2025 Roadmap Revealed, With Binance Coin (BNB) Price Surging, What Other Potential Targets Are There in the BNB Chain Ecosystem Spring?

On February 9, the number of unique addresses on the BNB Chain's network surpassed 5 billion and continues to grow. According to DUNE data, BNB Chain has now become the top EVM-compatible chain in terms of transaction volume in the last 30 days.

Following closely on February 11, BNB Chain released its 2025 technical roadmap, revealing that BNB Chain will undergo multiple network upgrades. The most anticipated upgrade by investors is the gas fee upgrade, which will support multiple token payments for gas and introduce a feature allowing project teams to sponsor user gas fees. This means that the entire ecosystem is gradually taking on a different shape, with CZ's focus helping to drive this momentum.

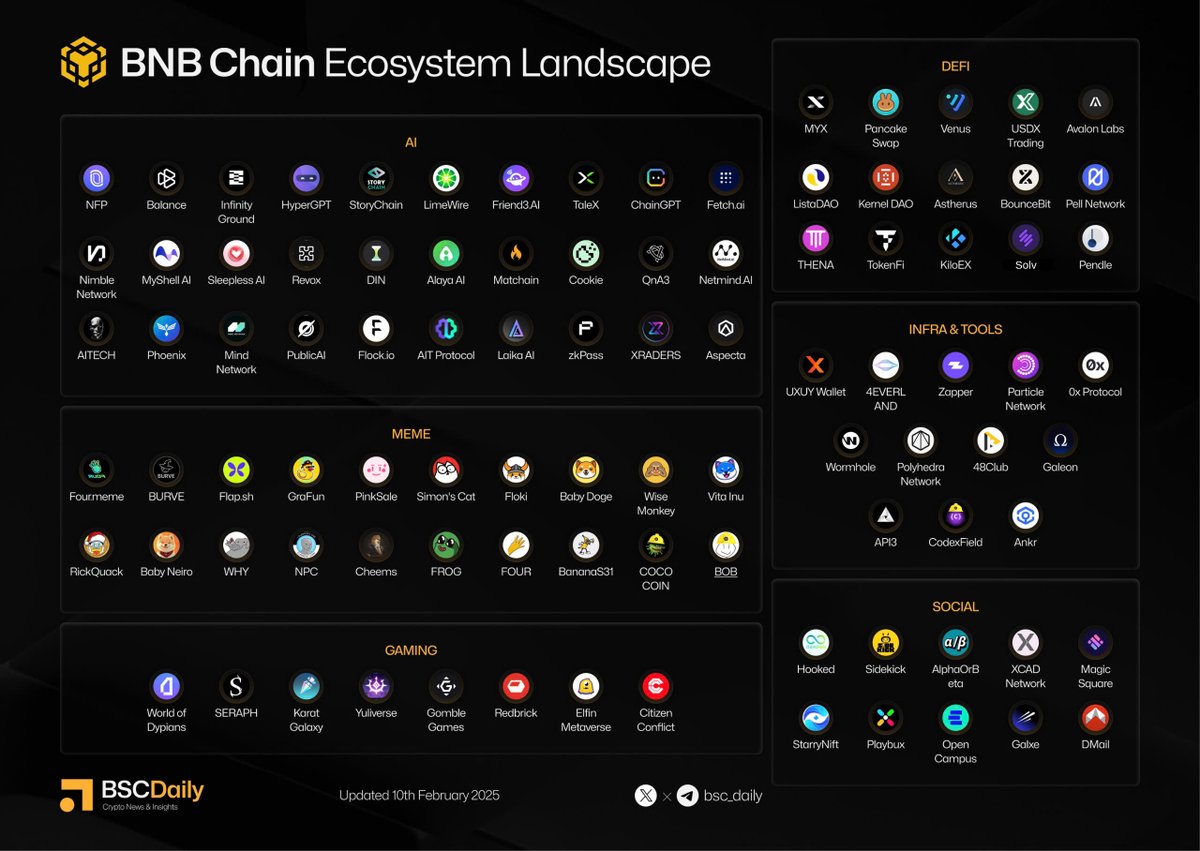

Over the past two days, BNB ecosystem tokens have seen across-the-board increases, leading the exchange gainers list, with meme tokens also taking the top spot on DexScreener. This article compiles high-quality assets worth noting in different tracks or sectors of the BNB Chain ecosystem. Perhaps in the current uncertain market environment, BNB Chain can provide some opportunities, offering investors some references and inspiration.

AI

BNB Chain currently has a complete AI ecosystem, ranging from data infrastructure and tools to AI-driven applications, from upstream AI hackathons to consumer-facing transaction frontends. The entire ecosystem has already deployed more than 60 projects, demonstrating a certain level of development resilience. Pay attention to ecosystem project launches or upcoming token opportunities, which may experience a boom along with the thriving BNB ecosystem.

Image Source: BSCDaily

For example, the following are representative AI projects in various tracks:

AI Agent Platform and Launchpad: Myshell, Eliza, Revox;

AI Games: World of Dypians, Xterio, SERAPH: In the Darkness;

AI Social: Tako, Jam.AI; AI DeFi: Termix, Anon;

Data Labeling: DIN, GATA, Alaya

On February 9, the leading issuance platform on the BNB Chain, Four.meme, and the AI project MyShell, supported by Dragonfly and YZI Labs, announced a strategic partnership. According to the partnership plan, Four.meme and MyShell will jointly invest in BNB Chain's AI ecosystem, incubating and supporting promising AI projects while providing comprehensive technical, funding, and marketing resource support.

Today, MyShell conducted an IDO, and the token generation event (TGE) conducted in partnership with Binance Wallet and PancakeSwap has received 27,959 BNB in subscriptions. The project aimed to raise 1,270 BNB and has now been oversubscribed 20 times.

TSA

On February 10, the AI project Holoworld AI announced that its first agent launch platform and market, Agent Market, had gone live on Solana and BNB Chain. Agent Market is a comprehensive platform that integrates the publication, interaction, and trading of multimodal agents, introducing several innovative features to bring more use cases to the BNB Chain ecosystem.

On the same day, Holoworld AI deployed its first test agent on the BNB Chain, and its native token TSA is currently valued at $6.9 million.

AICELL

AICell aims to build a decentralized "agent civilization" ecosystem focused on creating standalone or collaboratively operating intelligent agents or "units." It has introduced the concept of an "agent cluster," where multiple agents can dynamically form a network or cluster to handle complex tasks and has been included in Binance Alpha.

COOKIE

On February 10, the South Korean cryptocurrency exchange Bithumb announced the launch of COOKIE. Previously, it had been listed on exchanges such as Binance and OKX. COOKIE is one of the most famous AI applications with practical use cases in the BNB Chain ecosystem, and the token has real utility. Users need to hold a certain amount of COOKIE tokens to access its data services.

CGPT

ChainGPT is an advanced AI model designed for the blockchain and crypto field, providing tools for knowledge access, development, and business solutions supported by the CGPT token. On January 10, CGPT was listed on Binance spot trading together with COOKIE.

Infrastructure

BNX

BNX is the native token of BinaryX, a Web3 gaming platform in the BNB Chain ecosystem. The Four.Meme platform was essentially an incubation of the BinaryX team. In September 2024, BinaryX announced a rebranding to Four, which has not been implemented yet. Additionally, the Four.Meme platform does not have a platform token, so BNX is considered a concept token and has been hyped. At the time of writing, BNX's current circulating market capitalization is $5.57 billion, with a price of $0.98 and a 30% price increase in the last 24 hours.

On February 11th, the meme project CaptainBNB, launched on the Four.Meme platform, surpassed a market cap of over $10 million in less than 6 hours, reaching as high as $15 million with an intraday surge of over 13,000%. It is evident that Four.Meme, as a meme launchpad on the BNB Chain ecosystem, has a sustained asset wealth effect.

CAKE

CAKE is the native token of the PancakeSwap platform. PancakeSwap is one of the most popular AMM protocols on the BNB Chain and a widely used DEX in the entire DeFi industry. PancakeSwap has attracted a large number of users due to its low transaction fees (0.2% fee) and rich features such as farming, lotteries, an NFT marketplace, among others. At the time of writing, Pancake has become the DEX with the highest 7-day trading volume. CAKE has a circulating market cap of around $9.1 billion and has experienced a 24-hour increase of 58%.

Thena

Thena is a decentralized trading and liquidity protocol on the BNB Chain and was the first project launched on Binance after CZ's release. Leveraging the technical support of the BNB Chain, Thena's advantages lie in its low fees and high performance. The platform also supports liquidity pools for various token pairs and attracts user participation through a dynamically adjusted yield strategy.

Related reading: "Interview with THENA: How Does the ve(3,3) Model Pioneer Change the DeFi Landscape of BNBChain?"

Thena aims to become a benchmark project for liquidity optimization in the BNB Chain ecosystem. On its first day of listing on Binance, $THE's trading volume exceeded $1 billion, surpassing mainstream crypto assets such as Dogecoin, Solana, and XRP in volume. Currently, DEX trading volume on the BNB Chain is second only to PancakeSwap, ranking second in the ecosystem. Its circulating market cap is $200 million, with a 24-hour increase of 73%.

LISTA

Lista DAO is a CDP stablecoin and LSDfi provider in the BNB Chain ecosystem, dedicated to maximizing BNB's returns. As of the time of writing, LISTA has a current market value of $330 million with a 24-hour increase of 18%.

At the end of January, Lista DAO announced that slisBNB and clisBNB are now available on Pendle, unlocking new BNB yield opportunities. The YT-clisBNB and SY Pendle LP will provide Binance Launchpool APR and BNB staking APR; the PT-clisBNB will offer a stable 45.21% APR.

BAKE

BakerySwap is a decentralized automated market maker (AMM) protocol and also the first NFT trading platform on the BNB Chain. It also has a token Launchpad section where users can earn BAKE tokens by staking or providing liquidity to pools. At the time of writing, BAKE has a current market cap of $84.7 million with a 91% increase in the last 24 hours.

meme

Since 2021, the BNB Chain has been a hub for meme culture, and its support and commitment to memes are widely recognized. In addition to Binance Alpha curating memes in the BNB Chain ecosystem, the official team has been holding multiple meme contests since the second half of last year, providing rewards and liquidity support. This approach aims to bring more long-lasting and liquid meme assets to the community.

The criteria for selecting high-quality meme coins are based on their trading volume, market cap, and price performance in the last 24 hours. The selected tokens follow a no-repeat principle each day, and the BNBChain community will make purchases after announcing the daily projects. Users can track real-time data of meme projects through the event's "leaderboard."

Previously, memes from the BNB Chain such as Cheems, CAT, Koma, and others have been listed on Binance. Both Binance Alpha and four.meme have incubated a group of meme assets from the BNB Chain ecosystem, including CaptainBNB, BOB, and more. Against the backdrop of supporting their own ecosystem, these projects are poised to become the next targets for Binance.

In addition, for meme players, the most distressing issue is undoubtedly MEV attack. At the peak of the market frenzy, the BNB Chain team officially released a countermeasure proposal against malicious MEV on February 7th, encouraging the community to vote and calling for more participation, including but not limited to block builders, RPC nodes, validators, and DApps, to detect and prevent malicious MEV, collectively taking responsibility to protect users from "sandwich" attacks.

Simultaneously, BNB Chain has recently collaborated with multiple wallet platforms (such as TrustWallet, Binance Wallet, TokenPocket, OKX Wallet, Safepal, etc.) to launch MEV protection features, effectively combating "sandwich attacks" and other MEV exploits.

This protection measure works by routing transactions through a private channel rather than the public mempool, preventing bots from manipulating prices before a transaction. Additionally, meme players can ensure transaction security by using wallets that support MEV protection, switching to private RPC, or opting for decentralized exchanges that support MEV protection. In the roadmap released yesterday, BNB Chain aims to eliminate malicious MEV from the ecosystem by 2025, creating a more equitable on-chain transaction environment.

CaptainBNB

Originally intended to be the mascot of the BNB Chain, CaptainBNB adopted a tokenomics model where holders receive a 7% BNB reflection reward, creating a passive income mechanism. Additionally, the token is designed with an Anti-Whale and Anti-Dump mechanism to prevent large sell-offs that could cause significant market fluctuations.

KOMA

As the "SHIB offspring" of the BNB Chain ecosystem, KOMA has always had a strong community bond, with a current circulating market cap of $40.6 million.

BOB

The Binance official Twitter account frequently mentions "Build On Bnb," giving rise to the concept of a Meme token, with a current circulating market cap of $8.8 million.

CAKEDOG

The first Meme token on the PancakeSwap SpringBoard pump platform launched by Pancake, with a current circulating market cap of $562,000.

FOUR

FOUR initially gained attention due to a point system launched by the Four.Meme platform, and the number 4 is also associated with a widely circulated photo of CZ, making it one of the cultural genes of the BNB Chain ecosystem, with a current circulating market cap of $4.7 million.

WHY

Issued by the Four.Meme platform, WHY revolves around the question "Why participate in meme culture?" Continuing the narrative centered around community-driven initiatives, users can earn points through various activities on the platform, with a current circulating market cap of $3.32 million.

CZ Public Support, Promising Future Ahead

On February 6, the number of active BNB addresses reached a new high, and on February 11, CZ stated, "BNB Chain has been constrained for too long, it's time to break free," hinting at a significant transformation in the BNB Chain ecosystem.

In the 2025 technical roadmap released last night, BNB Chain revealed a series of new plans, with a focus on optimizing developer tools. This includes enhancing SDKs and APIs to make blockchain development resources more transparent and user-friendly, enhancing development efficiency. They will also introduce AI-driven development tools to help developers write code and debug programs more quickly, focusing on building innovative products.

There is also the mentioned more flexible gas fee payment method at the beginning of the article, allowing users to pay gas fees using stablecoins or other BEP-20 tokens, no longer limited to BNB. The above initiatives are beneficial in forming a virtuous cycle foundation of developers, users, funds, and attention from the infrastructure end.

Currently, meme coin speculation is still the mainstream hype in the crypto market. As one of the primary issuance platforms for meme coins, BNB Chain is expected to further solidify its market position through optimizing the listing process and liquidity management. CZ's return and proactive statements have injected new vitality into the BNB Chain. His vision and strategic adjustments may drive BNB Chain to a new round of explosive growth in 2025. Whether it's technological upgrades or ecosystem expansion, BNB Chain is worth continuous attention.

With CZ's deep involvement, the BNB Chain ecosystem is facing unprecedented development opportunities—from opBNB's technological breakthrough to optimizing the listing process, BNB Chain is experimenting with asset issuance in the crypto industry at a crossroads. Currently, funds and attention have also been allocated, and in the future, whether BNB Chain can continue to stand out in the intense liquidity competition remains to be seen.

You may also like

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Pharos, deeply integrated with AntChain, is about to launch. How can we get involved?

$COIN Joins S&P 500, but Coinbase Isn't Celebrating

On May 13, S&P Dow Jones Indices announced that Coinbase would officially replace Discover Financial Services in the S&P 500 on May 19. While other companies like Block and MicroStrategy, closely tied to Bitcoin, were already part of the S&P 500, Coinbase became the first cryptocurrency exchange whose primary business is in the index. This also signifies that cryptocurrency is gradually moving from the fringes to the mainstream in the U.S.

On the day of the announcement, Coinbase's stock price surged by 23%, surpassing the $250 mark. However, just 3 days later, Coinbase was hit by two consecutive events: a hack where employees were bribed to steal customer data and a demand for a $20 million ransom, and an investigation by the U.S. Securities and Exchange Commission (SEC) into the authenticity of its claim of having over 100 million "verified users" in its securities filings and marketing materials. These two events acted as mini-bombs, and at the time of writing, Coinbase's stock had already dropped by over 7.3%.

Coincidentally, Discover Financial Services, being replaced by Coinbase, can also be considered the "Coinbase" of the previous payment era. Discover is a U.S.-based digital banking and payment services company headquartered in Illinois, founded in 1960. Its payment network, Discover Network, is the fourth largest payment network apart from Visa, Mastercard, and American Express.

In April, after the approval of the acquisition of Discover by the sixth-largest U.S. bank, Capital One, this well-established digital banking company of over 60 years smoothly handed over its S&P 500 "seat" to this emerging cryptocurrency "bank." This unexpected coincidence also portrayed the handover between the new and old eras in Coinbase's entry into the S&P 500, resembling a relay race scene. However, this relay baton also brought Coinbase's accumulated "external troubles and internal strife" to a tipping point.

Over the past decade, cryptocurrency exchanges have been the most stable "profit machines." They play a role in providing liquidity to the entire industry and rely on trading fees to sustain their operations. However, with the comprehensive rollout of ETF products in the U.S. market, this profit model is facing unprecedented challenges. As the leader in the "American stack," with over 80% of its business coming from the U.S., Coinbase is most affected by this.

Starting from the approval of Bitcoin and Ethereum spot ETFs, traditional financial capital has significantly onboarded users and funds that originally belonged to exchanges in a more cost-effective, compliant, and transparent manner. The transaction fee revenue of cryptocurrency exchanges has started to decline, and this trend may further intensify in the coming months.

According to Coinbase's 2024 Q4 financial report, the platform's total trading revenue was $417 million, a 45% year-on-year decrease. The contribution of BTC and ETH's trading revenue dropped from 65% in the same period last year to less than 50%.

This decline is not a result of a decrease in market enthusiasm. In fact, since the approval of the Bitcoin ETF in January 2024, the inflow of BTC into the U.S. market has continued to reach new highs, with asset management giants like BlackRock and Fidelity rapidly expanding their management scale. Data shows that BlackRock's iShares Bitcoin ETF (IBIT) alone has surpassed $17 billion in assets under management. As of mid-May 2025, the cumulative net inflow of 11 major institutional Bitcoin spot ETFs on the market has exceeded $41.5 billion, with a total net asset value of $1214.69 billion, accounting for approximately 5.91% of the total Bitcoin market capitalization.

Institutional investors and some retail investors are shifting towards ETF products, partly due to compliance and tax considerations. On one hand, ETFs have much lower trading costs compared to cryptocurrency exchanges. While Coinbase's spot trading fee rate varies annually in a tiered manner but averages around 1.49%, for example, the management fee for IBIT ETF is only 0.25%, and the majority of ETF institution fees fluctuate around 0.15% to 0.25%.

In other words, the more rational users are, the more likely they are to move from exchanges to ETF products, especially for investors aiming for long-term holdings.

According to multiple sources, several institutions, including VanEck and Grayscale, have submitted applications to the SEC for a Solana (SOL) ETF, with some institutions also planning to submit an XRP ETF proposal. Once approved, this may trigger a new round of fund migration. According to a report submitted by Coinbase to the SEC, as of April, the platform's trading revenue from XRP and Solana accounted for 18% and 10%, nearly one-third of the platform's fee revenue.

However, the Bitcoin and Ethereum ETFs passed in 2024 also reduced the fees for these two tokens on Coinbase from 30% and 15% to 26% and 10%, respectively. If the SOL and XRP ETFs are approved, it will further undermine the core fee revenue of exchanges like Coinbase.

The expansion of ETF products is gradually weakening the financial intermediary status of cryptocurrency exchanges. From their original roles as matchmakers and clearers to now gradually becoming mere "on-ramps and off-ramps" for funds, exchanges are seeing their marginal value squeezed by ETFs.

On May 12, 2025, SEC Chairman Paul S. Atkins gave a keynote speech at the Tokenization and Cryptocurrency Working Group roundtable. The theme of his speech revolved around "It is a new day at the SEC," where he indicated that the SEC would not approach enforcement and regulation the same way as before but would instead pave the way for cryptocurrency assets in the U.S. market.

With signs of cryptocurrency compliance such as the SEC's "NEW DAY" declaration, an increasing number of traditional brokerages are attempting to enter the cryptocurrency industry. One of the most representative cases is the well-known U.S. brokerage Robinhood, which began expanding its crypto business in 2018. By the time of its IPO in 2021, Robinhood's crypto business revenue accounted for over 50% of the company, with a significant boost from the Dogecoin "moonshot" promoted by Musk.

In Q1 2025 earnings report, Robinhood showcased strong growth, especially in revenue from cryptocurrency and options trading. Fueled by Trump's Memecoin, cryptocurrency-related revenue reached $250 million, nearly doubling year-over-year. Consequently, Robinhood Gold subscription users reached 3.5 million, a 90% increase from the previous year, with the rapid growth of Robinhood Gold providing the company with a stable source of income.

Meanwhile, RobinHood is actively pursuing acquisitions in the cryptocurrency space. In 2024, it announced a $2 billion acquisition of the long-standing European cryptocurrency exchange Bitstamp. Additionally, Canada's largest cryptocurrency CEX, WonderFi, which recently went public on the Toronto Stock Exchange, also announced its integration with RobinHood Crypto. After obtaining virtual asset licenses in the UK, Canada, Singapore, and other markets, RobinHood has taken a proactive approach in the compliant cryptocurrency trading market.

Furthermore, an increasing number of brokerage firms are exploring the same path. Futu Securities, Tiger Brokers, and others are also dipping their toes into cryptocurrency trading, with some having applied for or obtained the VA license from the Hong Kong SFC. Although their user bases are currently small, traditional brokerages have a natural advantage in user trust, regulatory licenses, and low fee structures. This could pose a threat to native cryptocurrency platforms in the future.

In April 2025, security researchers discovered that some Coinbase user data was leaked on the dark web. While the platform initially responded by attributing it to a "technical misinformation," it still raised concerns among users regarding its security and privacy protection. Just two days before Dow Jones Indexes announced Coinbase's addition to the S&P 500 Index, on May 11, 2025, Coinbase received an email from an unknown threat actor claiming to have obtained customer account information and internal documents, demanding a $20 million ransom to keep the data private. Subsequent investigations confirmed the data breach.

Cybercriminals obtained the data by bribing overseas customer service agents and support staff, mainly in "non-U.S. regions such as India." These agents abused their access to Coinbase's internal customer support system and stole customer data. As early as February this year, blockchain detective ZachXBT revealed on X platform that between December 2024 and January 2025, Coinbase users lost over $65 million to social engineering scams, with the actual amount potentially higher.

Among the victims was a well-known figure, 67-year-old Ed Suman, an established artist in the art world for nearly two decades, having been involved in the creation of artworks such as Jeff Koons' "Balloon Dog" sculpture. Earlier this year, he fell victim to an impersonation scam involving fake Coinbase customer support, resulting in a loss of over $2 million in cryptocurrency. ZachXBT critiqued Coinbase for its inadequate handling of such scams, noting that other major exchanges have not faced similar issues and recommending Coinbase to enhance its security measures.

Amidst a series of ongoing social engineering incidents, although there has not been any impact on user assets at the technical level so far, it has raised concerns among many retail and institutional investors. Especially institutions holding massive assets on Coinbase. Just considering the U.S. BTC ETF institutions, as of mid-May 2025, they collectively hold nearly 840,000 BTC, and 75% of these are custodied by Coinbase. If we price BTC at $100,000, this amount reaches a staggering $63 billion, which is equivalent to the nominal GDP of two Iceland in the year 2024.

In addition, Coinbase Custody also serves over 300 institutional clients, including hedge funds, family offices, pension funds, and endowments. As of the Q1 2025 financial report, Coinbase's total assets under management (including institutional and retail clients) reached $404 billion. The specific amount of institutional custodied assets was not explicitly disclosed in the latest report, but it should still be over 50% based on the Q4 2024 report.

Once this security barrier is breached, not only could the rate of user attrition far exceed expectations, but more importantly, institutional trust in it would undermine the foundation of its business. Therefore, after a hacking event, Coinbase's stock price plummeted significantly.

Facing a decline in spot trading fee revenue, Coinbase is also accelerating its transformation, attempting to find growth opportunities in derivatives and emerging assets. Coinbase acquired a stake in the options platform Deribit at the end of 2024 and announced the official launch of perpetual contract products in 2025. This acquisition fills in Coinbase's gap in options trading and its relatively small global market share.

Deribit has a strong presence in non-U.S. markets, especially in Asia and Europe. The acquisition has enabled Coinbase to gain a dominant position in bitcoin and ethereum options trading on Deribit, accounting for approximately 80% of the global options trading volume, with daily trading volume remaining above $2 billion.

Meanwhile, 80-90% of Deribit's customer base consists of institutional investors, with their professionalism and liquidity in the Bitcoin and Ethereum options market highly favored by institutions. Coinbase's compliance advantage, coupled with its already robust institutional ecosystem, makes it even more suitable. By using institutions as an entry point, it can face the squeeze from giants like Binance and OKX in the derivatives market.

Facing a similar dilemma is Kraken, which is attempting to replicate Binance Futures' model in non-U.S. markets. Since the derivatives market relies more on professional users, fee rates are relatively higher and stickiness is stronger, making it a significant source of revenue for exchanges. In the first half of 2025, Kraken completed the acquisition of TradeStation Crypto and a futures exchange, aiming to build a complete derivatives trading ecosystem to hedge the risk of declining spot transaction fee income.

With the surge of Memecoin in 2024, Binance, OKX, and various CEX platforms began massively listing small-market-cap, highly volatile tokens to activate active trading users. Due to the wealth effect and trading activity of Memecoins, Coinbase was also forced to join the battle, successively listing popular tokens from the Solana ecosystem such as BOOK OF MEME and Dogwifhat. Although these coins are controversial, they are frequently traded, with fee rates several times higher than mainstream coins, serving as a "blood-boosting" method for spot trading.

However, due to its status as a publicly traded company, this practice is a riskier endeavor for Coinbase. Even in the current crypto-friendly environment, the SEC is still investigating whether tokens like SOL, ADA, and SAND constitute securities.

In addition to the forced transformation strategies carried out by the aforementioned CEXs, they are also starting to lay out RWAs and the most talked-about stablecoin payment fields, such as the PYUSD launched through a collaboration between Coinbase and Paypal, Coinbase's support for the Euro stablecoin EURC by Circle that complies with EU MiCA regulatory requirements, or the USD1 launched through a collaboration between Binance and WIFL. In the increasingly crowded trading field, many CEXs have shifted their focus from just the trading market to the application field.

The golden age of transaction fees has quietly ended, and the second half of the crypto exchange platform game has silently begun.

Key Market Insights for May 16th, how much did you miss out on?

The End and Rebirth of NFTs: How the Meme Coin Craze Ended the PFP Era?

Key Market Intelligence on May 14th, how much did you miss out on?

1.Binance Alpha Launches HIPPO, BLUE, and Other Tokens

2.Believe Ecosystem Tokens See General Rise, LAUNCHCOIN Surges Over 250% in 24 Hours

3.Tiger Securities Introduces Cryptocurrency Deposit and Withdrawal Service, Supports Mainstream Cryptocurrencies such as BTC and ETH

4.Current Bitcoin Rally Possibly Driven by Institutions, Retail Traders Yet to Join

5.Binance Wallet's New TGE Privasea AI Participation Requires a 198 Point Threshold, with a Point Consumption of 15

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on its new creator revenue-sharing model: the platform will allocate 50% of PumpSwap revenue to token creators, sparking varied reactions from users. Some criticize the move as insufficient or even misleading, while others view it as a positive step the platform is taking to reward creators. Meanwhile, PUMP faces market pressure from emerging competitors like LetsBONKfun and Raydium, which are rapidly gaining market share. Users also express concerns about PUMP's sustainability and potential regulatory risks in the U.S., with discussions extending to the platform's impact on the entire memecoin ecosystem.

COINBASE: Today, Coinbase became the first crypto company to join the S&P 500 Index, replacing Discover Financial Services, sparking widespread industry attention. The entire crypto community views this milestone as a significant development, signaling that crypto assets are further integrating into the mainstream financial system. The news has sparked lively discussions on Twitter, with many users pointing out that this may attract more institutional investors to enter the Bitcoin and other cryptocurrency markets.

XRP: XRP became the focal point of today's crypto discussion, with its significant market movements and strategic advances drawing attention. XRP has surpassed USDT to become the third-largest cryptocurrency by market capitalization, sparking market excitement and discussions about its future potential. The surge in market capitalization and price is believed to be related to increasing institutional interest, deepening strategic partnerships, and its role in the crypto ecosystem. Additionally, XRP's integration into multiple financial systems and its potential as a macro asset class are also seen as key factors driving the current market sentiment.

DYDX: Today's discussions about DYDX mainly focused on the dYdX Yapper Leaderboard launched by KaitoAI. The leaderboard aims to identify the most active community participants, with a total of $150,000 in rewards to be distributed over the first three seasons. This initiative has sparked broad community participation, with many users discussing the potential rewards and the incentive effect on the DYDX ecosystem. Meanwhile, progress on the ethDYDX to dYdX native chain migration and historical airdrop events have also been topics of discussion.

1. "What Is 'ICM'? Holding Up the $4 Billion Market Cap Solana's New Narrative"

Overnight, the hottest narrative in the crypto space has become "Internet Capital Markets," with a host of crypto projects and founders, led by the Solana ecosystem's new Launchpad platform Believe, releasing this phrase. Together with "Believe in something," it has become the new slogan heralding the onset of a bull market. What exactly is the so-called "Internet Capital Market," will it become a short-lived hype phrase like the Base ecosystem's previous Content Coin, and what related targets are available for selection?2.《LaunchCoin Surges 20x in One Day, How Did Believe Create a $200M Market Cap Shiba Inu After Going to Zero?|100x Retrospective》

LAUNCHCOIN broke through a $200 million market cap today, with the long-lost liquidity and such a high market cap "Memecoin" almost bringing half of the on-chain crypto community CT into the fray. The community is crazily discussing this token, with half of it being FOMO and the other half being FUD. This token, originally issued by Believe founder Ben Pasternak under his personal identity, transformed into a new platform token after a renaming. From once going to zero to a $200 million market cap, what happened in between?May 14 On-chain Fund Flow

Within 24 hours, GOONC's market cap soared to 70 million, could GOONC be the next billion-dollar dog on the Believe platform?

Bitcoin has broken $100,000, Ethereum has surpassed 2500, and is Solana's hot streak about to make a comeback?

The current market is in a state of macro euphoria, with GOONC riding the wave today, skyrocketing 10x in just a few hours, reaching a market cap of tens of millions of dollars, trading volume soaring past 50 million, and rumors swirling that the developer may be from OpenAI (unconfirmed but intriguing enough).

A ludicrous and absurd Solana meme that some actually buy into.

GOONC is a meme coin that has sprouted from the "gooning" subculture, offering no technological innovation or practical use, its sole function being speculation.

It takes inspiration from an NSFW term "gooning," which refers to a person being deeply immersed in certain content (you know what), eventually entering a nearly religious-like trance.

In Reddit (such as r/GOONED, r/GoonCaves) and some counterculture media outlets (such as MEL Magazine in 2020), "gooning" has gradually transitioned from an adult label to a meme-addicted, digital content and virtual self-indulgence synonym, arguably the epitome of Degen spirit.

GOONC is playing around with this concept, packaging the addictive nature, uselessness, and irony of gooning into a tradable financial product. The project team has made it clear: "We do not solve blockchain problems, we only trade absurdity." Blunt but oddly genuine.

GOONC launched on May 13, 2025, using the meme coin launch platform Believe App's LaunchCoin module on Solana. This tool is highly Degen: zero technical barriers, a few clicks to create a coin, perfect for projects like GOONC that can come up with ideas out of the blue.

The mastermind behind GOONC is also quite something and is the most talked-about, with KOL @basedalexandoor on X platform (alias "Pata van Goon") personally involved. His profile even caught the attention of Marc Andreessen, co-founder of a16z, making onlookers unable to resist speculating if GOONC has a hint of OpenAI lineage.

While this 'OpenAI Endorsement' is currently just community speculation, it is definitely a good card to play to fuel hype. Saying "we are pure speculation" on one hand, while tagging a few "AI + a16z" on the other.

GOONC took off as soon as it launched. After its launch on May 13, 2025, its market capitalization skyrocketed to $22 million within 4 hours, with a trading volume exceeding $25.6 million in 24 hours. According to platform data, the first day of trading saw an astonishing +41,100% surge, soaring from $0.0000001 to $0.02, becoming a "missed-the-boat" situation.

GOONC quickly formed an active trading community post-launch, with a lot of discussion and trading signals appearing on X platform (such as the 292x return signal provided by DeBot). Liquidity pools on exchanges like Raydium and Meteora grew rapidly, supporting high trading volumes and price increases.

The real climax occurred between May 13 and May 14, with the market cap rising to $5.5 million in the morning and directly surpassing $55 million in the afternoon. By the 14th, it briefly approached a $70 million market cap, with the trading volume soaring to $59 million. Some community members even posted screenshots claiming an increase of +85,000%, creating a new myth out of the ruins.

As of 1:30 pm on May 14, the price stabilized around $0.039, with a total market cap and FDV both around $39.6 million, and a 24-hour trading volume of $5.43 million. Active platforms include XT.COM, LBank, Meteora, and others.

Although there was a slight pullback from the peak ($0.07), the coin's popularity remains strong. For a coin that relies purely on "irony + community + X post" to thrive, this performance is already at a stellar level.

Currently, the background of the token's development team is not transparent, increasing the potential risk of a rug pull. Rugcheck.xyz warns that the creator of the GOONC contract may have permission to modify the contract (e.g., change fees or mint additional tokens), posing certain security risks.

Community members speculate that the meteoric rise of GOONC may be the "last hurrah".

Deconstructing Binance Alpha2.0's New "Asia-Led Liquidity Mining" Model

After Surging 40%, Has Ethereum Price Peaked Upon Exiting the Craze?

Whether you are an insider or an outsider, these days you must be familiar with the news about Ethereum. The reason is simple, causing Ethereum enthusiasts to sigh with emotion and almost throwing off-guard those who defend Ethereum, Ethereum, with a "3-day surge of 40%," climbed to the top of the Douyin Hot List.

As we all know, Ethereum launched the Pectra upgrade on May 7th. This most significant network upgrade since early 2024 integrates the Prague execution layer hard fork and the Electra consensus layer upgrade, significantly improving Ethereum's performance through 11 improvement proposals. The account abstraction feature (EIP-7702) allows users to flexibly manage wallets through social media accounts or multi-signature schemes, reducing the user threshold, attracting more users and developers. The staking mechanism optimization increases the validator ETH cap from 32ETH to 2048ETH and introduces a flexible withdrawal method, making it easier for institutions and individuals to participate in network security, enhancing the market's confidence in Ethereum's long-term value.

At the same time, Pectra optimized the interaction efficiency of Layer 2 networks such as Arbitrum and Optimism, making transactions faster and cheaper, leading to a surge in on-chain activity. As a crucial step for Ethereum's transition from "2G" to "5G," the Pectra upgrade not only enhances network vitality but also "recharges confidence" in the market, directly driving the price increase.

Related Reading: "Ethereum Skyrockets 22% in One Day, E Enthusiasts Rejoice"

It's not just Ethereum itself, as Wall Street also brought important bullish news.

The world's largest asset management company, BlackRock, proposed to the SEC allowing Ethereum ETFs for staking. This proposal is expected to elevate Ethereum ETFs from a mere investment tool to a bond-like "interest-bearing asset," bringing investors both capital appreciation and passive income, igniting market optimism about Ethereum's future potential.

Specifically, BlackRock has proposed to amend its S-1 filing to allow investors to create and redeem ETF shares directly with Ethereum instead of the U.S. dollar (i.e., in-kind redemption). This move, combined with its $2.9 billion BUIDL Fund launched in March 2024, aims to deepen the integration of traditional finance with blockchain. The BUIDL Fund is a tokenized fund operating on the Ethereum network, investing in traditional assets such as U.S. Treasury bonds. This setup is highly attractive to institutional investors, as they can not only benefit from Ethereum's price appreciation but also earn stable cash flow through staking.

Robert Mitchnick, BlackRock's Head of Digital Assets, stated in a CNBC interview in March 2025 that the addition of staking functionality will significantly enhance the appeal of the Ethereum ETF. He admitted that when the Ethereum spot ETF was launched in July 2024 without staking functionality, the market demand was lackluster, and staking could be the key to reversing this trend.

Meanwhile, the SEC's shifting stance on cryptocurrency regulation has also fueled this upward trend. During the tenure of the previous SEC chairman, the regulatory approach was tough, and staking was strictly viewed through the Howey test as a potential unregistered security. Therefore, when approving the Ethereum spot ETF in May 2024, staking functionality was explicitly prohibited.

However, with Trump back in the White House and Paul Atkins taking over the SEC, there has been a noticeable relaxation in crypto regulation. Apart from BlackRock, ETF issuers such as Invesco Galaxy, VanEck, WisdomTree, and 21Shares have also submitted applications for similar staking and in-kind redemption.

Related reading: "New Chairman Takes Office, SEC Transforms into 'Crypto Daddy' Within 48 Hours"

If staking ETFs are approved, the benefits are likely to go beyond price appreciation. The introduction of staking functionality could redefine the role of crypto assets, making them more similar to traditional financial products that provide returns and value appreciation, thereby driving Ethereum closer to mainstream finance.

Currently, the SEC still needs to address several decisions related to crypto ETFs, including whether to approve ETFs for Solana, XRP, Litecoin, and even Dogecoin. With the calls for an "altcoin season" growing louder, Ethereum's strong performance may just be the beginning of a larger crypto market frenzy.

In addition, the Trump family-related DeFi project WLFI is also bullish on this wave of rise, with frequent on-chain activities. According to on-chain data analyst @ai_9684xtpa's monitoring, a WLFI-related address is currently borrowing coins to go long on ETH, borrowing 4 million U from Aave to buy 1590 ETH at an average price of $2515 per ETH.

For this epic surge of Ethereum after half a year of silence, the community has indeed gained more confidence and hope, which has also led to a revival of the entire altcoin market. However, amidst the joy, there are also voices of pessimism. Below is a summary conducted by BlockBeats based on community discussions.

The optimists point out that the current market structure is similar to the eve of the bull markets in 2016 and 2020, predicting a life-changing surge in the next 3-6 months, where some altcoins may even achieve astonishing single-day gains of up to 40%.

@liuwei16602825 stated that this surge signifies the return of the bull market as a sure thing. There is no need to worry about a pullback. The driving force behind the surge uses a high-cost isolated operation, fearing a drop more than any retail investor and will definitely do everything to support the price.

Related Reading: "Ethereum Leads the Surge Triggering the 'Altcoin Season' Speculation, How Do Traders View the Future Market?"

The bears mainly believe that this surge is different from the bull market of 2021, as the current market lacks the confidence of large-scale retail investors entering and holding positions for the long term, with funds rotating too quickly.

@market_beggar observed that a Bitfinex E/B whale has started to close positions and believes that if this whale maintains its high-speed position-closing operation for the next few days, it can be inferred that the whale no longer sees the upside potential of ETH, preparing to take profits and exit. The closing time will be a key focus going forward.

@FLS_OTC stated that there are still many uncertainties at the macro level, and the liquidity cannot support a major bull market. At this stage, it is a "last hurrah," not a complete reversal, and will continue to remain in a short position.

@off_thetarget believes that after ETH transitioned from POW to POS, it lost the "gold standard" of mining machine power cost support. The staking economic model led to a breakdown in value anchoring. Additionally, the L2 ecosystem (such as Starknet, zkSync, etc.) suffered from liquidity fragmentation, failing to establish an effective capital inflow mechanism, causing the collapse of the split disc pattern. Furthermore, the ETH community's excessive pursuit of technical narratives divorced from real-world needs resulted in a weak ecosystem growth. Therefore, he believes that ETH's intrinsic value system has crumbled, and the price is bound to plummet to the 800-1200 range, with a decisive short position at 1800.

@Airdrop_Guard, based on the core logic of the "High Probability Trading Strategy," where three sets of underlying logic different trading systems (such as volume depletion, price supply-demand, long/short position funding rate, etc.) simultaneously issue a short signal at the same point (2580), creating a high-probability trading opportunity. He emphasizes that these systems must be based on different algorithms and logics (rather than mere technical indicator overlays). The current ETH trend aligns with the short conditions in multiple independent dimensions of his trading system, hence the decision to short.

Overall, Bitcoin still maintains over 54% market dominance, and institutional funds' continued preference for it may limit the altcoin's upward potential. The market's future direction will depend on multiple factors, such as Bitcoin's price trend, global macroeconomic conditions, and whether funds can effectively rotate from Bitcoin to the altcoin sector.

Although Ethereum's recent leadership in the market has brought about optimistic sentiment, investors still need to remain rational as different sectors of altcoins are likely to show divergence in trends. Whether this round of Ethereum's rise will usher in a true altcoin frenzy may require more time and conducive conditions.

Binance Alpha Points Gameplay Overtakes on the Inside Track, Sweeping 90% of the Web3 Wallet Market

How to Get Rich in Crypto Without Relying on Luck? Financial Veteran Raoul Pal's Macro Insights and Investment Path

Stablecoins Driving Global B2B Payment Innovation: How to Break Through Workflow Bottlenecks and Unlock Trillion-Dollar Market Potential?

These startups are building cutting-edge AI models without the need for a data center

Science Equity Movement: DeSci's Trillion-Dollar Knowledge Economy Reconstruction Revolution

Sentient In-Depth Research Report: Secures $85 Million in Funding to Build a Decentralized AGI New Paradigm

April 30th Market Key Intelligence, How Much Did You Miss?

Interview with Virtuals Co-Founder empty: AI Startups Don't Need a Lot of Funding, Crypto is One of the Answers

Week 16 On-Chain Data: Intensifying Structural Supply-Demand Imbalance, Data Reveals Solid Blueprint for Next Bull Run?

a16z Leads $18M Seed Round for Catena Labs, Crypto Industry Bets on Stablecoin AI Payment

Pharos, deeply integrated with AntChain, is about to launch. How can we get involved?

$COIN Joins S&P 500, but Coinbase Isn't Celebrating

On May 13, S&P Dow Jones Indices announced that Coinbase would officially replace Discover Financial Services in the S&P 500 on May 19. While other companies like Block and MicroStrategy, closely tied to Bitcoin, were already part of the S&P 500, Coinbase became the first cryptocurrency exchange whose primary business is in the index. This also signifies that cryptocurrency is gradually moving from the fringes to the mainstream in the U.S.

On the day of the announcement, Coinbase's stock price surged by 23%, surpassing the $250 mark. However, just 3 days later, Coinbase was hit by two consecutive events: a hack where employees were bribed to steal customer data and a demand for a $20 million ransom, and an investigation by the U.S. Securities and Exchange Commission (SEC) into the authenticity of its claim of having over 100 million "verified users" in its securities filings and marketing materials. These two events acted as mini-bombs, and at the time of writing, Coinbase's stock had already dropped by over 7.3%.

Coincidentally, Discover Financial Services, being replaced by Coinbase, can also be considered the "Coinbase" of the previous payment era. Discover is a U.S.-based digital banking and payment services company headquartered in Illinois, founded in 1960. Its payment network, Discover Network, is the fourth largest payment network apart from Visa, Mastercard, and American Express.

In April, after the approval of the acquisition of Discover by the sixth-largest U.S. bank, Capital One, this well-established digital banking company of over 60 years smoothly handed over its S&P 500 "seat" to this emerging cryptocurrency "bank." This unexpected coincidence also portrayed the handover between the new and old eras in Coinbase's entry into the S&P 500, resembling a relay race scene. However, this relay baton also brought Coinbase's accumulated "external troubles and internal strife" to a tipping point.

Over the past decade, cryptocurrency exchanges have been the most stable "profit machines." They play a role in providing liquidity to the entire industry and rely on trading fees to sustain their operations. However, with the comprehensive rollout of ETF products in the U.S. market, this profit model is facing unprecedented challenges. As the leader in the "American stack," with over 80% of its business coming from the U.S., Coinbase is most affected by this.

Starting from the approval of Bitcoin and Ethereum spot ETFs, traditional financial capital has significantly onboarded users and funds that originally belonged to exchanges in a more cost-effective, compliant, and transparent manner. The transaction fee revenue of cryptocurrency exchanges has started to decline, and this trend may further intensify in the coming months.

According to Coinbase's 2024 Q4 financial report, the platform's total trading revenue was $417 million, a 45% year-on-year decrease. The contribution of BTC and ETH's trading revenue dropped from 65% in the same period last year to less than 50%.

This decline is not a result of a decrease in market enthusiasm. In fact, since the approval of the Bitcoin ETF in January 2024, the inflow of BTC into the U.S. market has continued to reach new highs, with asset management giants like BlackRock and Fidelity rapidly expanding their management scale. Data shows that BlackRock's iShares Bitcoin ETF (IBIT) alone has surpassed $17 billion in assets under management. As of mid-May 2025, the cumulative net inflow of 11 major institutional Bitcoin spot ETFs on the market has exceeded $41.5 billion, with a total net asset value of $1214.69 billion, accounting for approximately 5.91% of the total Bitcoin market capitalization.

Institutional investors and some retail investors are shifting towards ETF products, partly due to compliance and tax considerations. On one hand, ETFs have much lower trading costs compared to cryptocurrency exchanges. While Coinbase's spot trading fee rate varies annually in a tiered manner but averages around 1.49%, for example, the management fee for IBIT ETF is only 0.25%, and the majority of ETF institution fees fluctuate around 0.15% to 0.25%.

In other words, the more rational users are, the more likely they are to move from exchanges to ETF products, especially for investors aiming for long-term holdings.

According to multiple sources, several institutions, including VanEck and Grayscale, have submitted applications to the SEC for a Solana (SOL) ETF, with some institutions also planning to submit an XRP ETF proposal. Once approved, this may trigger a new round of fund migration. According to a report submitted by Coinbase to the SEC, as of April, the platform's trading revenue from XRP and Solana accounted for 18% and 10%, nearly one-third of the platform's fee revenue.

However, the Bitcoin and Ethereum ETFs passed in 2024 also reduced the fees for these two tokens on Coinbase from 30% and 15% to 26% and 10%, respectively. If the SOL and XRP ETFs are approved, it will further undermine the core fee revenue of exchanges like Coinbase.

The expansion of ETF products is gradually weakening the financial intermediary status of cryptocurrency exchanges. From their original roles as matchmakers and clearers to now gradually becoming mere "on-ramps and off-ramps" for funds, exchanges are seeing their marginal value squeezed by ETFs.

On May 12, 2025, SEC Chairman Paul S. Atkins gave a keynote speech at the Tokenization and Cryptocurrency Working Group roundtable. The theme of his speech revolved around "It is a new day at the SEC," where he indicated that the SEC would not approach enforcement and regulation the same way as before but would instead pave the way for cryptocurrency assets in the U.S. market.

With signs of cryptocurrency compliance such as the SEC's "NEW DAY" declaration, an increasing number of traditional brokerages are attempting to enter the cryptocurrency industry. One of the most representative cases is the well-known U.S. brokerage Robinhood, which began expanding its crypto business in 2018. By the time of its IPO in 2021, Robinhood's crypto business revenue accounted for over 50% of the company, with a significant boost from the Dogecoin "moonshot" promoted by Musk.

In Q1 2025 earnings report, Robinhood showcased strong growth, especially in revenue from cryptocurrency and options trading. Fueled by Trump's Memecoin, cryptocurrency-related revenue reached $250 million, nearly doubling year-over-year. Consequently, Robinhood Gold subscription users reached 3.5 million, a 90% increase from the previous year, with the rapid growth of Robinhood Gold providing the company with a stable source of income.

Meanwhile, RobinHood is actively pursuing acquisitions in the cryptocurrency space. In 2024, it announced a $2 billion acquisition of the long-standing European cryptocurrency exchange Bitstamp. Additionally, Canada's largest cryptocurrency CEX, WonderFi, which recently went public on the Toronto Stock Exchange, also announced its integration with RobinHood Crypto. After obtaining virtual asset licenses in the UK, Canada, Singapore, and other markets, RobinHood has taken a proactive approach in the compliant cryptocurrency trading market.

Furthermore, an increasing number of brokerage firms are exploring the same path. Futu Securities, Tiger Brokers, and others are also dipping their toes into cryptocurrency trading, with some having applied for or obtained the VA license from the Hong Kong SFC. Although their user bases are currently small, traditional brokerages have a natural advantage in user trust, regulatory licenses, and low fee structures. This could pose a threat to native cryptocurrency platforms in the future.

In April 2025, security researchers discovered that some Coinbase user data was leaked on the dark web. While the platform initially responded by attributing it to a "technical misinformation," it still raised concerns among users regarding its security and privacy protection. Just two days before Dow Jones Indexes announced Coinbase's addition to the S&P 500 Index, on May 11, 2025, Coinbase received an email from an unknown threat actor claiming to have obtained customer account information and internal documents, demanding a $20 million ransom to keep the data private. Subsequent investigations confirmed the data breach.

Cybercriminals obtained the data by bribing overseas customer service agents and support staff, mainly in "non-U.S. regions such as India." These agents abused their access to Coinbase's internal customer support system and stole customer data. As early as February this year, blockchain detective ZachXBT revealed on X platform that between December 2024 and January 2025, Coinbase users lost over $65 million to social engineering scams, with the actual amount potentially higher.

Among the victims was a well-known figure, 67-year-old Ed Suman, an established artist in the art world for nearly two decades, having been involved in the creation of artworks such as Jeff Koons' "Balloon Dog" sculpture. Earlier this year, he fell victim to an impersonation scam involving fake Coinbase customer support, resulting in a loss of over $2 million in cryptocurrency. ZachXBT critiqued Coinbase for its inadequate handling of such scams, noting that other major exchanges have not faced similar issues and recommending Coinbase to enhance its security measures.

Amidst a series of ongoing social engineering incidents, although there has not been any impact on user assets at the technical level so far, it has raised concerns among many retail and institutional investors. Especially institutions holding massive assets on Coinbase. Just considering the U.S. BTC ETF institutions, as of mid-May 2025, they collectively hold nearly 840,000 BTC, and 75% of these are custodied by Coinbase. If we price BTC at $100,000, this amount reaches a staggering $63 billion, which is equivalent to the nominal GDP of two Iceland in the year 2024.

In addition, Coinbase Custody also serves over 300 institutional clients, including hedge funds, family offices, pension funds, and endowments. As of the Q1 2025 financial report, Coinbase's total assets under management (including institutional and retail clients) reached $404 billion. The specific amount of institutional custodied assets was not explicitly disclosed in the latest report, but it should still be over 50% based on the Q4 2024 report.

Once this security barrier is breached, not only could the rate of user attrition far exceed expectations, but more importantly, institutional trust in it would undermine the foundation of its business. Therefore, after a hacking event, Coinbase's stock price plummeted significantly.

Facing a decline in spot trading fee revenue, Coinbase is also accelerating its transformation, attempting to find growth opportunities in derivatives and emerging assets. Coinbase acquired a stake in the options platform Deribit at the end of 2024 and announced the official launch of perpetual contract products in 2025. This acquisition fills in Coinbase's gap in options trading and its relatively small global market share.

Deribit has a strong presence in non-U.S. markets, especially in Asia and Europe. The acquisition has enabled Coinbase to gain a dominant position in bitcoin and ethereum options trading on Deribit, accounting for approximately 80% of the global options trading volume, with daily trading volume remaining above $2 billion.

Meanwhile, 80-90% of Deribit's customer base consists of institutional investors, with their professionalism and liquidity in the Bitcoin and Ethereum options market highly favored by institutions. Coinbase's compliance advantage, coupled with its already robust institutional ecosystem, makes it even more suitable. By using institutions as an entry point, it can face the squeeze from giants like Binance and OKX in the derivatives market.

Facing a similar dilemma is Kraken, which is attempting to replicate Binance Futures' model in non-U.S. markets. Since the derivatives market relies more on professional users, fee rates are relatively higher and stickiness is stronger, making it a significant source of revenue for exchanges. In the first half of 2025, Kraken completed the acquisition of TradeStation Crypto and a futures exchange, aiming to build a complete derivatives trading ecosystem to hedge the risk of declining spot transaction fee income.

With the surge of Memecoin in 2024, Binance, OKX, and various CEX platforms began massively listing small-market-cap, highly volatile tokens to activate active trading users. Due to the wealth effect and trading activity of Memecoins, Coinbase was also forced to join the battle, successively listing popular tokens from the Solana ecosystem such as BOOK OF MEME and Dogwifhat. Although these coins are controversial, they are frequently traded, with fee rates several times higher than mainstream coins, serving as a "blood-boosting" method for spot trading.

However, due to its status as a publicly traded company, this practice is a riskier endeavor for Coinbase. Even in the current crypto-friendly environment, the SEC is still investigating whether tokens like SOL, ADA, and SAND constitute securities.

In addition to the forced transformation strategies carried out by the aforementioned CEXs, they are also starting to lay out RWAs and the most talked-about stablecoin payment fields, such as the PYUSD launched through a collaboration between Coinbase and Paypal, Coinbase's support for the Euro stablecoin EURC by Circle that complies with EU MiCA regulatory requirements, or the USD1 launched through a collaboration between Binance and WIFL. In the increasingly crowded trading field, many CEXs have shifted their focus from just the trading market to the application field.

The golden age of transaction fees has quietly ended, and the second half of the crypto exchange platform game has silently begun.

Key Market Insights for May 16th, how much did you miss out on?

The End and Rebirth of NFTs: How the Meme Coin Craze Ended the PFP Era?

Key Market Intelligence on May 14th, how much did you miss out on?

1.Binance Alpha Launches HIPPO, BLUE, and Other Tokens

2.Believe Ecosystem Tokens See General Rise, LAUNCHCOIN Surges Over 250% in 24 Hours

3.Tiger Securities Introduces Cryptocurrency Deposit and Withdrawal Service, Supports Mainstream Cryptocurrencies such as BTC and ETH

4.Current Bitcoin Rally Possibly Driven by Institutions, Retail Traders Yet to Join

5.Binance Wallet's New TGE Privasea AI Participation Requires a 198 Point Threshold, with a Point Consumption of 15

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on its new creator revenue-sharing model: the platform will allocate 50% of PumpSwap revenue to token creators, sparking varied reactions from users. Some criticize the move as insufficient or even misleading, while others view it as a positive step the platform is taking to reward creators. Meanwhile, PUMP faces market pressure from emerging competitors like LetsBONKfun and Raydium, which are rapidly gaining market share. Users also express concerns about PUMP's sustainability and potential regulatory risks in the U.S., with discussions extending to the platform's impact on the entire memecoin ecosystem.

COINBASE: Today, Coinbase became the first crypto company to join the S&P 500 Index, replacing Discover Financial Services, sparking widespread industry attention. The entire crypto community views this milestone as a significant development, signaling that crypto assets are further integrating into the mainstream financial system. The news has sparked lively discussions on Twitter, with many users pointing out that this may attract more institutional investors to enter the Bitcoin and other cryptocurrency markets.

XRP: XRP became the focal point of today's crypto discussion, with its significant market movements and strategic advances drawing attention. XRP has surpassed USDT to become the third-largest cryptocurrency by market capitalization, sparking market excitement and discussions about its future potential. The surge in market capitalization and price is believed to be related to increasing institutional interest, deepening strategic partnerships, and its role in the crypto ecosystem. Additionally, XRP's integration into multiple financial systems and its potential as a macro asset class are also seen as key factors driving the current market sentiment.

DYDX: Today's discussions about DYDX mainly focused on the dYdX Yapper Leaderboard launched by KaitoAI. The leaderboard aims to identify the most active community participants, with a total of $150,000 in rewards to be distributed over the first three seasons. This initiative has sparked broad community participation, with many users discussing the potential rewards and the incentive effect on the DYDX ecosystem. Meanwhile, progress on the ethDYDX to dYdX native chain migration and historical airdrop events have also been topics of discussion.

1. "What Is 'ICM'? Holding Up the $4 Billion Market Cap Solana's New Narrative"

Overnight, the hottest narrative in the crypto space has become "Internet Capital Markets," with a host of crypto projects and founders, led by the Solana ecosystem's new Launchpad platform Believe, releasing this phrase. Together with "Believe in something," it has become the new slogan heralding the onset of a bull market. What exactly is the so-called "Internet Capital Market," will it become a short-lived hype phrase like the Base ecosystem's previous Content Coin, and what related targets are available for selection?2.《LaunchCoin Surges 20x in One Day, How Did Believe Create a $200M Market Cap Shiba Inu After Going to Zero?|100x Retrospective》

LAUNCHCOIN broke through a $200 million market cap today, with the long-lost liquidity and such a high market cap "Memecoin" almost bringing half of the on-chain crypto community CT into the fray. The community is crazily discussing this token, with half of it being FOMO and the other half being FUD. This token, originally issued by Believe founder Ben Pasternak under his personal identity, transformed into a new platform token after a renaming. From once going to zero to a $200 million market cap, what happened in between?May 14 On-chain Fund Flow