The Possibility of a Fed Chair Bringing a Wild Bull Run

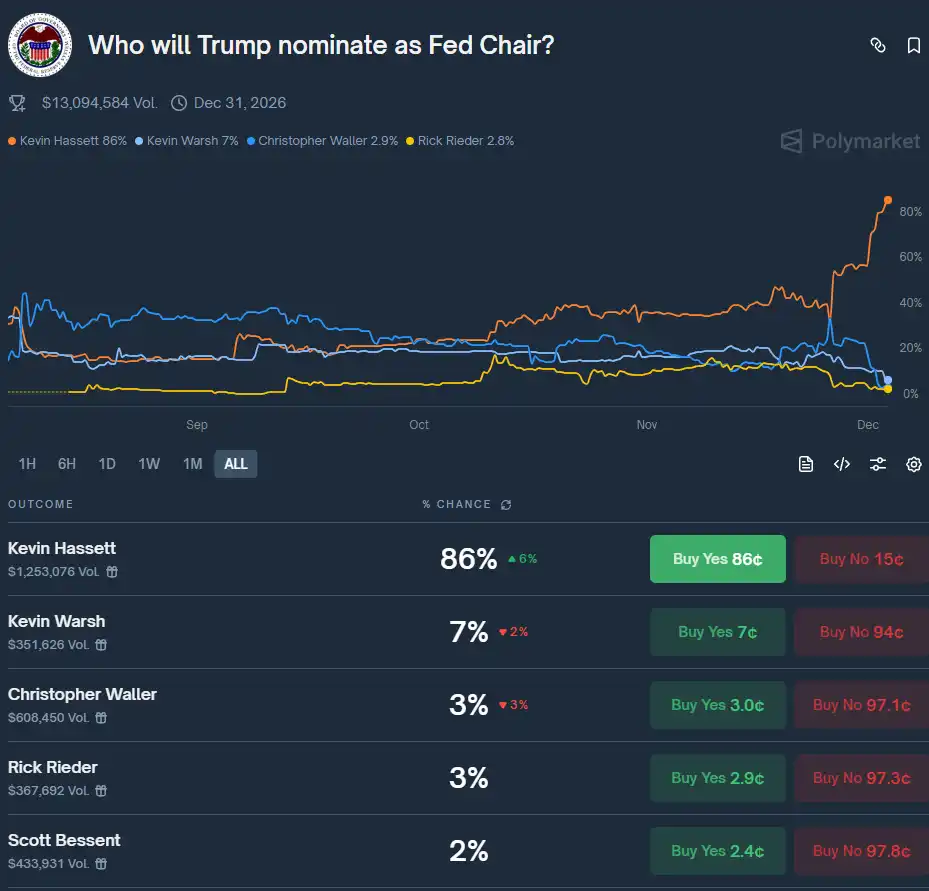

In the prediction market Polymarket, the probability of Hassett being elected as the new Federal Reserve Chair has risen to 86%, far ahead of other possible candidates for the position.

As expected, Kevin Hassett will most likely be the next Federal Reserve Chair, Trump's favorite.

The actions of the Federal Reserve have always been a key factor impacting the cryptocurrency market. So, if Hassett eventually becomes the new Federal Reserve Chair as expected by the market, what kind of impact can be expected on the market?

Accelerated Interest Rate Cuts

In late November, Hassett mentioned that pausing interest rate cuts at that time would be "a very bad time" because the government shutdown had already dragged down fourth-quarter economic growth. He projected that the government shutdown would cause a 1.5 percentage point decline in fourth-quarter Gross Domestic Product (GDP). Additionally, he noted that the September Consumer Price Index (CPI) showed better-than-expected inflation performance.

Earlier on November 13, Hassett stated that he expected a 1.5% GDP decline in the fourth quarter due to the government shutdown. He couldn't see many reasons not to cut interest rates.

Therefore, if Hassett becomes the new Federal Reserve Chair, it is expected that he will advocate for faster rate cuts, potentially lowering the federal funds rate to below 3%, even approaching 1%, to stimulate economic growth and employment.

This is also what Trump wants to see.

Resuming QE (Quantitative Easing)

On December 1, the Federal Reserve officially ended its Quantitative Tightening (QT) policy, marking the end of the balance sheet reduction process that began in 2022. Although some believe that the effects may not be seen until early next year, the expectation of loose liquidity is gradually materializing.

Hassett may be more tolerant of inflation, seeing the 2% inflation target as a flexible upper limit rather than a strict anchor. The focus would be on employment and GDP growth, reducing the "gradual" decision-making based on data and shifting to a more proactive pro-growth intervention.

In September of this year, during an interview with Fox Business, Hassett stated that the U.S. is experiencing a supply-side boom, in an economy without real inflation, the current rates are hindering economic growth and job creation. He also mentioned that the U.S. is expected to achieve 4% GDP growth.

The viewpoint prioritizing economic growth over inflation control, making it expected for the Federal Reserve under Powell's leadership to restart QE.

Impact on Bitcoin

Every Federal Reserve Chair candidate, whether they directly address the crypto topic or not, will have a structural impact on the cryptocurrency industry. Powell has more than just a passing association with the industry – openly holding Coinbase stock worth millions and serving on Coinbase's advisory board.

Moreover, he participated in an internal White House working group on digital asset policy, pushing for regulatory frameworks that leave room for innovation and seeing crypto tech as a significant variable shaping future economic structures. He once stated that Bitcoin would "rewrite financial rules."

Powell's crypto background could reduce regulatory uncertainty, drive institutional adoption, and lead the Fed to explore crypto integration. This could enhance Bitcoin's legitimacy and liquidity, potentially propelling prices to new highs.

Many traders are bullish on the market post-Powell's appointment, believing that the bull market will start then, expecting this to happen by mid-next year, making the latter half of '26 a focal point for the crypto industry.

You may also like

Blockchains Quietly Prepare for Quantum Threat as Bitcoin Debates Timeline

Key Takeaways: Several blockchains, including Ethereum, Solana, and Aptos, are actively preparing for the potential threat posed by…

Three Signs that Bitcoin is Discovering its Market Bottom

Key Takeaways: Indicators suggest the selling pressure on Bitcoin is diminishing, hinting at a potential bottom. With improving…

Trump’s World Liberty Financial Token Ends 2025 Significantly Down

Key Takeaways World Liberty Financial, led by the Trump family, witnessed its token value drop by over 40%…

Kraken IPO and M&A Deals to Reignite Crypto’s ‘Mid-Stage’ Cycle

Key Takeaways: Kraken’s upcoming IPO may draw significant interest and capital from traditional finance (TradFi) investors, boosting the…

Extended Crypto ETF Outflows Indicate Institutional Pullback: Glassnode

Key Takeaways: Recent outflows from Bitcoin and Ether ETFs suggest a withdrawal of institutional interest. Institutional disengagement has…

HashKey Secures $250M for New Crypto Fund Amid Strong Institutional Interest

Key Takeaways HashKey Capital successfully secured $250 million for the initial close of its fourth crypto fund, showcasing…

JPMorgan Explores Cryptocurrency Trading for Institutional Clients

Key Takeaways JPMorgan Chase is considering introducing cryptocurrency trading services to its institutional clientele, marking a notable shift…

El Salvador’s Bitcoin Dreams Faced Reality in 2025

Key Takeaways El Salvador’s ambitious Bitcoin strategy, introduced in 2021, faced significant challenges and revisions by 2025, particularly…

Price Predictions for 12/22: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Key Takeaways: Bitcoin’s recovery efforts are met with strong resistance, indicating potential bearish trends at higher levels. Altcoins…

Bitcoin Perpetual Open Interest Surges as Traders Look Forward to Year-End Rally

Key Takeaways Bitcoin perpetual open interest has risen to 310,000 BTC, reflecting a bullish sentiment among traders as…

What Happened in Crypto Today: Insights on Bitcoin, IMF, and Ether ETFs

Key Takeaways Anthony Pompliano anticipates a stable Bitcoin price trajectory in the coming year due to its lack…

Venture Capital Post-Mortem 2025: Hashrate is King, Narrative is Dead

Are Those High-Raised 2021 Projects Still Alive?

Aave Community Governance Drama Escalates, What's the Overseas Crypto Community Talking About Today?

Key Market Information Discrepancy on December 24th - A Must-See! | Alpha Morning Report

2025 Whale Saga: Mansion Kidnapping, Supply Chain Poisoning, and Billions Liquidated

Believing in the Capital Market - The Essence and Core Value of Cryptocurrency

Absorb Polymarket Old Guard, Coinbase Plunges Into Prediction Market Abyss

Blockchains Quietly Prepare for Quantum Threat as Bitcoin Debates Timeline

Key Takeaways: Several blockchains, including Ethereum, Solana, and Aptos, are actively preparing for the potential threat posed by…

Three Signs that Bitcoin is Discovering its Market Bottom

Key Takeaways: Indicators suggest the selling pressure on Bitcoin is diminishing, hinting at a potential bottom. With improving…

Trump’s World Liberty Financial Token Ends 2025 Significantly Down

Key Takeaways World Liberty Financial, led by the Trump family, witnessed its token value drop by over 40%…

Kraken IPO and M&A Deals to Reignite Crypto’s ‘Mid-Stage’ Cycle

Key Takeaways: Kraken’s upcoming IPO may draw significant interest and capital from traditional finance (TradFi) investors, boosting the…

Extended Crypto ETF Outflows Indicate Institutional Pullback: Glassnode

Key Takeaways: Recent outflows from Bitcoin and Ether ETFs suggest a withdrawal of institutional interest. Institutional disengagement has…

HashKey Secures $250M for New Crypto Fund Amid Strong Institutional Interest

Key Takeaways HashKey Capital successfully secured $250 million for the initial close of its fourth crypto fund, showcasing…

Popular coins

Latest Crypto News

Customer Support:@weikecs

Business Cooperation:@weikecs

Quant Trading & MM:bd@weex.com

VIP Services:support@weex.com