tremendous. I even think it's significant enough to enter the top five in Crypto history.

Although abbreviated as the GENIUS Act, which translates directly to the Genius Act, it is actually the Guiding and Establishing National Innovation for U.S. Stablecoins, which translates to "Guiding and Establishing National Innovation for US Dollar Stablecoins."

The proposal is lengthy, with several key points summarized for everyone:

· Mandatory 1:1 Full Asset Backing: Assets include cash, demand deposits, and short-term US Treasuries. At the same time, misappropriation and rehypothecation are strictly prohibited.

· High-Frequency Disclosure: Reserve reports must be published at least monthly, introducing external audits.

· Licensing Requirement: Once the circulating market cap of the issuer's stablecoin exceeds $100 billion, it must transition into the federal regulatory system within a specified timeframe, adopting banking-grade regulation.

· Introduction of Custody: The custodian of the stablecoin and its reserve assets must be a regulated qualified financial institution.

· Clear Definition as a Payment Medium: The bill explicitly defines stablecoin as a new type of payment medium, primarily regulated by the banking regulatory system, rather than restricted by the securities or commodities regulatory system.

· Embracing Existing Stablecoins: A maximum 18-month grace period after the bill's enactment, aimed at encouraging existing stablecoin issuers (such as USDT, USDC, etc.) to promptly obtain licenses or become compliant.

After finishing the main content, let's talk about the significance of this matter with an excited heart.

Over the years, when others asked, "After working in the Crypto industry for 16 years, what application have you created?"

In the future, you can confidently tell others—Stablecoins.

Some people have held opposing views. In the past, people's impression of stablecoins was that they were an opaque black box. Every few months, there would be FUD — whether Tether's assets were frozen or Circle had a significant black hole deficit.

In fact, if you think about it, Tether easily rakes in billions of dollars a year just from the interest on those underlying government bonds. Circle, slightly less, also made a $1.7 billion profit last year.

They basically made money while standing there. From a motivational standpoint, they have no malicious intentions. In fact, they are the most eager for compliance.

Now, this opaque black box will become a transparent white box.

In the past, the only complaint was that Tether's funds might have been frozen by the United States. Now, they will be directly placed into U.S. compliant custodial institutions, with high-frequency disclosures, so you can rest assured.

【No need to worry about a rug pull】 is such a huge advantage—I think especially all Crypto people understand this.

Stablecoins were once almost on the verge of being overtaken by CBDCs. In any country, if a central bank digital currency really exists, it is highly likely not built on a blockchain, at most it is built on some internal central bank consortium chain, which to be honest, is meaningless.

When CBDCs were at their peak, that was the most dangerous time for stablecoins.

If CBDCs had become a reality back then, stablecoins today would have been relentlessly suppressed into a dark corner, and blockchain would only be able to play a minimal role.

The remaining half-dead stablecoins would even have to learn the standards of central bank digital currencies, completely relinquishing their standard-setting power.

And now, stablecoins have won (or are about to).

Instead, everyone should learn the 【Blockchain + Token】 standard.

Nowadays, many blockchains actually have no meaningful applications on top, only stablecoin transfers. For example, with Aptos, the only scenario I use Aptos for is transfers between Binance and OKX.

And now, stablecoins will be legislated, what does that mean?

That's right, blockchain will become the only standard.

In the future, every stablecoin user will be the first to learn how to use a wallet.

As an aside, I actually think Ethereum's concerted push for EIP-7702 is quite forward-thinking. While other chains are all about memes, thank you Ethereum for sticking to account abstraction.

EIP-7702 is about Account Abstraction, which can support, for example:

· Social Account Registration Wallet

· Paying GAS with Native Coin

· And more

This paves the way for future new users to heavily use stablecoins, solving the last-mile problem.

Furthermore, once stablecoins receive legislative support, deposits and withdrawals will become even easier.

Let's imagine a scenario: previously, hindered by the gray nature of stablecoins, but after the bill passes, many traditional brokerages can support stablecoins themselves. The money from a US stock investor can be converted into stablecoins in minutes and instantly deposited into Coinbase. Believe it or not.

Let's imagine another scenario: if the brilliant bill smoothly passes through the House of Representatives, next, you will see:

Due to the extremely lucrative nature of this trading, existing stablecoin leaders and newly entering traditional giants will crazily start promoting their stablecoin products.

And an outsider, due to these promotions, will start using stablecoins. And then one day, after finding out that the wallet account has been created, will explore Bitcoin inside. Is mining Bitcoin difficult?

Stablecoins are a huge Trojan horse. The moment you start using stablecoins, you unwittingly step half a foot into the Crypto world.

As a large reservoir for digesting US debt, although stablecoins cannot directly absorb debt, they at least provide ammunition for the US debt secondary market. These functions are quite important, and slowly, stablecoins are becoming a part of the US debt market's body. Therefore, once the US legislation is passed and experiences the benefits, there is no turning back.

And, we are also confident that stablecoins are indeed one of the great innovations in our industry. People who have used stablecoins will find it hard to return to the traditional cash-banking system.

Once the bill is passed, users can't go back. In the future, concerns are about to be resolved, standards will be mastered, and the era of large deposits seems to be on the horizon.

Original Article Link

After CEX and Wallet, OKX enters the payment game

Why Are Crypto Projects Rushing to Issue Credit Cards? A Battle Between Web3 and the Real World

Launch on Binance Alpha, how much is your HAEDAL airdrop worth?

Taking Stock of the Top 10 Emerging Launchpad Platforms: Who Will Succeed in Disrupting Pump.fun?

Parse Haedal Protocol: Sui Liquidity Staking Gem Project, TVL Ratio Exceeds Sum of Competitors

Stablecoin Showdown: Six Rising Stars Enter the Fray, Will the Market Structure Shift?

Deep Dive into Dubai's Crypto Dream: Illusion, Capital, and Decentralized Empire

HTX Research Latest Research Report丨Sonic: A Case Study of the New DeFi Paradigm

While the industry was still embroiled in the Layer 2 scaling debate, Sonic offered a new answer through a "foundational revolution." Recently, HTX Research released its latest research report "Sonic: A Blueprint for the DeFi New Paradigm," detailing the new public chain Sonic. While fully compatible with the EVM, Sonic has achieved a throughput of over 2000 TPS, 0.7-second transaction finality, and a transaction cost of 0.0001 USD, outperforming mainstream Layer 1 solutions and even surpassing most Layer 2 solutions. The performance-boosting Sonic is reshaping public chain infrastructure, officially ushering in the "sub-second era" of public chains.

As a high-performance public chain based on a Directed Acyclic Graph (aDAG), Fantom Opera initially stood out for its high throughput and fast confirmation capabilities. However, as the on-chain ecosystem expanded, the limitations of its traditional EVM architecture became increasingly apparent: state storage expansion, slow node synchronization, and constrained execution efficiency. To address this, Fantom introduced the new upgrade solution Sonic, aimed at achieving performance leaps through fundamental reconstruction without relying on sharding or Layer 2.

Led by the restructured Sonic Labs, Sonic's core development team brought together top industry talents, including CEO Michael Kong, CTO Andre Cronje (founder of Yearn Finance), and Chief Research Officer Bernhard Scholz. Over a period of two and a half years, the team comprehensively optimized from the virtual machine, storage engine to the consensus mechanism, ultimately creating the standalone new chain Sonic. While being EVM-compatible, Sonic has achieved over 2000 TPS, 0.7-second finality, $0.0001 transaction cost, a 90% improvement in storage efficiency, and reduced node synchronization time from weeks to within two days.

· SonicVM: The new virtual machine dynamically compiles EVM bytecode, caches high-frequency operations (such as SHA3 hashing), and pre-analyzes jump instructions, improving execution efficiency several times over to support high-throughput demands.

· SonicDB: Using a layered storage design, it separates real-time state (LiveDB) from historical data (ArchiveDB), compressing storage space by 90%, reducing node maintenance thresholds, and enhancing decentralization.

· Sonic Gateway: A Layer 2-like cross-chain bridge to Ethereum, balancing security and efficiency through a batch processing mechanism, supporting bi-directional asset migration, and seamless integration with the Ethereum ecosystem.

Sonic introduces its native token S, exchanged 1:1 with the old token FTM, undertaking functions such as gas payment and governance staking. Its innovative mechanisms include:

· Gas Fee Monetization (FeeM): Developers can receive up to 90% of transaction fee sharing, incentivizing ecosystem app innovation; non-FeeM apps have 50% of fees burned to deter inflation.

· Point Airdrop System: Users earn points (Passive/Activity Points and Gems) through holding tokens, participating in DeFi, or ecosystem interactions, redeemable for a total of 200 million S tokens, creating a "usage is mining" positive feedback loop.

During the market downturn in 2025, Sonic's on-chain TVL grew over 500% against the trend, with stablecoin volume surpassing $260 million, driven by high-leverage yield strategies:

· Silo v2 Recurring Borrowing: Pledge S tokens to borrow stablecoins, leverage up to 20x, capturing multiple points and spread yields.

· Euler+Rings Combination: Deposit USDC to mint overcollateralized stablecoin scUSD, leverage up to 10x, while receiving Sonic points and protocol airdrops.

· Shadow DEX Liquidity Mining: Provide liquidity for mainstream trading pairs, earning up to 169% APY and receiving a share of trading fees.

The ecosystem's future plans involve introducing Real World Asset (RWA) yields and off-chain payment scenarios, expanding through compliant asset backing and consumer app integration, establishing a sustainable stablecoin utility loop.

Sonic's core DEX, FlyingTulip, designed by Andre Cronje, integrates trading, lending, and leverage functions, with key technological breakthroughs including:

· Adaptive AMM Curve: Combining Curve V2's liquidity aggregation advantage, introducing external oracle monitoring of volatility, dynamically adjusting the curve shape—close to a constant-product curve during low volatility (low slippage), and approaching a constant-product curve during high volatility (preventing liquidity depletion), reducing impermanent loss by 42%, and improving capital efficiency by 85%.

· Dynamic LTV Lending Model: Drawing inspiration from Curve's LLAMA liquidation mechanism but dynamically adjusting the loan-to-value (LTV) ratio based on market volatility. For example, the ETH collateral loan-to-value ratio can plummet from 80% during calm periods to 50% during volatile periods, reducing systemic risk.

With its triple advantage of "high performance + nested yield + low threshold," Sonic is expected to exceed $2 billion in TVL within 12 months, and its token S may impact billions of dollars in market capitalization. Its model has established a new paradigm for the industry: replacing liquidity speculation with on-chain efficiency and real returns, potentially triggering a fundamental shift in the logic of public chain competition.

Potential risks are concentrated at the technical level, including the Adaptive AMM relying on an external oracle, which could result in liquidity pool anomalies if the price feed is attacked. High-leverage strategies face liquidation risks during extreme market conditions and require hedging tools (such as perpetual contract shorts) to manage volatility.

From a macro perspective, Sonic is poised to be the dark horse in the 2025 DeFi revival wave, with the success of its stablecoin ecosystem creating broad upside potential for the ecosystem token S and overall network value. Sonic's rise validates a key proposition: even in a bear market, through mechanism innovation and performance breakthroughs, DeFi can still build a "yield fortress" to attract rational capital for long-term retention. Its nested yield model, developer incentive system, and efficient infrastructure provide the industry with a reusable template. If successfully integrated with RWAs and payment scenarios, Sonic may become a bridge connecting on-chain yield with real economic demand, propelling DeFi into a new stage of mass adoption.

To read the full report, please visit: https://square.htx.com/wp-content/uploads/2025/04/HTX-Research-Latest-Report.pdf

HTX Research is the dedicated research arm of HTX Group, responsible for in-depth analysis of a wide range of areas including cryptocurrency, blockchain technology, and emerging market trends. HTX Research produces comprehensive reports, offers professional evaluations, and is committed to providing data-driven insights and strategic foresight. It plays a key role in shaping industry perspectives and supporting informed decision-making in the digital asset space. With rigorous research methods and cutting-edge data analysis, HTX Research always remains at the forefront of innovation, driving industry thought leadership and facilitating a deep understanding of the evolving market dynamics.

From Cantor to Securitize, Crypto Industry Buys Up Washington

WLFI Holdings Token Analysis: Did the Trump Family's Crypto Investment Pay Off?

This Week in Review | Trump to Host Dinner for TRUMP Holders; Musk and US Treasury Secretary Engage in Heated Argument at the White House

Key Market Information Discrepancy on April 27th - A Must-Read! | Alpha Morning Report

Cryptocurrency Market Sentiment Warms Up, MCP Emerges as New AI Frontier

Dialogue Backpack CEO: Everything is a Meme, Bitcoin is always the ultimate value

Three-Day 54% Surge: Where Does SUI's Growth Momentum Come From?

RWA Track Deep Dive Playbook: 10 RWA Projects to Watch in 2025

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Never Underestimate the Significance of the US Stablecoin 'Infrastructure Bill'

If the US stablecoin bill, the "GENIUS Act," passes smoothly this time, its significance will be tremendous. I even think it's significant enough to enter the top five in Crypto history.

Although abbreviated as the GENIUS Act, which translates directly to the Genius Act, it is actually the Guiding and Establishing National Innovation for U.S. Stablecoins, which translates to "Guiding and Establishing National Innovation for US Dollar Stablecoins."

The proposal is lengthy, with several key points summarized for everyone:

· Mandatory 1:1 Full Asset Backing: Assets include cash, demand deposits, and short-term US Treasuries. At the same time, misappropriation and rehypothecation are strictly prohibited.

· High-Frequency Disclosure: Reserve reports must be published at least monthly, introducing external audits.

· Licensing Requirement: Once the circulating market cap of the issuer's stablecoin exceeds $100 billion, it must transition into the federal regulatory system within a specified timeframe, adopting banking-grade regulation.

· Introduction of Custody: The custodian of the stablecoin and its reserve assets must be a regulated qualified financial institution.

· Clear Definition as a Payment Medium: The bill explicitly defines stablecoin as a new type of payment medium, primarily regulated by the banking regulatory system, rather than restricted by the securities or commodities regulatory system.

· Embracing Existing Stablecoins: A maximum 18-month grace period after the bill's enactment, aimed at encouraging existing stablecoin issuers (such as USDT, USDC, etc.) to promptly obtain licenses or become compliant.

After finishing the main content, let's talk about the significance of this matter with an excited heart.

Over the years, when others asked, "After working in the Crypto industry for 16 years, what application have you created?"

In the future, you can confidently tell others—Stablecoins.

Some people have held opposing views. In the past, people's impression of stablecoins was that they were an opaque black box. Every few months, there would be FUD — whether Tether's assets were frozen or Circle had a significant black hole deficit.

In fact, if you think about it, Tether easily rakes in billions of dollars a year just from the interest on those underlying government bonds. Circle, slightly less, also made a $1.7 billion profit last year.

They basically made money while standing there. From a motivational standpoint, they have no malicious intentions. In fact, they are the most eager for compliance.

Now, this opaque black box will become a transparent white box.

In the past, the only complaint was that Tether's funds might have been frozen by the United States. Now, they will be directly placed into U.S. compliant custodial institutions, with high-frequency disclosures, so you can rest assured.

【No need to worry about a rug pull】 is such a huge advantage—I think especially all Crypto people understand this.

Stablecoins were once almost on the verge of being overtaken by CBDCs. In any country, if a central bank digital currency really exists, it is highly likely not built on a blockchain, at most it is built on some internal central bank consortium chain, which to be honest, is meaningless.

When CBDCs were at their peak, that was the most dangerous time for stablecoins.

If CBDCs had become a reality back then, stablecoins today would have been relentlessly suppressed into a dark corner, and blockchain would only be able to play a minimal role.

The remaining half-dead stablecoins would even have to learn the standards of central bank digital currencies, completely relinquishing their standard-setting power.

And now, stablecoins have won (or are about to).

Instead, everyone should learn the 【Blockchain + Token】 standard.

Nowadays, many blockchains actually have no meaningful applications on top, only stablecoin transfers. For example, with Aptos, the only scenario I use Aptos for is transfers between Binance and OKX.

And now, stablecoins will be legislated, what does that mean?

That's right, blockchain will become the only standard.

In the future, every stablecoin user will be the first to learn how to use a wallet.

As an aside, I actually think Ethereum's concerted push for EIP-7702 is quite forward-thinking. While other chains are all about memes, thank you Ethereum for sticking to account abstraction.

EIP-7702 is about Account Abstraction, which can support, for example:

· Social Account Registration Wallet

· Paying GAS with Native Coin

· And more

This paves the way for future new users to heavily use stablecoins, solving the last-mile problem.

Furthermore, once stablecoins receive legislative support, deposits and withdrawals will become even easier.

Let's imagine a scenario: previously, hindered by the gray nature of stablecoins, but after the bill passes, many traditional brokerages can support stablecoins themselves. The money from a US stock investor can be converted into stablecoins in minutes and instantly deposited into Coinbase. Believe it or not.

Let's imagine another scenario: if the brilliant bill smoothly passes through the House of Representatives, next, you will see:

Due to the extremely lucrative nature of this trading, existing stablecoin leaders and newly entering traditional giants will crazily start promoting their stablecoin products.

And an outsider, due to these promotions, will start using stablecoins. And then one day, after finding out that the wallet account has been created, will explore Bitcoin inside. Is mining Bitcoin difficult?

Stablecoins are a huge Trojan horse. The moment you start using stablecoins, you unwittingly step half a foot into the Crypto world.

As a large reservoir for digesting US debt, although stablecoins cannot directly absorb debt, they at least provide ammunition for the US debt secondary market. These functions are quite important, and slowly, stablecoins are becoming a part of the US debt market's body. Therefore, once the US legislation is passed and experiences the benefits, there is no turning back.

And, we are also confident that stablecoins are indeed one of the great innovations in our industry. People who have used stablecoins will find it hard to return to the traditional cash-banking system.

Once the bill is passed, users can't go back. In the future, concerns are about to be resolved, standards will be mastered, and the era of large deposits seems to be on the horizon.

Original Article Link

After CEX and Wallet, OKX enters the payment game

Why Are Crypto Projects Rushing to Issue Credit Cards? A Battle Between Web3 and the Real World

Launch on Binance Alpha, how much is your HAEDAL airdrop worth?

Taking Stock of the Top 10 Emerging Launchpad Platforms: Who Will Succeed in Disrupting Pump.fun?

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com